- Nvidia faced the Supreme Court review for securities fraud.

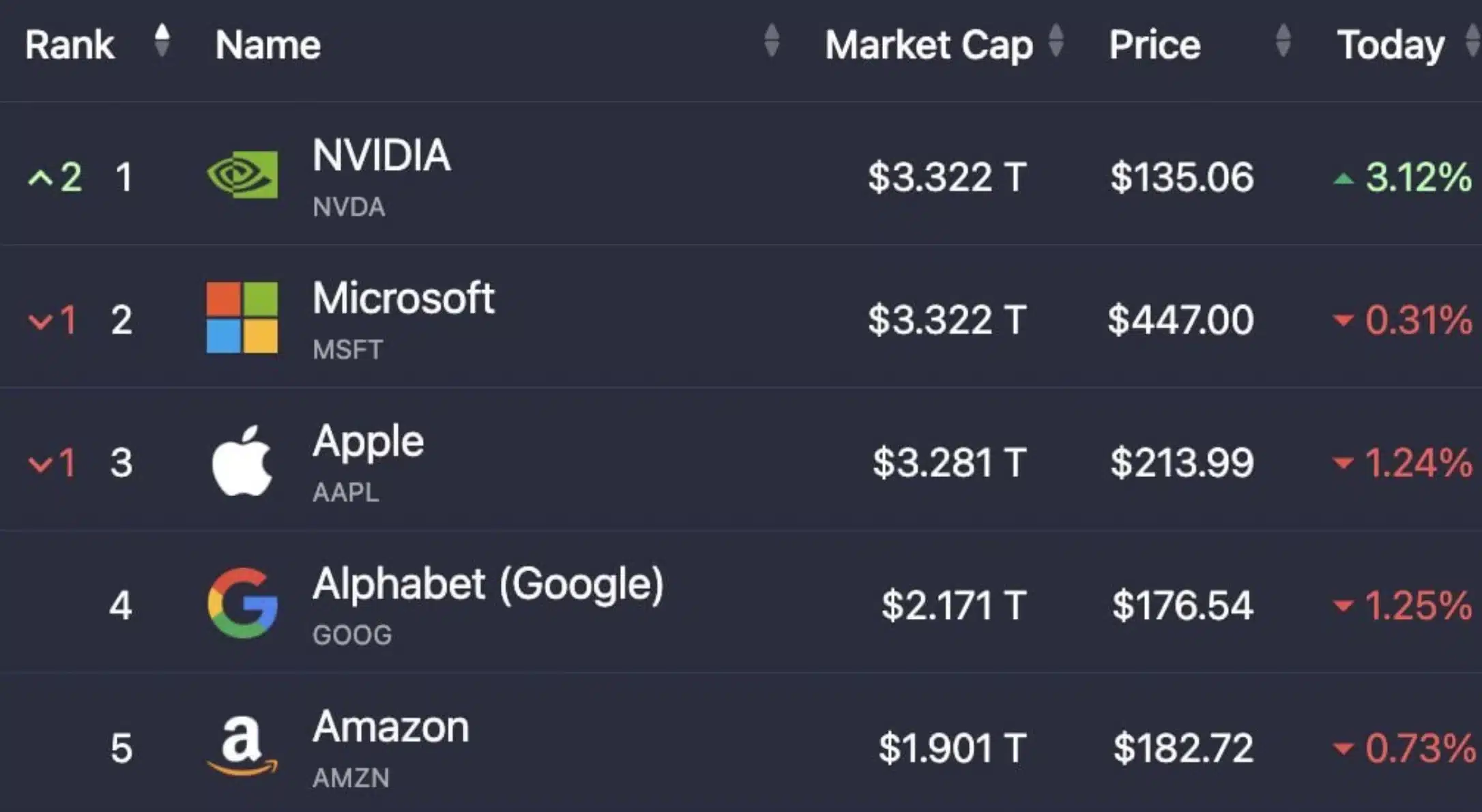

- Nvidia’s $3.34 trillion market value surpassed Microsoft and Apple.

As a seasoned crypto investor, I’ve witnessed my fair share of market turbulence and legal battles within the industry. The recent news regarding Nvidia’s impending Supreme Court review for securities fraud is a concerning development that I closely monitor.

More recently, the US Supreme Court has decided to examine Nvidia’s petition to dismiss a securities fraud claim. This lawsuit accuses Nvidia of deceiving investors regarding the revenue generated from sales related to cryptocurrency.

Supreme Court takes charge

In response to the petition, the Supreme Court has decided to review Nvidia’s case for dismissing this lawsuit on the 17th of June.

After being reinstated by a lower court, California shareholders’ class-action lawsuit against Nvidia and its CEO Jensen Huang for undisclosed damages was granted approval by the court.

The story so far…

In 2018, Nvidia’s chips began gaining widespread use for crypto mining as they possessed the ability to handle intricate mathematical calculations essential for generating new blocks in cryptocurrencies such as Bitcoin [BTC].

Nvidia and its high-ranking executives were charged by the plaintiffs with breaching the Securities Exchange Act of 1934. The accusation claimed that Nvidia had downplayed in their statements during 2017 and 2018 the significance of crypto sales on their financial growth.

As a crypto investor, I’ve noticed some concerns raised about Nvidia’s transparency regarding the influence of cryptocurrency mining on their business. Some claim that the company failed to provide sufficient information, potentially misleading both investors and analysts.

After that, Judge Haywood Gilliam Jr. of the U.S. District Court dismissed the case in the year 2021. However, the 9th U.S. Circuit Court of Appeals in San Francisco reversed this decision with a split vote of 2 to 1.

According to Reuters, the plaintiffs had adequately claimed that Nvidia’s CEO Jensen Huang made,

“False or misleading statements knowingly or recklessly.”

The appellate court ruled that this was just a tactic to prolong the lawsuit. In response, Nvidia appealed to the Supreme Court, maintaining that the 9th Circuit’s judgment might set a dangerous precedent if upheld.

“Abusive and speculative litigation.”

Nvidia stands strong

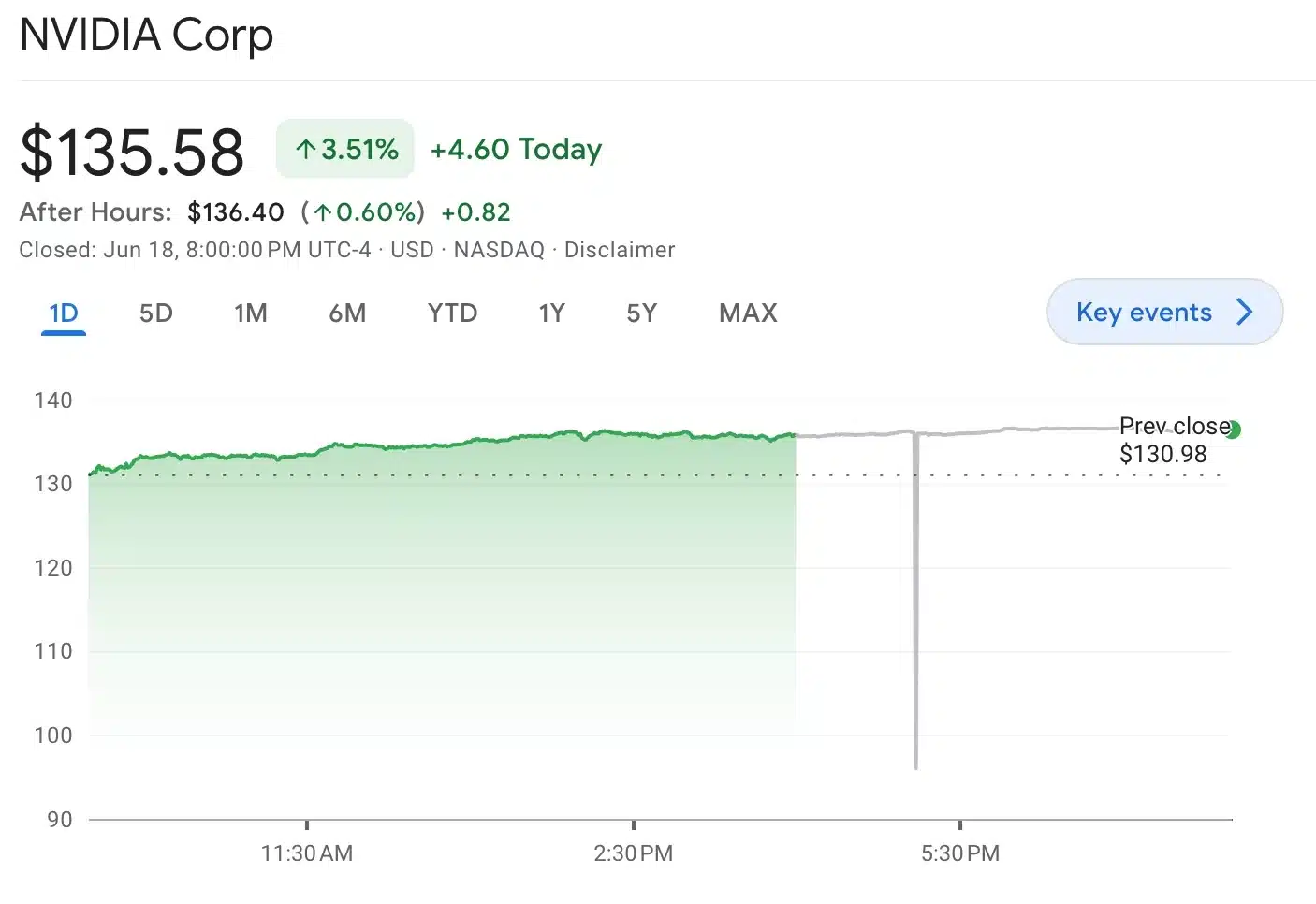

In spite of an ongoing legal dispute, Nvidia’s stock price increased by 3.5% on June 18th, reaching a market capitalization of approximately $3.34 trillion.

As a market analyst, I can say that Nvidia’s latest strategic move has catapulted it past both Microsoft and Apple in terms of market value. This achievement places Nvidia at the helm among the globe’s most esteemed corporations.

As a researcher studying investment trends, I’ve observed an impressive display of confidence from investors in Nvidia’s technological abilities, even amidst accusations.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2024-06-19 14:15