-

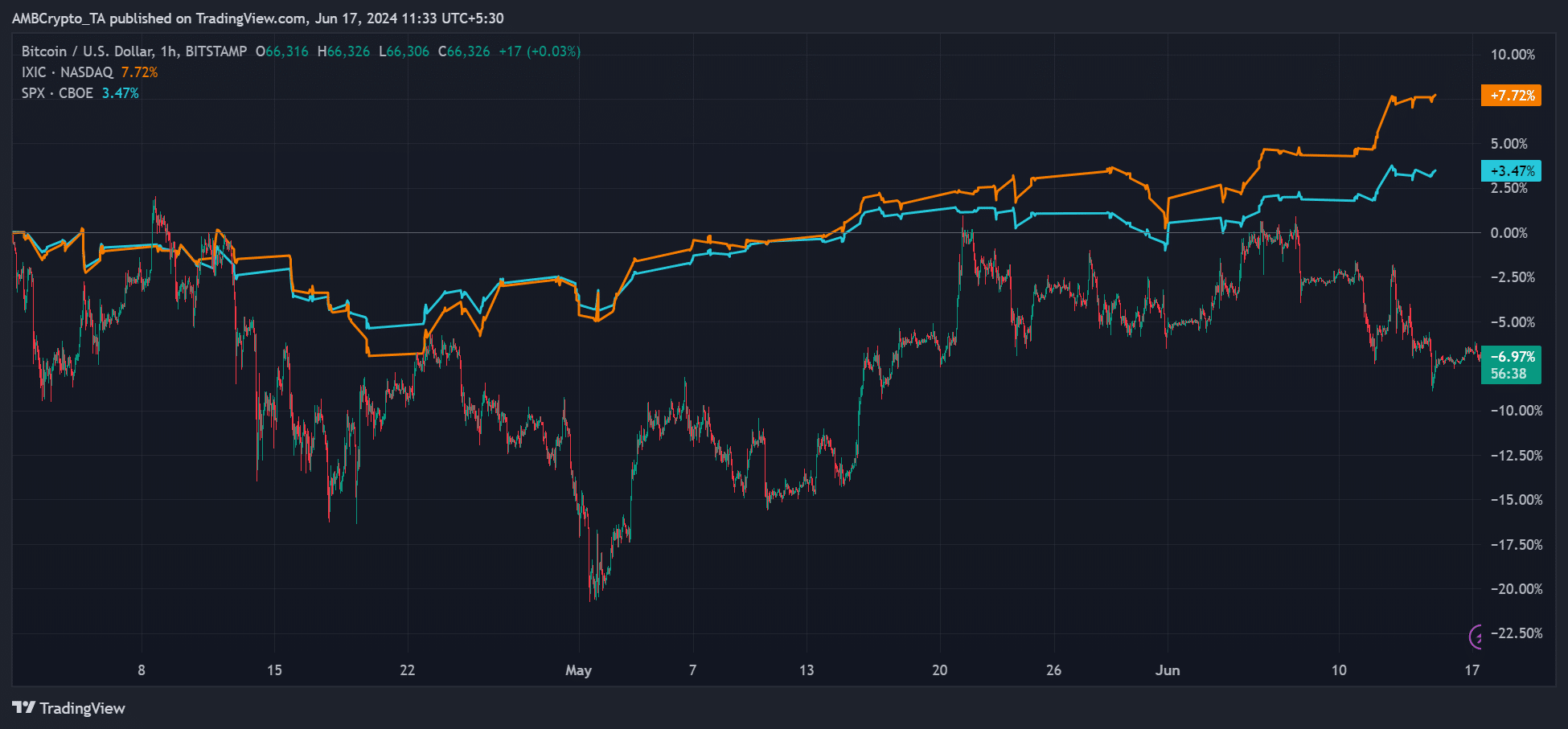

US tech stock, based on the Nasdaq Composite, was up 7%, while BTC was down by 7% in Q2.

Crypto fund hedge exec projected BTC could extend the dismal performance into Q3.

As an experienced financial analyst, I have closely monitored the recent performance of US tech stocks versus Bitcoin (BTC). Based on the data provided and my analysis of the market trends, I believe that the underperformance of Bitcoin compared to US tech stocks could persist into Q3.

Bitcoin [BTC] has underperformed US stocks in Q2, and the trend could extend into Q3.

As a financial analyst, I’ve been following the market trends closely, and according to my observations, Quinn Thompson, the founder and Chief Investment Officer of crypto hedge fund Lekker Capital, anticipates a potential deepening of Bitcoin’s inverse correlation with major US tech stocks in the upcoming weeks.

‘I suspect over the next 4-6 weeks we get one of these’

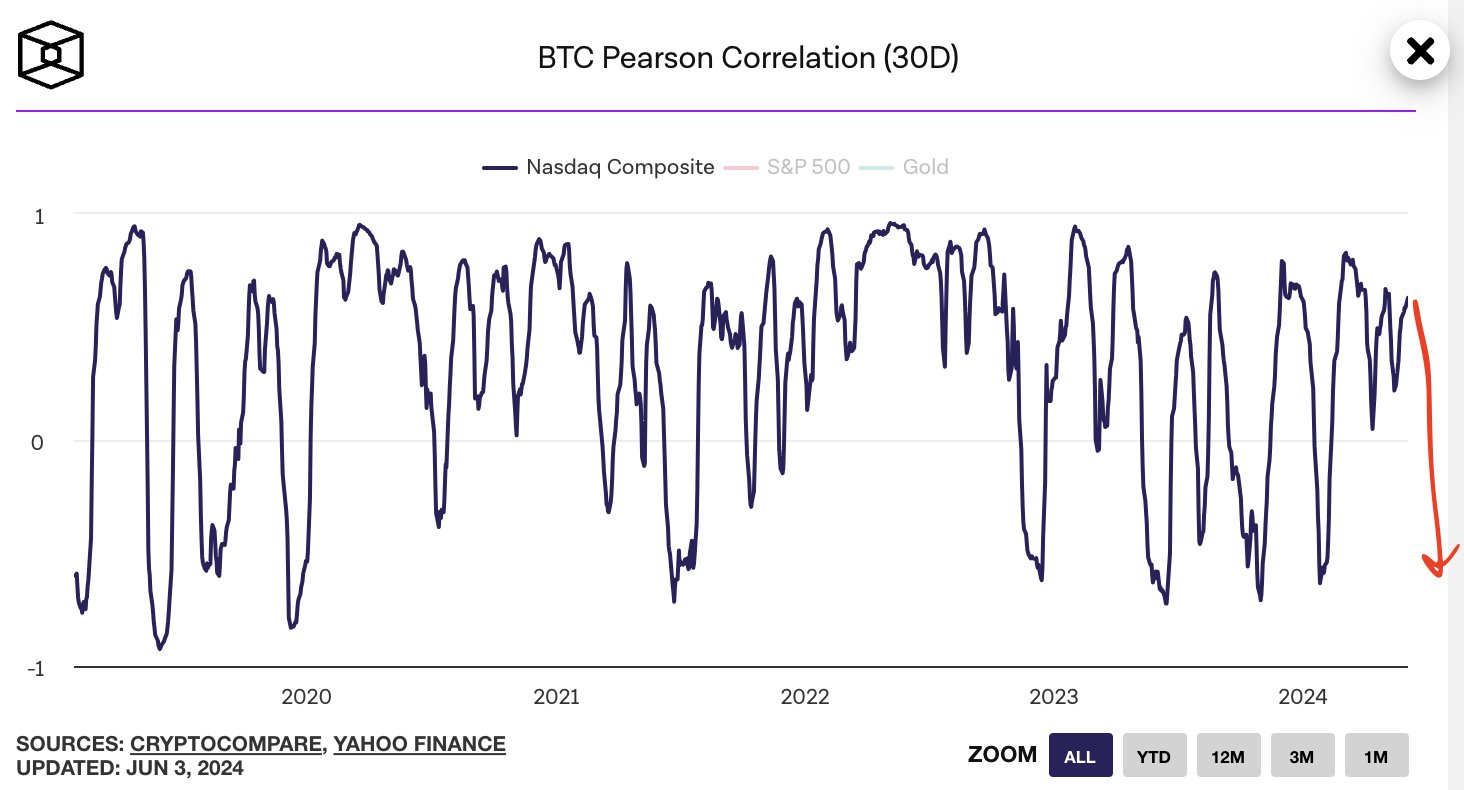

As a market analyst, I often examine the relationship between the Nasdaq Composite and Bitcoin (BTC) to identify potential trends and patterns in their price movements. One effective way of measuring this correlation is through calculating the Pearson correlation coefficient directly between the two assets’ daily percentage change indices. This statistical method provides an indication of the linear relationship between them, offering valuable insights for investors and traders alike.

It’s intriguing that the Index reached a new peak, whereas Bitcoin plummeted to $65K. According to Thompson’s analysis, the correlation between the two could weaken further (indicated by the red arrow) due to unfavorable macroeconomic conditions resulting from the Federal Reserve’s more aggressive monetary policy stance.

Should you bet on US stocks or BTC?

In the last seven years, Bitcoin (BTC) has consistently surpassed the performance of the US stock market. And in the first quarter of 2024, this trend continued as BTC registered a significant gain of approximately 67%.

However, in Q2 2024, gold and US bonds have ‘beaten’ the largest digital asset.

According to a Bloomberg article published recently, JPMorgan analysts have expressed doubts that the present rate of cryptocurrency investments will continue through the entirety of 2024.

At the time of this analysis, Bitcoin (BTC) had experienced a significant decline of approximately 7% in the second quarter. In contrast, the Nasdaq Composite (IXIC) and S&P 500 Index (SPX) showed impressive gains, with the Nasdaq increasing by 7.7% and the S&P 500 advancing by 3.4%. According to TradingView data.

Based on Thompson’s analysis, the increasing divergence between Bitcoin (BTC) and US tech stocks indicates a potential continuation of this trend in the coming month. As a crypto investor, I would keep a close eye on this decoupling and consider adjusting my portfolio accordingly if US tech stocks continue to outperform BTC.

As a researcher examining the current market trends, I’ve observed that Bitcoin (BTC) has shown significant growth with double-digit percentage gains year-to-date (YTD), while the major US stock indices have only managed to achieve single-digit increases.

Quessing Thompson had shared beforehand that the Federal Reserve’s latest position might pose challenges for Bitcoin during the third quarter.

After the Federal Open Market Committee (FOMC) meeting, Deribit Insight’s data indicated that bears felt more confident following a more definite schedule for Ethereum Spot ETF acceptance, approximately by July 2nd.

If the positive shift in sentiment continues into next week, Bitcoin’s price may rebound from its current level of $66K.

CrypNuevo, a Bitcoin technical analyst, expressed some skepticism regarding an imminent price increase. He anticipated that the cryptocurrency might revisit its support level before potentially reaching $73,500 – a significant area with substantial market liquidity.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

2024-06-17 15:03