-

Greed remained dominant as the price of crypto assets declined.

BTC has sipped and stayed below its support levels.

As an experienced analyst, I have closely followed the cryptocurrency market for several years now. The recent decline in major crypto assets like Bitcoin (BTC) and Ethereum (ETH) has been a cause for concern among traders and investors alike. While the Fear and Greed Index indicates that sentiment remains positive, I believe there are reasons to be cautious.

As a crypto investor, I’ve been feeling the ripples of unease throughout the community following the recent downturn in the value of major cryptocurrencies like Bitcoin [BTC] and Ethereum [ETH].

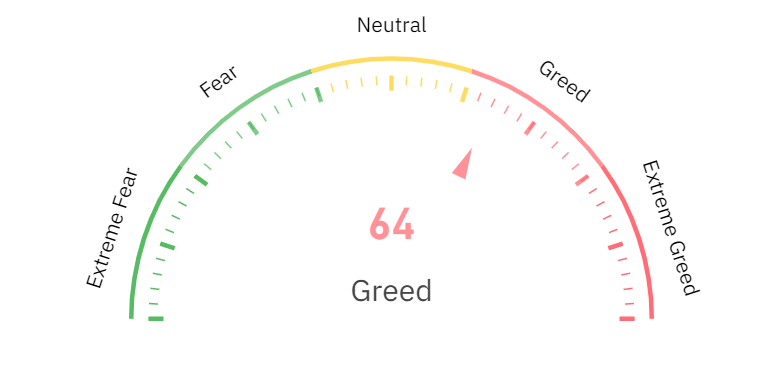

Traders kept a keen eye on price movements, but according to the Fear and Greed Index, investor sentiment remained upbeat at this point.

Fear and Greed Index remains positive

As a researcher studying the crypto market, I recently examined the Fear and Greed Index data. Surprisingly, even though the prices of most cryptocurrencies were on a downward trend, an underlying sense of optimism persisted based on my analysis.

The index indicated a state of greed, with a current rating of around 64%.

At present, according to a study of the Coinglass chart, the degree of greed among investors was on the decline. The day prior, the related index stood near 74.

This suggested that while the crowd’s sentiment remains positive, it was becoming less bullish.

In simple terms, AMBCrypto’s examination of Bitcoin and Ethereum price movements recently sheds light on why the Fear and Greed Index has behaved as it has over the past few days.

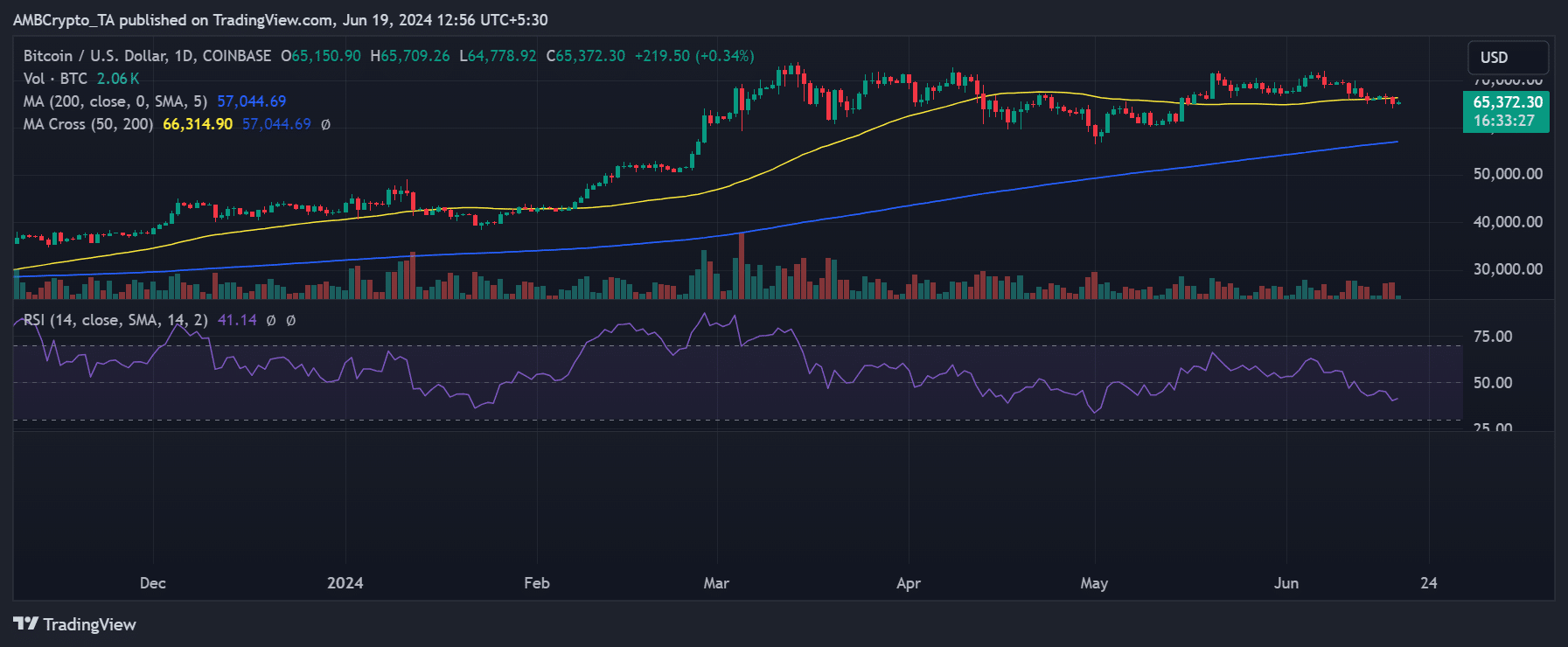

How the Bitcoin affected the Index

The historical price pattern of Bitcoin indicated that the $65,000 mark functioned as a significant support level. Lately, though, the declining trend in Bitcoin’s price has shattered this long-standing support.

On June 18th, the Bitcoin price dipped below its previous support level for the first time, reaching $65,152 following a minor 2% decrease. (Or: The Bitcoin price slipped beneath its prior support level on June 18th, hitting $65,152 after a 2% drop.)

The stock’s Relative Strength Index (RSI) stayed beneath the neutral threshold, implying a robust downward trend currently.

If the Fear and Greed Index continues to indicate a positive emotion towards Bitcoin at its current price, that feeling could shift to fear if Bitcoin’s value continues to decrease.

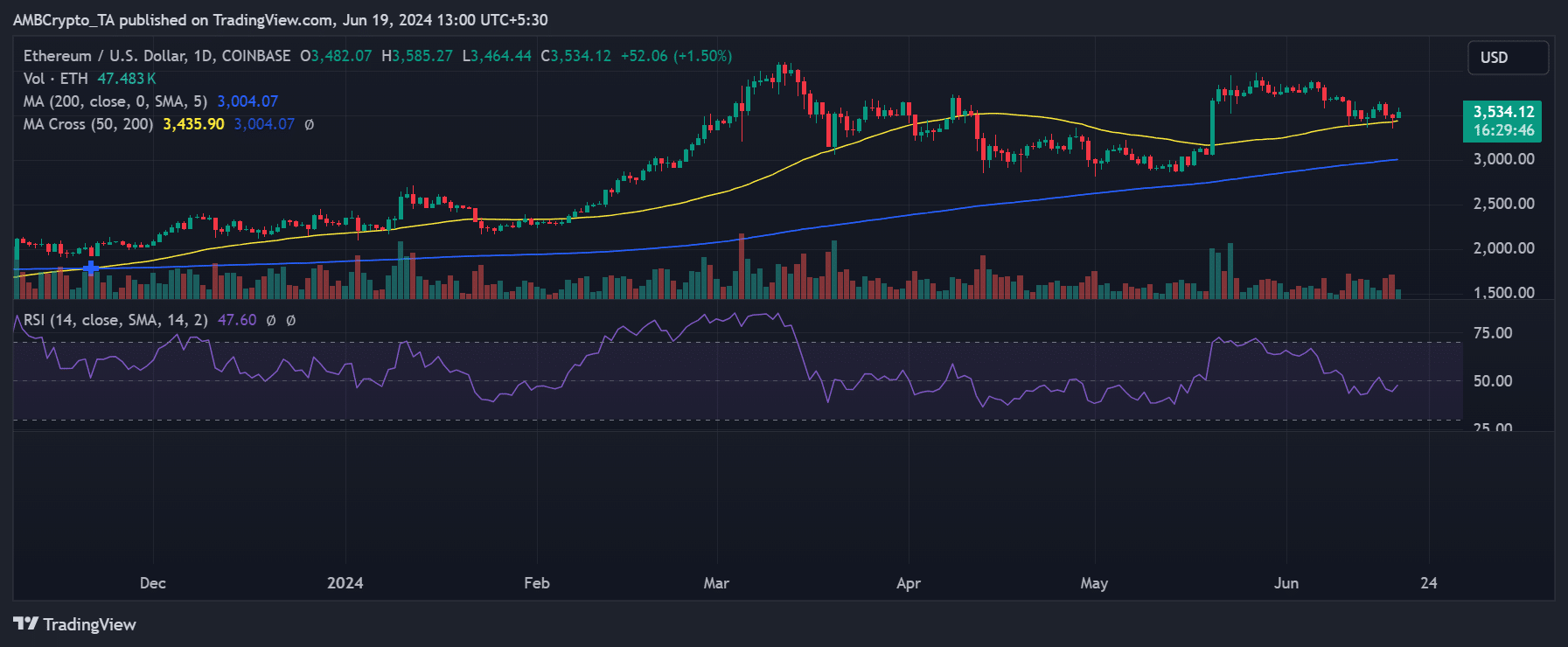

Ethereum’s effects on the Index

In recent days, Ethereum’s pricing pattern indicates a downward shift. In contrast, its support threshold has managed to withstand this trend, unlike Bitcoin.

From my research, Ethereum experienced a minimal decrease of approximately 0.7% on the 18th of June, causing its price to dip down to around $3,482. At present, however, Ethereum has rebounded with over 1% growth and is being traded above $3,500.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

As a market analyst, I’ve observed that the value of Bitcoin (BTC) has taken a downturn recently, causing the Fear and Greed Index to flirt with fear territory. However, despite this decline, the larger price trend has kept the cryptocurrency relatively stable thus far.

However, given BTC’s dominance, a further drop in its price could push the index into panic mode.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-19 15:03