-

Price looked set to move to the high liquidity area identified around $585

Online discussions about BNB dropped, indicating low interest in the coin

As an experienced analyst, I’ve seen my fair share of market fluctuations in the cryptocurrency world. Based on the current trend of Binance (BNB), it seems that the coin is set to move towards the liquidity area identified around $585.64 to $590.74.

Approximately a week ago, AMBCrypto noted that Binance Coin (BNB) had dropped from its peak price. There were initial indications that the coin might be making a recovery.

After that event, its price took a nosedive. Currently priced at around $532, Binance Coin (BNB) has experienced a 15% decrease in value over the past week. Notably, it was the first among the top ten altcoins to exceed its all-time high. However, it has also joined Dogecoin (DOGE) and Cardano (ADA) as one of the poorest performing cryptocurrencies within the top ten during this timeframe.

Liquidity changes position

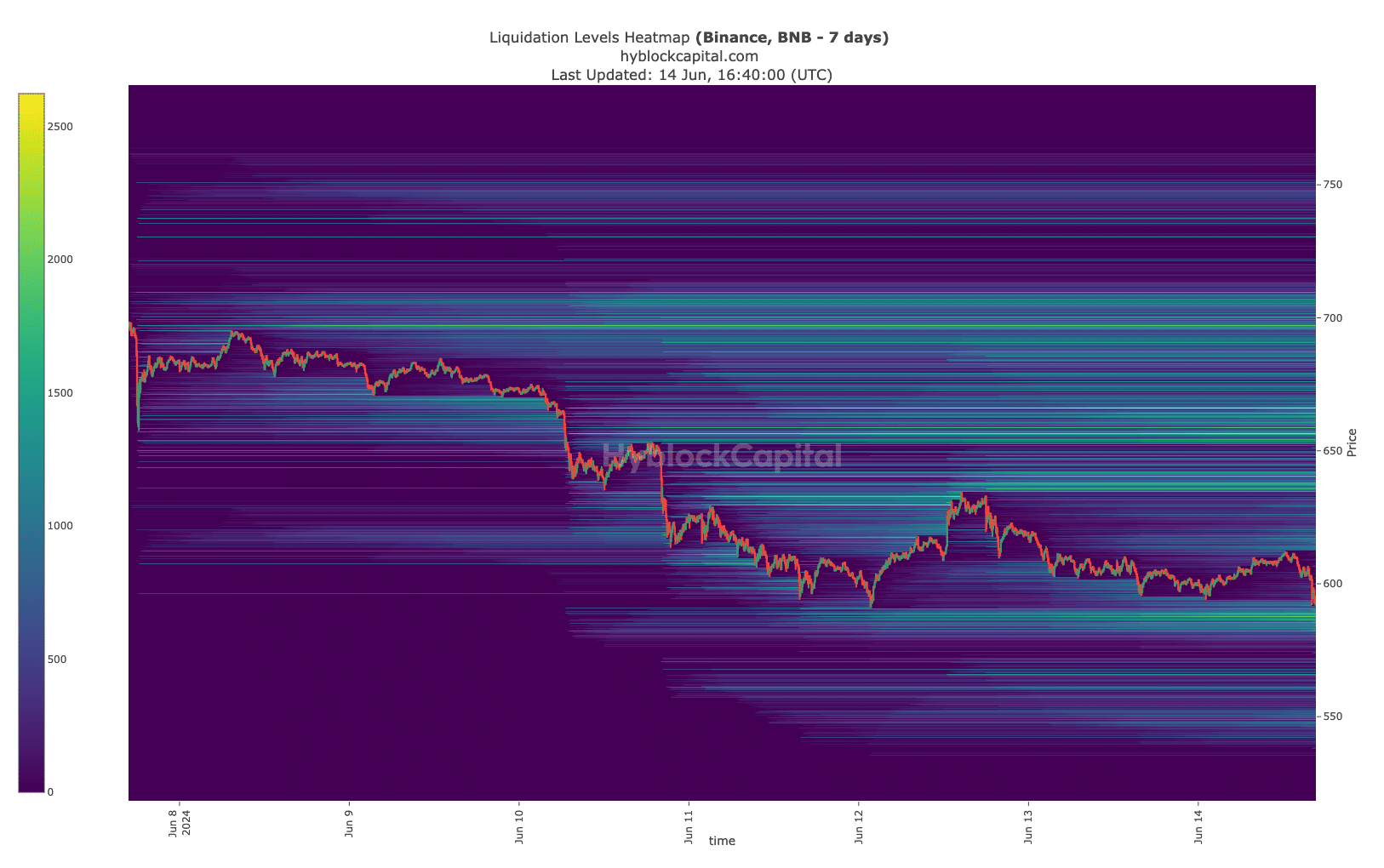

Based on appearances, there’s a possibility that the coin could continue dropping in value. To confirm this projection, AMBCrypto examined the liquidation map as verification.

As a crypto investor, I often refer to a liquidation heatmap as a tool that highlights potential price thresholds for my positions. These levels indicate possible liquidation points, meaning if the market price reaches these levels, some of my open positions may be automatically closed by the exchange to mitigate risk. Additionally, this indicator can provide valuable insights into potential targets or resistance levels for a specific cryptocurrency’s price movement.

Based on Hyblock’s analysis, I identify that BNB exhibited substantial liquidity between the ranges of approximately $585.64 and $590.74. Consequently, it is plausible for the coin’s price to gravitate towards these levels in the upcoming days.

Traders need to be aware that a change for the better in the broader market conditions could result in the cancellation (invalidation) of the current price trend for BNB. Consequently, if this occurs, the price of BNB may surge to reach $635.40.

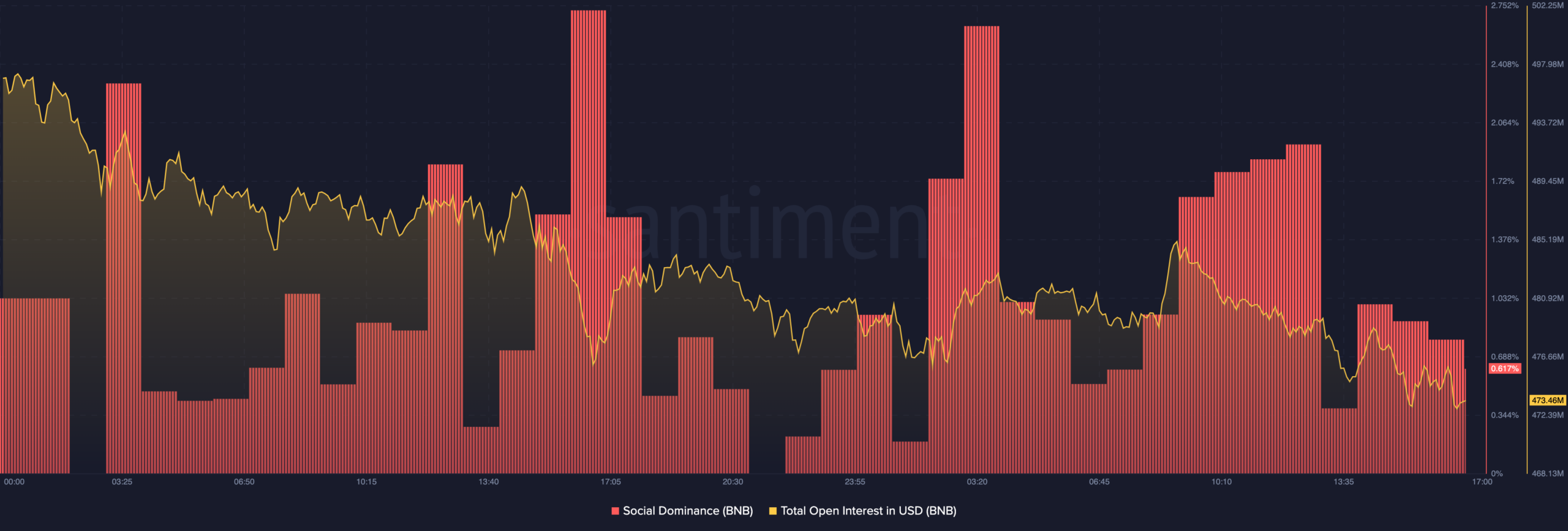

As a crypto investor, I’m excited about the potential of this digital asset reaching a high of $656.28 in an optimistic market condition. However, taking a closer look at other metrics such as social dominance has raised some concerns and given weight to the bearish perspective.

What’s the next target?

Currently, the social influence of this altcoin is at a level of 0.617, as indicated by social media and crypto media chatter.

The decrease suggested a waning interest and participation in BNB within the community. Consequently, it might be difficult for the coin to generate significant demand indicative of potential price increases.

Additionally, the Open Interest for this cryptocurrency stood at approximately $473.46 million as of the present moment. Open Interest refers to the total value of outstanding contracts linked to a specific cryptocurrency within the market.

As a researcher studying cryptocurrency markets, I’ve observed that when the value of a coin like BNB experiences an increase, it often signifies heightened speculative interest in that particular asset. Typically, this surge of activity provides support for further price growth. Conversely, if there is a decrease in speculative positions for BNB, it may indicate challenges for the price to rebound.

If current trends persist, BNB may further decline and breach crucial support thresholds. Such a move would suggest a potential deepening of the downtrend. Nevertheless, a reversal could occur if purchasing power significantly increases.

Realistic or not, here’s BNB’s market cap in BTC terms

As a crypto investor, if I notice a pickup in online interest towards a particular altcoin, it might be an early sign of an upward price trend. Should this recovery continue, the altcoin could establish a new trading range above the $600 mark. Conversely, if the interest doesn’t materialize or wanes, my targets for BNB would likely remain between the support levels of $585 and $600.

Read More

2024-06-15 16:07