- Shiba Inu could plummet further if key resistance levels are broken.

- Metrics suggested a potential bearish run.

As a crypto investor with some experience under my belt, I’ve seen my fair share of market volatility. And right now, looking at Shiba Inu [SHIB], I can’t help but feel a sense of unease.

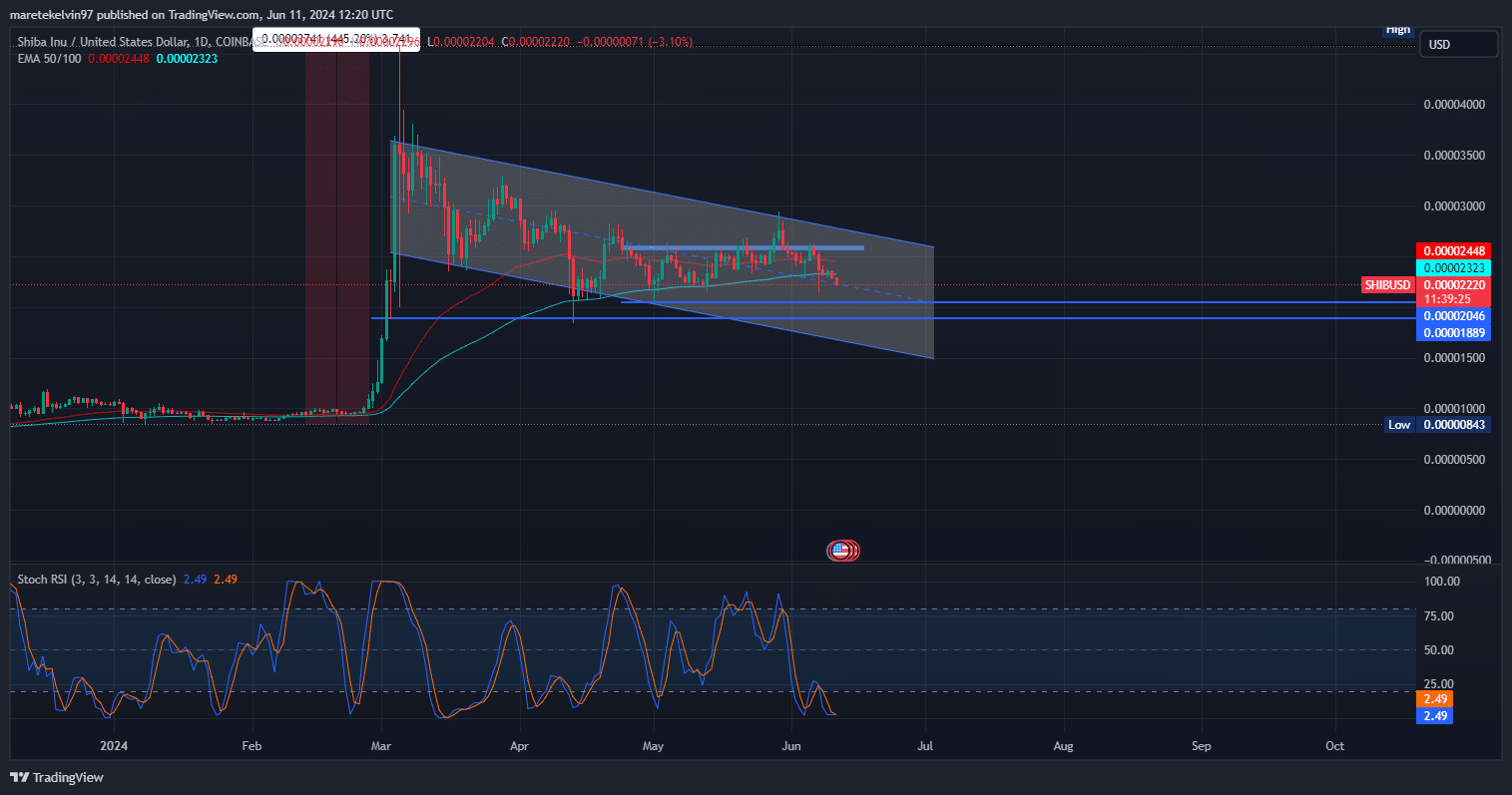

Over the past six days, SHIB‘s value has decreased by 15.17%. The recent downturn is significant as SHIB’s price has now closed beneath the 100 Exponential Moving Average (EMA) and opened below it in the current trading session, which is a strong indication of a bearish trend.

As a researcher studying Shib’s price trends, I would caution that if the bearish pressure continues to mount, Shib’s prices could potentially drop as low as the $0.000019 support level. This warning comes with the caveat that should the price fall below the currently established consolidation support at $0.0000205, a further downward spiral may ensue.

At present, based on the information from CoinMarketCap, SHIB is valued at $0.00002215. This represents a decrease of 4.36% over the past 24 hours and a more substantial drop of 7.22% during the last week.

As a market analyst, I’ve observed that Shib’s market capitalization experienced a decrease of 4.21%, bringing it down to approximately $13.08 billion within the past 24 hours. Simultaneously, there was an uptick in trading activity, with the volume rising by an impressive 21.31%.

Shiba Inu’s losses strain the chain

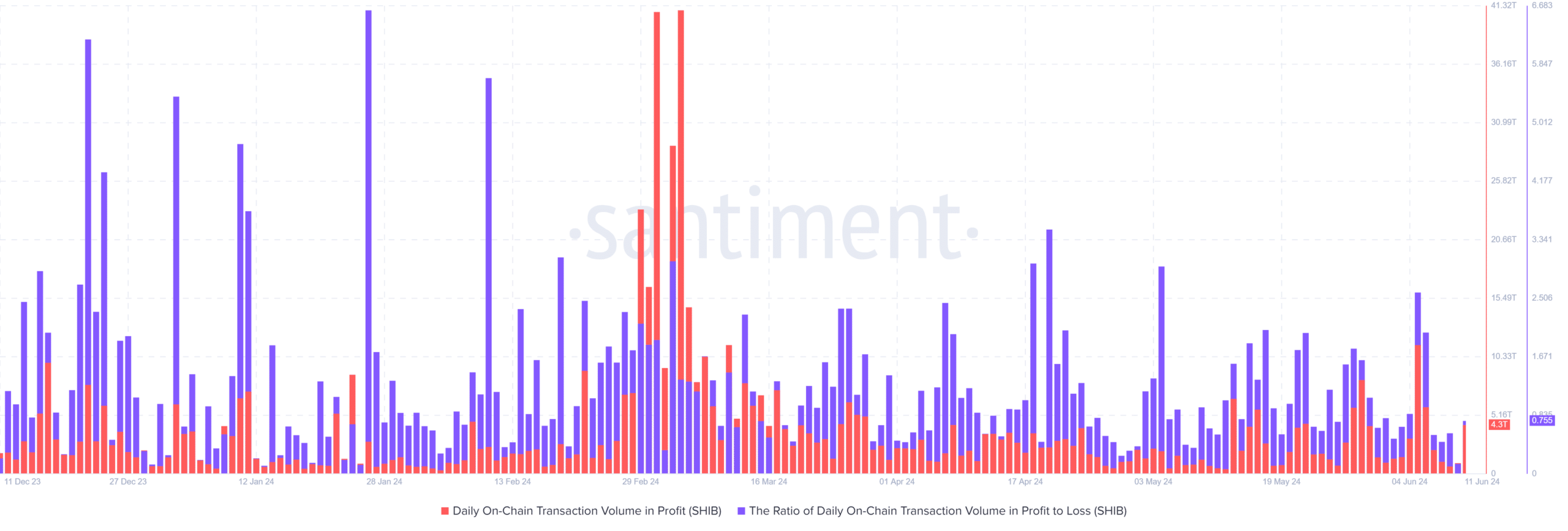

Santiment’s daily transaction data was closely examined by AMBCrypto. They focused on the transaction volume generated from profitable trades and the ratio of profitable to loss transactions. The recent decrease in profits indicated by the profit bars raised concerns.

The profit-to-loss ratios showed inconsistent trends, featuring notable surges in losses during the latest price decreases. It appears that an increased number of traders might have been forced to sell at a loss due to fear of deeper price falls.

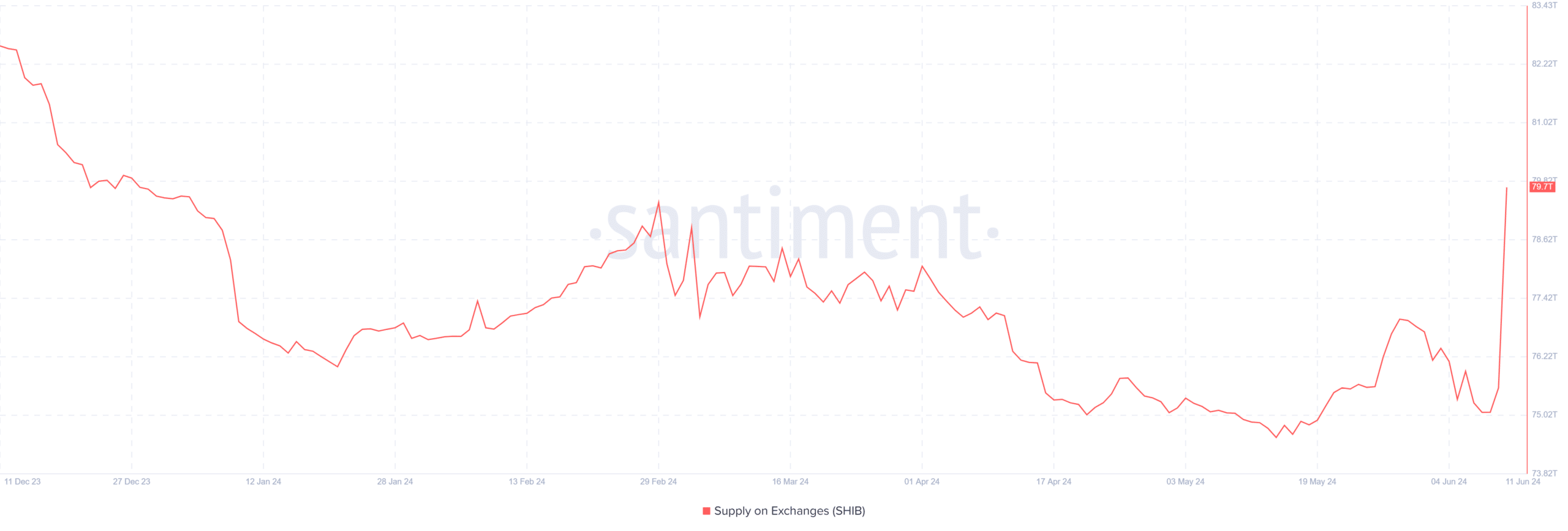

According to AMBCrypto’s analysis using data from Santiment, Shiba Inu’s exchange supply has been increasing and recently experienced a notable surge.

Investors’ eagerness to sell puts additional pressure on the market to make a sale, signaling a bearish trend.

At the current moment, the stochastic RSI for SHIB showed signs of being oversold at a level of 2.49. This implies that there’s a potential for a short-term price reversal, although it’s essential to note that the broader trend continues to be negative as SHIB is trading beneath its moving averages.

What’s next for SHIB?

As a researcher studying the cryptocurrency market trends, I’ve observed some significant shifts in the Shiba Inu coin’s performance. The profit-to-loss ratio has seen an uptick in spikes, indicating increased volatility. Simultaneously, there’s been a surge in supply on exchanges as investors look to cash out. Concurrently, transaction volumes in profitable positions have decreased, suggesting bearish market sentiments. Critical support levels for Shiba Inu are being put to the test during this period.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

As a researcher studying the current market trends, I would caution that the price could potentially dip down to hit the $0.000019 mark if there isn’t a significant influx of buyers or a clear indication of a market reversal.

However, if a reversal occurs in the short term, SHIB may pull back to $0.000024 resistance level.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-12 11:03