-

Solana’s price dropped by nearly 10% in the last seven days.

SOL’s metrics looked bullish, but indicators suggested otherwise.

As a researcher with extensive experience in the crypto market, I’ve seen my fair share of price fluctuations and trend reversals. Solana’s [SOL] recent drop by nearly 10% in just seven days was disheartening for investors, especially when the token’s metrics looked bullish. However, it seems that a potential buy signal has appeared on its chart, which might indicate a shift in market sentiment.

Last week, I observed bears asserting their dominance in the crypto market. Consequently, they drove down the prices of several digital currencies, among them Solana [SOL].

Despite suffering losses for investors recently, there’s a potential shift in fortune for SOL, as indicators suggest a buying opportunity may have emerged based on its chart. However, this doesn’t definitively guarantee a bull market for SOL.

Buy signal on Solana’s chart

As a Solana investor, I’ve experienced a challenging week as the token’s value dipped by almost 10%, leaving me with a current price of around $144.39 per SOL. The market cap, now exceeding $66 billion, offers some comfort in these turbulent times.

As an analyst, I would like to reassure investors that despite recent market fluctuations, there’s been an intriguing development in the crypto sphere. Notably, Ali, a widely-followed industry expert, has shared his insights on this topic via a recent tweet.

As per the tweet, a buy signal flashed on Solana’s TD sequential near the $141 mark.

As an analyst, I can interpret that the token’s ability to maintain its previous support level signifies a promising outlook for Solana (SOL) in recovering from its recent losses.

As a crypto investor, I recently came across an interesting analysis by AMBCrypto on CGFI.io’s data for Solana (SOL). At the present moment, based on the fear and greed index, the market sentiment for SOL is in the “fear” phase, with a value of 37%. This indicates that investors are more likely to be cautious and risk-averse during this time.

As an analyst, I would interpret hitting that specific level on the indicator as a potential sign of approaching bullish strength for the token’s price.

Is a bull rally around the corner?

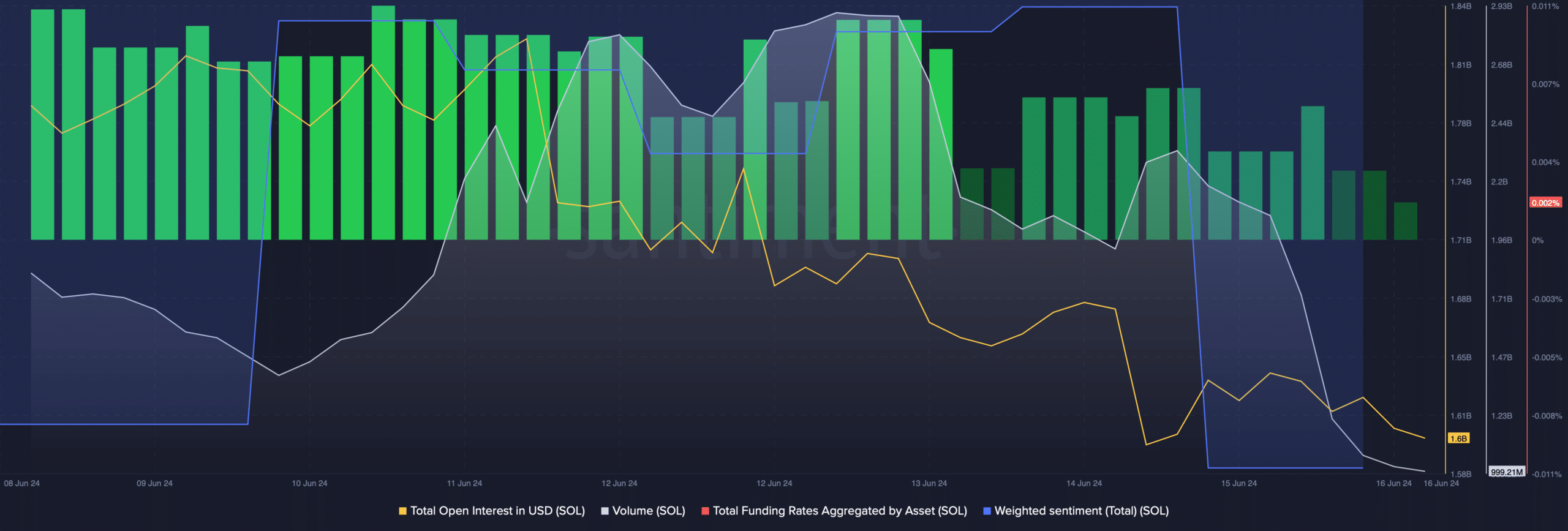

Based on the previous data suggesting a potential trend reversal, AMBCrypto explored SOL‘s on-chain metrics for insights into the possibility of a bull rally. Our examination revealed that SOL’s Funding Rate had decreased.

As a crypto investor, I’ve noticed that the pricing trends often go against the Funding Rate. When I see the Open Interest decreasing alongside a falling price, it’s a sign that the current bearish trend might be shifting.

Additionally, the decreased volume of SOL trading hints at an impending price rise. However, investor faith in SOL remained unstable.

As the token’s Weighted Sentiment decreased, it indicated that negative sentiment prevailed among market participants towards the token.

Market indicators showed signs of pessimism, as evidenced by a decrease in the Relative Strength Index (RSI), and a parallel decline in the Chaikin Money Flow (CMF).

Additionally, the MACD indicator showed a negative edge in the market, implying potential downward price movement for the token in the near future.

Based on our analysis of Hyblock Capital’s data, SOL may decrease further to reach around $139 if the current trend persists.

If a change in direction occurs for Solana, it becomes essential for its price to surpass $145 to prevent a significant rise in liquidations. A surge in liquidations can lead to corrective price movements in the near term.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Moana 3: Release Date, Plot, and What to Expect

- How to Get to Frostcrag Spire in Oblivion Remastered

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

2024-06-16 20:07