As a researcher with extensive experience in crypto markets, I believe that Uniswap [UNI] and Bitcoin [BTC] experienced significant price corrections on June 10, 2024. The sudden increase in Uniswap’s social dominance and price surge created a wave of Fear of Missing Out (FOMO), leading to the correction. However, this trend might not have been solely due to FOMO, as Bitcoin’s decline also influenced broader market sentiment.

As an analyst, I’ve noticed that the rising price trend of UNI on the 10th of June sparked a sense of urgency among investors, potentially leading to a FOMO-driven correction. However, it’s essential to consider that this corrective phase may have other contributing factors beyond just FOMO.

Bitcoin [BTC] underwent a significant drop, with its trajectory often influencing the wider cryptocurrency market.

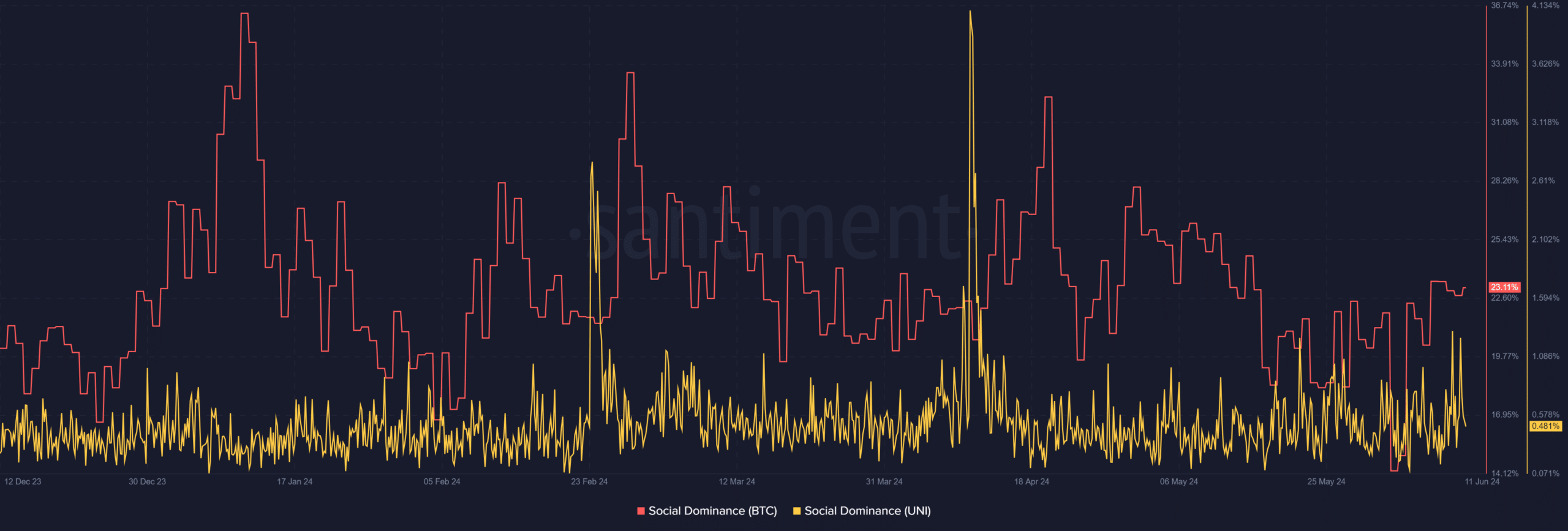

Uniswap and Bitcoin: Comparing social metrics

Based on the latest findings from Santiment, Uniswap gained significant prominence in social media discussions on June 10th. Notably, amongst the assets undergoing growth that day, UNI stood out the most according to the data.

The price surge brought significant attention to UNI, creating FOMO.

Despite the surge in cost and popularity, this trend took on a more ominous tone than an optimistic one. Notably, this unfolded as Bitcoin experienced a downturn, a factor that significantly impacts the overall market mood.

As a researcher studying Bitcoin’s social dominance trend for AMBCrypto, I found that there were no significant shifts observed within the given timeframe.

From my perspective as an analyst, Bitcoin’s social dominance standing above UNI‘s is notable, but its price trend seems regular compared to the current figures. At present, Bitcoin holds approximately 23% of the social dominance in the cryptocurrency market, whereas UNI accounts for around 0.5%.

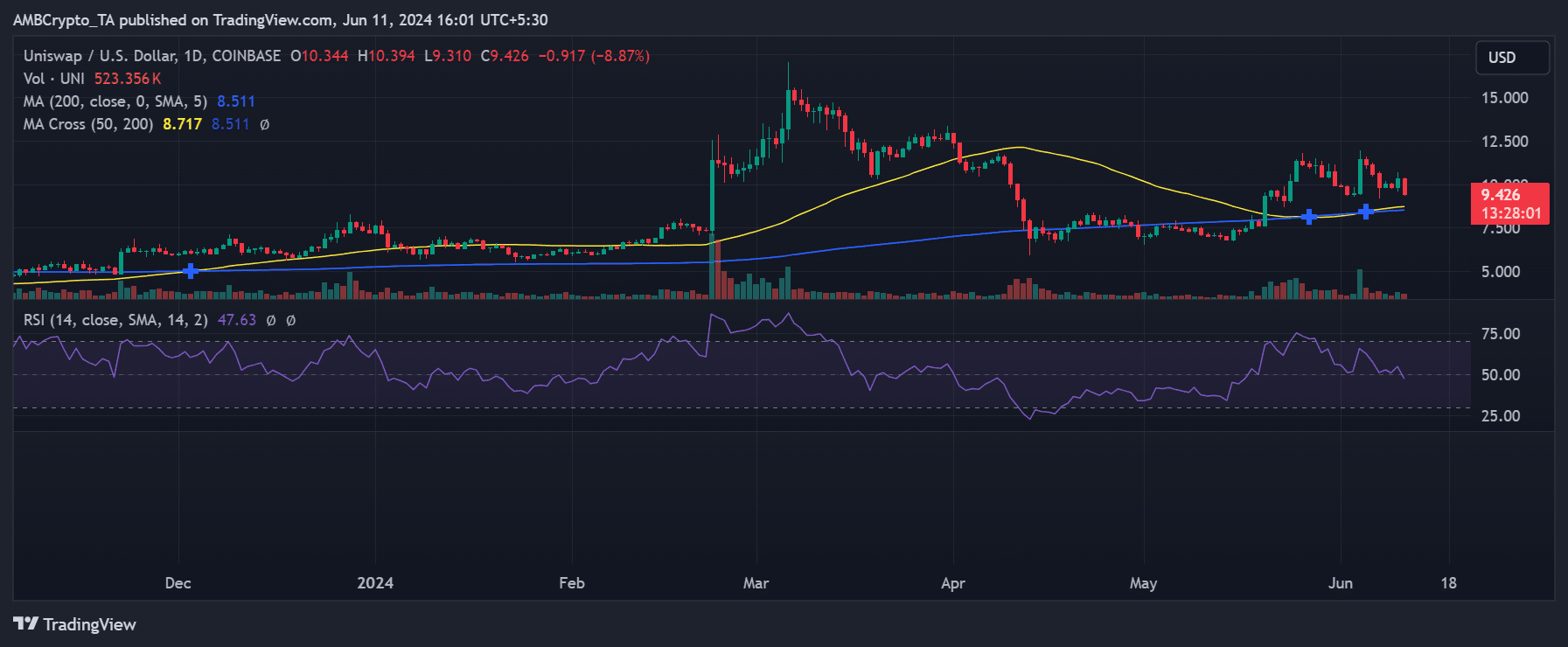

How UNI trended

As a crypto investor, I observed an encouraging 5% growth in Uniswap’s price on the 10th of June, pushing it up from approximately $9.80 to $10.30. Regrettably, this advancement and additional gains have since been reversed.

As of this writing, Uniswap was trading at around $9.40, with a decline of over 8%.

Uniswap’s downward trend has caused its Relative Strength Index (RSI) to drop below the neutral threshold, indicating bearish sentiment.

This decline is attributed to the rise in FOMO and the recent decline in Bitcoin.

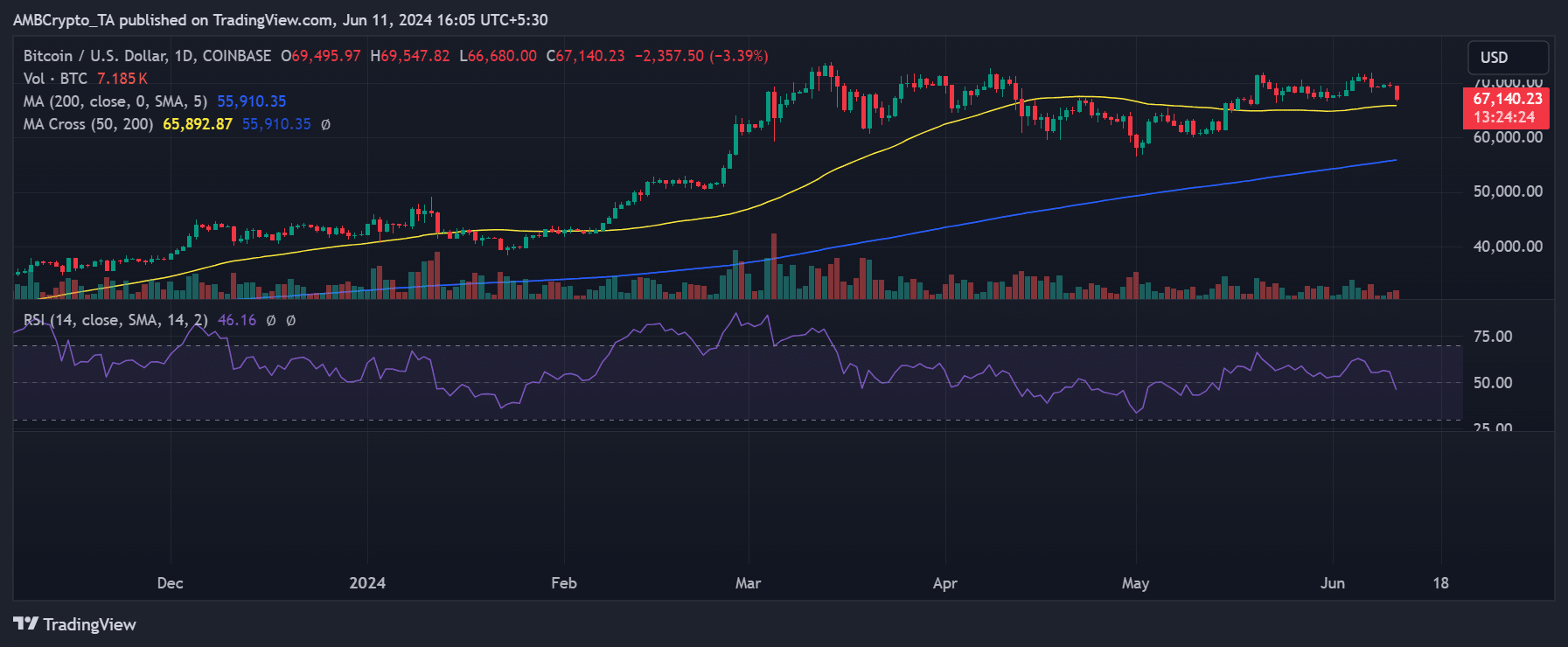

How has Bitcoin fared?

In contrast to UNI‘s price surge without fear of missing out (FOMO), Bitcoin experienced a minimal 0.2% decrease over the past 24 hours, with a current value near $69,497.

At present, I’ve observed a persistent decrease in value, with the price dipping by more than 3% to approximately $67,400.

As a crypto investor, I’ve been closely monitoring the Relative Strength Index (RSI) of this digital asset. Recently, I noticed that its RSI has dipped below the neutral line of 50, signaling a potential bear trend in the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-12 03:03