- Altcoin market has experienced a significant correction, with a 12.5% drop from its peak.

- Analyst predictions suggest a revival driven by new ETF listings and macroeconomic factors.

As an experienced analyst, I’ve witnessed numerous ups and downs in the cryptocurrency market over the years. The recent correction in the altcoin market, resulting in a 12.5% drop from its peak, has left many investors feeling uncertain about the future of these digital assets. However, based on my analysis and understanding of market trends, I believe that there are reasons for optimism.

The value of altcoins is experiencing a significant decrease, causing the total market capitalization to drop from its peak of $1.2 trillion in March to the current $1.05 trillion, representing a decline of approximately 12.5%.

As a researcher studying the cryptocurrency market, I’ve observed that the recent economic downturn has led to substantial losses for many altcoins. In fact, some have experienced declines exceeding 40% over the past fortnight.

In his most recent video examination, Michael Van De Poppe, a renowned cryptocurrency expert, explored the unpredictability of the altcoin market and offered insights into its potential future developments.

Based on Van De Poppe’s perspective, the altcoin market’s volatile nature is nothing new and is marked by both substantial profits and harsh pullbacks.

Many are expressing doubts about the future of altcoins following a recent slump in the market, with some fearing that this downtrend may persist. According to Van De Poppe, there are several significant reasons contributing to this instability, most notably impacting major cryptocurrencies like Ethereum.

Factors influencing altcoin stability

One significant reason for the volatility in the altcoin sector, according to the analysis, is the postponed commencement of trading for the Ethereum spot ETF, even though it has been approved.

The postponement has brought about uncertainty and volatility in the markets, leaving traders and investors questioning the timeline for engaging with these legally sanctioned financial instruments.

Van De Poppe proposes that the introduction of a new spot ETF might generate heightened investor curiosity and possibly ignite a market rally, much like past ETF debuts have done.

In addition, key macroeconomic indicators like the Consumer Price Index (CPI), Producer Price Index (PPI), and communications from the Federal Open Market Committee (FOMC) significantly influence investor attitudes towards the markets.

New data indicating a possible relaxation of inflationary tension might lead the Federal Reserve to reduce interest rates in the future. Throughout history, this monetary policy move has generally boosted the performance of altcoins. These assets thrive during periods of quantitative easing and low borrowing costs when there is ample global liquidity.

In spite of the present difficulties, Van De Poppe remains hopeful that the altcoin market may experience a resurgence.

He believes the economic slump will come to an end shortly, fueled by the upcoming Ethereum spot ETF listing. This development is predicted to greatly enhance market trust and attraction, potentially signaling the start of a recovery for altcoins.

Spotlight on Solana: A case study

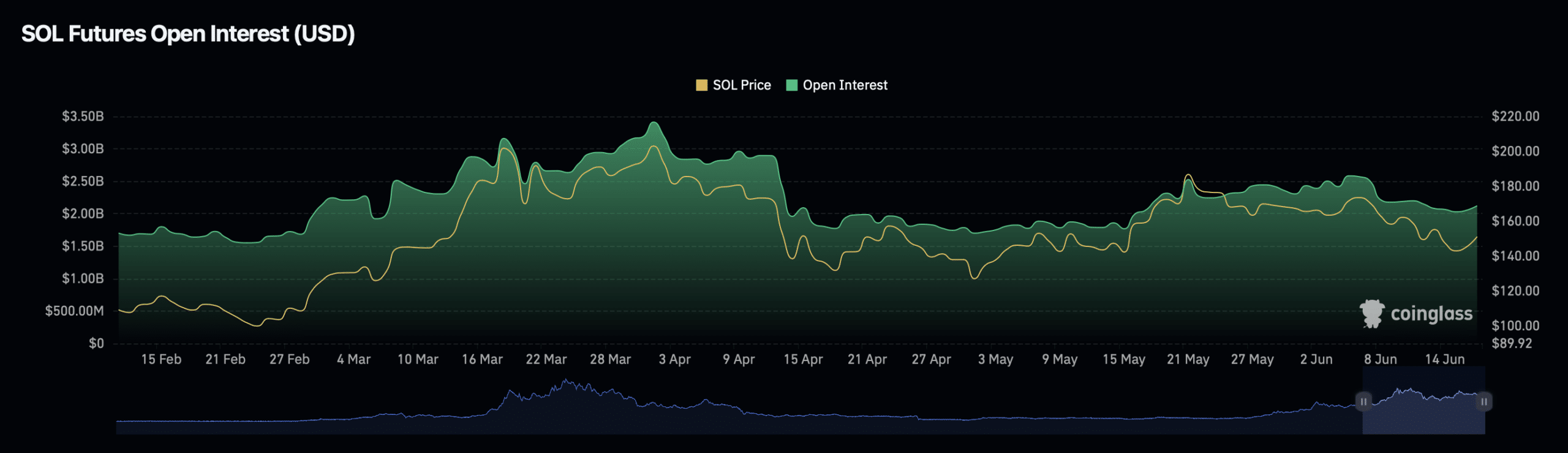

Examining the cryptocurrency Solana (SOL) more closely, it has suffered a substantial decline of approximately 50% from its highest point in March this year, with a current market price at $146.52. Indications suggest that a potential reversal may be unfolding based on recent developments.

In the past 24 hours, Solana has seen an increase of 1.6% in its price.

At the same time, the open interest has increased by 0.36 percent, while open interest volume significantly jumped by 68% to reach a value of $3.83 billion.

As a researcher studying the digital asset market, I’ve noticed an exciting development. The positive momentum in the industry aligns with the significant surge in Non-Fungible Token (NFT) transactions on the Solana (SOL) blockchain. Intriguingly, according to recent reports from AMBCrypto, SOL’s NFT transaction volume has outpaced that of Bitcoin and Ethereum. This dynamic shift is a testament to the growing interest and adoption of NFTs within the Solana ecosystem.

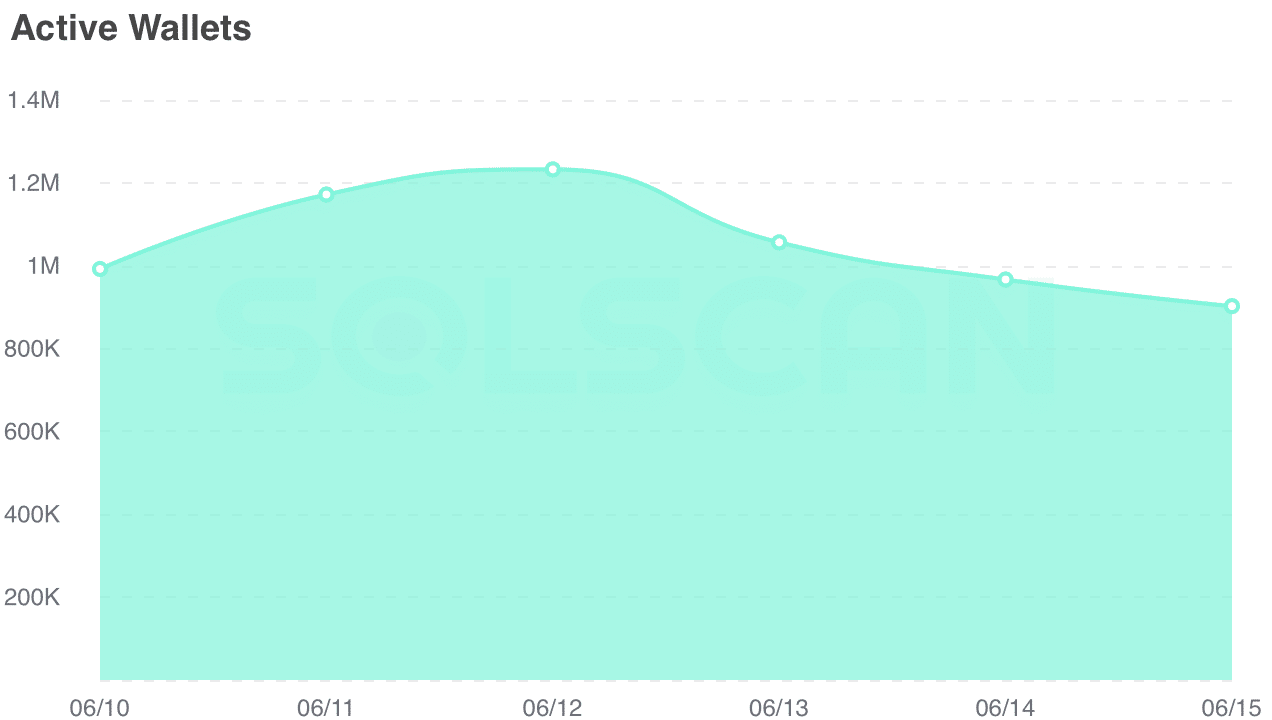

Over the past week, there’s been a slight drop in the number of active Bitcoin addresses from around 950,000 to approximately 902,000. This decline suggests less activity on the network. However, it’s important to note that this decrease might not necessarily reflect market sentiment as other factors could be influencing the number of active addresses. Nevertheless, there are signs that market sentiment could be changing.

Read Ethereum’s [ETH] Price Prediction 2024-25

As a cryptocurrency analyst, I’d like to draw your attention to the significance of the $141 mark as a crucial support level for Solana. Based on my analysis of the daily chart, a buy signal has emerged at this price point.

As a Solana investor, I’m keeping an eye on the current support level. If it doesn’t give way, there’s a chance that Solana may bounce back in the near future. This means that there’s still reason to be optimistic about this altcoin.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-17 18:16