-

FET’s price has rallied by 30% in the past 24 hours.

Despite this, token holders continue to record losses.

As a seasoned crypto investor with several years of experience under my belt, I’ve witnessed numerous price rallies that have left token holders feeling disappointed. The recent 30% surge in Fetch.ai’s [FET] price within the past 24 hours is no exception.

I’ve experienced an impressive 30% price jump in Fetch.ai (FET) within the last 24 hours, making it the top-performing crypto asset for me during this timeframe. Currently, I observe the artificial intelligence token trading at a seven-day peak of $1.61.

As a researcher studying market trends, I’ve noticed an impressive rally of over 10% for First Equipment Technology (FET) stocks following a significant milestone reached by Nvidia (NVDA), a prominent player in the artificial intelligence chip-making industry. Specifically, Nvidia recently surpassed other companies to become the world’s most valuable organization in this sector.

On June 18th, I watched with excitement as my crypto investment surpassed Microsoft (MSFT) in market capitalization to claim the title of the most valuable company in the world. This was a significant milestone that came just two short weeks after it had overtaken Apple (AAPL) for the second position.

Fetch.ai is the talk of the town

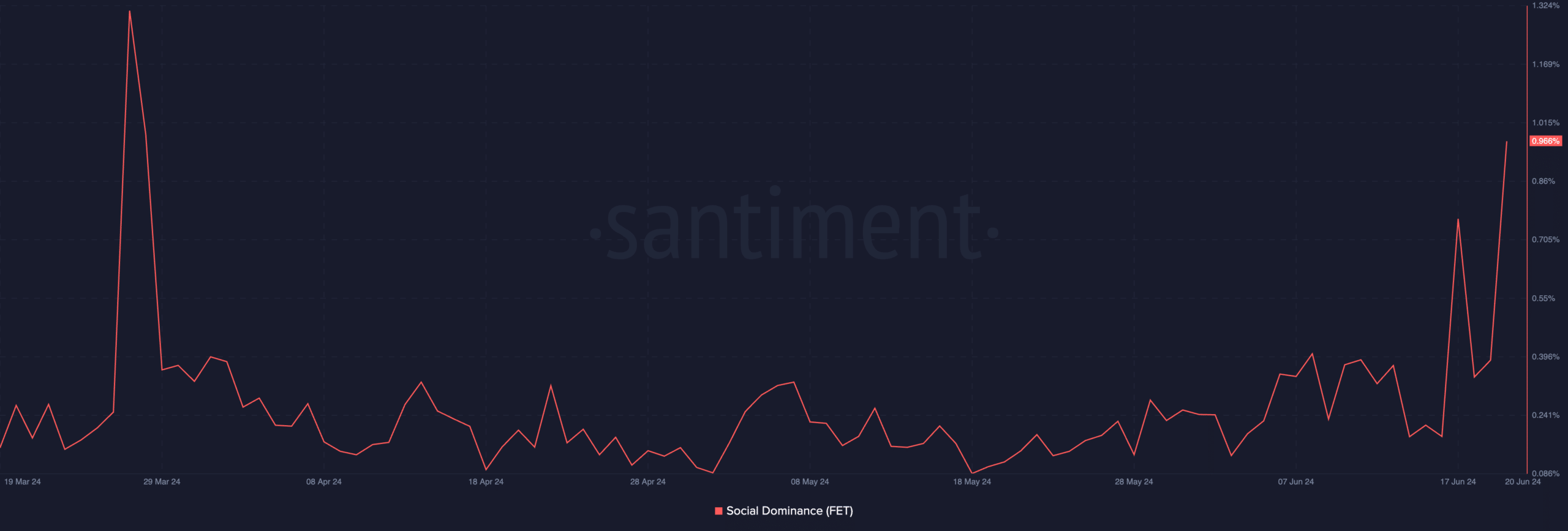

In the previous 24 hours, FET‘s strong performance caused a significant increase in its social prominence based on data from Santiment. Currently, FET holds a social dominance of 0.96%, a figure not seen since March.

An asset’s social dominance represents the proportion of conversations about the top 100 cryptocurrencies by market cap that refer to it.

When its discourse occupies such a prominent position, it indicates that talks surrounding this specific asset make up a substantial proportion of the crypto market’s dialogues, as opposed to previously.

As a researcher studying the discourse around the top 100 cryptocurrencies by market capitalization, I’ve discovered that approximately 0.96% of all conversations online refer to FET in these discussions.

The surge in interest has significantly increased the number of transactions for this token within the past day. Specifically, FET has recorded a trading volume of approximately $377 million, marking a substantial 92% increase.

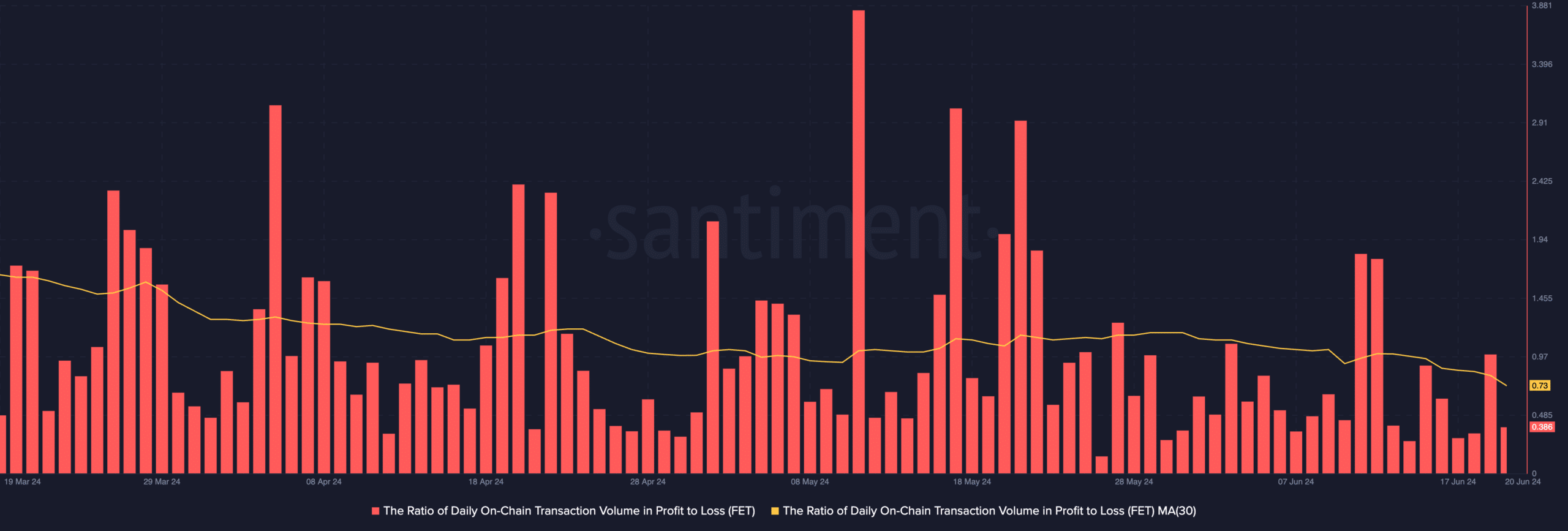

As a researcher studying financial markets, I find it intriguing that despite the significant increase in the value of Field-Effect Transistors (FETs), surpassing the double-digit mark, and the social influence of this asset reaching multi-month highs, the investors have yet to realize any profits from their transactions.

On June 19th, according to AMBCrypto’s analysis, the daily FET transaction volume’s profit-to-loss ratio stood at 0.98. Currently, this ratio is at 0.38. Looking back over the past 30 days, the average value for this metric was 0.73.

Read Fetch.ai [FET] Price Prediction 2024-25

In my analysis of the data from the past 30 days, I found that for every failed FET transaction, there were approximately 1.36 transactions that resulted in profits. Alternatively, just over 7 out of every 10 transactions (73%) ended in losses.

Based on recent data, it appears that FET holders have experienced more losses than gains over the last month, and the current price increase has yet to reverse this trend.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-06-20 12:07