-

Fed keeps rates steady, drawing criticism from analysts.

Bitcoin price sees declines but BTC ETFs show inflows.

As an experienced financial analyst, I believe that the Federal Reserve’s decision to keep interest rates steady, despite some criticism from analysts like Anthony Pompliano, is a prudent one. However, it is important for central banks to be mindful of market signals and adapt accordingly.

Based on the data from the CME FedWatch Tool indicating a 0.6% chance of rate change and in line with expectations, the US Federal Reserve kept interest rates steady during their announcement on June 12th.

Following a two-day long Federal Open Market Committee (FOMC) session, its members opted to keep interest rates unchanged at the range of 5.25% to 5.50% for the seventh meeting in a row. In sync with market anticipations on Wall Street, this choice was made.

Remarking on this with a touch of criticism Anthony Pompliano, in a recent stream said,

As a researcher studying the dynamics of financial markets, I would argue that it’s hubris for a central bank to assume they have the sole authority to determine interest rates. In truth, the market plays a pivotal role in setting interest rates based on various economic factors and market conditions.

After the recent announcement, I’ve noticed a substantial dip in the crypto market. Specifically, Bitcoin [BTC] has decreased by 2.35% over the last 24 hours, and Ethereum has seen a larger drop of 3.66% as I pen this down.

Only one rate cut by the end of 2024

The Federal Open Market Committee (FOMC) members have adjusted their predictions for the total number of interest rate reductions to be made this year. Originally, in March, the FOMC forecasted three such cuts by the end of 2024. However, they have since revised this estimate and now anticipate only one cut.

The updated prediction from the Federal Open Market Committee indicates they expect to make just one reduction of 0.25 percentage points to interest rates by the year’s end.

Some analysts were taken aback by this announcement, as they had anticipated larger interest rate reductions. These analysts suspect that the Federal Reserve may have to revise its prediction and possibly make adjustments in response to shifting economic circumstances within the next few months.

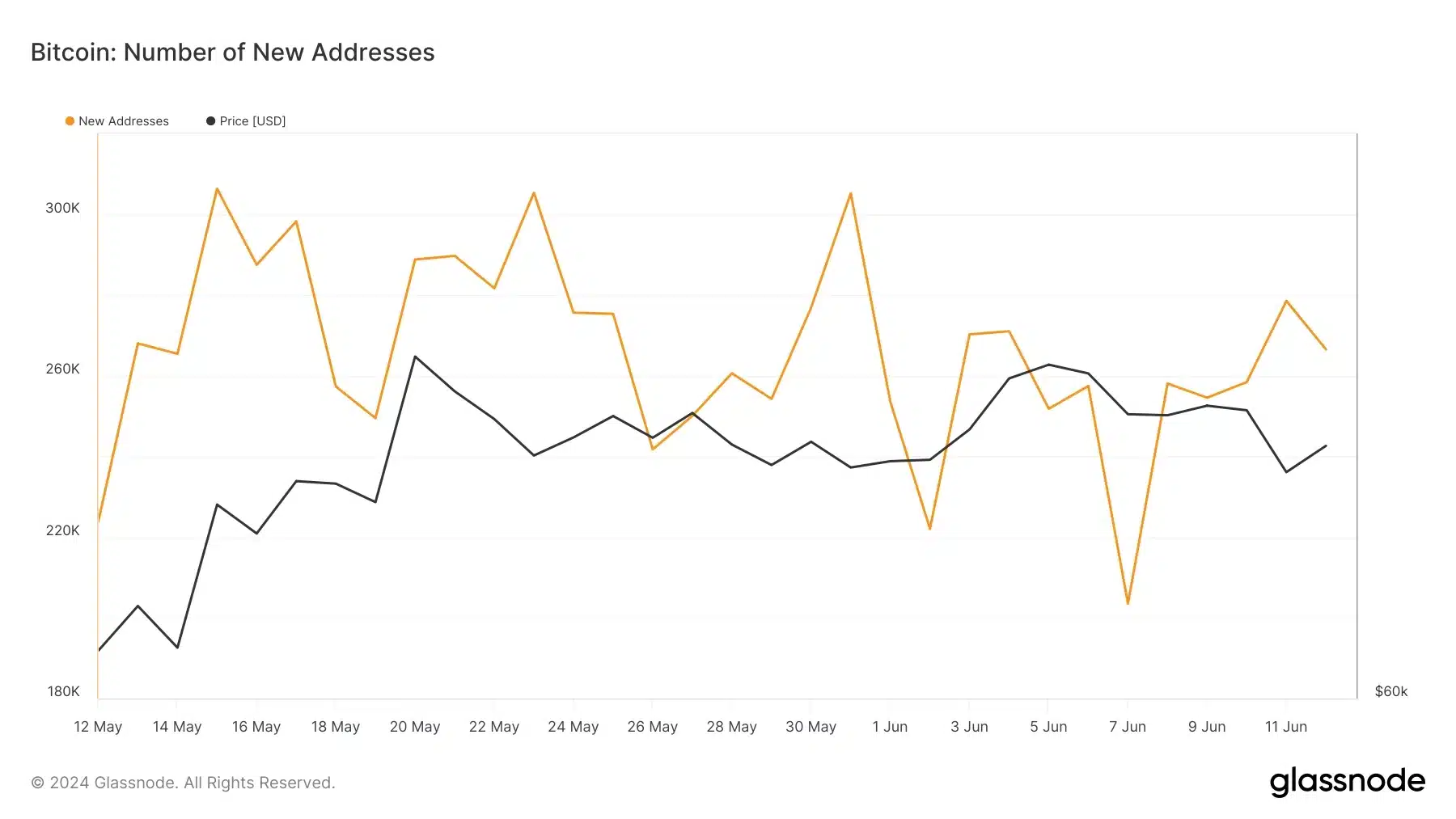

During the current scenario, there was a decrease in the number of new Bitcoin addresses according to AMBCrypto’s assessment based on Glassnode data.

Bitcoin stands strong

Although Bitcoin has experienced a downturn recently, not all indicators suggest a pessimistic view. Based on AMBCrypto’s interpretation of Santiment’s data, Social Dominance metrics have shown a significant increase.

The RSI indicator hasn’t shown any strong signals for purchasing or selling yet.

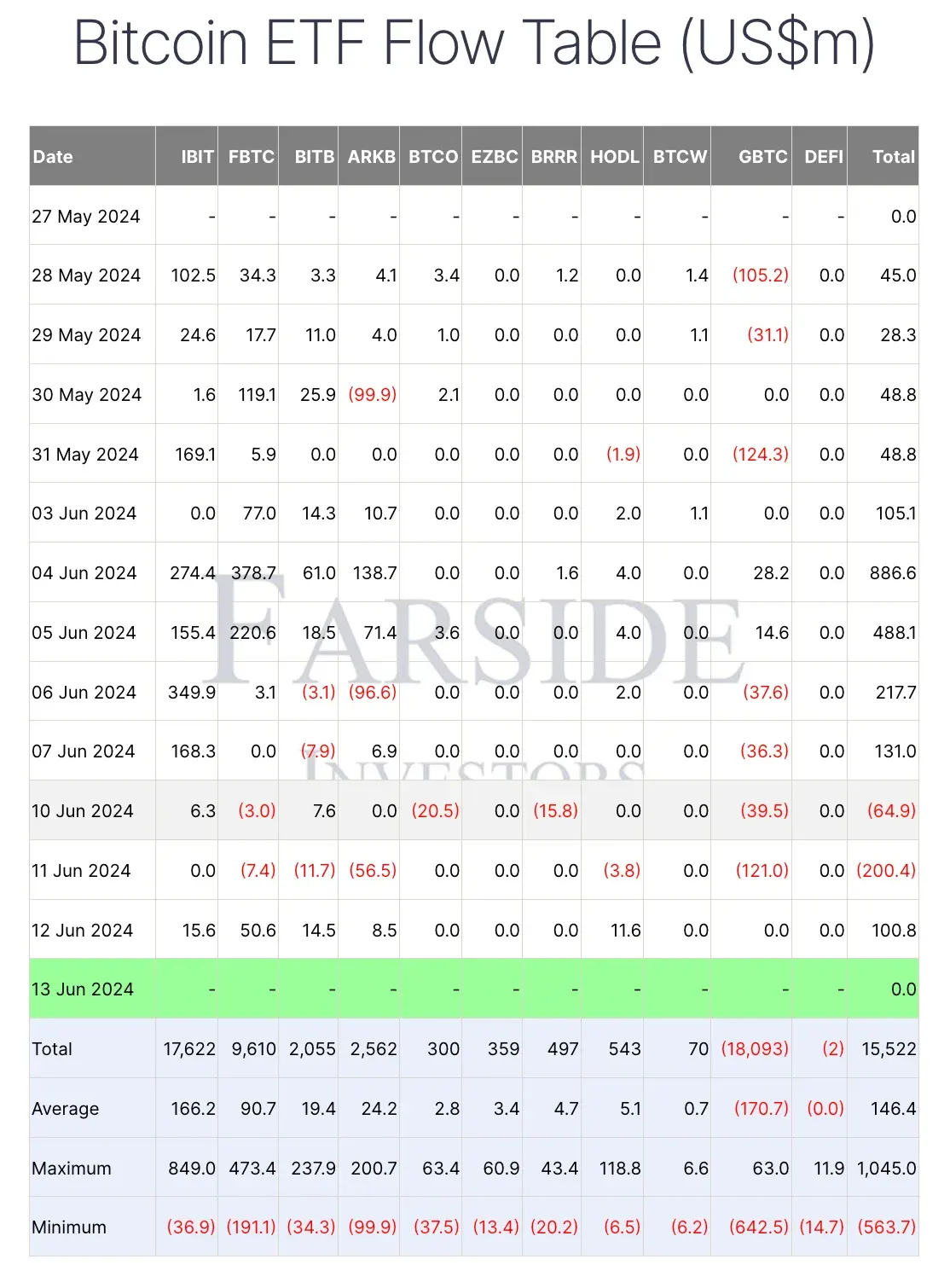

Bitcoins’ spot Exchange-Traded Funds (ETFs) saw net purchases totaling $100.8 million, signaling a reversal following two successive days of withdrawals.

Pompliano, best put it when he said,

As a seasoned crypto investor, I’ve come across various assets in my journey, but none quite compare to Bitcoin. Among all the investments I’ve made, Bitcoin stands alone as the asset class that not only holds its ground against inflation but surpasses it with impressive returns.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-14 04:07