-

MicroStrategy intends to buy more BTC with a recent convertible notes offer.

MSTR’s remain an irresistible short-term bet over BTC.

As a seasoned crypto investor, I’ve learned that following the price action of specific stocks and digital assets requires a nuanced approach. MicroStrategy (MSTR) is one such stock that has piqued my interest due to its significant exposure to Bitcoin.

On June 13th, MicroStrategy (MSTR) disclosed its intention to acquire additional Bitcoin (BTC) using the funds raised from a private offering of $500 million convertible notes. These senior notes, which represent a debt financing method, will mature in 2032. A portion of their announcement stated,

MicroStrategy plans to utilize the funds obtained from selling the notes to purchase more bitcoin and for various business needs.

MicroStrategy has been leveraging debt to ramp up its Bitcoin strategy.

I analyzed the firm’s Bitcoin transactions in April and discovered they acquired an additional 122 coins for approximately $7.8 million. With this latest purchase, their total Bitcoin holdings now exceed 214,400 coins, translating to a value of over $14.5 billion based on current market prices.

In spite of other potential market influencers such as being added to the MSCI Index and the forthcoming integration into the Russell 1000 Index on June 28th, MicroStrategy Inc.’s (MSTR) stock has consistently mirrored Bitcoin’s price trends.

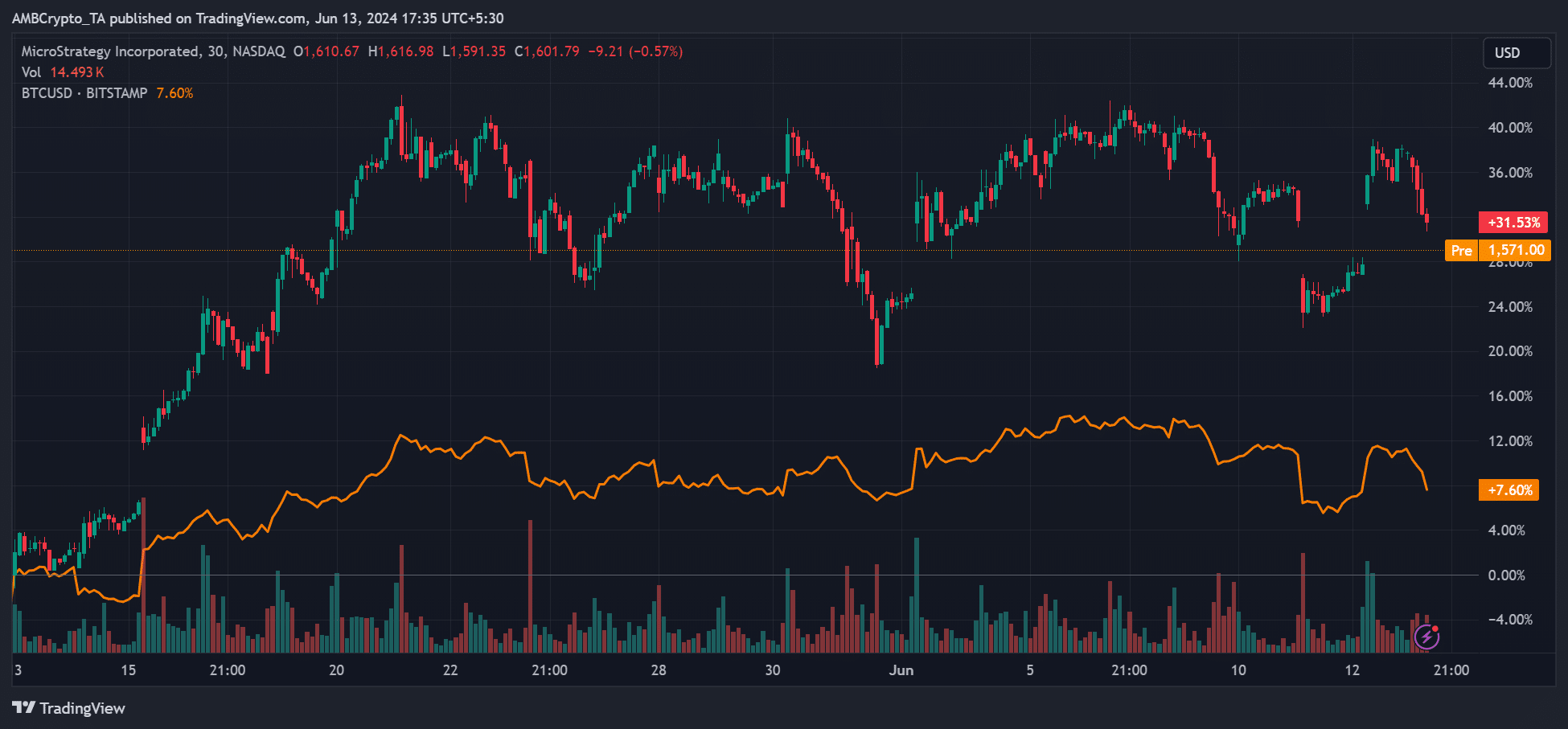

As a researcher, I’ve noticed an intriguing shift in the market. Contrary to popular belief, this particular stock has shown superior performance compared to Bitcoin in the short term. On numerous occasions, it has surpassed Bitcoin’s gains.

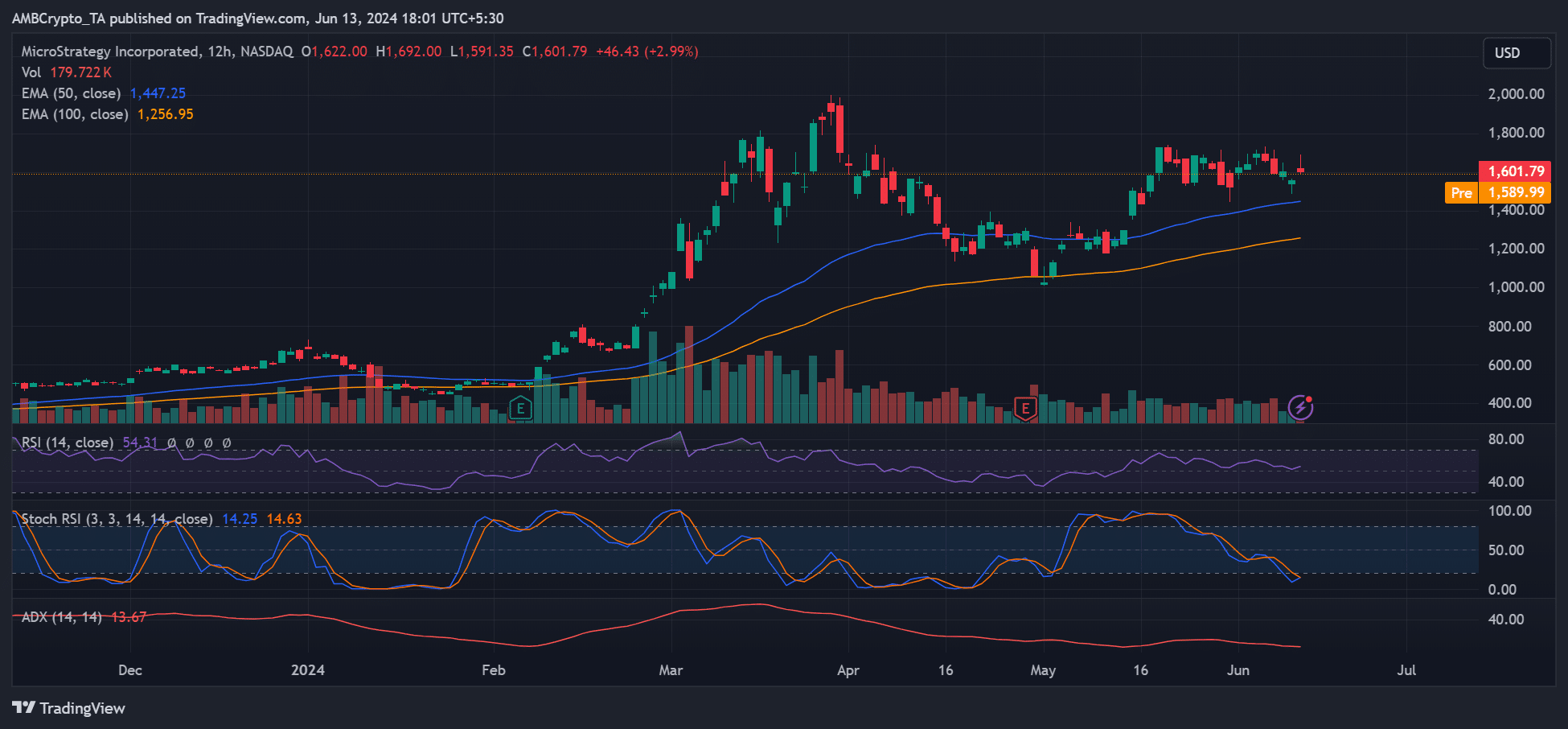

MicroStrategy stock price chart position

Despite the recent market downturn following the Federal Reserve’s hawkish interest rate decision, the market condition of the MSTR remained more favorable.

Significantly, the stock of MSTR (MicroStrategy Incorporated) remained above its 100-day and 50-day moving averages, indicating that both its short-term and long-term price trajectories showed strength at that point in time.

The Relative Strength Index (RSI) remained above its median value, signaling moderate buying activity that was stronger than average. Meanwhile, the stochastic RSI approached oversold levels, possibly indicating an impending bullish turnaround.

If so, MSTR could soon bounce off the 50-EMA and target $1800 or $2000.

As a crypto investor, if Bitcoin continues to incur more losses, my stock could potentially be pulled down to the 100-Exponential Moving Average (EMA) at around $1256. The Average Directional Index (ADX) reading falling below 20 implies that the trend is weak and it’s essential for traders to exercise caution.

As a crypto investor, I’ve noticed that the market has taken a hit and prices have been relatively stable for the past three months. However, during this period, I managed to earn more returns from investing in MicroStrategy (MSTR) compared to Bitcoin (BTC).

At the time this article was published, MicroStrategy (MSTR) provided approximately 30% greater returns than Bitcoin (BTC) on a monthly adjusted basis. In simpler terms, your investment in MSTR would have yielded around four times the returns compared to investing in Bitcoin over the same duration.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-13 23:04