- Bitcoin’s projected target remains high at $91,539 according to the “Magic Bands” model.

- Recent whale activities and increasing active addresses suggest strong market support for this bullish outlook.

As an experienced financial analyst, I closely monitor the crypto market and its trends. Based on my analysis of recent developments, Bitcoin’s projected target remains high at $91,539 according to the “Magic Bands” model. This bullish outlook is further reinforced by recent whale activities and increasing active addresses in the network.

As a researcher studying the crypto market, I’ve observed some volatility in recent times. Nevertheless, Bitcoin [BTC], in particular, has displayed promising indicators of future growth.

As a crypto investor, I’ve noticed an uptick in Bitcoin’s price following the release of the recent U.S. Consumer Price Index (CPI) report. The report showed signs of decelerating inflation, which led to a temporary spike in Bitcoin’s value, pushing it up to around $69,000.

At the moment of publication, the price was holding steady around $67,505, representing a slight gain in the previous 24 hours. This stability emerged against the larger context of market adjustments, which resulted in a 4.7% decrease for this asset over the last seven days.

Bitcoin: Technical predictions

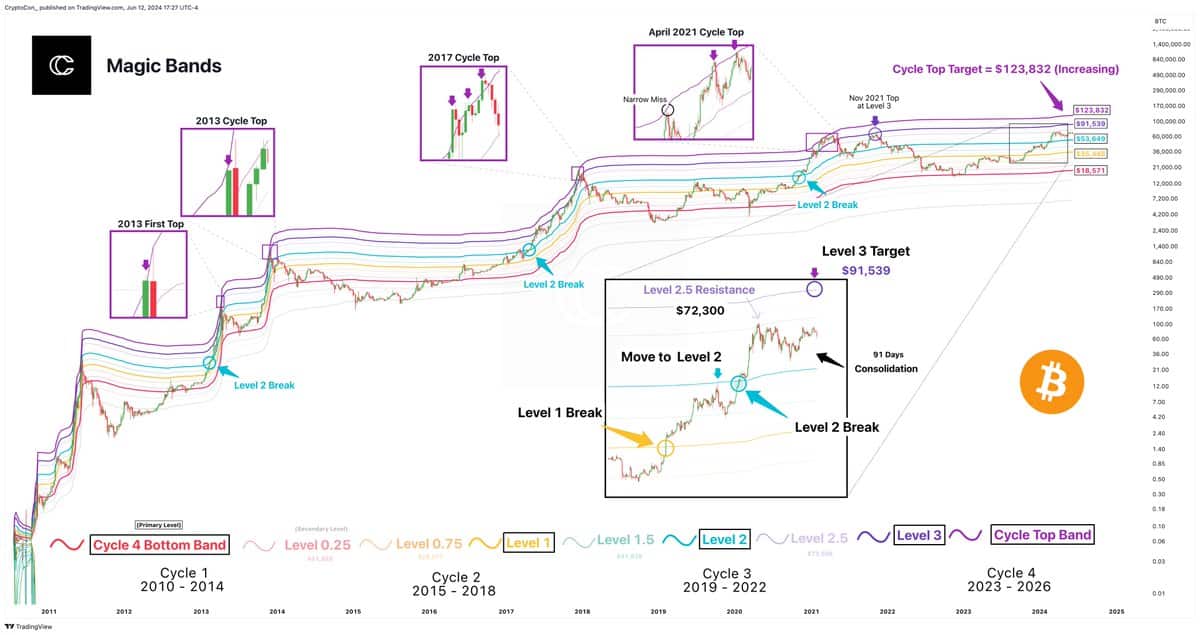

In the midst of fluctuating prices, the technically-inclined analyst known as CryptoCon maintains a optimistic perspective on Bitcoin’s future value, predicting it could reach as high as $91,539 in the not too distant future.

According to a recent post by CryptoCon on social media X (previously Twitter), the stated objective of their plan remains constant, unfazed by the Federal Reserve’s announcement to keep interest rates steady with a slight decrease predicted for 2024.

The “Magic Bands” model is used for the prediction, and it analyzes past highs and lows to estimate future prices.

According to the “Magic Bands” theory, Bitcoin, which is presently in the ‘level 2.5’ stage of its cycle, has the potential for a significant surge, potentially reaching a price tag of $91,539.

As a crypto investor, I can tell you that a potential increase in value to the predicted “Cycle Top Target” of $123,832 would represent a substantial leap from its current valuation. This upward trend could serve as a precursor to reaching this significant price point.

Analyzing fundamentals

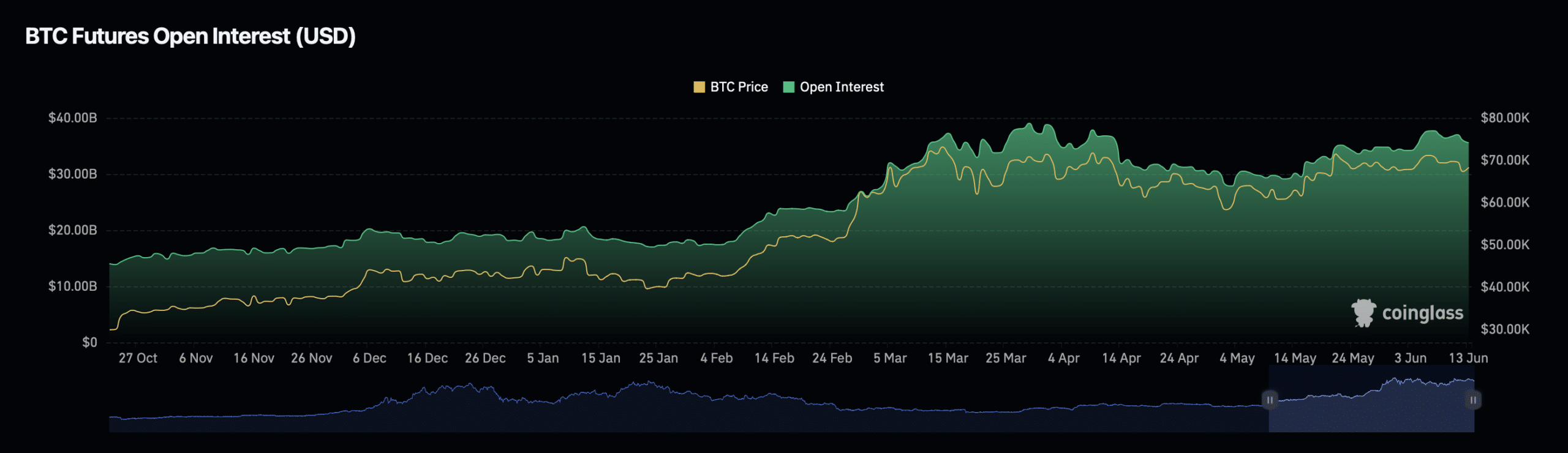

To assess whether such a significant price increase is viable for Bitcoin, consider examining its Open Interest and active addresses as indicators.

According to AMBCrypto’s assessment, Open Interest exhibited a varied trend, whereas the total Open Interest decreased by 3.11% over the last 24 hours.

During the same timeframe, the valuation experienced a substantial increase of 53.11%, implying a more constricted market with potential for price fluctuations.

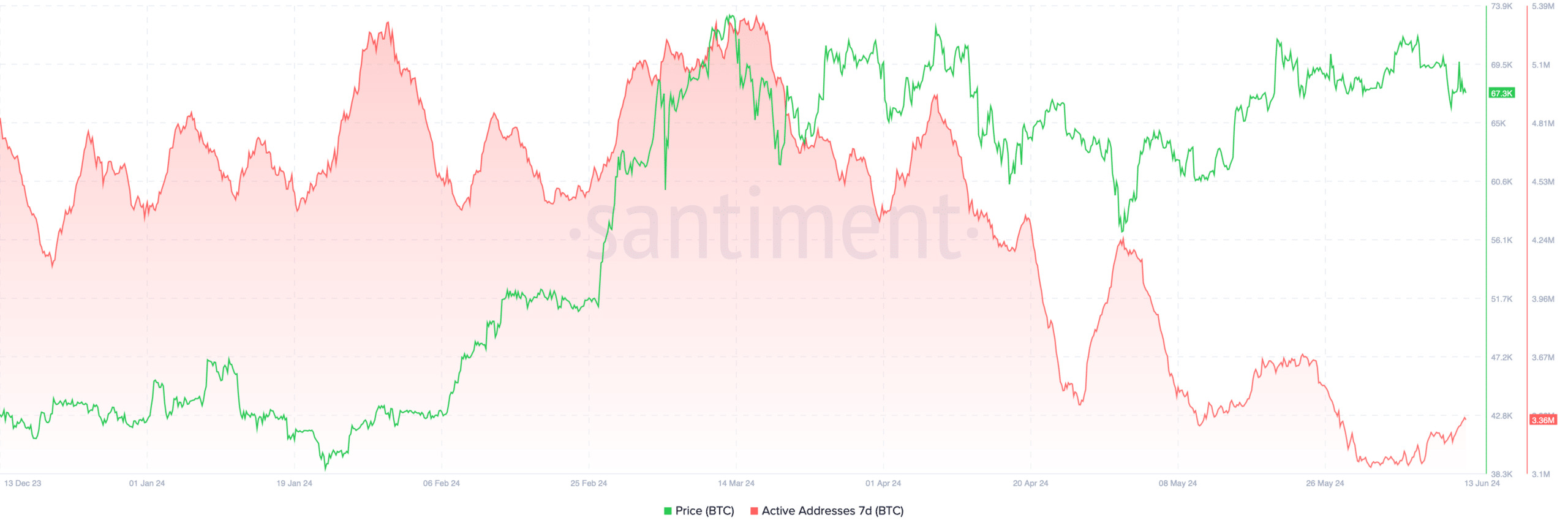

Additionally, there has been a rise in the count of active Bitcoin addresses, climbing from 3.14 million to 3.36 million within a short time frame.

Active user addresses often signal expansion in the user community and may forecast greater transaction activity, potentially leading to higher market values.

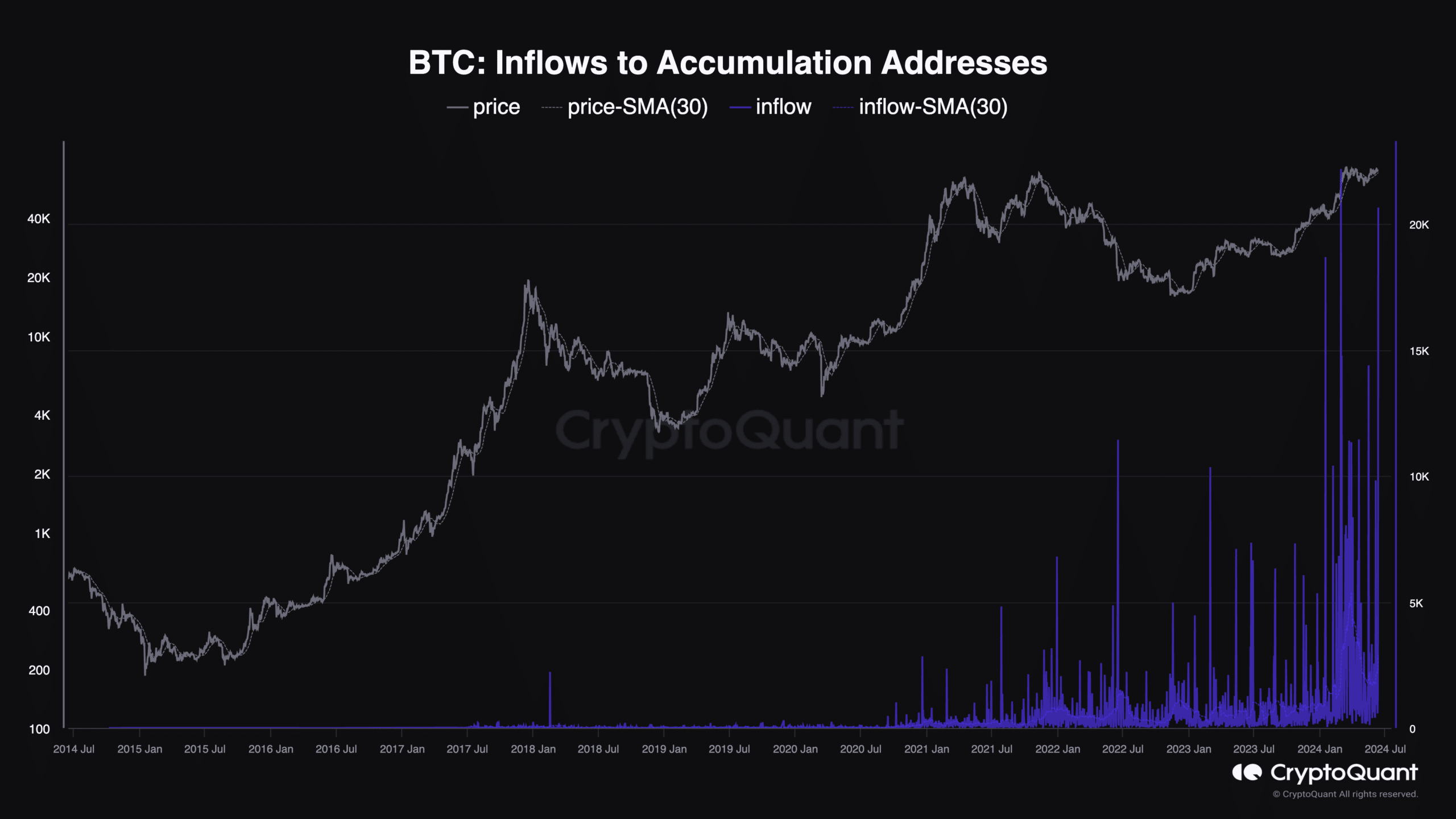

The actions of significant Bitcoin investors, or “whales,” offered valuable clues about market attitude. On June 11th, during a significant price decline, these major investors acquired an extra 20,600 BTC, equivalent to around $1.38 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

As a financial analyst, I’ve observed a notable purchasing spree from large investors recently, representing one of the biggest one-day buys since February. This action indicates that these market heavyweights recognized value in current prices and could be preparing for potential future price growth.

As a researcher, I’ve come across an intriguing report by AMBCrypto regarding a significant revival of inactive Bitcoin addresses.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-13 19:04