- Dogecoin surged by 8% in the last 24 hours.

- Metrics indicate a potential reversal at the $0.1145 key level.

As a seasoned crypto investor with a few battle scars from the market’s volatility, I’ve learned to keep an eye on key metrics and trends before making any investment decisions. And right now, Dogecoin [DOGE] is piquing my interest.

Over the last month, I’ve seen Dogecoin (DOGE) go through some extreme highs and lows alongside the overall crypto market. The unpredictability of prices has left me and many other investors feeling uneasy about the coin’s potential trajectory.

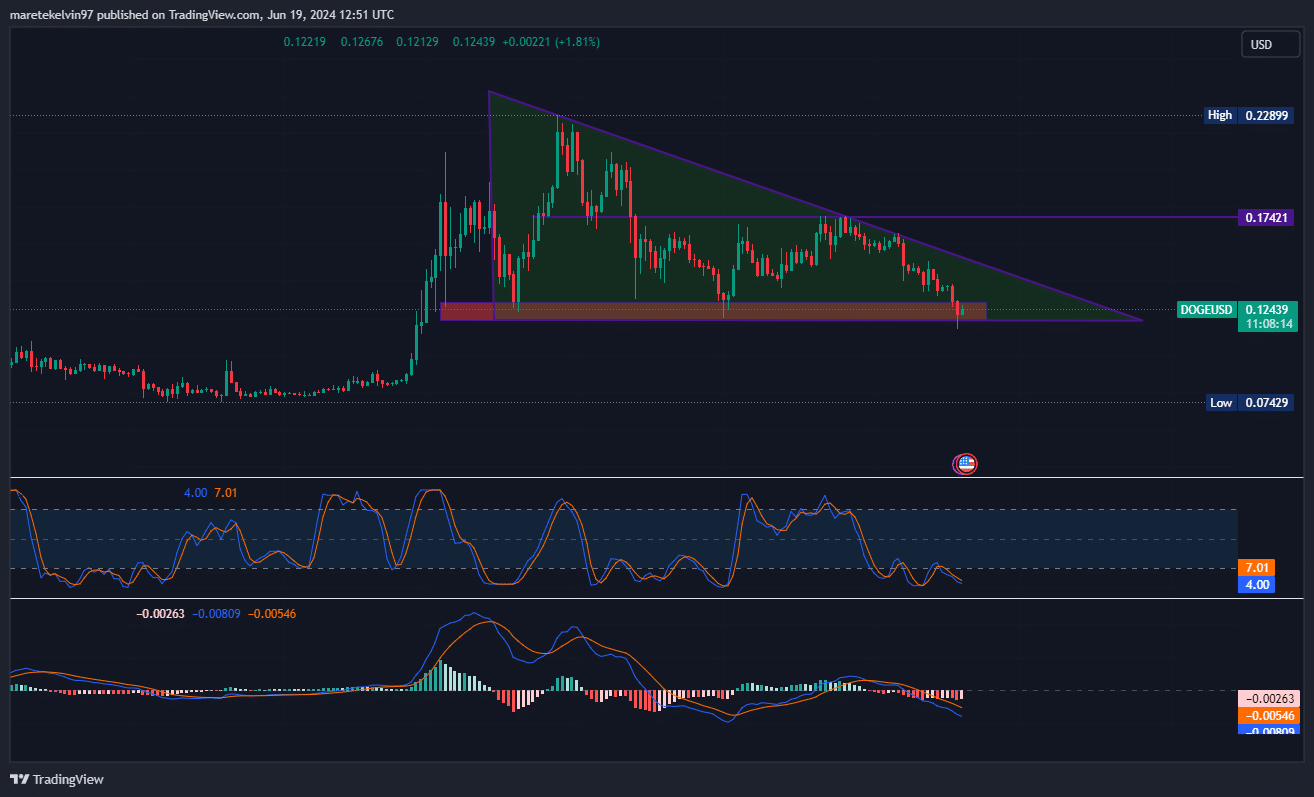

The price of Dogecoin has decreased by approximately 32% over the past fortnight. The downward sloping trendline hints at a potentially bearish market scenario.

Based on my analysis of the market trends, it appears that the price surge of 8% within the past 24 hours could be an early indication of a potential bullish reversal.

At the current moment, the average Dogecoin price was hovering around $0.1247. The cryptocurrency recorded a 24-hour trading volume of approximately $851.62 million, while its market capitalization reached an impressive $18.03 billion.

The random walk RSI signifies that the market is undervalued, potentially leading to a market turnaround with bullish tendencies. On the other hand, the moving average convergence divergence (MACD) line suggests weakening bearish trends, as recent bearish price movements are losing steam over time.

Social volume and development activities to fuel a reversal ?

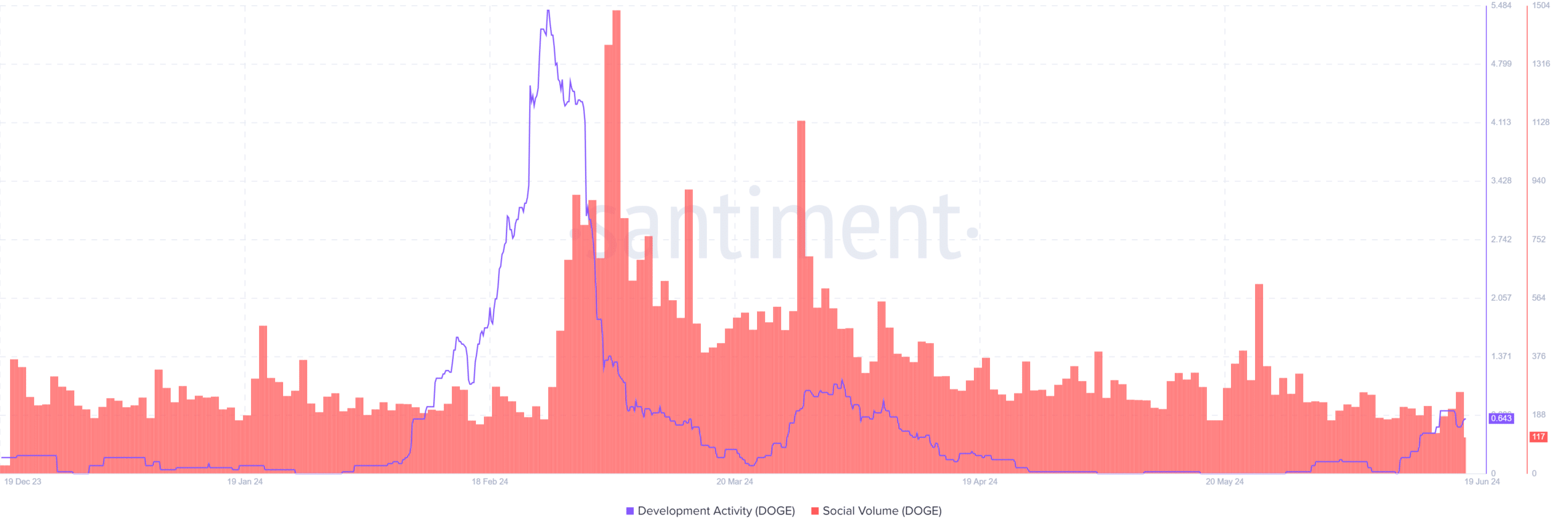

Santiment’s data indicated a spike in DOGE’s social volume and development activities.

A sharp increase in activity within the Dogecoin community indicates growing enthusiasm for this cryptocurrency. The recent surge in development efforts may foreshadow significant advancements related to DOGE, thereby enticing further investment from potential buyers.

Liquidation and short squeezes

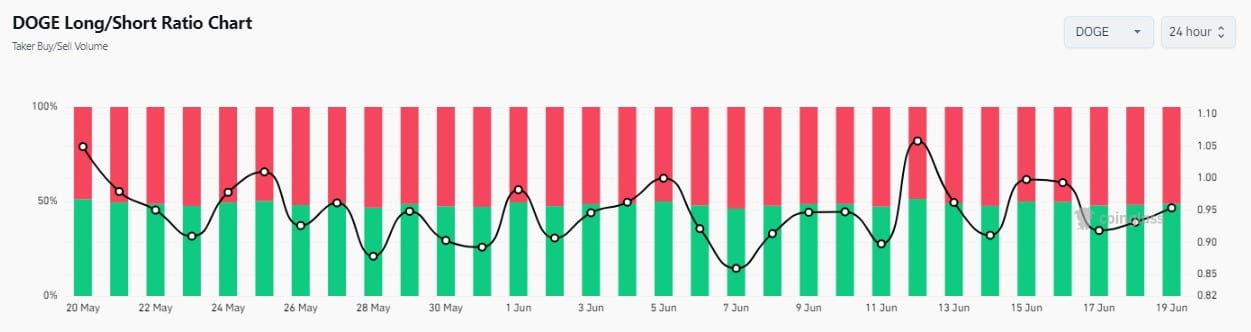

Based on the liquidation map information from Coinglass, I’ve noticed that Dogecoin (DOGE) experienced multiple surge-and-dive periods for both long and short positions. This volatile trend could potentially indicate impending short squeezes.

This scenario can fuel rapid price surges, as seen in the recent DOGE rally.

Another interpretation of the long-short ratio trends is that they signal a dominant influence from long position investors in the market.

His purchase at this critical point could strengthen the bullish momentum for Dogecoin, potentially leading to a price increase.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-20 10:15