-

Global reach of BTC ETFs expand with the Australian Stock Exchange set for a new listing on 20th June.

It remains to be seen whether the US spot ETH ETF approvals will increase demand for BTC ETFs.

As an experienced financial analyst, I view the Australian Stock Exchange’s (ASX) approval of its first Bitcoin ETF product from VanEck as a significant development for investors in Australia seeking regulated avenues to trade and invest in Bitcoin (BTC). The listing, which is set to debut on June 20th, follows renewed interest in cryptocurrency products after the successful launch of US and Hong Kong spot BTC ETFs.

As a financial analyst, I’m excited to share that the Australian Stock Exchange (ASX) has taken a significant step forward in the cryptocurrency space by granting approval for the first Bitcoin Exchange-Traded Fund (ETF) product. This groundbreaking development comes from asset manager VanEck.

On June 20th, the VanEck Bitcoin ETF (VBTC) is scheduled to begin trading on the Australian Securities Exchange (ASX), making history as the first ETF connected to the largest digital currency to be introduced on this platform.

According to Andrew Campion, the ASX‘s investment products manager, the hold-up in granting approval for Bitcoin ETFs on the exchange can be attributed to the cryptocurrency market downturn in 2022. He further explained this phenomenon to the Australian Financial Review as the “crypto winter.”

“Despite the recent rise in cryptocurrency prices, there has been significant curiosity towards our project during the past year. This culminated in us receiving approval.”

ASX signaled renewed interest after US and Hong Kong spot BTC ETFs went live.

Demand for Bitcoin ETF Australia

Arian Neiron, the Asia Pacific managing director at VanEck, highlighted the increasing interest among investors in Bitcoin.

‘Bitcoin has remained an emerging asset class that many advisers and investors want”

For those interested in investing in Bitcoin with regulatory oversight in Australia, the ASX‘s listing serves as an excellent indicator.

Products similar to those recently introduced on ASX are now available on another major Australian trading platform, Cboe Australia. This marketplace serves as a significant rival to the ASX.

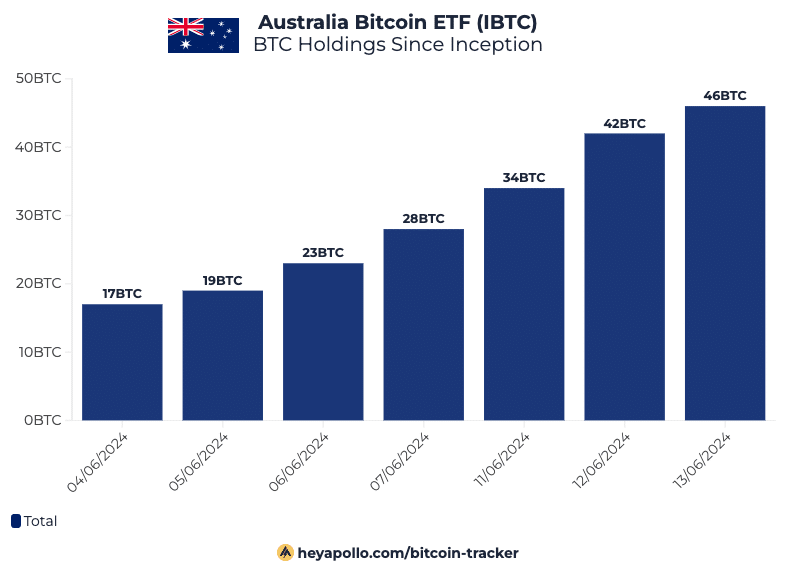

I’ve noticed an intriguing development in the world of Bitcoin ETFs: the Monochrome Bitcoin ETF (IBTC) commenced trading on Cboe Australia on June 3rd. By June 14th, this product had amassed a total of 46 Bitcoins, according to Bitcoin analyst and investor Julian Farher’s recent disclosure.

It’s intriguing that the ASX‘s listing of Ethereum [ETH] is set to debut only a few days prior to the potential approval of US spot Ethereum ETFS. Some market experts consider this coincidence as a significant catalyst for the broader market. However, whether it will boost the demand for Australian Bitcoin ETFS remains to be determined.

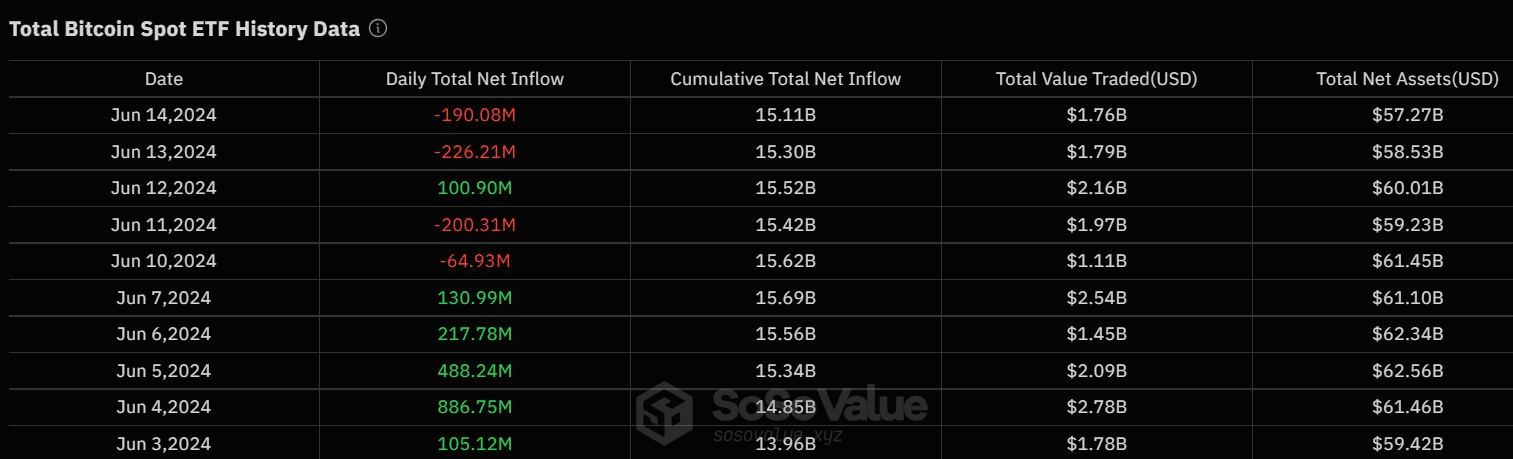

Last week, US Bitcoin exchange-traded funds experienced notable withdrawals. This occurred both prior to and following the Federal Reserve’s announcement that they would maintain the current interest rates for the seventh time in a row. Investors made these moves as part of their risk management strategies.

Last week, except for the 12th, there were significant withdrawals totaling over $680 million by US investors, signifying a cautious stance towards risk.

At the moment of writing this analysis, Bitcoin’s price has dipped under the $66,000 mark. If the pessimistic outlook continues to dominate, we might witness a further slide down towards the lower end of the price range.

According to Coinglass statistics, the overall market’s Open Interest (OI) was in the red at the current moment, signaling reduced liquidity in the derivatives sector and further amplifying the pessimistic outlook.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-17 19:03