-

Spot ETH ETF’s prospective issuers are awaiting feedback from the SEC.

ETH has seen significant selling pressure in the past few weeks.

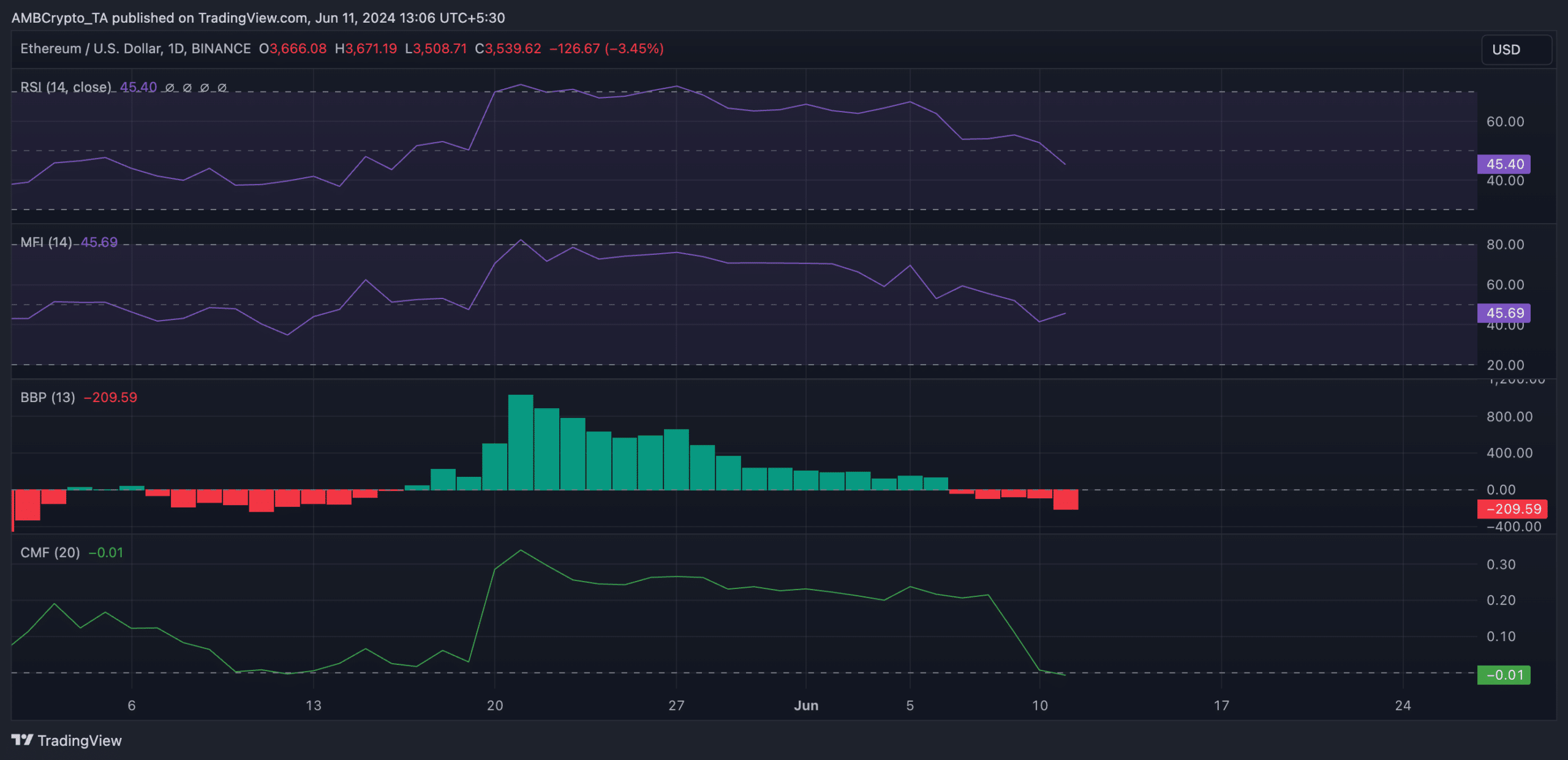

As an experienced financial analyst, I’m closely monitoring the Ethereum [ETH] market as we wait for feedback from the SEC on the prospective spot ETF applications. The selling pressure on Ethereum is becoming increasingly evident, with its price dropping almost 10% in just the last week. This downtrend is confirmed by various technical indicators, including the Relative Strength Index (RSI), Money Flow Index (MFI), Chaikin Money Flow (CMF), and Elder-Ray Index.

The demand to sell Ethereum [ETH] increases as potential providers of spot Ethereum exchange-traded-funds (ETFs) anxiously wait for the Securities and Exchange Commission (SEC) to provide feedback on their application filings, which were submitted on May 31st.

Several individuals anticipated receiving comments from the regulatory body regarding these submissions by June 7th.

On the 23rd of May, feedback was not provided to any of the eight applicants whose issuance applications were approved.

Although the length of time required for SEC approval of S-1 forms is not definitively known, SEC Chair Gary Gensler mentioned in a CNBC interview that this process would likely take an extended period.

ETH bears the brunt

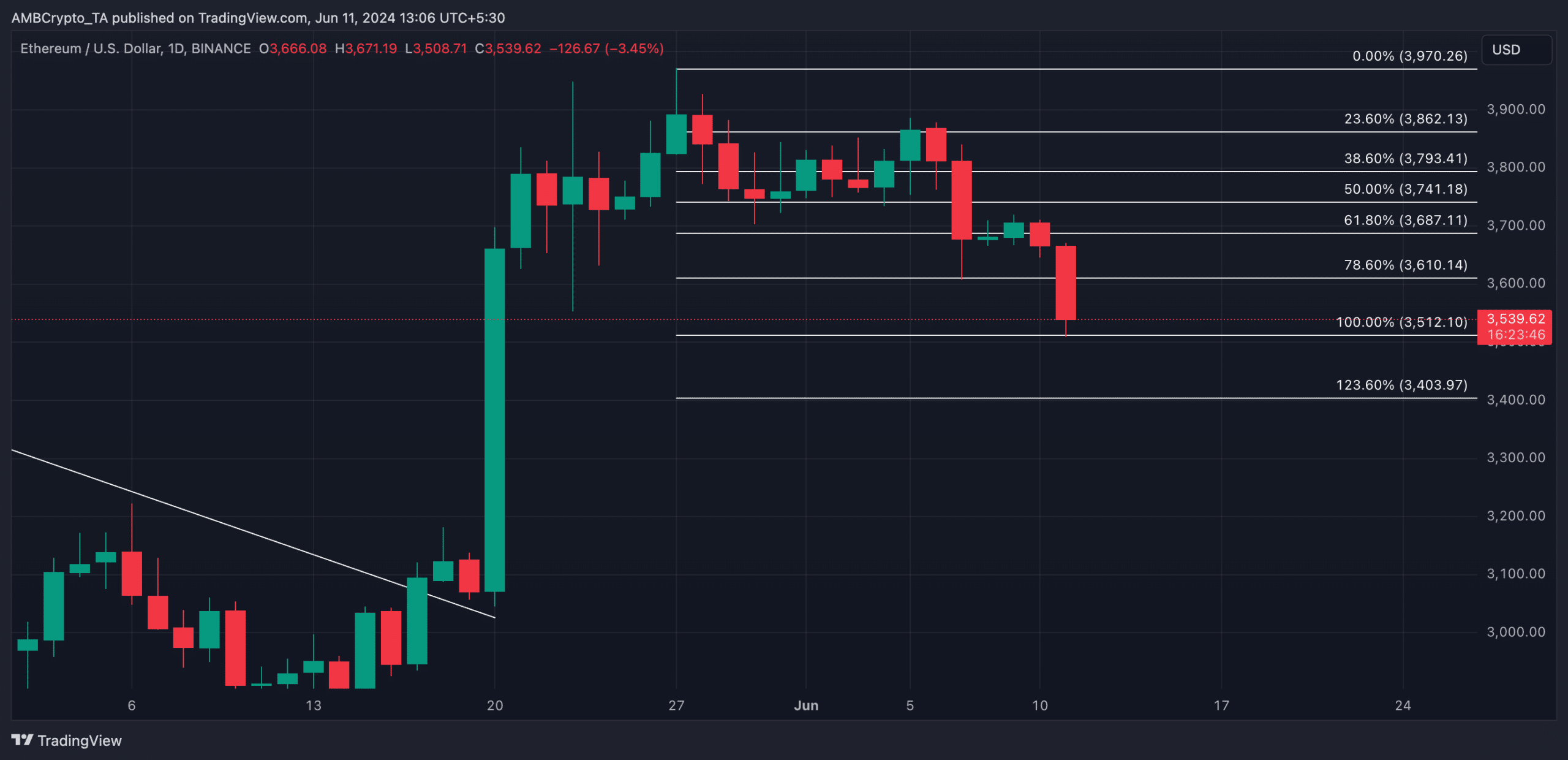

As of the current moment, Ethereum (ETH) had a value of $3,539 based on market information from CoinMarketCap. However, there’s been a significant drop – nearly 10% – in ETH’s worth over the past week.

The decline in the altcoin’s price can be attributed to a decrease in new buyers. At present, its crucial momentum signals are positioned beneath their midpoints, signaling an increase in selling activity.

As a crypto investor, I closely monitor the momentum and strength of Ethereum’s (ETH) price movements using two essential technical indicators: Relative Strength Index (RSI) and Money Flow Index (MFI). Recently, I noticed that ETH’s RSI stood at 45.40, while its MFI was slightly higher at 45.69. These readings suggest a neutral trend for Ethereum, with neither significant buying nor selling pressure observed in the market at that time.

As a crypto investor, I’ve noticed that the current market conditions seem to indicate a preference among participants for selling Ethereum (ETH) rather than buying new coins.

The trend of Ethereum’s declining Chaikin Money Flow (CMF) further supports this downward movement. Currently, Ethereum’s CMF value is negative at -0.01, indicating a downtrend in buying pressure.

As an analyst, I would explain that the Composite Money Flow (CMF) indicator measures the net inflow or outflow of funds into a particular asset’s market. A CMF value less than zero implies a net outflow of capital from the market. This is indicative of market weakness and a bearish stance towards the asset.

As a researcher investigating the Ethereum (ETH) market, I’ve found that the Elder-Ray Index has provided bearish signals for this altcoin based on its negative values. This particular indicator assesses the balance between buying and selling power within the market by measuring their respective strengths.

When its value is negative like this, bear power is dominant in the market.

As of this writing, the value of ETH’s Elder-Ray Index was -209.

Read Ethereum’s [ETH] Price Prediction 2024-25

If the demand for selling Ethereum (ETH) increases significantly, its price could potentially fall below the $3500 mark and be traded around $3403 instead.

If invalidated and bullish sentiment returns to the market, ETH’s price might rally toward $3610.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-06-12 01:11