- Bitcoin’s price remained over $65,000 amid a decline in retail investor activity.

- Current on-chain data suggested a lack of short-term holder activity, indicating potential for future market movements.

As an experienced analyst, I believe that Bitcoin’s current price stability above $65,000 is not a sign of market strength but rather a lack of retail investor activity. The absence of short-term holders and their decreased participation in the market is a clear departure from previous cycles.

As a Bitcoin investor, I’m currently observing the market with BTC trading at an price of $65,524. However, I can’t ignore the persistent downtrend we’ve been witnessing.

Based on the information I’ve gathered from CoinMarketCap, I’ve observed that Bitcoin has experienced a 7.9% decrease over the past fortnight, and this downward trend persists as it dips an extra 0.1% in the most recent 24 hours. However, there are several factors contributing to this price action beyond just the data:

Lack of usual retail boost

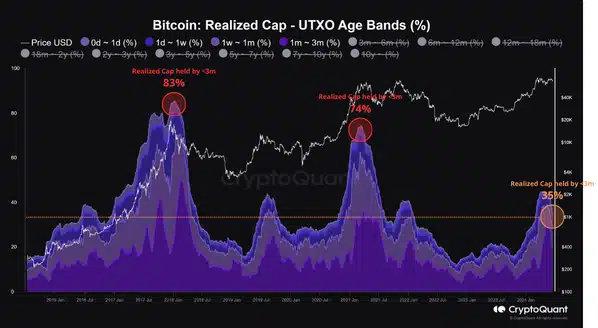

A CryptoQuant analyst provided profound insights into the Bitcoin market, pointing out the conspicuous lack of participation from individual or retail investors.

In Bitcoin’s market history, an influx of new investors and short-term traders, who usually hold their coins for under a quarter year, has been a characteristic feature of price peaks.

The analyst noted,

“An essential feature of Bitcoin price peaks is the significant influence of coins held for less than 3 months. Previously, this trend has signaled that long-term investors (shrewd investors) have previously cashed out their gains, leaving the market at the mercy of speculators and newcomers. Consequently, the market structure becomes more unstable.”

In contrast to past market cycles, the current one is distinguished by a minimal involvement of short-term investors.

As an analyst examining the data, I’ve discovered that approximately 65% of Bitcoin’s current realized capital is not held by this particular group. This figure is considerably less than the over 70% observed during peak market periods in previous Bitcoin market cycles.

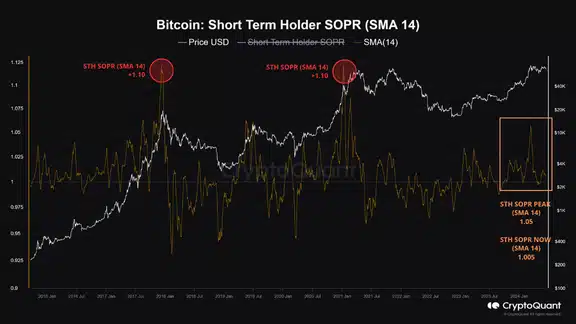

The Spent Output Profit Ratio (SOPR) of these investors stayed low, implying that the market hadn’t reached a stage of excessive speculation.

Based on the analysis, it indicated that we weren’t yet at the height of a bull market, as the signs of peak excitement or exuberance – which can signal an impending market correction – were still absent.

The analyst added:

Long-term investors hold a large portion of the market, creating a strong foundation for price stability. The infrequent presence of short-term traders reduces the likelihood of a sudden shift into a bear market. This resilient setup suggests that there may be room for a substantial rally before the market reaches its peak.

Bitcoin: Technical perspective

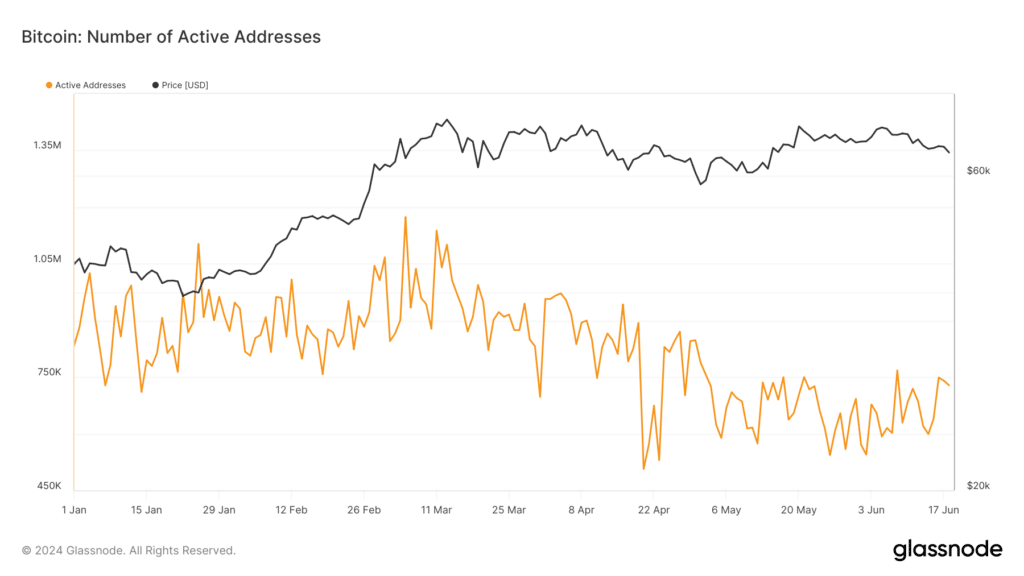

Examining Bitcoin’s on-chain data provided insight into why the retail sector appears to be underrepresented in the Bitcoin market.

As an analyst examining the latest data from Glassnode, I’ve noticed a significant decrease in the number of active Bitcoin addresses. This figure peaked at over one million in March but has since dropped to around 800,000 and has remained relatively stable for the past month.

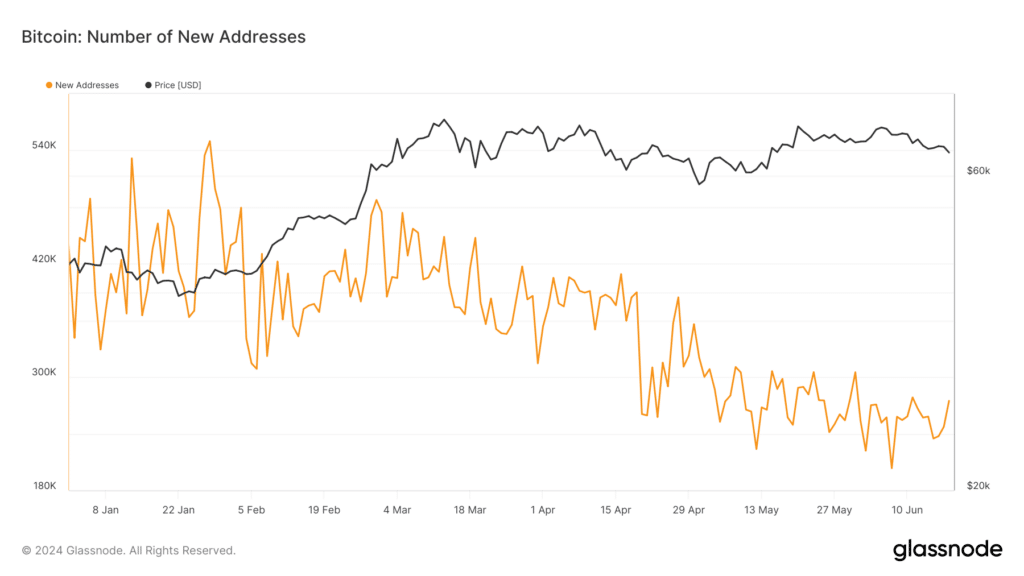

An extra noteworthy observation is that the generation of fresh Bitcoin addresses has significantly decreased. The number fell from more than 500,000 in January to less than 300,000 as of the current reporting period.

A decrease in the number of active and new addresses implies that retail investors may be less involved, since a surge in these numbers usually indicates greater retail involvement in cryptocurrency markets.

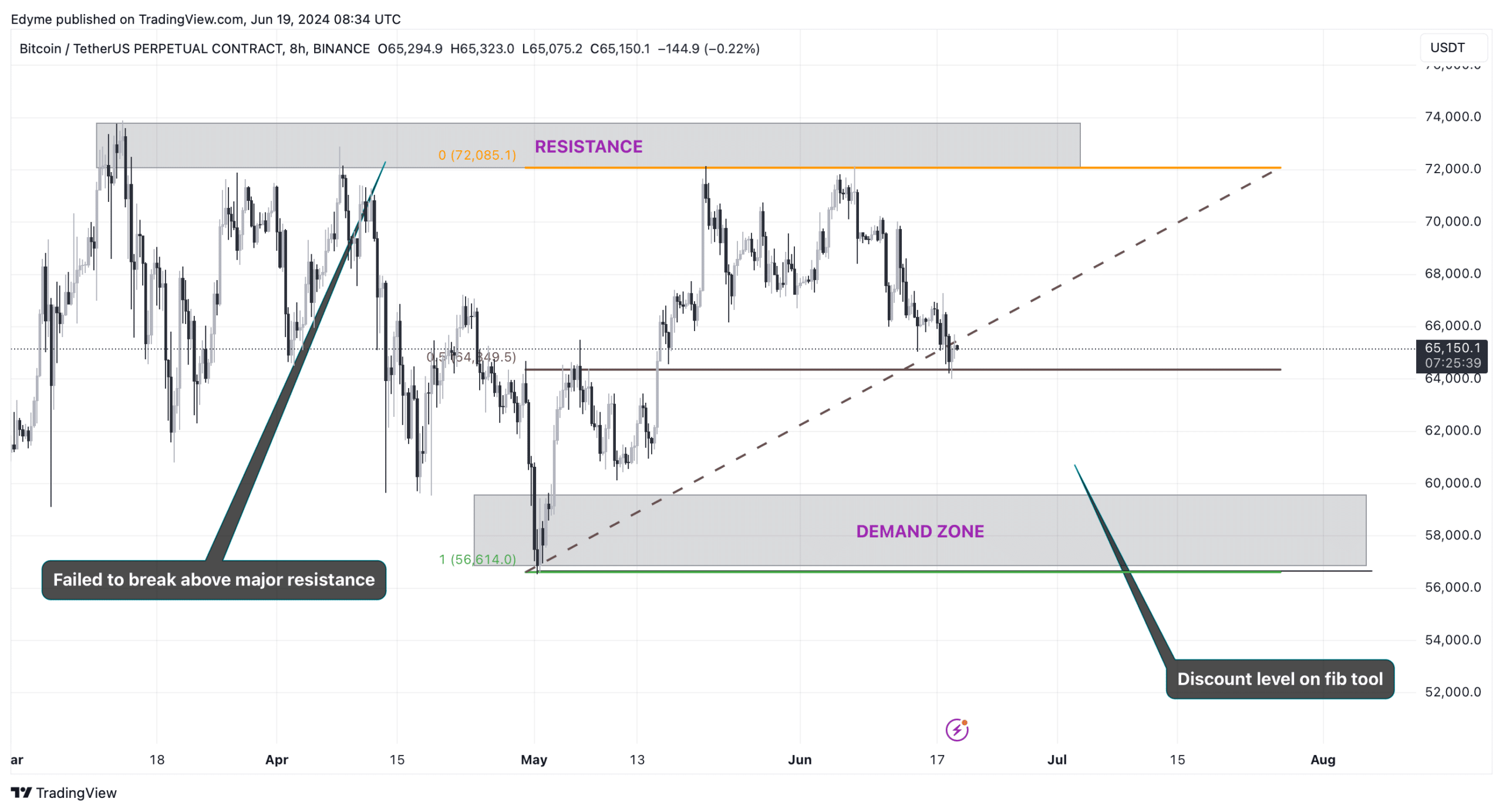

Transitioning from essentials to intricate examination, Bitcoin displayed indications of a declining trend, as it repeatedly fell short of surmounting significant resistance markers on its daily chart.

As a crypto investor, I was anticipating that the cryptocurrency would keep trending downwards until it touched a significant level of buying interest. This potential demand zone could trigger a price reversal and lead to an uptrend.

As a crypto investor, when I analyzed Bitcoin’s 8-hour chart using the Fibonacci tool, I identified a potential demand zone between $60,000 and $56,500.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Based on the accuracy of technical indicators, Bitcoin may continue to drop and reach the discount area. This potential downturn could pave the way for a potential recovery once demand significantly increases at the reduced price points.

The findings of this analysis align with AMBCrypto’s recent report indicating that miners are likely to put downward pressure on Bitcoin’s price until the hashrate undergoes an improvement.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-06-19 17:12