- Dogwifhat has traded within a descending channel since the end of May.

- If the memecoin’s bulls fail to defend the support level, its value may plunge further.

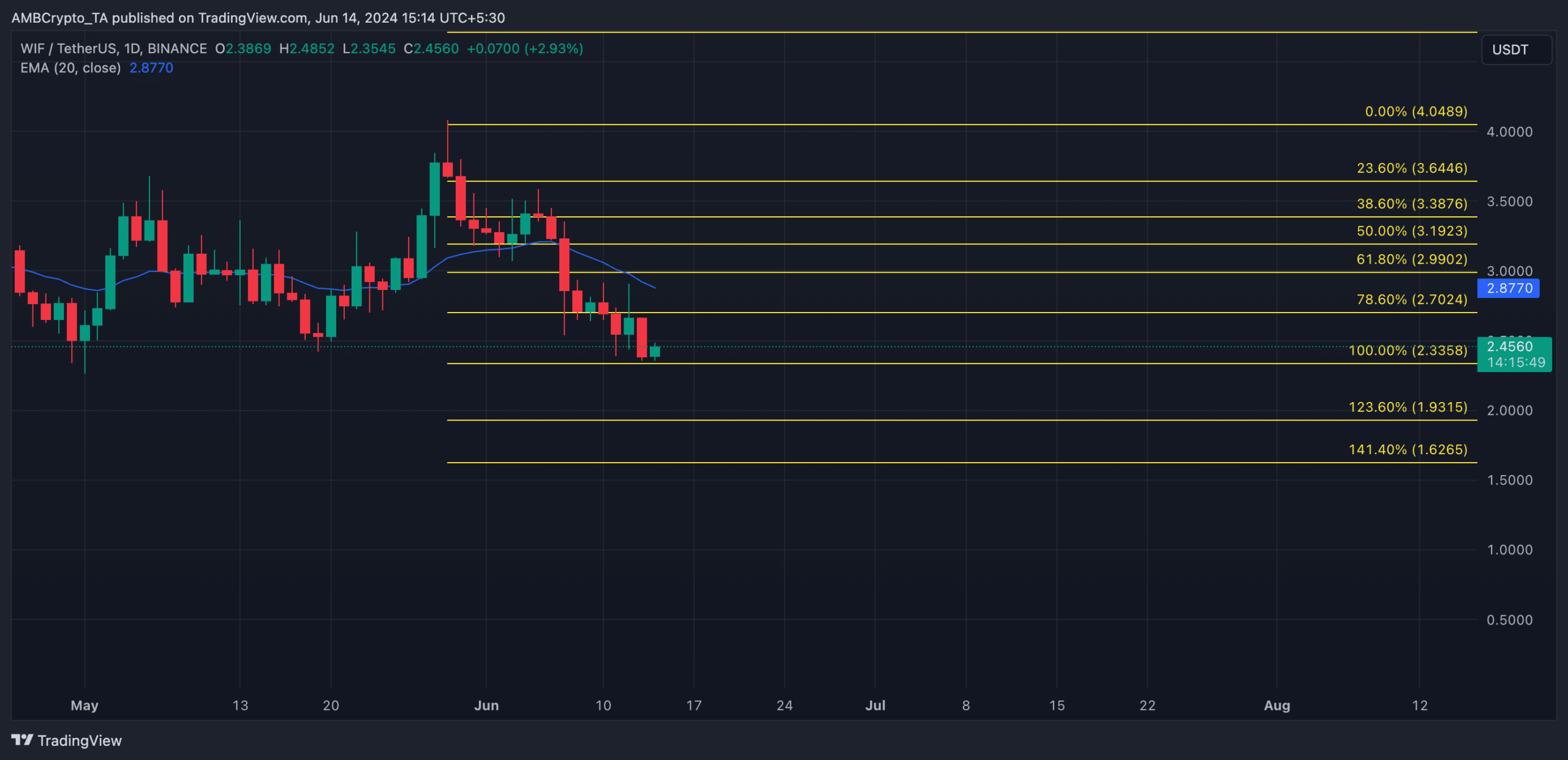

As an experienced financial analyst, I have observed Dogwifhat (WIF) trading within a descending channel since late May. The memecoin’s bulls have failed to defend the support level at $4.10, and if this trend continues, WIF may plunge further and breach the support level at $2.08.

As a market analyst, I would interpret Dogwifhat’s (WIF) current trend as potentially setting the stage for a bounce-back. With the stock nearing the support line of its downward channel, a reversal could be on the horizon.

Since May 29th, the memcoin with a dog theme and widespread popularity has seen a downward trend on the charts. Its value closed at $3.67 that day but is currently being traded for $2.44 – marking a 34% decrease in price.

The bulls and bears must slug it out

When a descending channel is formed, it is a bearish sign that connotes sustained selling pressure.

In simpler terms, the top boundary of this chart functions as a barrier for the asset’s price rise, while the bottom boundary acts as a floor. For the given symbol WIF, it has encountered resistance when trying to go above $4.10 and found support when its price dropped down to $2.08.

As a researcher studying financial markets, I would explain that when an asset’s price nears the lower boundary of a downward trendline, it is reaching a point where it has historically encountered buying interest from bullish investors. Consequently, these buyers might reenter the market to defend this level and potentially halt the asset’s downtrend.

If the bulls manage to keep the price of the asset above the support level, there’s a good chance that the price will bounce back and move up towards the resistance line. But if the support line is broken, this could indicate that the bearish trend is continuing, potentially causing the asset’s value to fall even further.

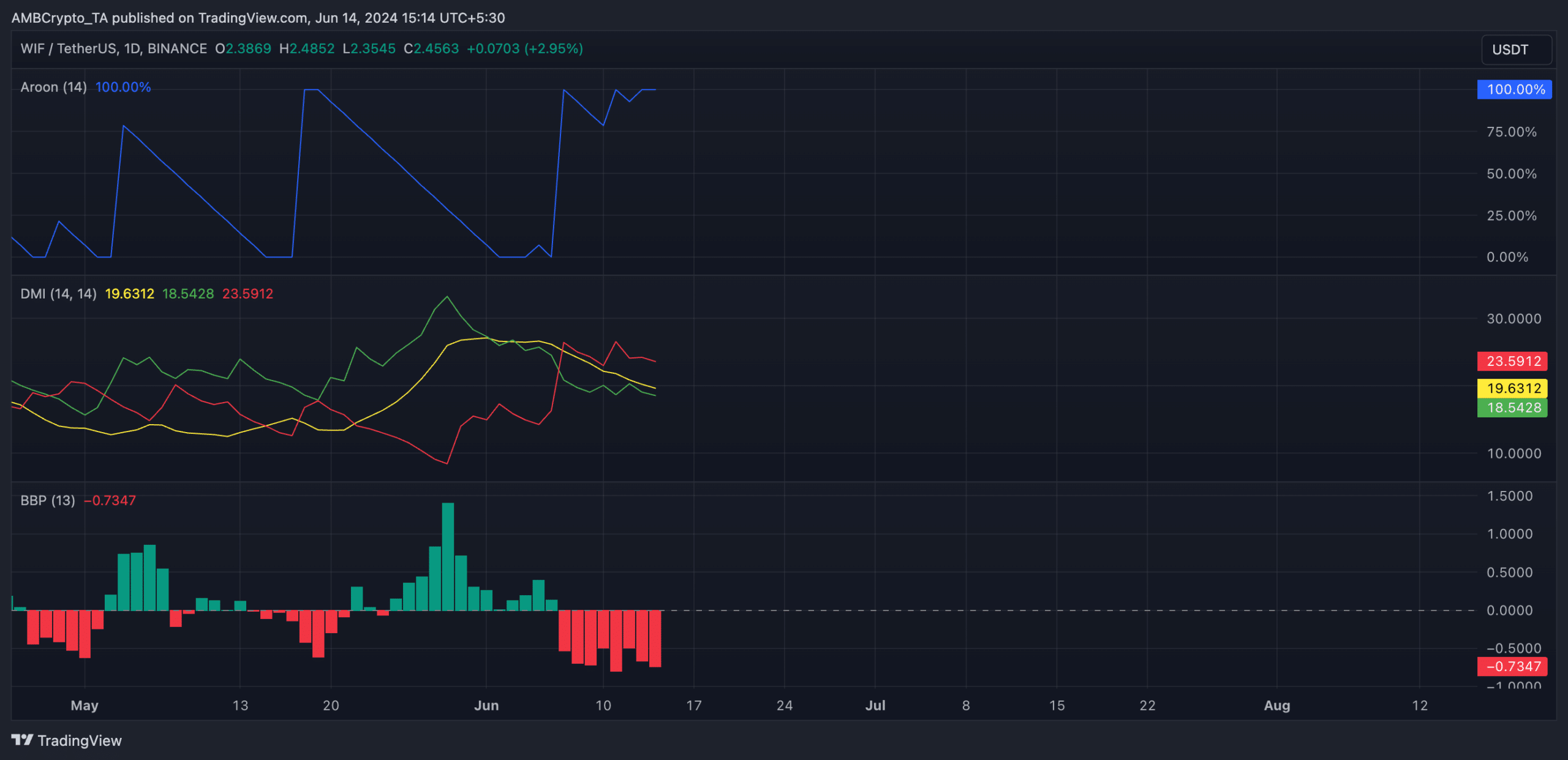

The bearish trend in the WIF market is quite strong, as indicated by the Directional Movement Index (DMI), with the red (negative) line lying above the green (positive) line.

This confirmed that selling pressure outpaced buying activity among the meme coin holders.

Since the 7th of June, the Elder-Ray Index of WIF‘s Women in Finance has consistently shown negative values. The index currently stands at a level of -0.75.

The value of this marker signifies the balance of influence between strong WIF purchasers and vendors in the marketplace. A negative figure implies that selling pressure holds more sway over the market.

The Aroon Down Line of WIF‘s indicator reached 100%, indicating a strong downward trend for the asset. The Aroon indicator is a technical tool that assesses the trend direction and possible turning points by analyzing the asset’s price movement.

As a researcher studying financial markets, I would interpret the situation as follows: When the Aroon Down line of an asset approaches 100, this signifies a robust downward trend for me. This means that the latest trough in the asset’s price was reached not too long ago.

Read dogwifhat’s [WIF] Price Prediction 2024-25

If this downtrend continues, WIF may breach support to trade at $1.93.

If the bulls manage to hold the support level and there’s a bounce back in WIF, its price could potentially surge towards $2.70.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What You NEED to Know!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Solo Leveling Season 3: What Fans Are Really Speculating!

2024-06-15 04:07