-

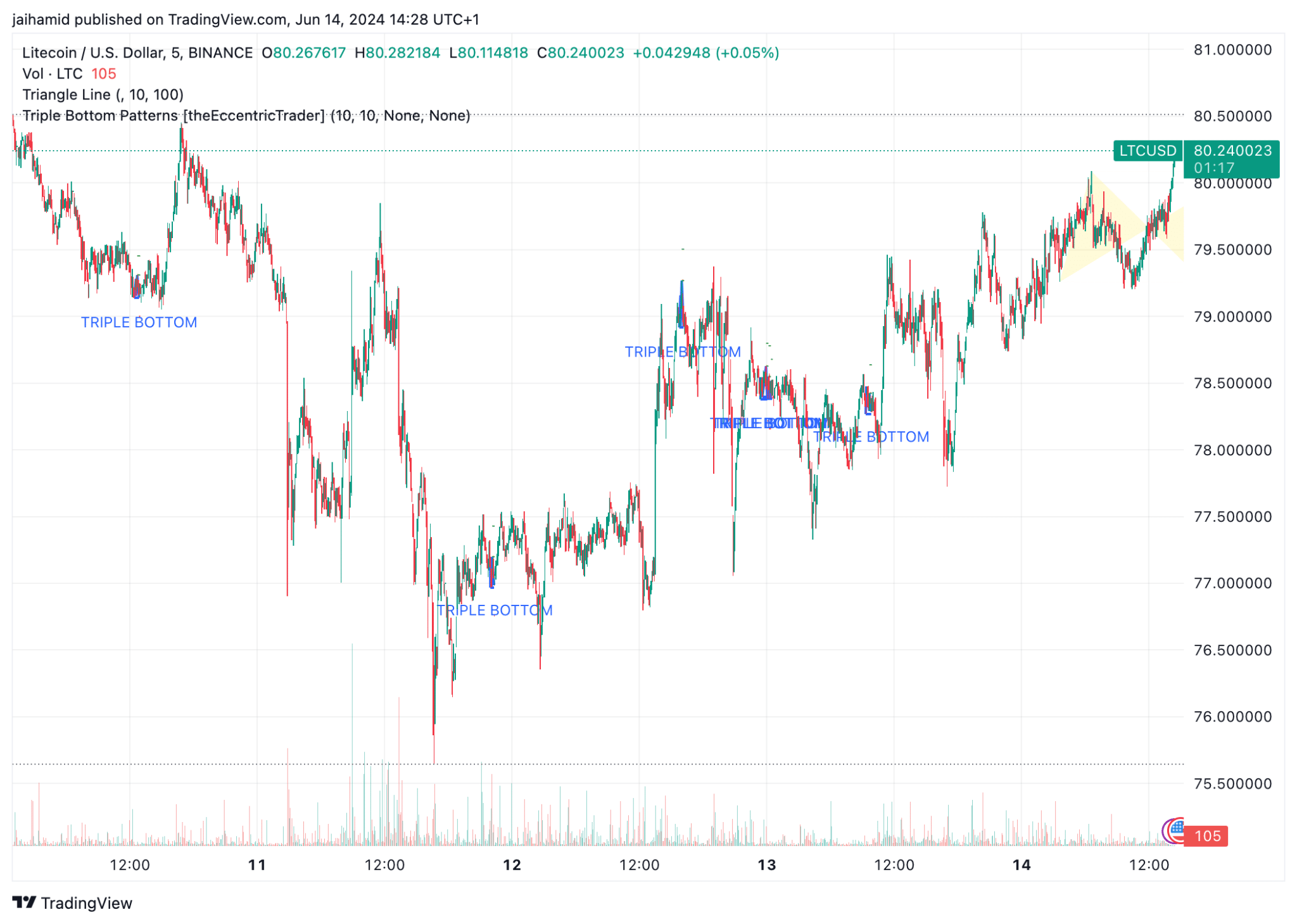

LTC seemed to be testing the support at the bottom of a triangle pattern

Short-term bullish sentiment seen thanks to the 50-day MA above longer MAs and the price trading above the Ichimoku Cloud

As a seasoned analyst with a background in technical analysis and extensive experience in cryptocurrency markets, I believe that Litecoin (LTC) is currently at a pivotal point in its price action. Based on the chart patterns and trend indicators, I see both bullish and bearish potentials for LTC.

From an analyst’s perspective, I’m observing that Litecoin (LTC) is currently probing the support level at the base of a triangle configuration on the price chart. This development has instilled some uncertainty among the crypto community, leaving us pondering over two plausible scenarios. Will LTC break above $90 and rally further, or will it succumb to the downward pressure and slide towards $70? The answer to this question is yet to unfold.

As a researcher studying the Live Cryptocurrency (LTC) market, I’ve noticed an intriguing development over the past five days. LTC has formed several triple-bottom patterns near specific price levels. This pattern is often indicative of a potential bullish reversal. In simpler terms, if these bottoms hold strongly, we could witness significant price growth.

Keep an eye on the resistance zone at the top of the triangle formation, which includes the $80 level. If the price surpasses this barrier, it may indicate a continuation of the uptrend, potentially reaching new resistance levels around $90 or even beyond.

At present, the graph indicates that Litecoin is attempting to hold its ground at the lower boundary of the triangle formation. Should this support prove insufficient against potential selling or bearish forces, a decline toward $70 may ensue.

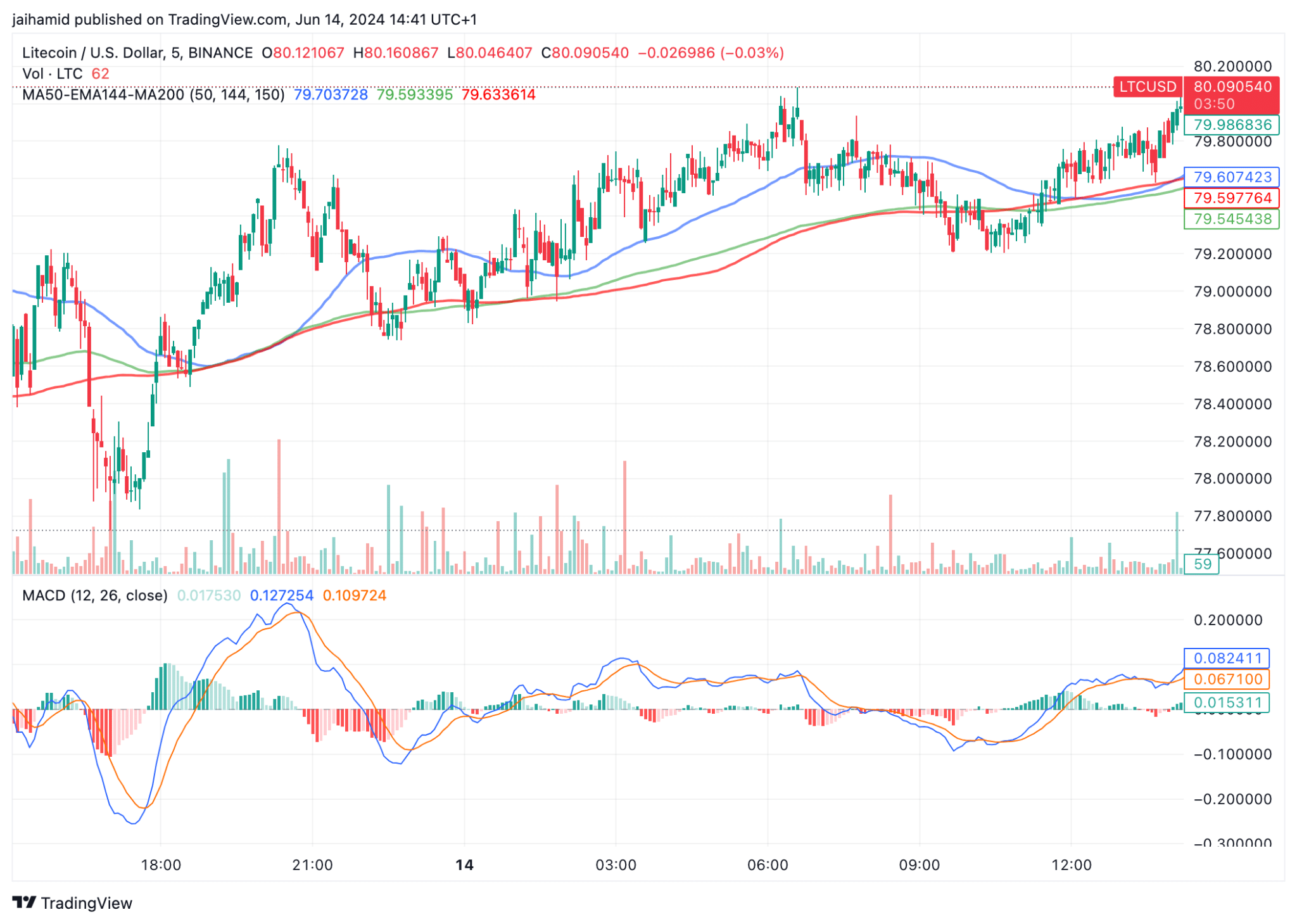

As an analyst, I’ve noticed that the 50-day moving average sits higher than both the 144-day exponential moving average and the 200-day moving average. This arrangement could indicate a potential uptrend or bullish sentiment in the near term.

The three lines on the chart were fairly near each other, suggesting a period of consolidation where there was little to no strong price movement up or down.

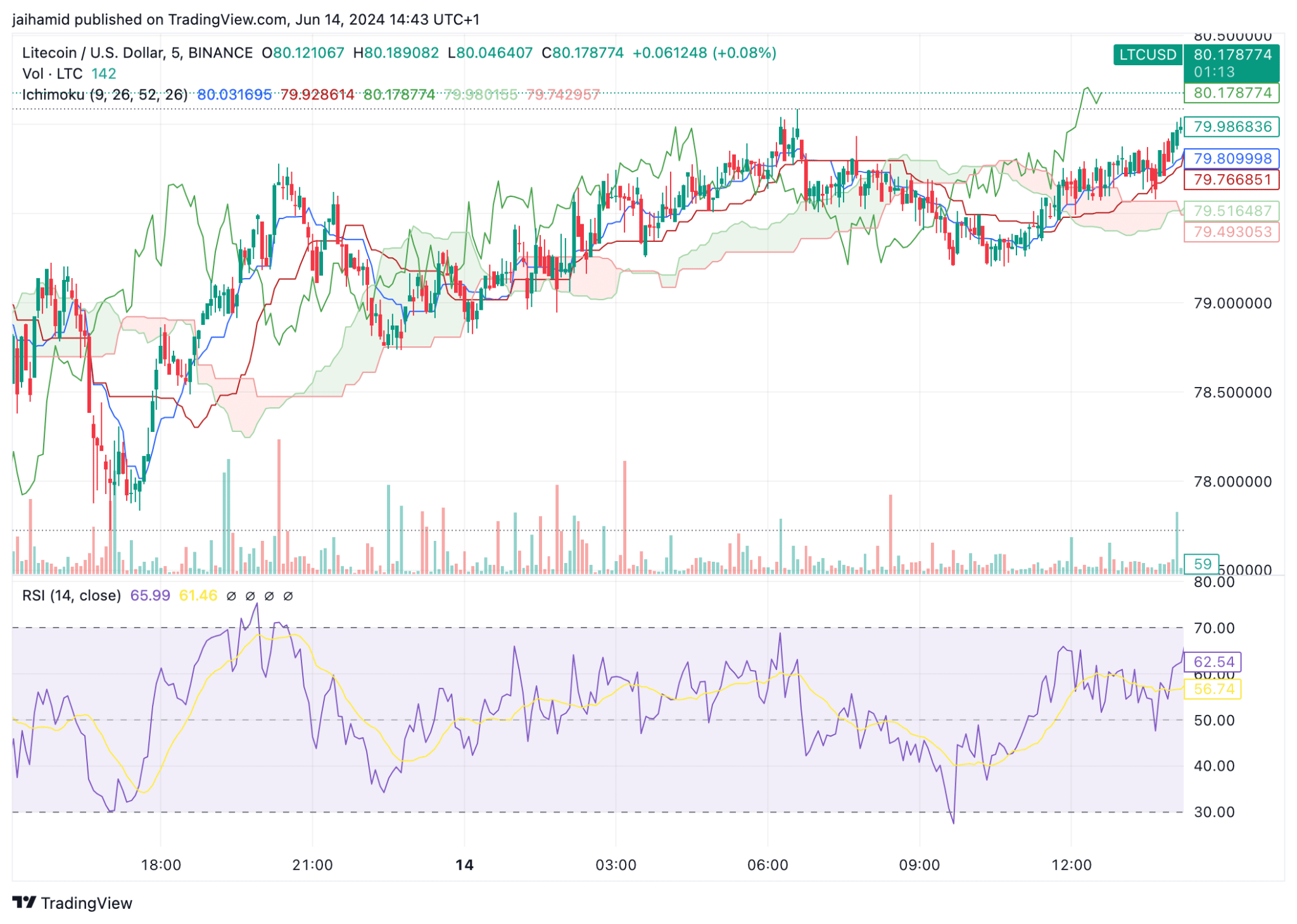

The Ichimoko Cloud indicated a bullish trend since the price was hovering above it, and this level usually functions as a base of support.

The blue conversion line lying above the red baseline indicated a bullish market trend, implying that short-term price movements could have more impact than long-term trends.

In simpler terms, the Relative Strength Index (RSI) for Litecoin was approximately 66 – Slightly more than the halfway mark, yet below the warning signal of 70 that indicates an overbought market. Therefore, while there may be significant demand for Litecoin, it has not yet reached a level of excessive buying that could lead to market saturation. Consequently, there could still be potential for further price gains before the market becomes overextended.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-15 10:15