-

PEPE saw relief above 61.8% and attempted a recovery.

However, a strong recovery could be delayed as BTC fluctuations persist.

As an experienced analyst, I’ve closely monitored PEPE‘s price action and market conditions. While PEPE showed some signs of relief after testing key support levels, the path to a strong recovery could be delayed due to persistent Bitcoin fluctuations.

During the second half of Quarter 2, cryptocurrency markets experienced a broader pullback, causing most altcoins to decline by double-digit percentages. Among them was Pepe Coin (PEPE), which had seen significant growth in May, losing over 30% of its value.

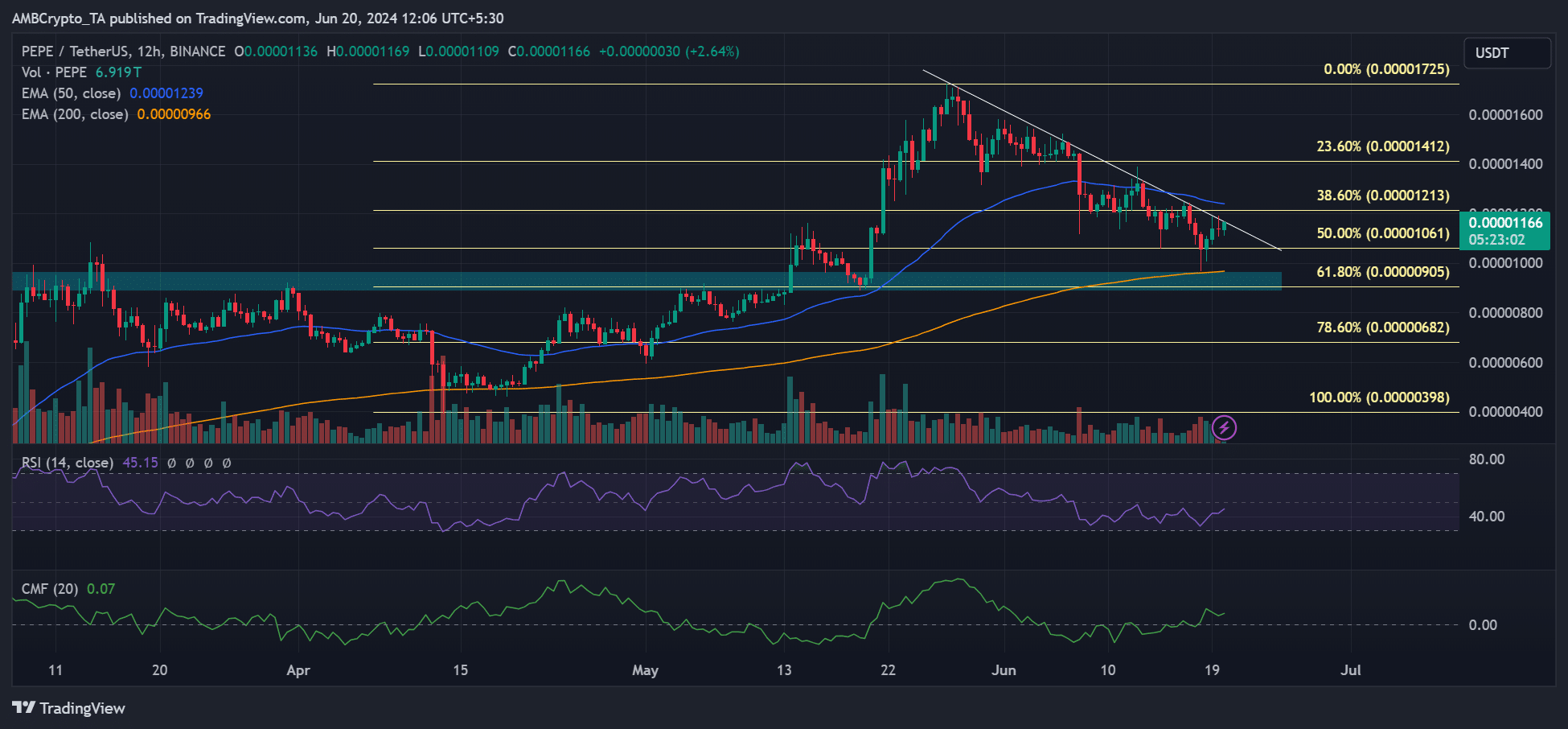

PEPE experienced some alleviation when it touched a significant support level and approached its 200-day Exponential Moving Average, which was around $0.000009.

As a market analyst, I’ve observed that the meme coin experienced a 4% price increase over the past 24 hours. However, it hasn’t yet signaled a bullish market structure based on current market data.

PEPE coin price prediction: Can bulls reclaim 50-EMA?

On the larger timeframes, some significant signs of increasing buying power emerged in the key technical indicators.

Significantly, the Chaikin Money Flow (CMF) for PEPE, which signifies the inflow of funds into these markets, has surpassed its typical threshold, indicating a sizeable injection of liquidity into the memecoin.

The Relative Strength Index (RSI), which measures the momentum or strength of a security’s price action, bounced back from its lower threshold, signaling growing demand from buyers for the meme stock.

In June, the indicator has been constrained between the lower and middle ranges, suggesting that demand remained subdued.

If PEPE manages to surpass the trendline resistance (represented by the white line) and the 50-Moving Average priced at $0.0000012, a further rally could be signaled.

Despite a brief recovery near the 50% Fibonacci level (Golden Ratio), PEPE‘s bulls can gain traction only if they manage to push the price above its 50-Exponential Moving Average (EMA).

In the near future, if Bitcoin‘s [BTC] moving average of 200 days (EMA) falls below the current level of around $66,000, this decline may not be easily disregarded as insignificant, given the challenges Bitcoin has faced in surpassing that price mark.

More headwinds for PEPE

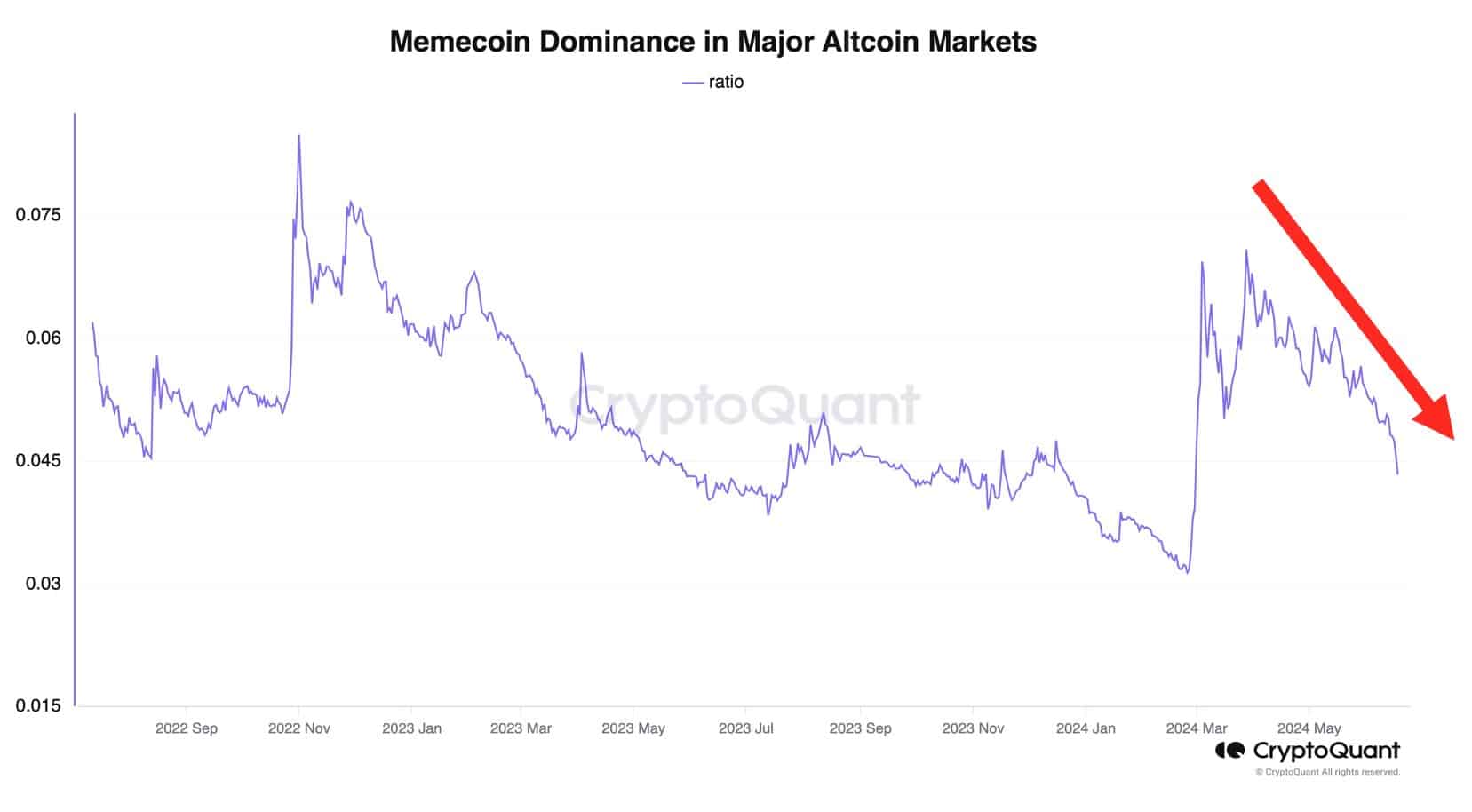

An alternative interpretation based on CryptoQuant’s data is that the influence of memecoins during the recent cryptocurrency rally has noticeably decreased over the past several weeks.

If mindshare shifts elsewhere from memes, this could add headwinds to PEPE’s strong recovery.

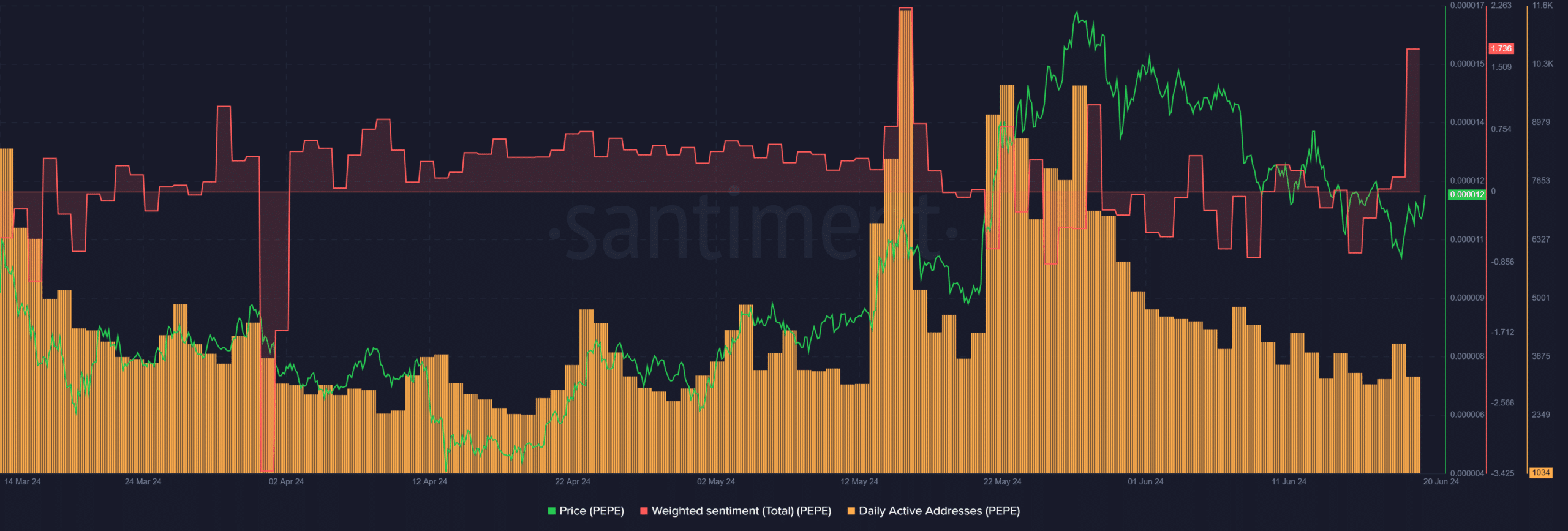

Despite a recent improvement in PEPE‘s Weighted Sentiment, the number of daily active addresses has continued to be relatively low. This implies that even with positive sentiment, the lack of user activity may hinder PEPE from advancing significantly.

Slowing progress with Ethereum [ETH] ETFs may pick up pace once they are launched, rumored to occur before July 4th.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Gold Rate Forecast

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

2024-06-20 18:15