- The crypto market maintained its over $2 trillion capitalization.

- Anticipation about the FOMC and CPI reports have contributed to the crypto decline.

As a researcher with extensive experience in the crypto market, I have witnessed firsthand how anticipation about important economic reports can significantly impact the market capitalization and price movements of major cryptocurrencies like Bitcoin and Ethereum.

As a researcher studying the cryptocurrency market, I’ve observed a significant downturn over the past 24 hours. Approximately millions of dollars have been erased from the total market value.

The declines in Bitcoin [BTC] and Ethereum [ETH] have played a significant role in this downturn.

The forthcoming U.S. Federal Open Market Committee (FOMC) gathering and recent Consumer Price Index (CPI) releases have significantly influenced Bitcoin and Ethereum’s downward trends.

The reason why crypto is down today

I’ve noticed a considerable drop in the total crypto market capitalization as per the latest analysis by AMBCrypto on CoinMarketCap.

Over the last two days, the market capitalization has decreased from approximately $2.5 trillion to roughly $2.47 trillion at present.

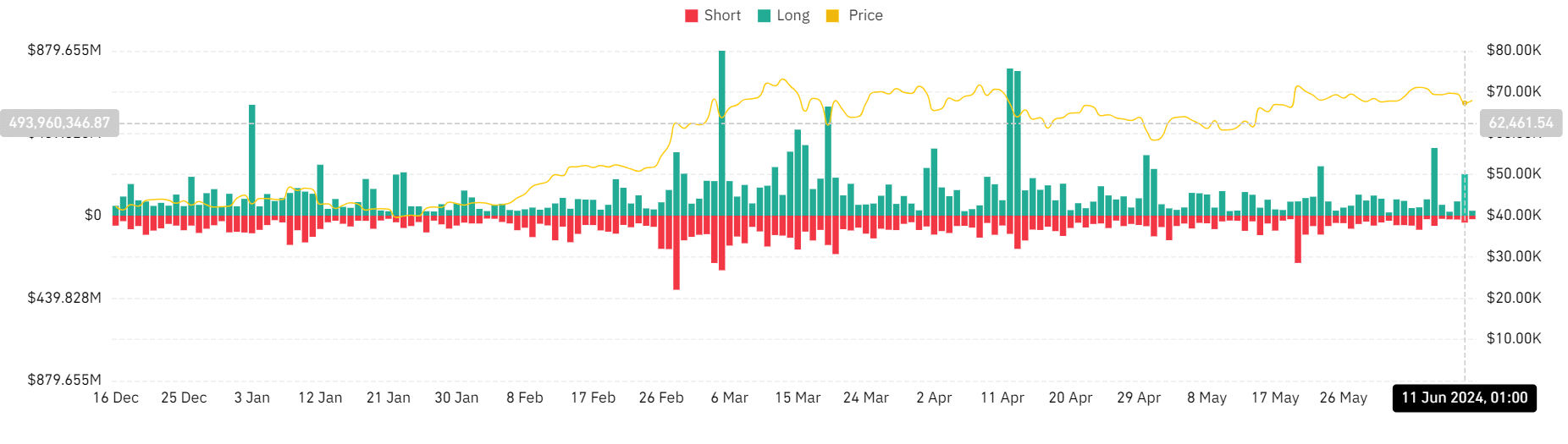

As a crypto investor, I closely monitor the market trends and liquidations data to gauge the health of my investments. According to the liquidation chart on Coinglass, the 11th of June saw a substantial increase in crypto liquidations. Notably, long positions were more affected than short ones as the prices took a sudden downturn.

The amount of assets being sold during the liquidation process exceeded $221 million, whereas the assets being bought during the same process were approximately $37 million in value.

Bitcoin, Ethereum lead market dip

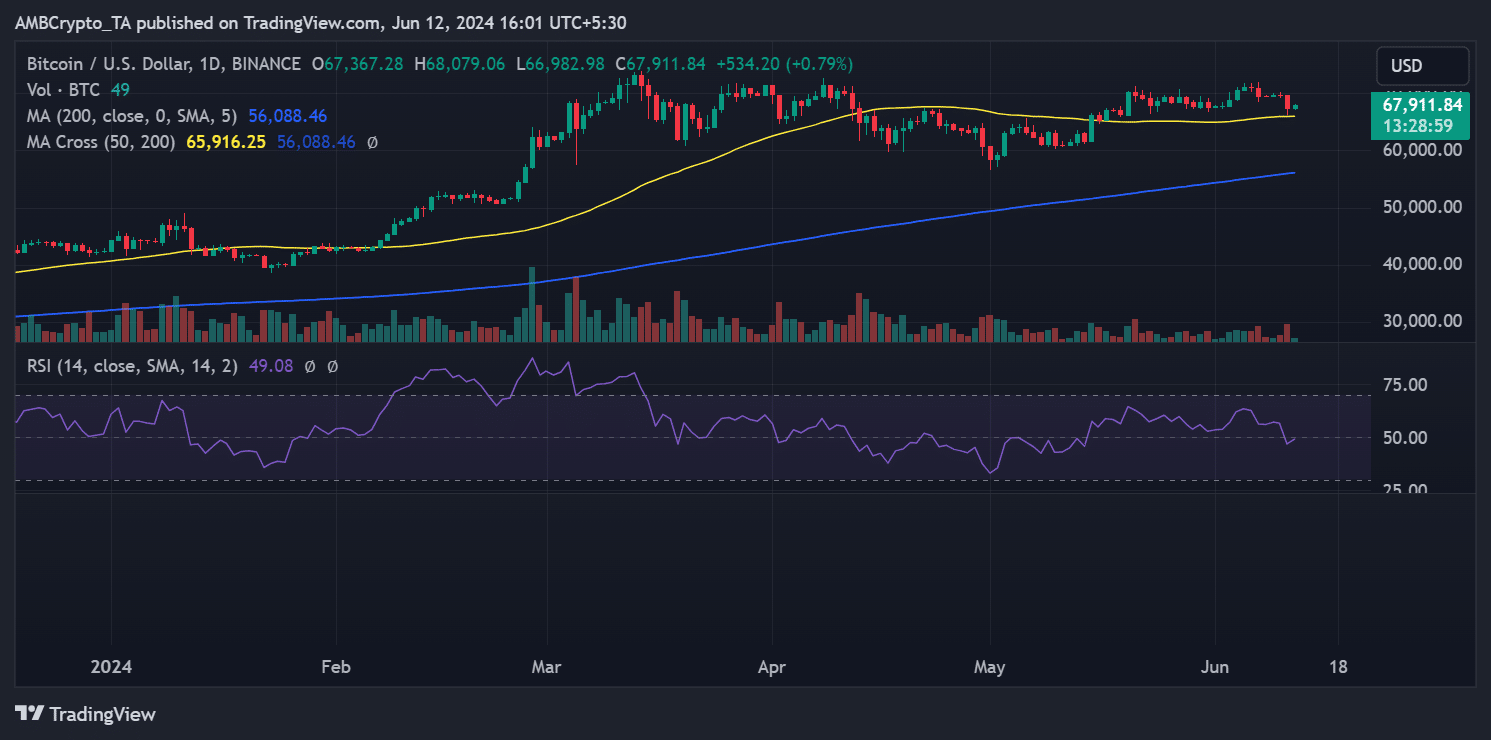

As a crypto investor observing Bitcoin’s daily performance, I noticed a significant decline of more than 3% on June 11th. According to the chart, this dip caused the cryptocurrency’s price to drop down to approximately $67,377.

BTC’s liquidation chart revealed that this decline led to over $66 million in liquidation volume.

In simpler terms, the long liquidations amounted to approximately $52 million, whereas the short liquidations totaled around $14 million.

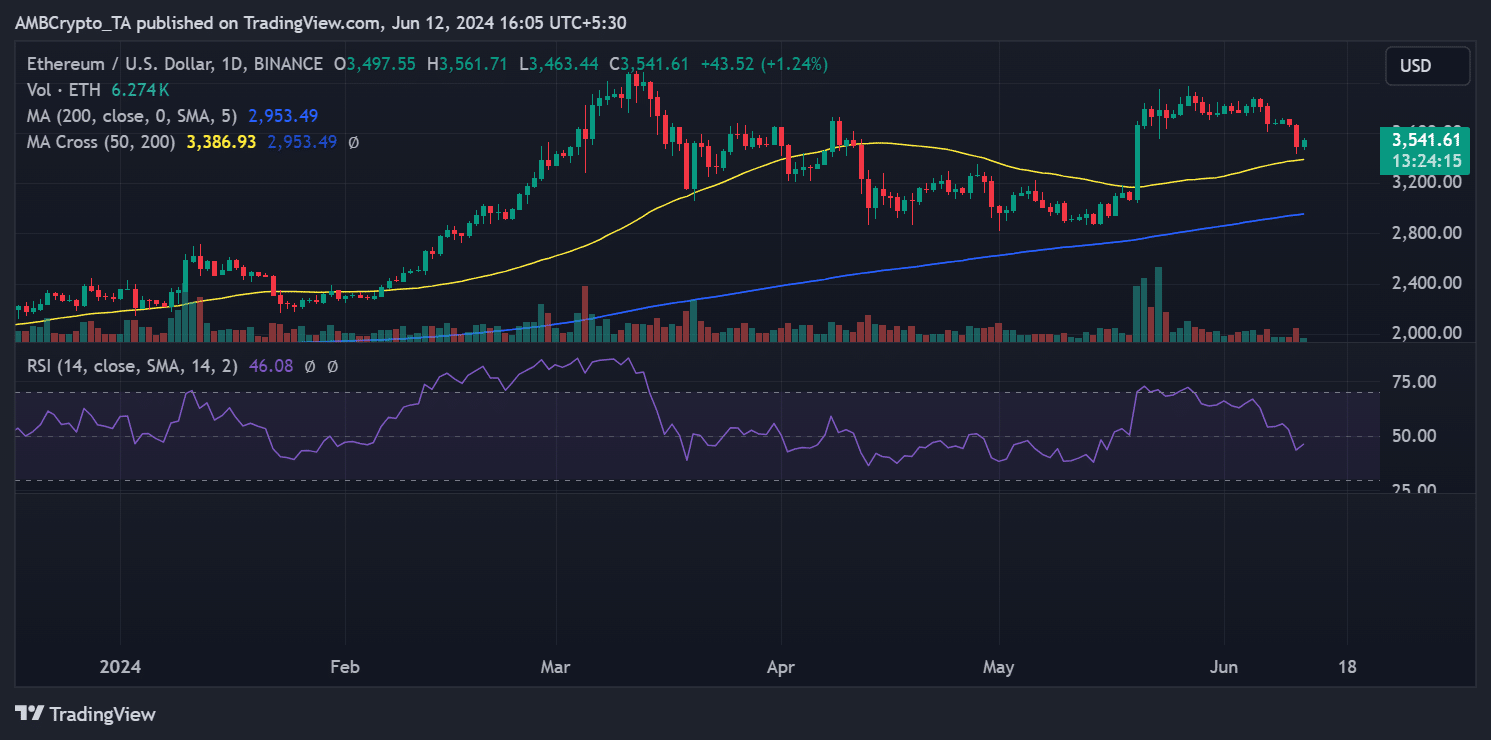

As an analyst, I’ve observed that Ethereum experienced a notable decrease of approximately 4.6% within the given timeframe. This downturn led its price to hover around $3,500. Furthermore, data from the liquidation chart indicated that a substantial amount – over $69 million – was forcibly sold off due to this decline.

As an analyst, I’d interpret that about $62 million of the total amount was attributable to long liquidations, whereas short liquidations amounted to over $7 million.

CPI and FOMC causing panic

Historically, the publication of Consumer Price Index (CPI) data or rate adjustments by the Federal Open Market Committee (FOMC) have frequently caused noticeable turbulence in the cryptocurrency market.

Investors modify their risk levels based on these economic signals. Generally, an increase in Consumer Price Index (CPI) tends to lead to a decrease in Bitcoin’s value.

When people have to spend more on necessities due to price hikes, their discretionary funds get diminished, resulting in a decrease in crypto investment.

The Federal Open Market Committee (FOMC) is projected to keep the current interest rates steady between 5.25% and 5.50%. At the same time, the Consumer Price Index (CPI) is forecasted to exhibit a modest rise, remaining within a range of 0.1% to 0.3%.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2024-06-12 15:35