-

A dormant wallet transferred 8,000 BTC, valued at roughly $536.5 million.

It suggests a renewed interest in BTC as new and former investors engage with the market.

As a researcher with extensive experience in the crypto market, I find the recent activity surrounding the dormant Bitcoin wallet and the renewed interest in the market intriguing. The sudden transfer of 8,000 BTC, valued at roughly $536.5 million, from a wallet that had not been active since December 2018 is an unusual occurrence, particularly given the current market downturn.

The cryptocurrency market is experiencing rough seas, with Bitcoin [BTC] finding it difficult to reach its past peak levels again.

At present, the price of Bitcoin hovers around $67,302, representing a nearly 6% decline during the last seven days, with a minimal 0.7% decrease observed within the previous day.

The crypto market experienced a significant decrease, contributing to a larger downturn that brought the total market value down to approximately $2.57 trillion – representing a daily loss of about 1.3%.

New activity: Significant whale movement

As a market analyst, I’ve been closely monitoring the current market downturn. An intriguing turn of events emerged concerning an inactive Bitcoin wallet. This specific wallet, last active in December 2018, suddenly moved a substantial amount of 8,000 BTC. The value of this transaction translates to approximately $536.5 million.

A transaction originated from a Coinbase-linked wallet kept in cold storage, transferring the funds directly into a recognized Binance withdrawal address.

As a crypto investor, I cannot help but raise some concerns based on the pattern of transactions I’ve observed. The implications behind these exchanges are not immediately clear to me, and their potential effects on the market merit further scrutiny.

Back in late 2018, I acquired a stash of cryptocurrency coins when Bitcoin was priced around $3,750. These coins have since experienced substantial growth in value.

It’s uncommon for large transactions from inactive wallets not to include preceding test transfers.

As a market analyst, I’ve observed historically that dormant wallets with substantial balances reactivating can indicate impending selling pressure within the market. This is particularly true when funds get transferred to exchange addresses.

The pattern indicates that the Bitcoin holder may be preparing to sell, taking advantage of the roughly 1,700% surge in value since their initial purchase.

Additionally, the use of these cryptocurrency wallets can align with larger market trends. According to Chainalysis, approximately 1.8 million Bitcoin wallets have remained dormant for over a decade, holding an estimated $121 billion in dormant funds.

As a crypto investor, I understand that not every wallet containing cryptocurrencies will be accessible. Sadly, many investors might have lost their private keys, making those wallets inactive. However, for the wallets that do become active, their contents could potentially have a significant impact on market dynamics.

Uptick in Bitcoin network participation

The recent transaction coincides with an uptick in overall market activity.

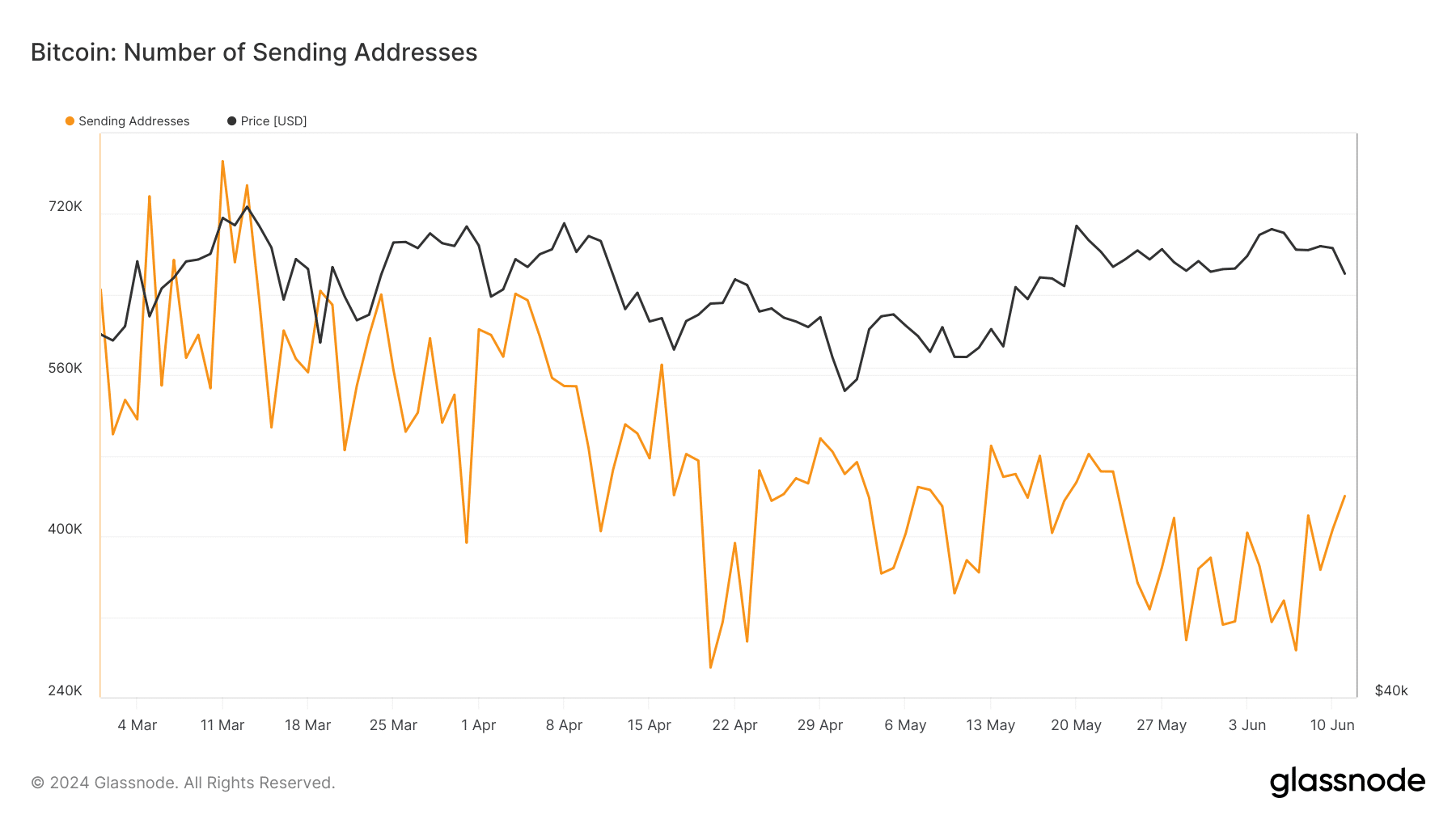

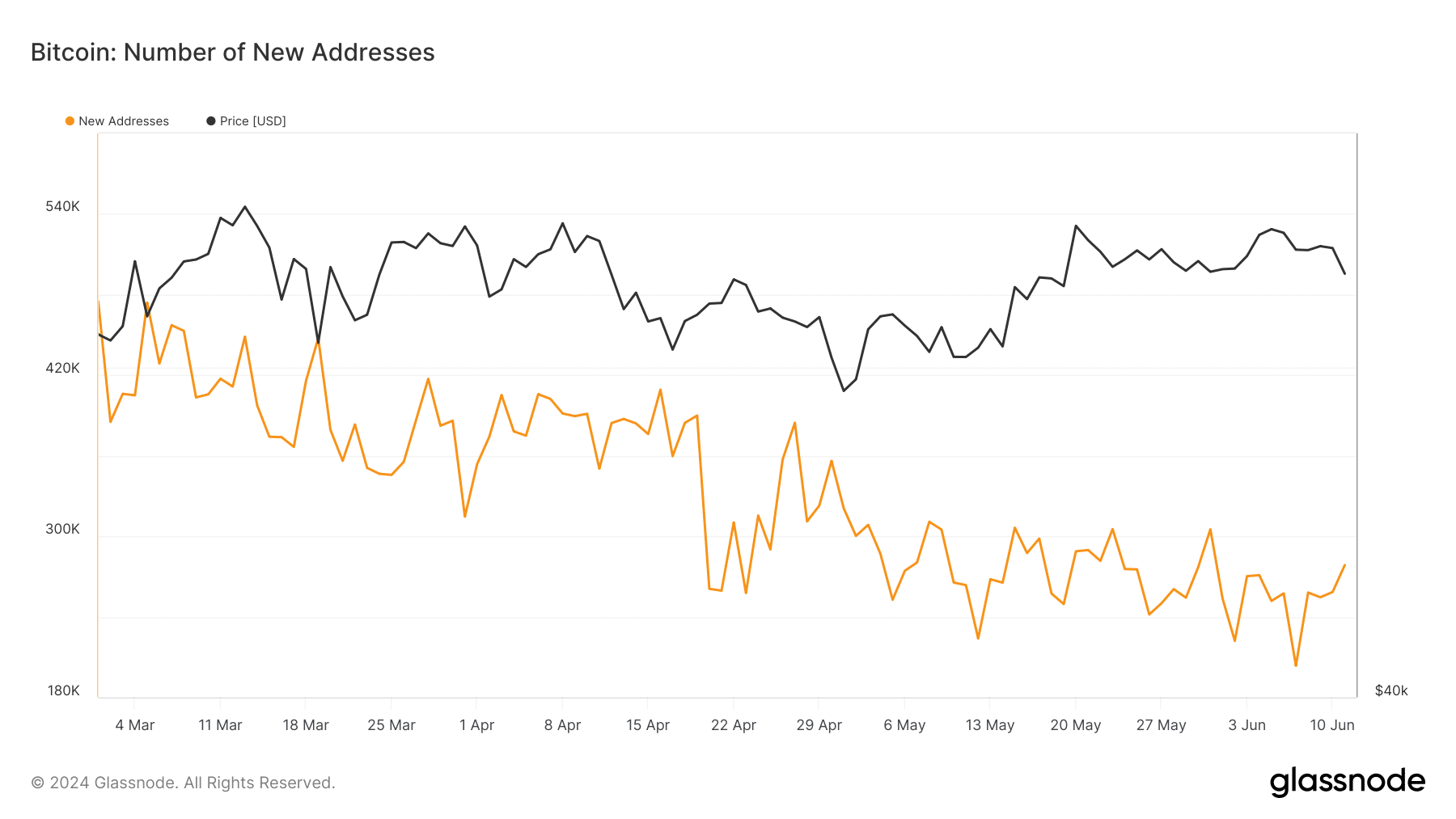

According to Glassnode’s latest data, there has been a notable rise in the number of unique Bitcoin addresses actively sending transactions on the network. The figure has surpassed the 400,000 mark after being below 300,000 not long ago.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

The recent surge in used Bitcoin addresses, combined with an increase in newly created addresses from 203,000 to 278,000, indicates a revived enthusiasm or potentially speculative behavior among old and new investors as they re-engage with the Bitcoin market.

Although it’s unclear what impact this individual trade may have on Bitcoin’s market position as a whole, AMBCrypto emphasizes the significance of Bitcoin holding strong at its key support line in order to keep the uptrend going.

Read More

2024-06-13 02:15