-

There is a hike in the demand for ADA short positions.

This is due to the steady decline in the coin’s value.

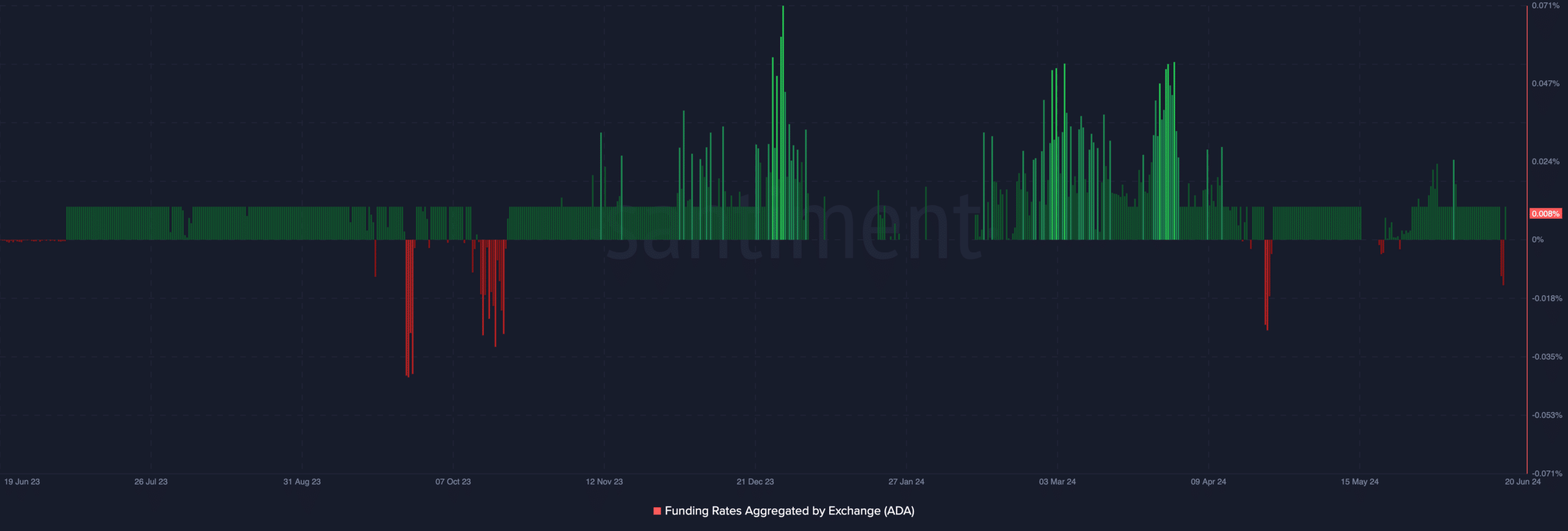

As an experienced analyst, I’m closely monitoring the Cardano (ADA) market and notice a significant increase in demand for ADA short positions. This trend is due to the steady decline in the coin’s value over the last month. The most recent data from Santiment shows that the shorting versus longing ratio for ADA reached its highest level since September 2023 on June 19th.

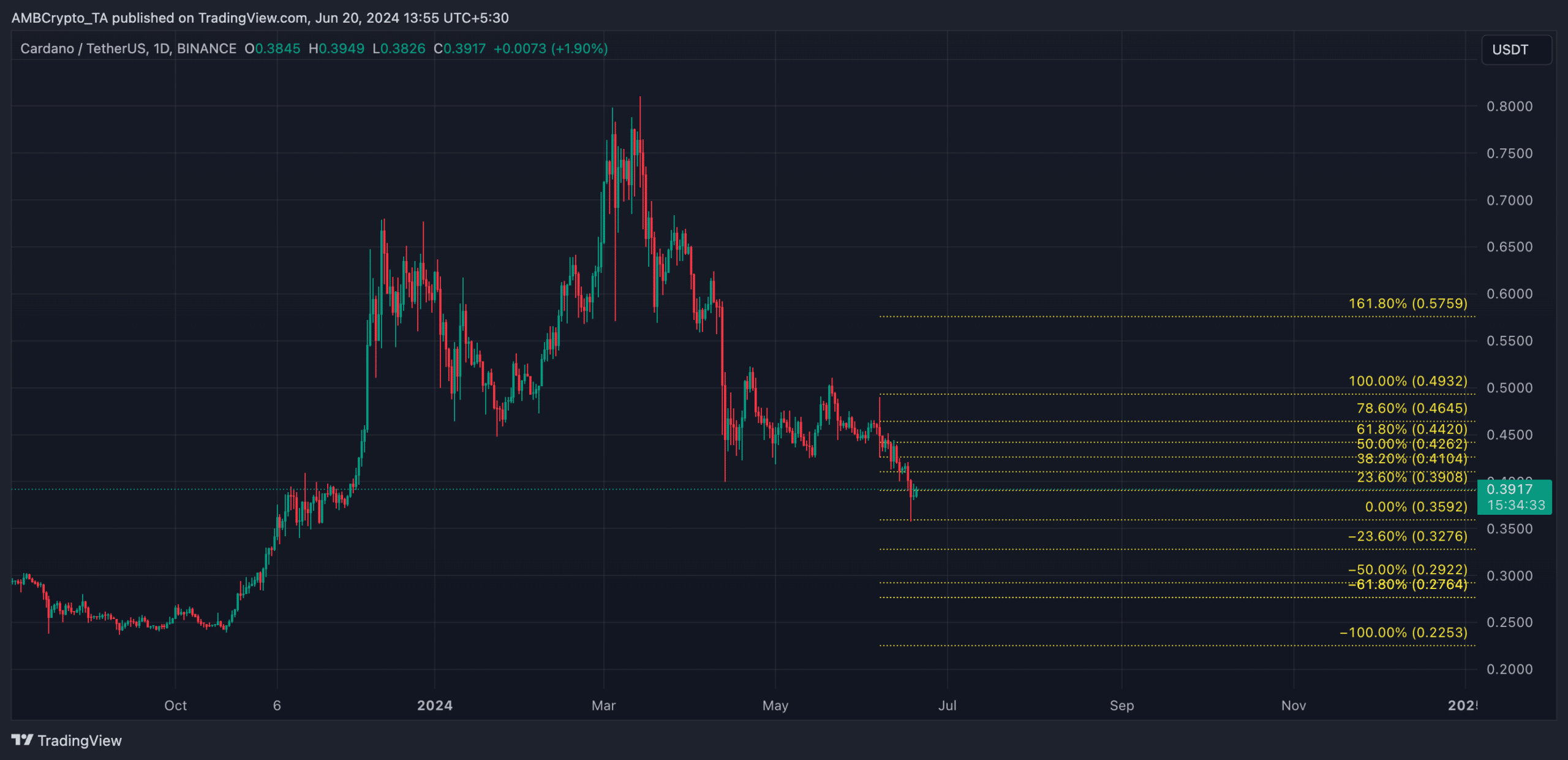

As a researcher studying the cryptocurrency market, I’ve noticed that the value of Cardano‘s [ADA] token has dropped by approximately 20% over the past month. Consequently, this price decline has sparked an increase in demand for short positions among traders participating in the futures market.

Based on information from Santiment, the short-to-long ratio for ADA was at its highest point since September 2023 on June 19th.

That day, the coin ended with a funding rate of 0.0031%, which remained in the red at the time of reporting. In contrast, cardano (ADA) had a funding rate of 0.008% by press time.

In perpetual futures contracts, funding rates serve as adjustments to keep the contract’s price aligned with the current market price (or “spot price”).

When the funding rate of an asset is positive, it means that the price of the contract for that asset is greater than its current spot price. As a result, more traders prefer to have open long positions in this asset.

In contrast, when an asset’s funding rate is below zero, it indicates that more traders are betting against the asset, believing it will decrease in value, as opposed to those who are buying it with the hope of reselling at a profit.

Long traders are victims

In a recent post on X, Santiment warned that an increase in short positions for ADA could have a hidden implication. Based on their on-chart analysis, this data provider revealed:

As a researcher studying the behavior of financial markets, I would interpret this situation as follows: For patients in the bull market, the liquidation of short positions serves as an advantageous catalyst. These short sellers’ forced sales can act as powerful propellants, fueling the price surge and contributing to the market’s upward trend.

Although this hasn’t happened yet, the trend so far has seen more prolonged declines in ADA‘s price, resulting in a larger number of long liquidations.

On the 18th of June, the total value of ADA‘s long liquidations reached a peak of $2.86 million in a single day, as indicated by Coinglass data – marking the highest daily figure since the 13th of April.

In the derivatives market for an asset, a trade is terminated against a trader’s will when they run out of money to keep their position open.

When the value of an asset suddenly and dramatically decreases, causing surprise among traders, those who had placed bets on a price increase are forced to sell their holdings in what is known as prolonged liquidations.

ADA sellers in control of the market

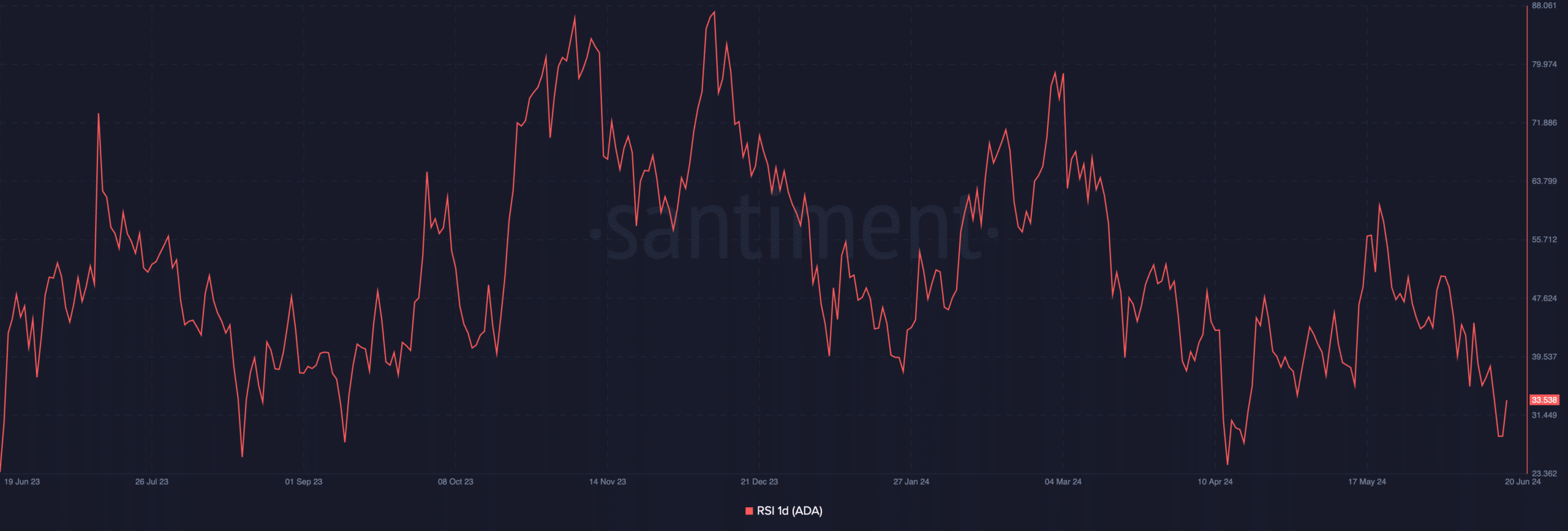

As a market analyst, I’ve observed that the downward trend in ADA‘s price may persist due to waning demand for the altcoin. Based on my assessment using technical indicators, the Relative Strength Index (RSI) of ADA was detected at 33.53.

This important metric reflects the buying and selling pressure of an asset by evaluating its price fluctuations, indicating whether it’s overbought or oversold.

As a researcher studying financial markets, I would describe the range of this particular indicator as spanning from zero to one hundred. A reading above 70 suggests the asset has been bought excessively, potentially leading to a price correction. On the other hand, a reading below 30 implies the asset has been sold heavily, possibly signaling an upcoming rebound.

Is your portfolio green? Check the Cardano Profit Calculator

At the 33.53 mark, the Relative Strength Index (RSI) of ADA indicated that sellers were more active than buyers in the market, potentially signaling further price decreases for ADA. If the downward trend continues, it’s possible that ADA could reach a trading value as low as 0.35.

As a crypto investor, if my bullish bias towards the coin intensifies and the demand surges, the current bearish outlook for the coin could be invalidated. In such a scenario, the coin might experience a significant price increase, potentially reaching $0.41.

Read More

2024-06-21 00:07