-

Rising volume combined with the price decrease might drive a lower value for the memecoin.

If a reversal occurs, PEPE could jump to $0.000014.

As a researcher with experience in analyzing cryptocurrency markets, I believe that the current trend for Pepe (PEPE) is not looking promising. The combination of increasing volume and decreasing price suggests that bearish forces are prevailing. This could potentially drive the value of PEPE lower, possibly towards the $0.000020 mark. However, if there is a reversal, PEPE could jump to $0.000014.

As a crypto investor, I’ve noticed that the past week has been quite challenging for memecoins, including PEPE. Based on information from CoinMarketCap, PEPE’s token was priced at just $0.000012 during this period.

This represented a 15.92% decrease in the last seven days.

Here’s a suggestion for paraphrasing the given sentence in a clear and conversational style:

As of the latest report, the market capitalization of that specific cryptocurrency stood at approximately $1.22 billion. A surge in trading activity indicates heightened curiosity and demand for the cryptocurrency. Conversely, reduced trading volumes imply fewer transactions taking place.

No way ahead for the memecoin

As an analyst observing market trends, when I notice an increase in trading volume coinciding with rising prices, I can infer that there’s significant buying activity taking place. This buying pressure can potentially fortify the upward trend.

Despite a surge in PEPE‘s trading volume, its price continued to decline, implying that the downward trend may intensify. Should this persist, it’s plausible that the token’s value could plummet, potentially reaching a low of $0.000020.

As an analyst, I’d rephrase it this way: A few days ago, according to AMBCrypto’s report, some significant investors in the crypto market were taking advantage of the price drop to purchase larger-than-average amounts of cryptocurrencies. In simpler terms, these individuals are referred to as ‘whales’ due to their substantial holdings.

Due to the substantial amounts of a particular asset they control, whales possess the power to impact market prices noticeably. Nevertheless, the price of the memecoin has not yet been influenced significantly by their accumulation.

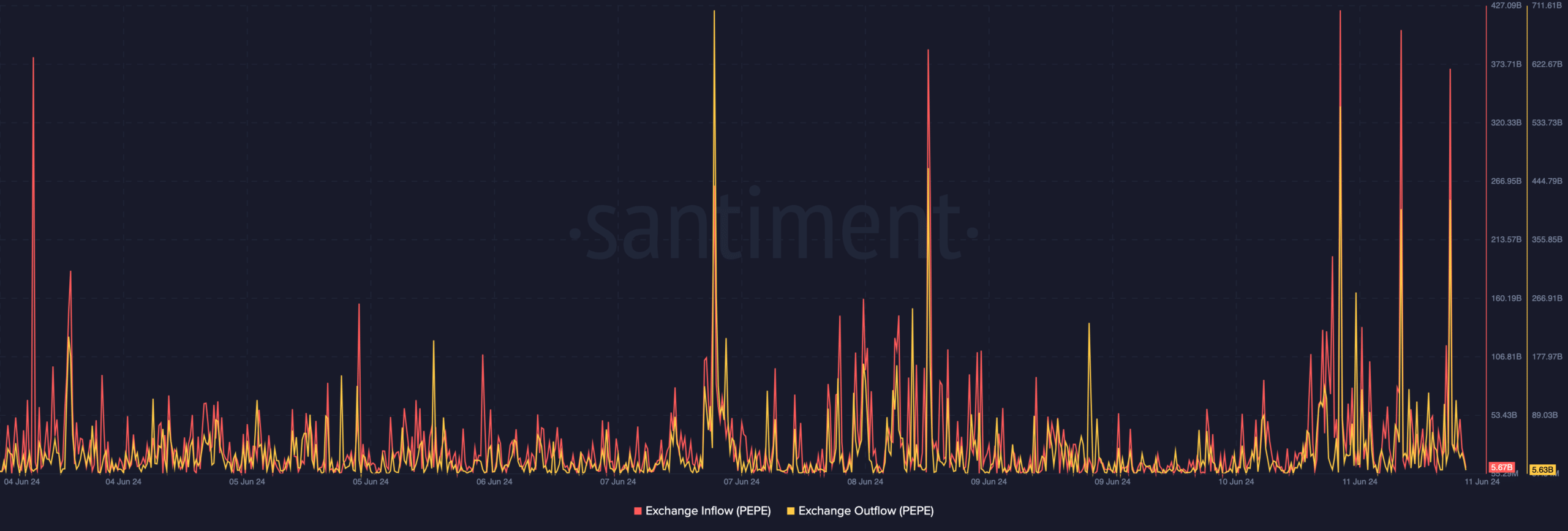

After observing the current market situation, we decided to examine if sales were continuing at a high volume. To determine this, we analyzed the trading activity.

Based on Santiment’s data, there were approximately 5.63 billion tokens transferred into exchanges. Conversely, a similar volume of around 5.67 billion tokens were taken out of PEPE exchanges. The former metric represents the amount of tokens moving into trading platforms for buying or selling.

When the Exchange Inflow grows, it usually results in a decline in cryptocurrency prices. Conversely, an escalating Exchange Outflow signifies that market players prefer to keep the cryptocurrency in their possession.

Based on my analysis, the incoming and outgoing amounts were nearly equal. Consequently, it’s unlikely that the token will require further adjustments.

PEPE’s price eyes $0.000010

PEPE is unlikely to dip below $0.000010 given its current state. But if the market becomes excessively volatile, there’s a possibility that negative sentiment could push the price downward.

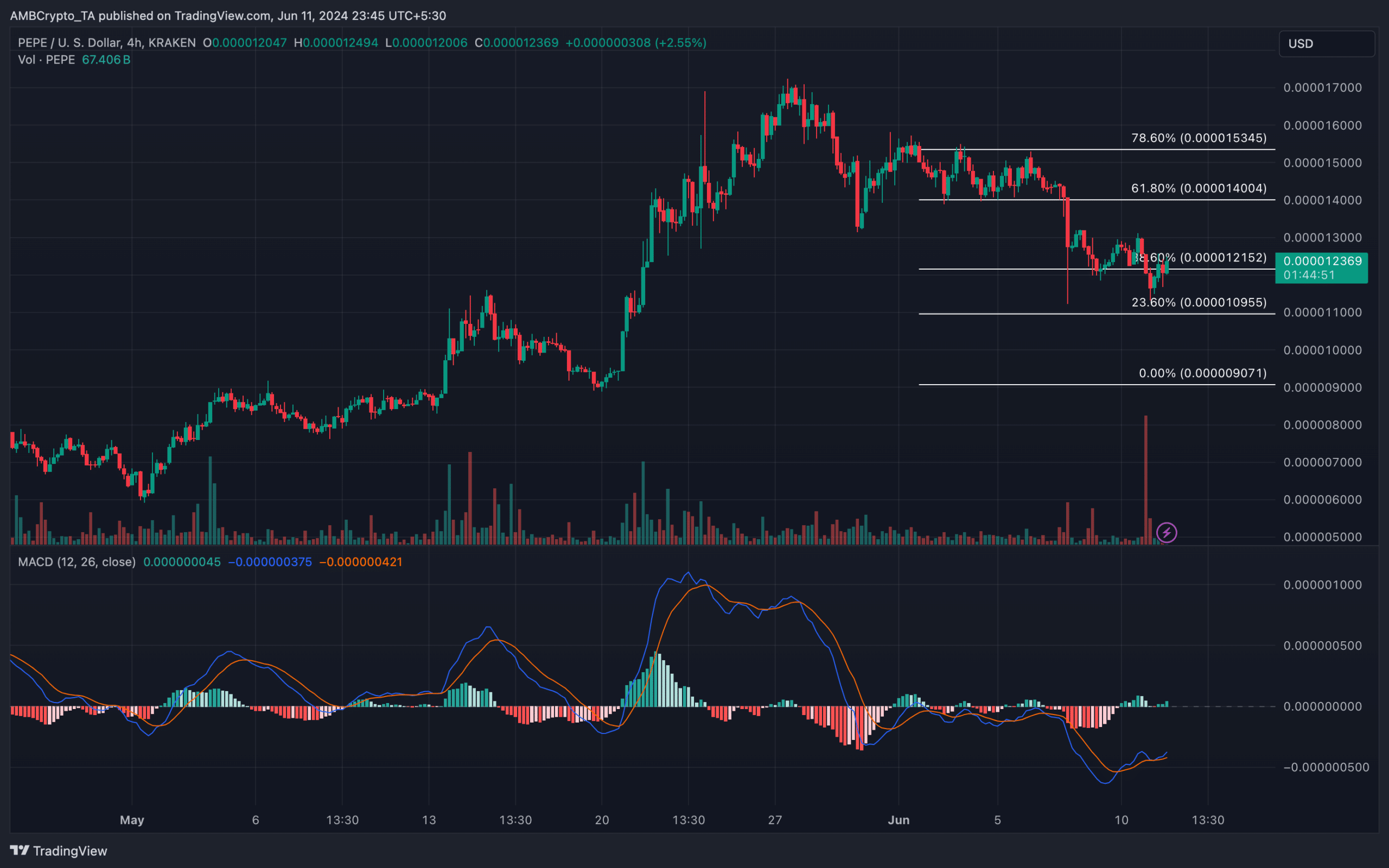

From a technical standpoint, AMBCrypto examined the token’s price action on the 4-hour chart. Initially, we employed the Fibonacci retracement indicator to identify significant levels of support and resistance.

At present, reaching the $0.000010 mark, which corresponds to the 0.236 Fibonacci level, could significantly impact the price trend of PEPE. This level served as a key support for the token in the past, suggesting a potential downward shift towards that region.

As a researcher examining market trends, I observed that the Moving Average Convergence Divergence (MACD) indicator added credence to this finding. Specifically, the MACD line was positively positioned at the current moment.

Read Pepe’s [PEPE] Price Prediction 2024-2025

The 12-day Exponential Moving Average (represented by the blue line) and the 26-day Exponential Moving Average (orange line) were both displaying negative values. This indicates that the price momentum wasn’t entirely bullish at that moment.

If the demand to purchase PEPE grows stronger, its price may encounter resistance at around $0.000014 – a level that previously housed the 0.618 Fibonacci retracement ratio.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-12 13:11