- Dogecoin’s price might keep consolidating between $0.12 and $0.15.

- Old coins are moving in numbers, indicating that price may slide in the short term.

As an experienced analyst, I have closely monitored Dogecoin’s [DOGE] price movements and on-chain metrics. Based on my evaluation of the Global In and Out of Money (GIOM) indicator and the analysis of Santiment data, I believe that Dogecoin’s price might remain range-bound between $0.12 and $0.15 in the short term.

🛑 Trump Tariffs vs. Euro: The Fight of the Decade?

Discover how the EUR/USD pair could react to unprecedented pressure!

View Urgent ForecastDogecoin’s value decreased by approximately 12% over the past week. However, based on the Global In and Out of Money (GIOM) analysis conducted by AMBCrypto, it is possible that DOGE‘s price could stay above the $0.10 mark in the upcoming weeks.

GOIM evaluates profits and loss-incurring addresses in cryptocurrency transactions. Consequently, this metric could function as a hidden barrier for price increases (resistance) or decreases (support) within the on-chain market.

As an analyst, I would interpret this as follows: The greater the quantity of addresses holding cryptocurrencies at a specific price level, the more influential that price becomes as a potential support or resistance point in the market.

Price stuck between crucial levels

Based on IntoTheBlock’s analysis, Dogecoin was transacting above a key on-chain support level. During this period, investors bought approximately 45 billion DOGE units, with an average purchase price of around $0.11.

Thus, this region served as a significant support for DOGE, potentially preventing it from dropping beneath the previously mentioned price.

As a crypto investor, I can tell you that reaching a price above $0.16 for a particular cryptocurrency could be an uphill battle. The reason being, there are numerous wallets containing around 20 billion coins each, which were bought when the prices were much lower. These investors are currently holding onto their coins at a loss, and may choose to sell if the price rises above their purchase price, thereby flooding the market with coins for sale and potentially hindering the coin’s ability to surpass $0.16.

If Dogecoin (DOGE) reaches $0.16 and continues to trend upwards, some investors may choose to cash out and realize their profits, potentially halting the upward momentum.

Based on current market conditions, I believe Dogecoin’s price may continue to fluctuate between $0.12 and $0.15 in the near future. To gain further insight into the community sentiment surrounding Dogecoin, I analyzed data provided by Santiment, specifically for DOGE.

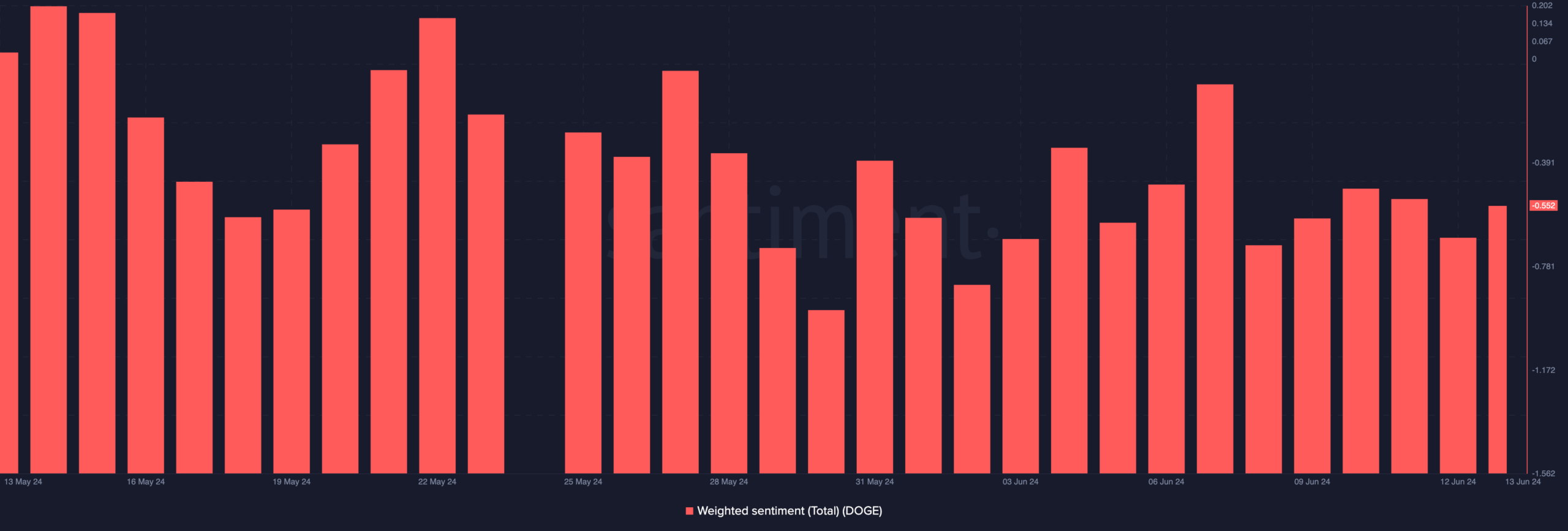

Based on the latest data, the Weighted Sentiment score for the project stands at -0.552. This metric reflects the overall emotional tone of comments about the project online, with negative values indicating predominantly negative sentiment and positive values signifying mostly positive comments.

No gain in sight for the coin

As an analyst, I would interpret a positive reading of the metric as my personal assessment that there’s a generally optimistic outlook towards the memecoin project in the market. However, since we received a negative reading instead, it signifies that investors and traders are currently less convinced about the coin’s potential for significant price appreciation or “bull run.”

As a researcher studying the DOGE market, if the sentiment towards reading the current news remains pessimistic, it’s likely that the demand for DOGE will stay suppressed. Consequently, the price of this cryptocurrency may continue to hover around its current level without significant movement upwards.

As a Dogecoin investor, I can tell you that if buying momentum picks up, the coin could surge past its current resistance at $0.16. Yet, it’s important to consider a more optimistic perspective: in a bull market scenario, the price might dip down to around $0.12 before bouncing back.

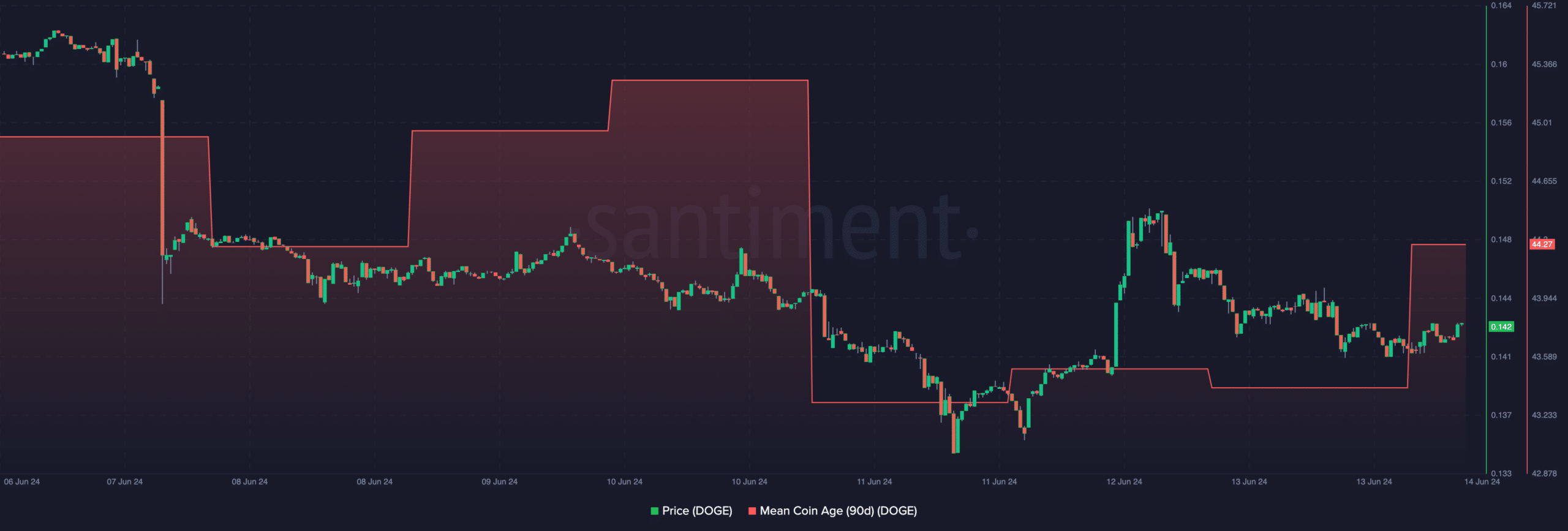

Furthermore, we noted that the Average Age of Circulating Coins for Dogecoin (referred to as Mean Coin Age or MCA by Santiment) has risen significantly. Specifically, the 90-day MCA for Dogecoin now stands at 44.27.

As a researcher studying blockchain data, I would describe the MCA (Median Age of Coins) as follows: The MCA represents the middle point of the age distribution for all coins existing on the blockchain. When this metric decreases, it signifies an increase in the number of recently minted or newly entered coins into circulation.

As a seasoned crypto investor, I’ve noticed that a high coin age can often signal that older coins have been in circulation for some time. This usually means that these coins may have been traded or sold. For instance, with Dogecoin, the prolonged state of this metric could potentially lead to a decrease in its price.

Is your portfolio green? Check the Dogecoin Profit Calculator

At the current moment of reporting, DOGE was being traded for $0.14. Although there’s a possibility of its price rising over the next few months, its immediate future appears uncertain and potentially bleak.

Therefore, it might not be in the best interest of traders to open long positions for DOGE.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Thief Build

- Gold Rate Forecast

- Ludicrous

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Elder Scrolls Oblivion: Best Sorcerer Build

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

2024-06-14 16:08