As a seasoned crypto investor with a keen interest in Bitcoin (BTC), I’ve witnessed the intricacies of the market for quite some time now. The recent surge in the market capitalization of US-listed Bitcoin miners, as reported by JPMorgan and Glassnode, has piqued my curiosity.

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing development: The market capitalization of US-listed Bitcoin miners has reached new heights recently. However, despite this upward trend in their stock prices, key metrics such as revenue and reserves have shown a downward trend over the past few days.

Bitcoin mining stock surges in capitalization

Based on data from JPMorgan’s team of analysts, the combined market value of Bitcoin mining companies trading on American stock exchanges reached a new peak of $22.8 billion by June 15th.

During the first half of June, Bitcoin mining stocks listed in the U.S. experienced significant growth. Notably, Core Scientific, TeraWulf, and IREN stood out among this group with impressive gains of 117%, 80%, and 70% respectively, according to JPMorgan analysts Reginald Smith and Charles Pearce.

Bitcoin miners see a decline in reserve and revenue

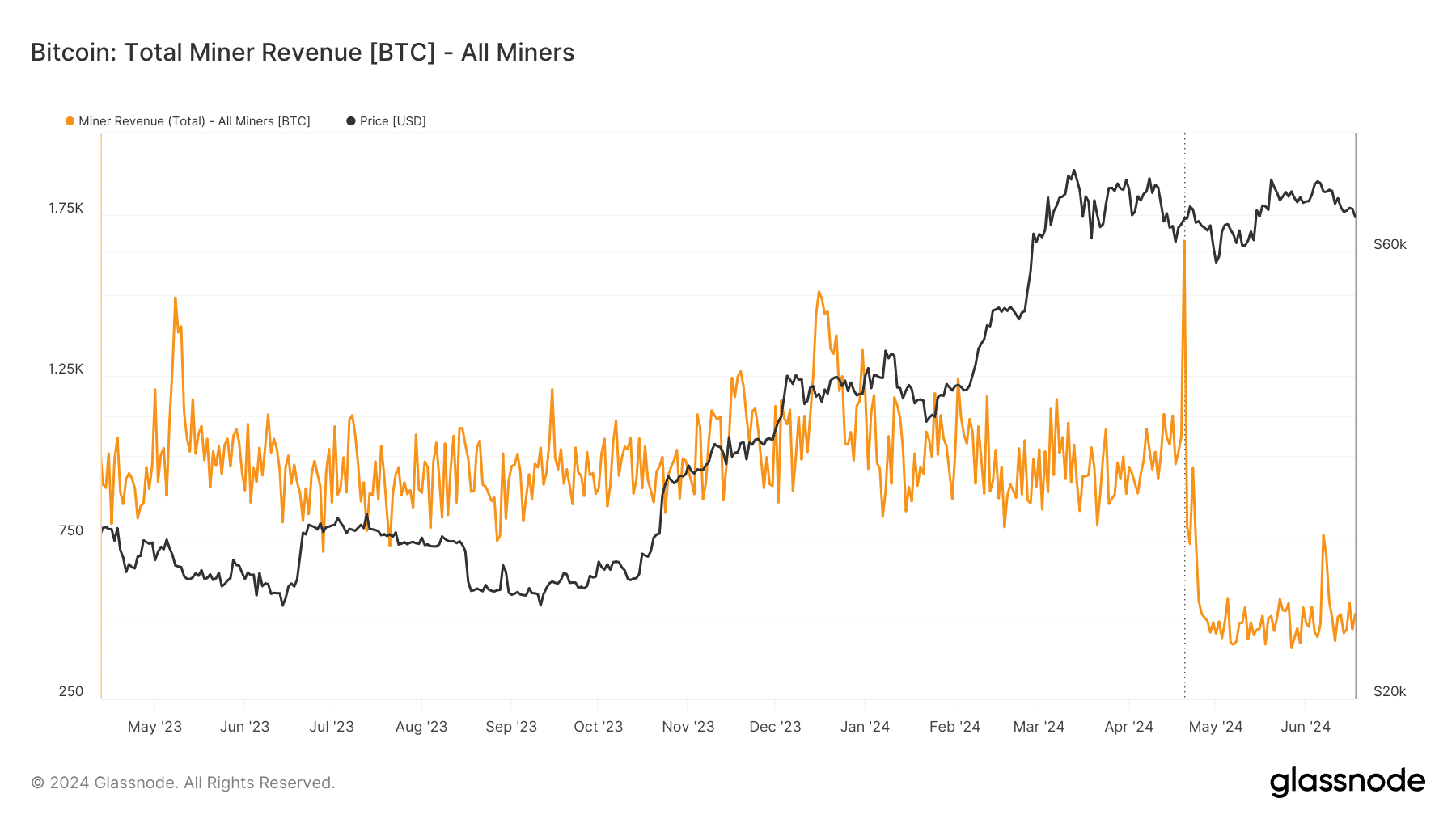

According to Glassnode’s assessment, the quantity of Bitcoin held by miners has been progressively declining for several weeks. At present, this figure hovers around 1.8 million BTC, a point last reached in the year 2021. This represents a three-year low.

As a crypto investor observing the market trends, I’ve noticed that the recent decline could be indicative of miners selling off their Bitcoin (BTC) holdings. The decreasing volume of BTC stored in miner wallets implies that they are liquidating their assets, potentially due to profit-taking or financial pressure. This sell-off could add downward pressure on the price and may continue until the mining community decides to halt these sales.

Additionally, an analysis of BTC miner revenue indicates a downward trend in recent weeks.

At present, our earnings amount to around 512 Bitcoins. This is a noticeable decrease from the more than 1,000 Bitcoins we had earlier in the year.

The latest halving event has played a role in the current drop, but there’s also been a broader reduction in earnings in general.

Bitcoin falls off support

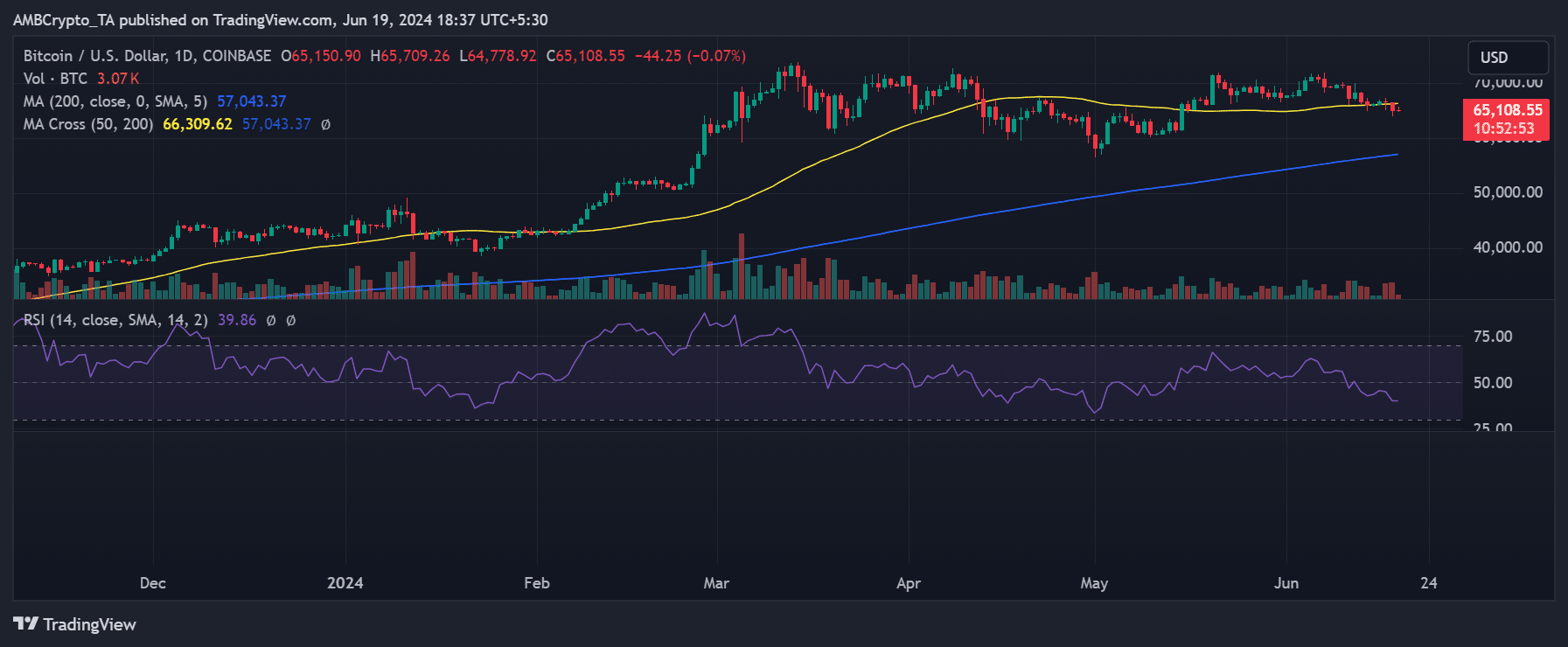

On the daily chart for Bitcoin, there was a downturn of about 2% on June 18th, resulting in a new approximate price of $65,152.

At first, the yellow line representing the moving average supported the price around the $66,000 mark. Later on, the price decrease caused the moving average to fall beneath this price point, making it a new barrier for the price to rise above.

Read Bitcoin (BTC) Price Prediction 2024-25

When I penned this down, Bitcoin was valued around $65,121 on the market, yet it failed to surpass the recently established resistance point. The stochastic marker echoes this bearish pattern, persistently moving in a descending direction.

As an analyst, I’ve taken a closer look at this indicator and have reason to believe that a substantial price move is imminent based on its current trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-20 08:07