As a crypto investor with some experience in the market, I’m keeping a close eye on recent developments with Bitcoin (BTC). The news that miners sold over $83 million in BTC recently and the subsequent drop to the $67,000 price level has raised some concerns.

Over the last several days, Bitcoin [BTC] has seen a downturn in value. The most substantial decrease took place on the 11th of June. In reaction to this slide, miners have decided to offload some of their Bitcoins, thereby cashing in on their profits.

Although the sales aren’t showing up on the exchanges, the open interest manages to keep a decent level of activity.

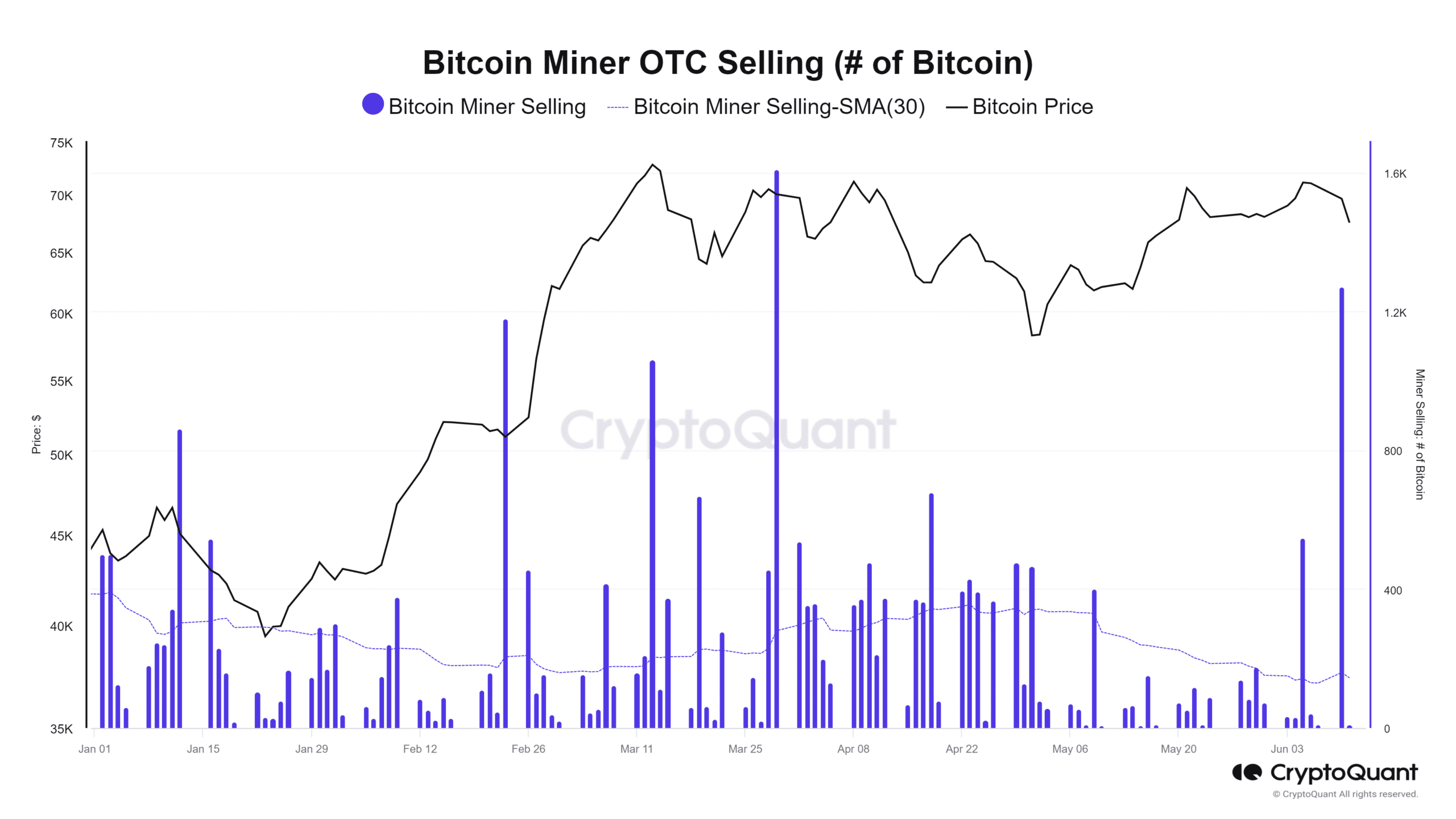

OTC sales deplete the Bitcoin miner reserve

As a researcher studying Bitcoin miner behavior, I’ve discovered that there has been a decrease in the amount of Bitcoin held by miners. Although the miner reserve still hovers around the 1.8 million mark, this trend represents a small yet noticeable decline.

An analysis of miner outflows revealed a downturn, suggesting less cryptocurrency is being transferred from miner wallets to exchanges.

As a crypto investor, I’ve noticed that the metrics can be perplexing at the outset due to the fact that the transfer of Bitcoin from miner wallets isn’t immediately observable. However, there have been noticeable decreases in the reserve.

However, the situation becomes clearer when analyzing Over the Counter (OTC) sales.

A thorough examination of over-the-counter (OTC) transactions involving Bitcoin miners uncovered that some prominent mining corporations have been disposing of their Bitcoins. As depicted in a CryptoQuant chart, the largest OTC sale transpired recently, amounting to approximately 1,200 BTC.

As a cryptocurrency market analyst, I’ve observed a notable trend: miners have been offloading their Bitcoin (BTC) stocks recently. This could be a result of mounting financial burdens or an attempt to secure gains as the market experiences downturns.

Transactions of this kind don’t boost exchange volume right away, yet they still decrease the total reserves.

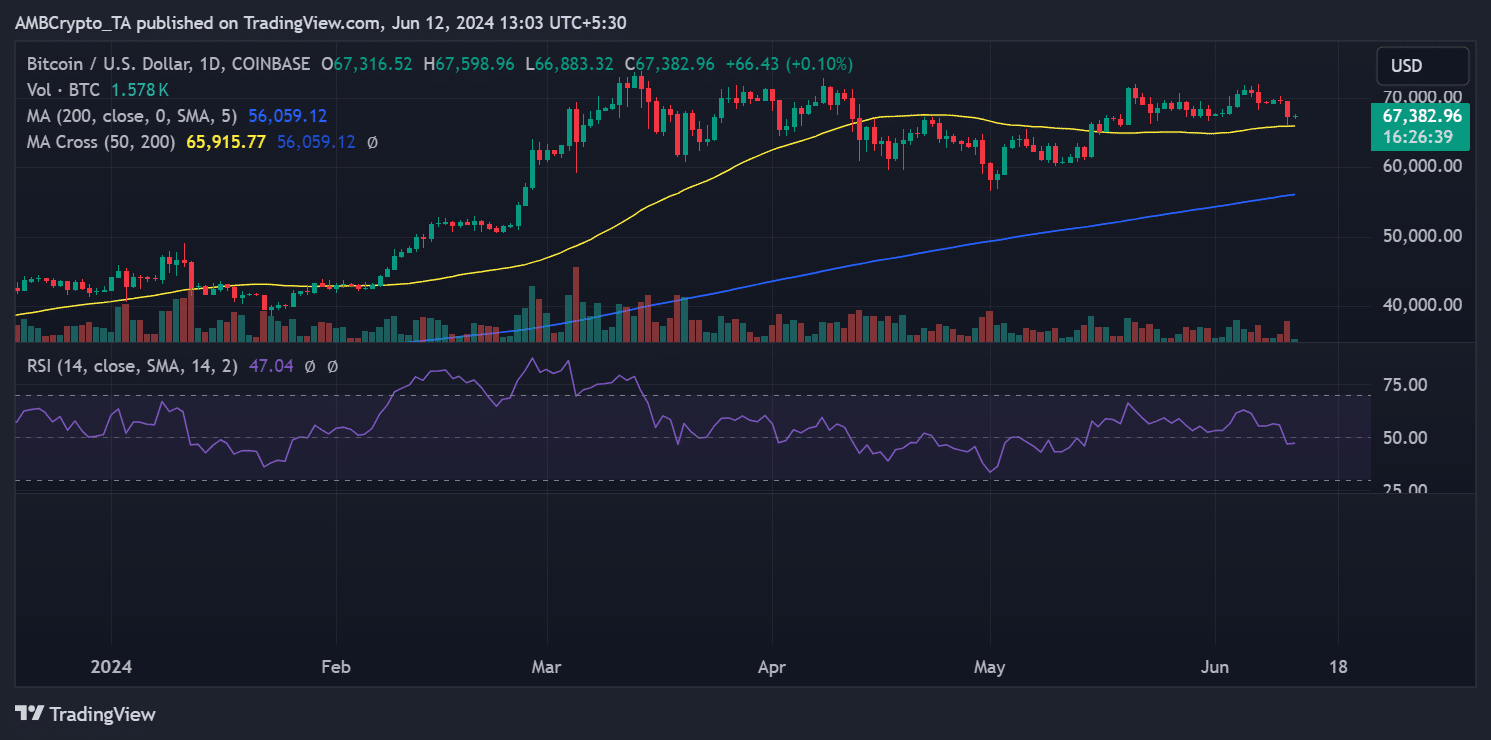

How has BTC trended amidst sell-offs

A seven-day analysis of Bitcoin’s daily chart revealed a downward trend. According to AMBCrypto’s assessment, Bitcoin’s value dipped from approximately $70,000 during the 6th to around $68,000 on the 7th of June.

On the 11th of June, Bitcoin experienced a significant drop, causing its price to fall below the $67,000 mark. An examination of the chart revealed that this decline amounted to over 3% reduction in value.

If current trends continue, Bitcoin approaching its yellow line moving average around $65,000 could indicate potential support for the price.

As of this writing, BTC was trading at around $67,400, with a slight attempt at an uptrend.

The RSI analysis for BTC reveals that it has dipped below the neutral threshold, sitting at approximately 47. This signifies that Bitcoin is presently exhibiting downward price movement, or is in a bear trend.

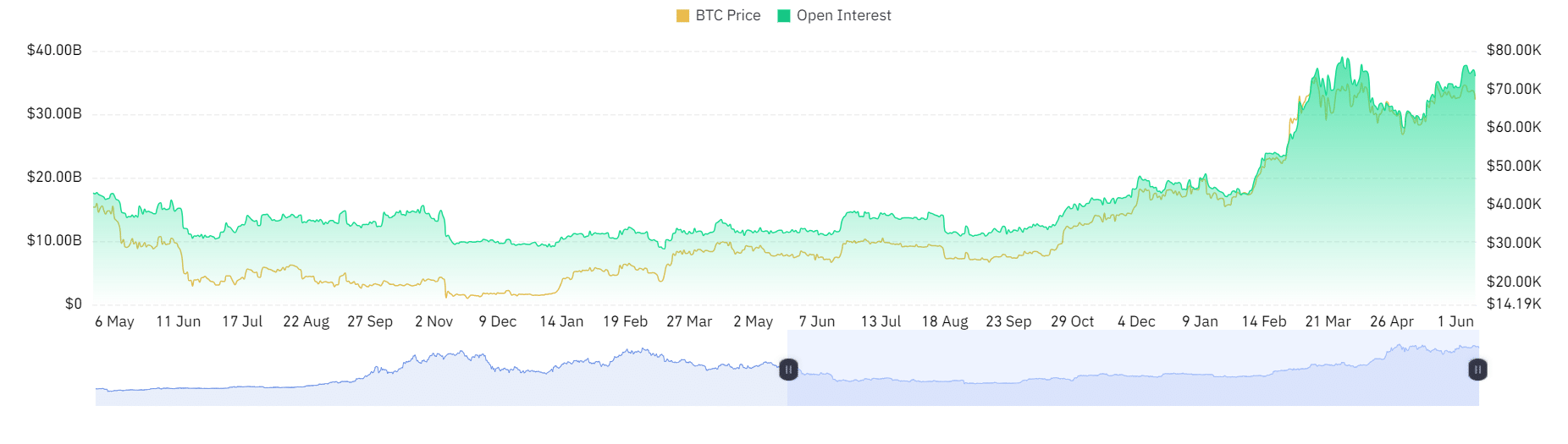

Bitcoin still getting lots of interests

Despite the drop in miner sales and decreasing prices, Bitcoin has remained a subject of significant attention as indicated by its continued high trading volume.

In a downtrend, there is still substantial interest and possibly some hope among market participants.

The Open Interest chart on Coinglass currently indicates a figure of approximately $34 billion.

The chart’s analysis revealed that its maximum value, or peak, hovered around $39 billion, which was attained back in March when Bitcoin’s price surpassed $70,000.

As a researcher observing market trends, I’ve noticed that despite the recent price decrease, cash is still flowing into the market. Many traders seem to be taking advantage of this dip by purchasing more assets.

Read Bitcoin (BTC) Price Prediction 2024-2025

The current level of open interest in Bitcoin (BTC) remains quite close to its record high, indicating a persistent bullish outlook among traders.

Despite the recent declines, traders remain engaged and optimistic about Bitcoin’s potential.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-06-12 18:16