-

The founder of Curve DAO has been facing massive liquidations.

CRV has dropped by over 23%.

As an experienced analyst, I’m deeply concerned about the recent developments surrounding Curve DAO (CRV). The founder’s massive borrowing positions and resulting liquidations have added fuel to the fire, causing CRV to drop by over 23% in just a few days.

In the past 24 hours, Curve DAO [CRV] has faced a significant wave of negative sentiment. This is primarily caused by the large borrowing positions taken on by the founder, which have since been liquidated.

Curve DAO at risk

As a researcher examining data from Arham Intelligence, I discovered that CRV tokens amounting to $140 million were in danger of being liquidated.

As a researcher studying the recent development in the cryptocurrency world, I came across an intriguing occurrence. The founder of a popular platform, Michael Egorov, secured around $95.7 million in stablecoins by leveraging his holdings of approximately $141 million worth of CRV tokens spread across five distinct protocols.

Based on the information provided, approximately $50 million worth of loans were taken out from a lending platform with an annual percentage yield (APY) of around 120%. The exorbitant APY is due to the scarcity of crvUSD for collateral in borrowing against CRV on this specific platform.

The risk here is that a drop in the value of CRV will cause these positions to be liquidated.

Lately, the cost of CRV has decreased significantly, leading to forced sales that have intensified this price decrease.

CRV’s historic decline

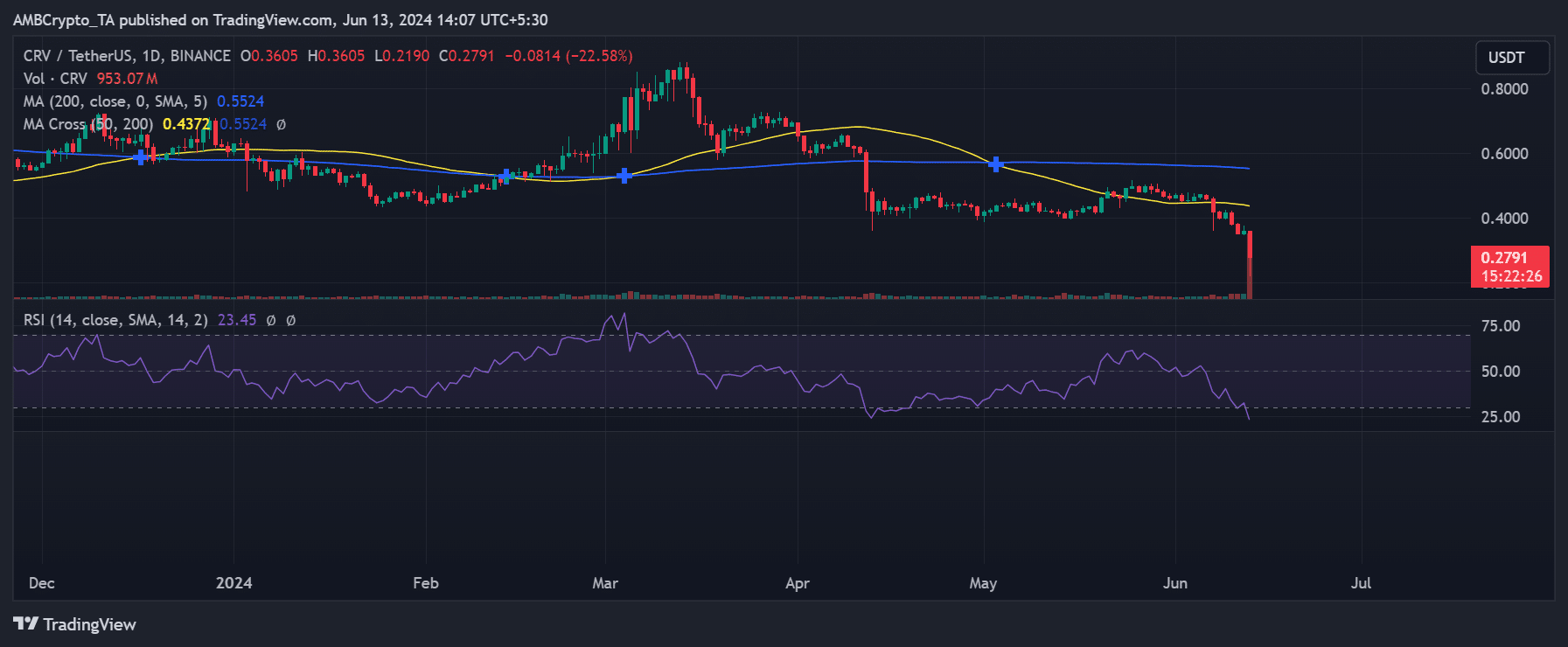

As a researcher studying the cryptocurrency market trends, I observed from AMBCrypto’s analysis that CRV‘s daily price pattern might lead to increased liquidations towards the end of the day.

At present, the price has experienced a significant decrease, dropping more than 23% from roughly $0.36 down to about $0.27.

I analyzed the CRV data and noticed a downturn on the 10th and 11th of June, with a cumulative decrease exceeding 16%. According to the chart, its value dropped from roughly $0.41 to around $0.35 within this two-day period.

On June 11th, the price experienced a brief respite as it rose by 2.74%, approximating $0.36. This uptick momentarily suggested the possibility of a recovery.

The chart indicated that the most significant decrease in CRV, amounting to over a year’s worth, had occurred recently.

Supply on Exchange hits ATH

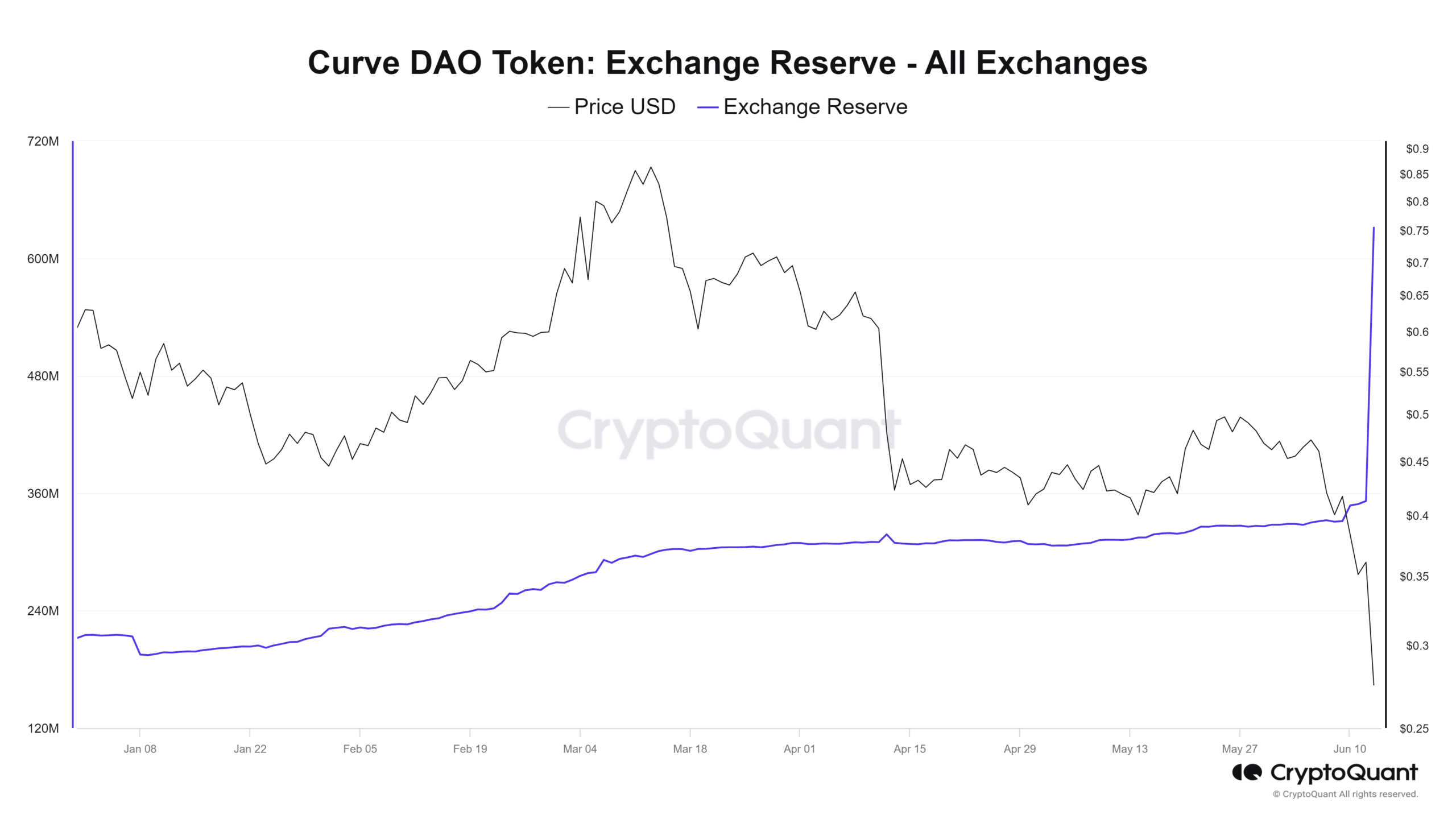

As a researcher observing the crypto market, I’ve noticed a surge of activity surrounding Curve DAO (CRV). This sudden buzz has caused concern among investors, resulting in a significant volume of CRV tokens being transferred to cryptocurrency exchanges.

As a researcher investigating the cryptocurrency market trends using AMBCrypto’s insights, I discovered an intriguing development regarding exchange reserves on CryptoQuant. In the past day, there has been a noticeable surge in these reserves.

As a crypto investor, I’ve noticed an intriguing development: the exchange reserves have experienced a substantial surge and currently stand at over 627 million units.

As a crypto investor, I’ve noticed that the amount of CRV tokens reserved for exchanges reached an unprecedented peak recently. This new record represents the highest level of CRV exchange reserves we’ve seen to date.

The majority of holders appeared to be selling off their assets, potentially leading to a deeper price decrease.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-13 22:15