- Schiff warned that hedge funds selling Bitcoin to cover MSTR shorts could crash Bitcoin’s price.

- Bitcoin faced bearish trends, showing red candles in daily and weekly charts.

As a seasoned crypto investor, I’ve seen my fair share of market volatility and price movements. Schiff’s warning about hedge funds selling Bitcoin to cover MicroStrategy shorts is concerning, but it lacks substantial support. The interconnected risks between the two assets are real, but it remains unclear why hedge funds would sell their Bitcoin holdings when they yield profits from their MSTR short positions.

Bitcoin’s bulls are finding it challenging to reverse the negative outlook, as the digital currency displayed red bars on its daily and weekly price charts.

At present price of $65,177.67 for trading, Bitcoin’s volatility has been a subject of much critique recently, with Peter Schiff being one of its vocal critics.

In an X (formerly Twitter) post dated the 17th of June, Schiff noted,

Schiff on Bitcoin and MicroStrategy

In this context, Schiff emphasized the linked dangers affecting Bitcoin and MicroStrategy (MSTR). He pointed out that any significant developments in one asset could potentially trigger chain reactions impacting the other.

Moreover, when asked by an X user—Jim—”Why would Bitcoin crash?,” Schiff replied,

“Hedge funds selling as they buy MSTR. They would be unwinding both sides of the spread.”

According to Schiff’s analysis, a drop in Bitcoin’s price might occur if hedge funds decide to offload their Bitcoin assets as they simultaneously purchase MicroStrategy (MSTR) stocks to cover their short positions.

Despite the fact that their Mara Marathon (MSTR) short positions are bringing in profits for hedge funds, there is still uncertainty as to why they would choose to sell their Bitcoin holdings.

Schiff’s remarks lack substantial support

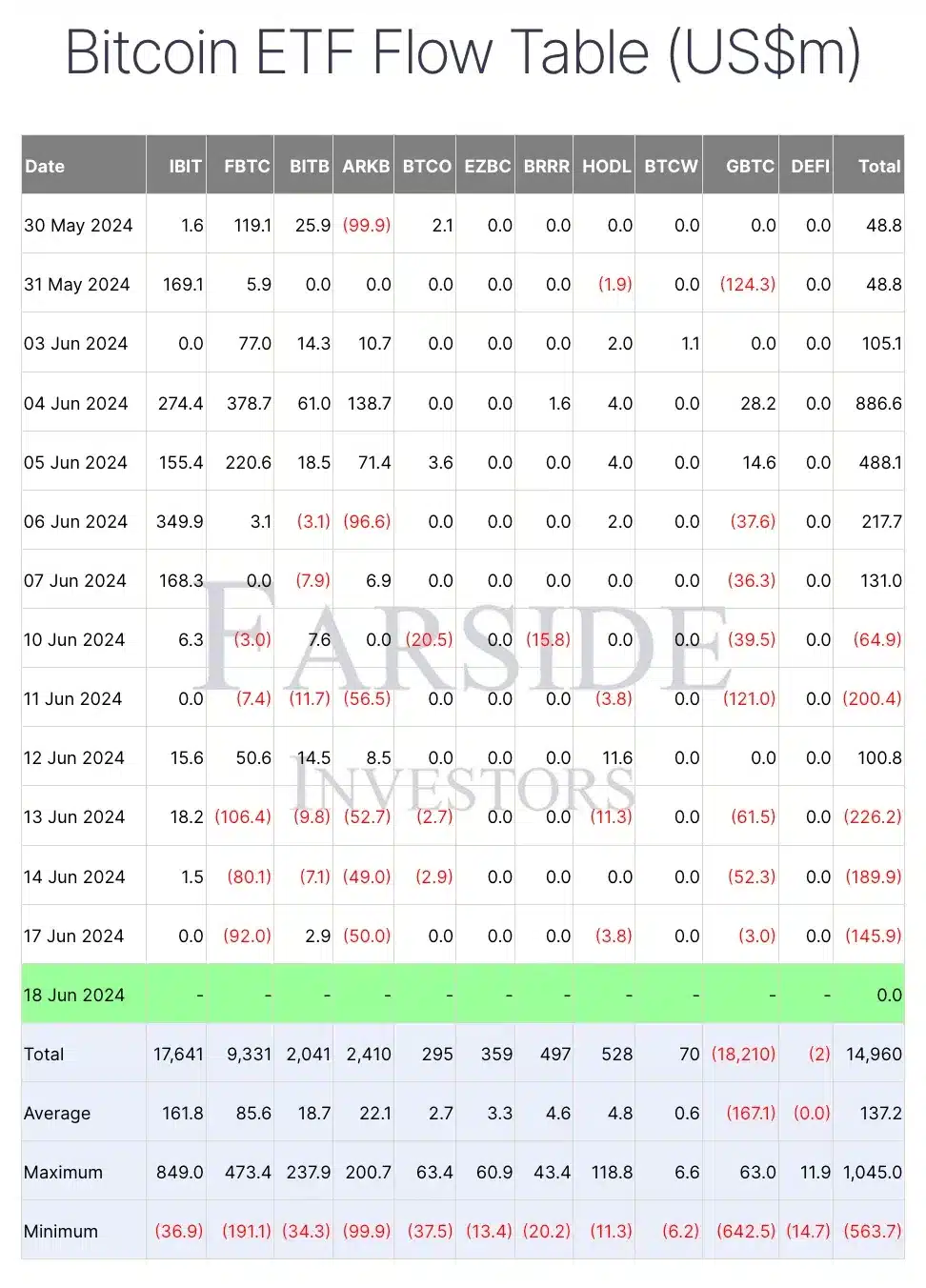

During Bitcoin’s continuous price battles, Exchange-Traded Funds (ETFs) linked to Bitcoin have encountered comparable difficulties. Specifically, from the 13th to the 17th of June, excluding weekends, these BTC ETFs experienced successive withdrawals.

Moreover, MicroStrategy’s stock,MSTR, also dropped by 3.13% in the past 24 hours.

As a researcher studying the stock market trends, I find myself observing Microstrategy (MSTR) with its Relative Strength Index (RSI) hovering around the neutral zone. The uncertainty lies in where this stock will head next. Should it successfully breach the resistance level at $1607.8, a potential bullish momentum could ensue.

As a researcher, I’ve discovered a significant correlation between the price movements of Bitcoin and MicroStrategy (MSTR). This finding highlights the strong relationship between these two markets, implying that MicroStrategy’s price behavior tends to mirror Bitcoin’s trends.

Bitcoin stands strong

Based on AMBCrypto’s examination of social media buzz and the number of active Bitcoin addresses within the last 24 hours, it was observed that there has been a noticeable uptick. This finding suggests that although Bitcoin’s price has dipped recently, optimism among investors regarding the cryptocurrency remains strong.

Echoing similar sentiment, YouTuber Crypto Rover, analyzed,

“Once this falling wedge on #Bitcoin breaks out, the price target is $72k.”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-06-19 08:07