As an analyst with a background in cryptocurrency market analysis, I find the recent trend in Ethereum [ETH] intriguing. While the price has seen a significant decline over the last few days, resulting in a bearish trend, there are opposing signs emerging from exchange outflow and whale accumulation metrics.

Recently, the cost of Ethereum [ETH] has dropped noticeably. Yet, there’s an intriguing disparity between two key indicators: exchange outflows and accumulation. While the former suggests a mass selling trend, the latter points to increasing hoarding. This divergence could potentially signal a buy opportunity or a temporary market manipulation, though it’s essential to keep monitoring these trends for further clarity on Ethereum’s price direction.

Ethereum takes hits

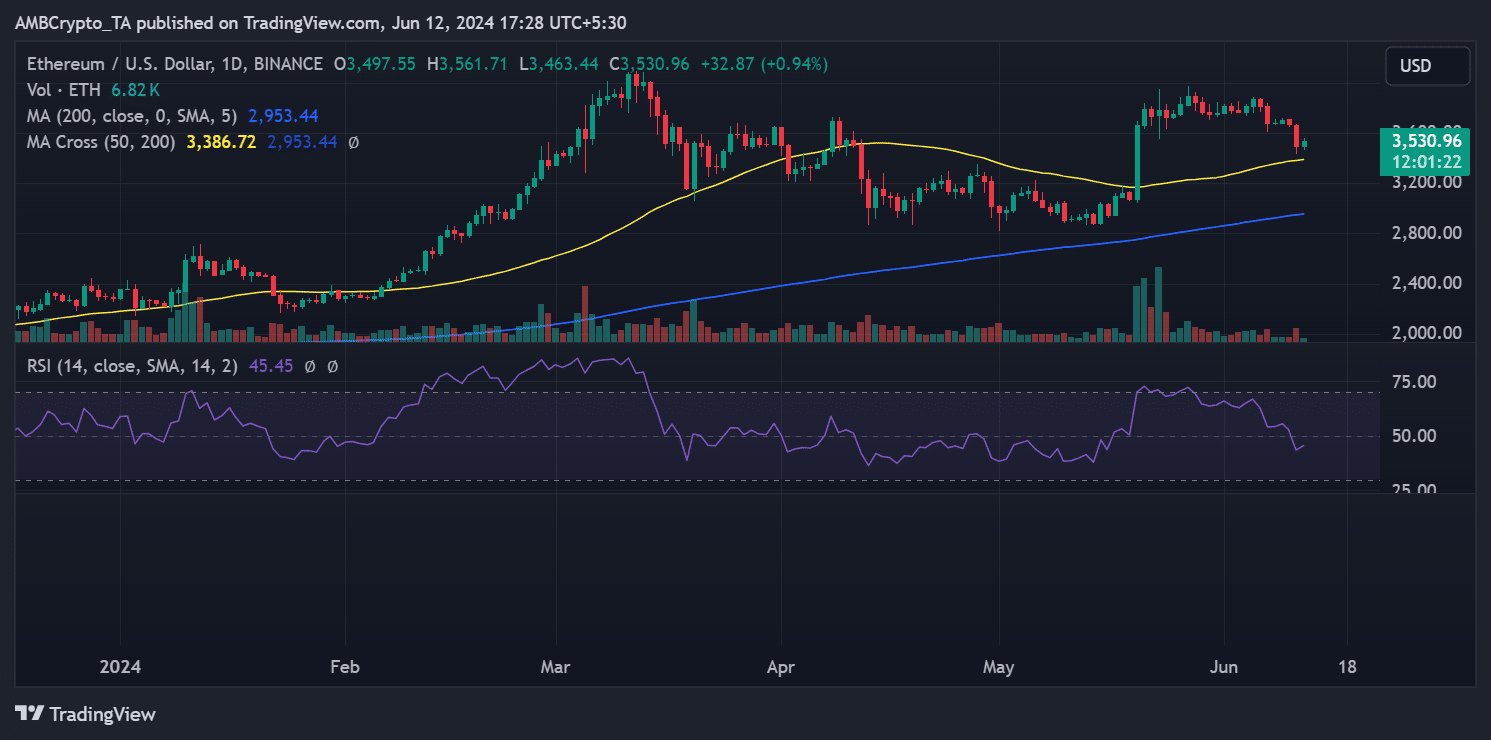

As a crypto investor observing Ethereum’s daily price trends, I noticed a significant setback on the 11th of June – the largest one-day decrease in over a month.

The graph showed a nearly 4.6% decrease in price, taking it down from approximately $3,650 to roughly $3,500. This downturn represented the culmination of the seven-day trend of sellers giving up and abandoning their positions.

The examination revealed that these decreases caused Ethereum to enter a downtrend, with its Relative Strength Index (RSI) dropping beneath the threshold of 50 – considered neutral. At present, the RSI still hovered below this level.

Furthermore, the price has rebounded slightly, registering a rise of more than 1% and hovering near $3,500. The short-term moving average (represented by the yellow line) has persisted in underpinning the price at approximately $3,300.

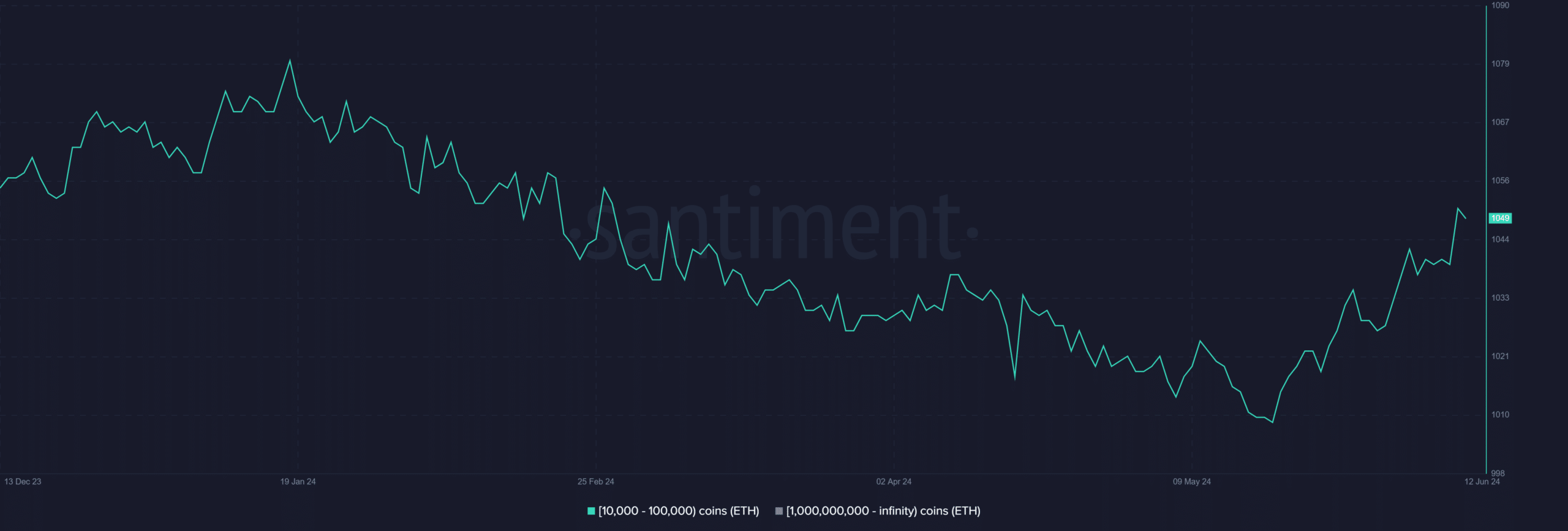

Whales continue to accumulate Ethereum

In examining the whale transactions on Santiment, it was observed that these addresses have persistently added to their holdings even as the price of Ethereum fell.

As of now, the graph shows an increase from 1,040 to 1,049 in the number of Ethereum addresses containing between 10,000 and 100,000 ETH.

The data uncovered the fact that whales had purchased approximately 240,000 ETH, equivalent to roughly $840 million, during the downturn period.

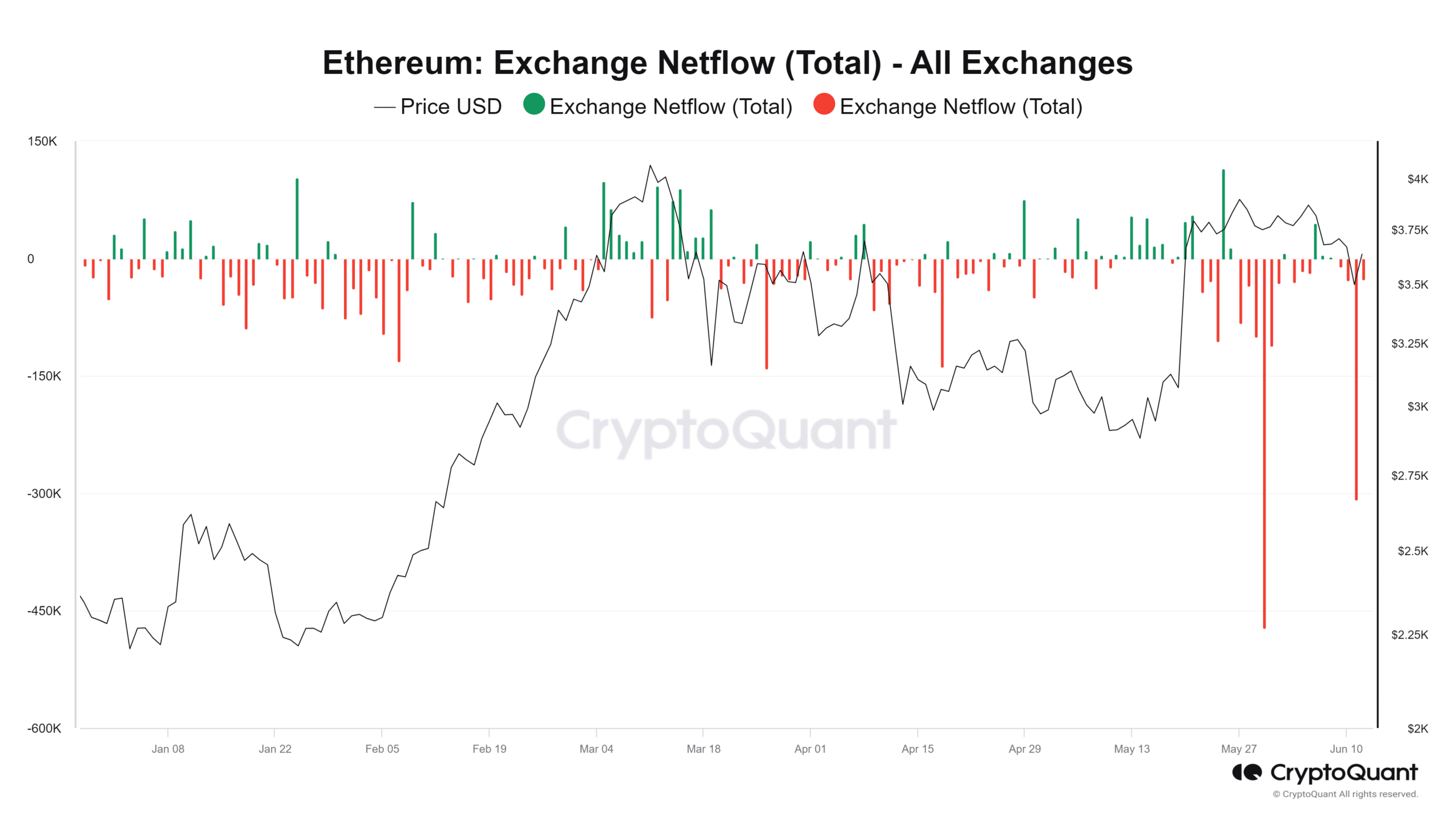

Ethereum sees massive outflow

As an analyst, I’ve noticed an increase in the amount of cryptocurrency being withdrawn from exchanges, most notably from Coinbase, based on the data provided by CryptoQuant.

Approximately $1 billion worth of Ethereum (ETH) was withdrawn from Coinbase in a single day, marking the largest outflow for the exchange during the year.

In recent days, Ethereum’s net flow has indicated a prevailing trend of outgoing transactions, with certain significant peaks observed.

Read Ethereum (ETH) Price Prediction 2024-25

By the close of business on the 11th of June, there had been a net outflow of approximately 307,000 units. Currently, the net flow hovers around a negative figure of roughly 27,000 units.

These metrics indicate that more traders are buying ETH as its price declines.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-13 08:07