-

Altcoins with market caps under $10 billion show signs of upcoming buying opportunities.

Chainlink (LINK) may be poised for recovery, indicated by increased large transaction activity.

As a researcher with a background in cryptocurrencies and market analysis, I have closely followed the recent downturn in the altcoin market, specifically focusing on smaller cap assets. Based on my findings and the insights shared by experts like Jamie Coutts, I believe that there are indeed signs of upcoming buying opportunities for these coins.

The value of the altcoin market has taken a dip in recent months. Reaching a peak market capitalization of an impressive $1.27 trillion in March, this sector of the cryptocurrency world has since then decreased by more than 8%. Consequently, its current worth stands at approximately $1.061 trillion.

This decline has been quite noticeable in every aspect of the altcoin market.

As a researcher studying the cryptocurrency market, I’ve observed that smaller cap crypto assets have lagged behind Bitcoin (BTC) since it hit record highs earlier this year.

In a thorough examination posted on social media platform X, Coutts pointed out that these alternative coins have encountered significant hurdles since their high point in March. This observation reflects the prevailing attitude of investors, who are approaching riskier assets with caution.

As a researcher studying the cryptocurrency market trends, I propose that the current market downturn might represent a common mid-cycle correction. Historically, such corrections have presented attractive purchasing opportunities within the broader cryptocurrency market cycle.

With the crypto market showing signs of recovery, shrewd investors may find promising opportunities in smaller and mid-cap digital currencies. This viewpoint is crucial as it highlights possible paths to restoration, offering hope amidst the market turmoil.

Analytical breakdown: Sector performance and predictions

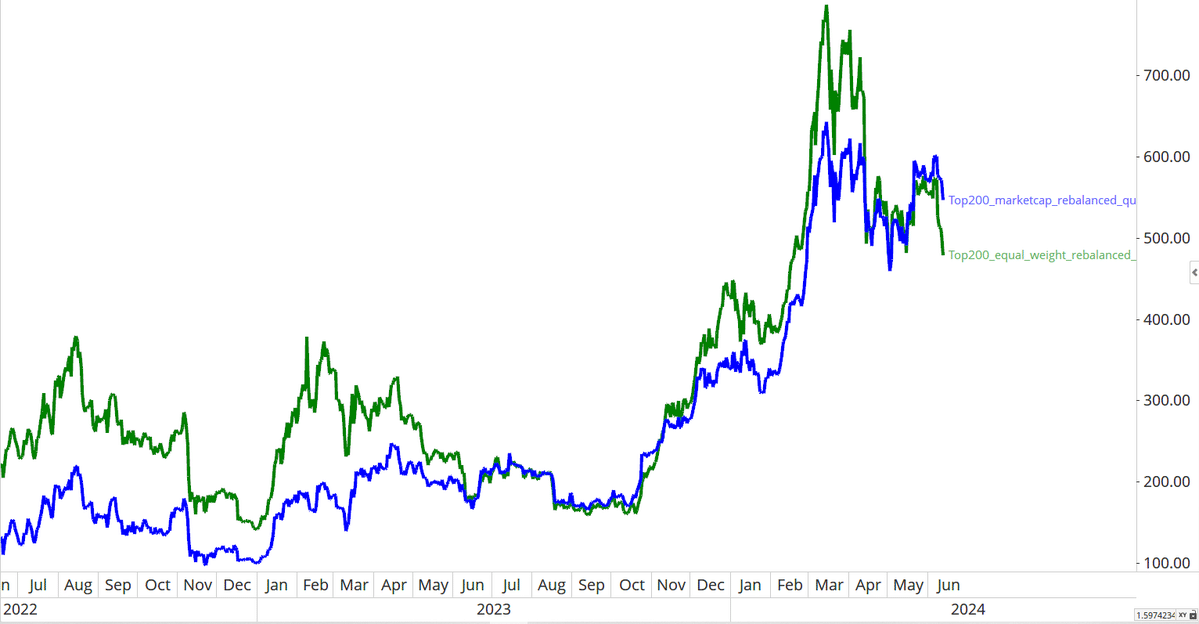

According to data shared by Jamie Coutts from the crypto tracking platform Bitformance, there are significant differences in the way various sectors of the cryptocurrency market are performing.

As an analyst, I’ve observed an intriguing development in the cryptocurrency market over the past three months. While the equal weight index, comprised of the top 200 cryptocurrencies with equal representation regardless of market capitalization, has experienced a significant decline of more than 30%, the market cap index has shown a less severe drop. This disparity underscores the resilience of larger cryptocurrencies, such as Bitcoin and Ethereum, which have weathered the market downturn relatively better due to their substantial market capitalizations.

Bitcoin and Ethereum [ETH] exhibited relatively smaller drops of 11% for Bitcoin and 5% for Ethereum, demonstrating their resilience against the market’s downturn. On the other hand, tokens connected to the Metaverse and infrastructure projects experienced significant losses, with declines reaching approximately 44%.

The substantial drop in multiple industries serves as a reminder of the riskiness of certain alternative coins during market turmoil, while simultaneously indicating the possibility of revival as market conditions improve.

Coutts’ examination offers intricate insights into the current status and future prospects of these industries. According to his observations:

As a researcher, I’m of the opinion that the current market situation could be a typical mid-cycle correction. If my assumption holds true, it may bring about prospective investments in the mid and small capitalization segments following the market stabilization.

Case Study: Chainlink’s market position

As a researcher studying the potential of smaller altcoins with market capitalizations under $10 billion for a possible rally, I find it illuminating to delve into the particular case of one such coin to gain a deeper understanding.

The LINK token from Chainlink, with a market capitalization exceeding $9 billion, makes for an excellent example to consider when looking for signs of a price increase.

I analyze the current market situation of Chainlink. The price hovers around $15.31, marking a 1.4% decline within the previous 24-hour period. A more significant downturn of 12.4% has been observed over the last week.

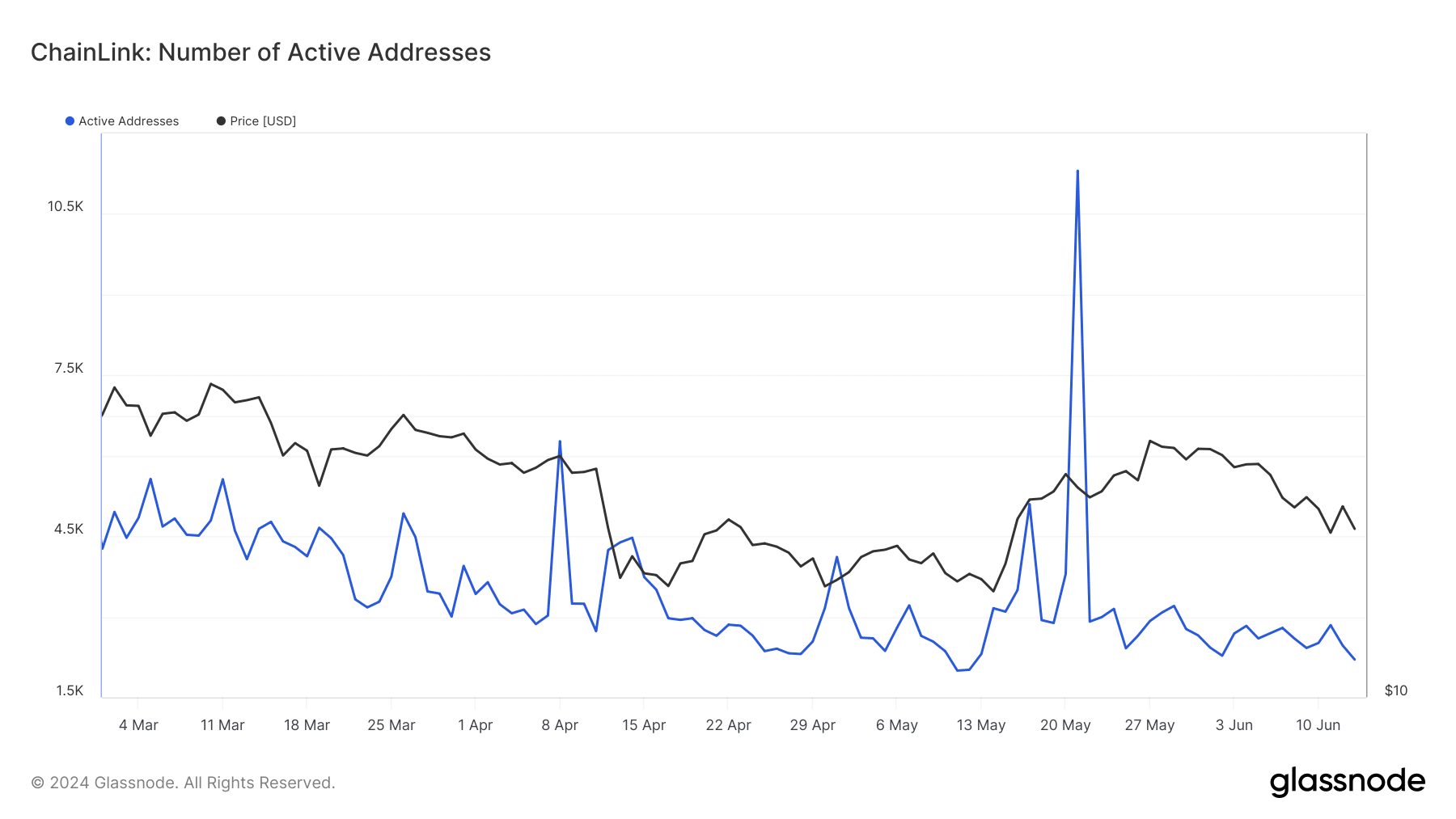

The decrease in activity during this economic slump is reflected in the diminishing number of active addresses. These addresses dropped dramatically from around 90,000 in March to under 60,000 currently.

A decrease in the number of active addresses usually signals fewer users interacting with the token, which may negatively impact its price consistency and potential for advancement.

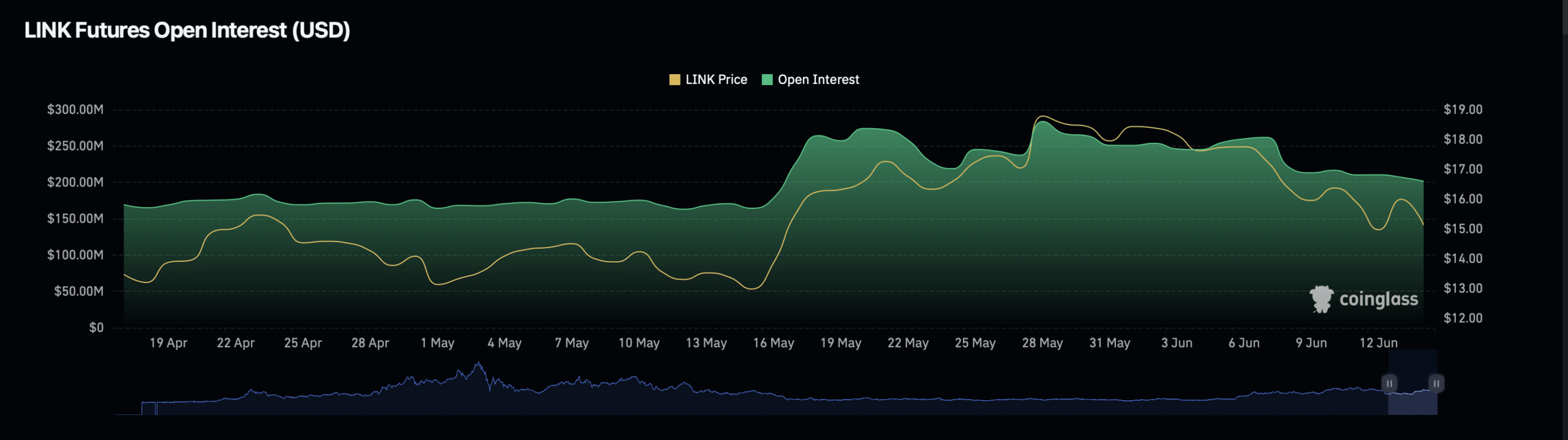

The open interest for LINK, indicating the current number of unfilled derivative contracts, has experienced a significant reduction of approximately 40% over the last 24 hours.

Despite the ambiguous indication of a 0.52% rise in open interest, implying market indecision, this trend may also signify investor tenacity.

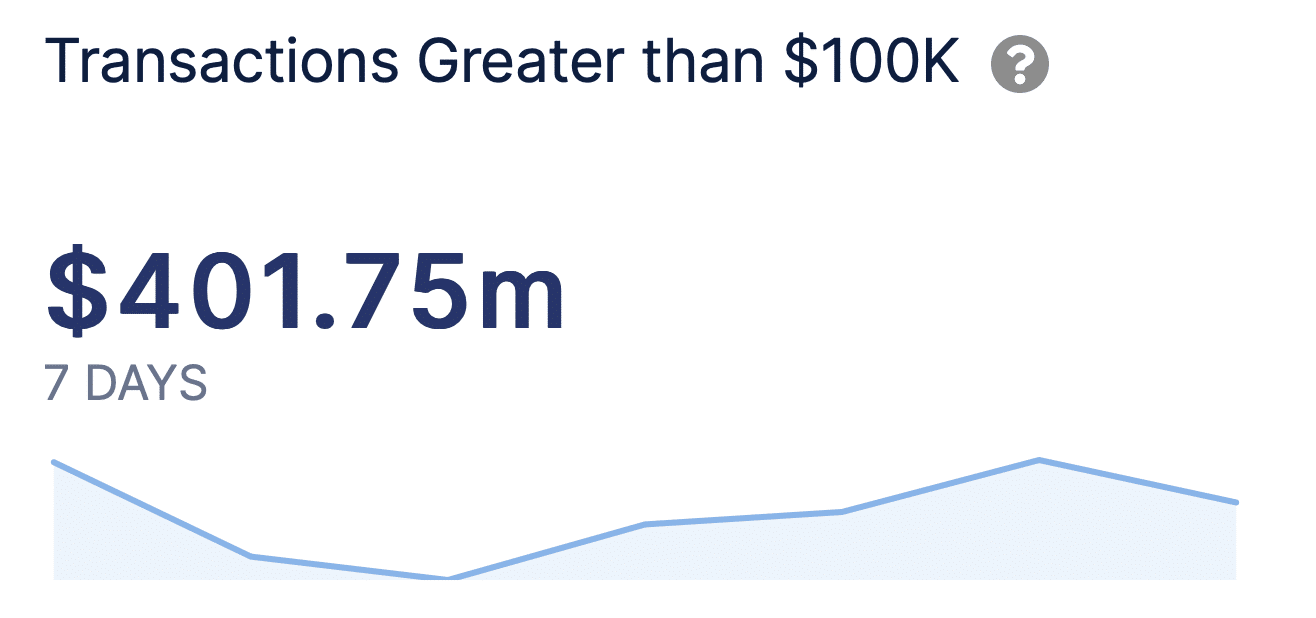

In spite of the obstacles, there’s a hint of hope. The quantity of substantial LINK deals, those surpassing $100,000, has noticeably increased – climbing from under 90 earlier in the week to more than 200 on June 12th.

Realistic or not, here’s LINK market cap in BTC’s terms

Based on IntoTheBlock’s findings, it appears that larger investors, referred to as ‘whales,’ have been purchasing significant amounts of LINK despite the marketwide downturn. This could be an indication that they are positioning themselves for potential price growth in the future.

As an analyst, I’ve noticed that according to AMBCrypto’s analysis, LINK‘s Relative Strength Index (RSI) currently hovers below the 63 mark. Historically, an RSI reading below this level has suggested the emergence of a robust bullish trend for a cryptocurrency.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-14 19:05