-

INJ traced a reversal pattern that could possibly mean a breakout

Hike in buying pressure could be good news too

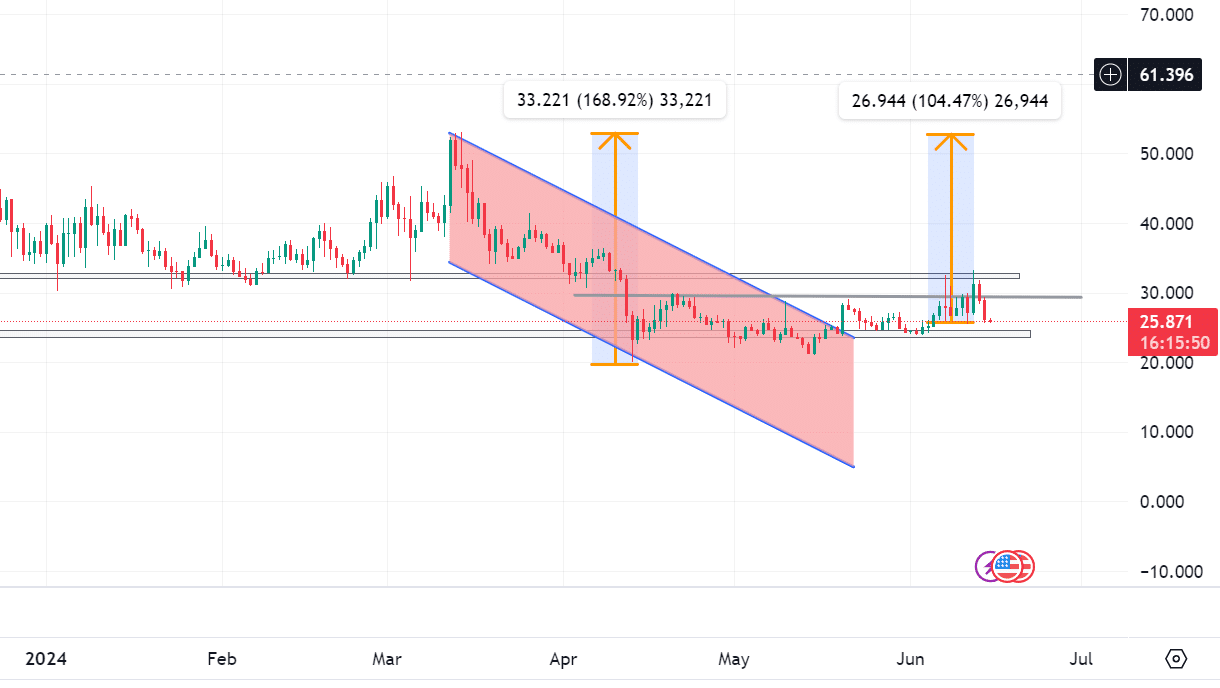

As a seasoned crypto investor with a keen eye for chart patterns and market trends, I find the recent developments in Injective (INJ) intriguing. The altcoin’s potential reversal pattern, as suggested by the chart analysis from AMBCrypto, is a promising sign that could possibly mean a breakout.

As a researcher observing the cryptocurrency market, I noticed that INJ experienced a decline of 11% over the past week and was currently priced at $25. Simultaneously, there was a significant decrease in INJ’s trading volume, which fell by approximately 22.38%, reaching a figure of around $192 million.

Over the past two months, I’ve witnessed INJ reaching its all-time high (ATH) of $33, fueled by a robust uptrend. Additionally, the cryptocurrency chart indicators have hinted at a possible breakout.

In my recent investigation using AMBCrypto’s analysis as a reference, I identified a notable breakthrough past the previous resistance at $30. This unexpected surge might be indicative of an upcoming market shift towards an upward trend.

If INJ experiences a 104% increase from its previously mentioned price range, it’s likely that the altcoin will reach a peak of around $53. This occurrence typically signals a bullish turnaround in the larger cryptocurrency market.

What do metrics tell us?

It’s essential to consider the insights provided by the metrics in addition to identifying trends based on patterns. In the context of INJ‘s charts, do the metrics support the hypothesis of an uptrend?

As a researcher analyzing data from Santiment, I discovered that INJ reached its peak social volume of 18 on June 8th. Following this spike, INJ’s social media buzz decreased, leading to an upward trend in its price chart.

In summary, a decrease in overall social media chatter about crypto results in less public debate on the subject, causing markets to move in directions contrary to popular anticipation. At this moment, INJ‘s social media activity level is recorded as 3, and it has been steadily declining over the past 24 hours.

As a researcher examining the cryptocurrency market trends, I came across some intriguing data from Santiment’s Exchange Supply metric. On June 13th, I observed a significant peak of $401K in exchange holdings. Surprisingly, however, there was a subsequent decrease in exchange supply to approximately $390K within the last 24 hours. This observation indicates an increase in market demand, which is typically associated with a bullish trend. Consequently, it can be hypothesized that this reduced pressure on the altcoin’s supply may pave the way for a potential price surge.

How far will INJ go?

As a researcher studying the potential price movement of INJ, if the anticipated trend continues and the altcoin surmounts the resistance level near $30, the bullish momentum is likely to intensify significantly. Consequently, INJ could potentially reach a price of $53, marking a noteworthy increase of approximately 104%.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What You NEED to Know!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Solo Leveling Season 3: What Fans Are Really Speculating!

2024-06-16 07:03