-

SHIB burn rate surges by 459% in the last 24 hours.

The Deflationary pressure fails to change the market trend as SHIB continues to decline.

As a crypto investor who has witnessed the rollercoaster ride of Shiba Inu (SHIB) over the past few weeks, I find the recent surge in SHIB burn rate both intriguing and concerning. Although there was an impressive 459% increase in the last 24 hours, it failed to reverse the downward trend.

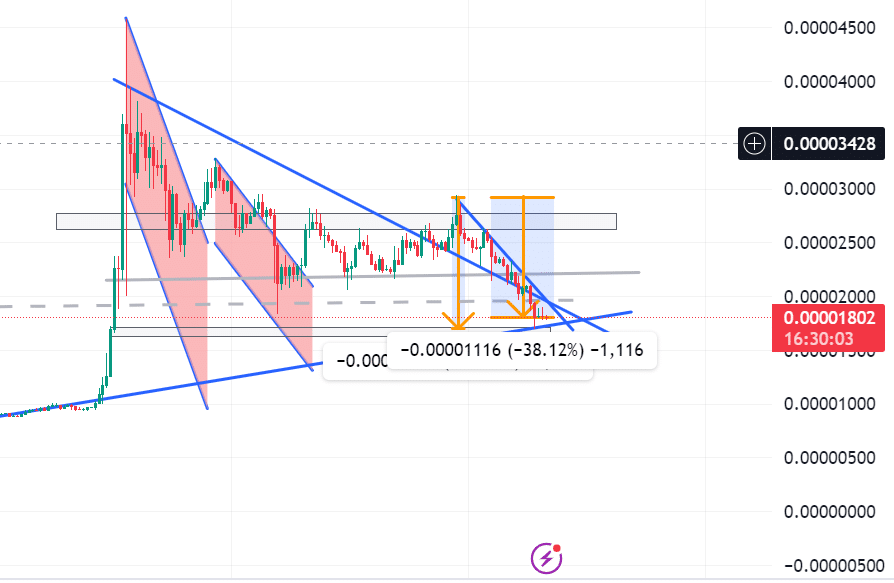

Shiba Inu experienced a significant decrease in value starting from May 30th, amounting to a 41% drop by June 21st. This unexpected decline, following the coin’s record-breaking peak at $0.0004558 on May 5th, has piqued the interest of numerous crypto investors.

Crypto analysts and enthusiasts have come out blazing to share developing news regarding SHIB.

Innovatekmobile shared on X, that

The burning rate of Shiba Inu, often referred to as Dogecoin‘s competitor, has surged by an impressive 459%. Moreover, there has been a notable increase of twofold in the frequency of large transactions. However, despite this significant deflationary pressure, Shiba Inu’s price has yet to experience a corresponding rise.

He posited that although there have been high transactions, SHIB prices are continuing to decline.

Crypto Crown shared similar insights on X, stating that,

As a researcher studying the cryptocurrency market, I’ve noticed an astonishing increase in Shibu Inu’s burn rate, which has surged by an impressive 459%. This translates to the torching of approximately 33.29 million SHIB tokens. However, despite this significant event causing a buzz in the community, the SHIB/USD pair hasn’t managed to rally as one might have expected.

According to Shibburn, holders eliminated over 33.29 million of SHIB tokens in circulation.

In the financial world, particularly in cryptocurrency markets, the term “burn rate” refers to a significant transfer of tokens into unreachable digital wallets.

As an analyst, I would describe this action as follows: By taking supply out of the market, this maneuver intends to decrease the overall availability of a good or service. Consequently, the remaining supply becomes more sought-after due to its scarcity, leading to heightened demand and ultimately, price increases.

How did SHIB react?

As a crypto investor, I’ve noticed AMBCrypto’s analysis suggesting that despite efforts to boost demand and create a favorable market environment, the deflationary pressure failed to significantly influence price growth.

At press time, SHIB was trading at $0.00001799 and experiencing a 3.19% decline in 24 hours.

Additionally, according to AMBCrypto’s assessment, Shiba Inu (SHIB) has experienced a decrease of approximately 30% this month, with a notable drop of around 29% over the past 30 days. The persistent selling pressure has led to a challenging situation for the market, making it difficult to sustain any price upticks.

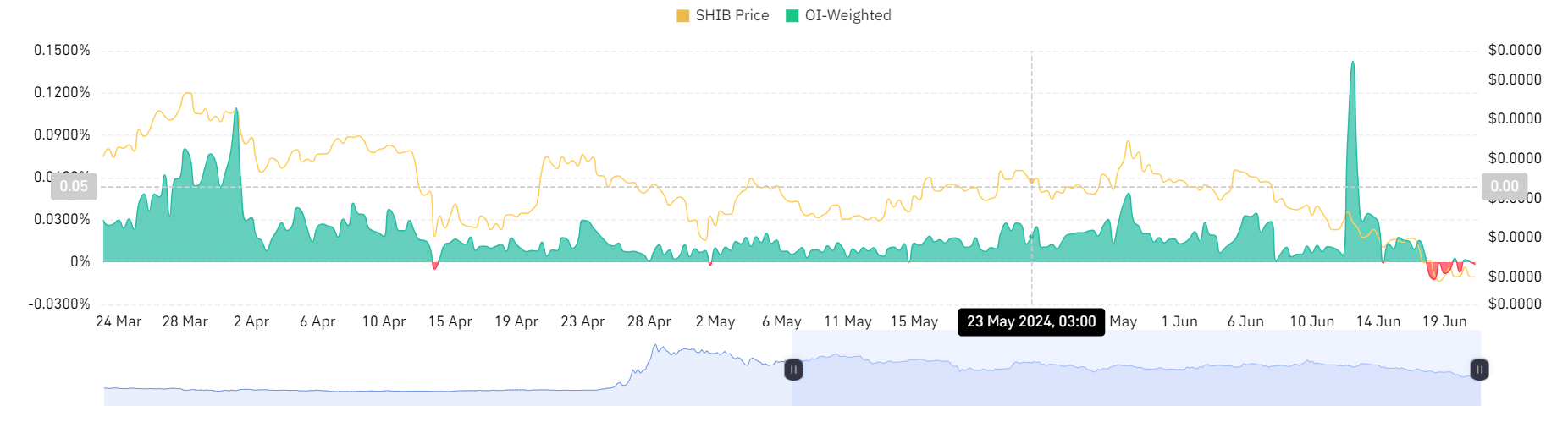

According to AMBCrypto’s examination of information from Coinglass, the significant token burn hasn’t influenced market opinion as of now. At present, SHIB‘s funded rate stood at a negligible -0.0015%. This indicates that investors were liquidating their positions without creating new ones.

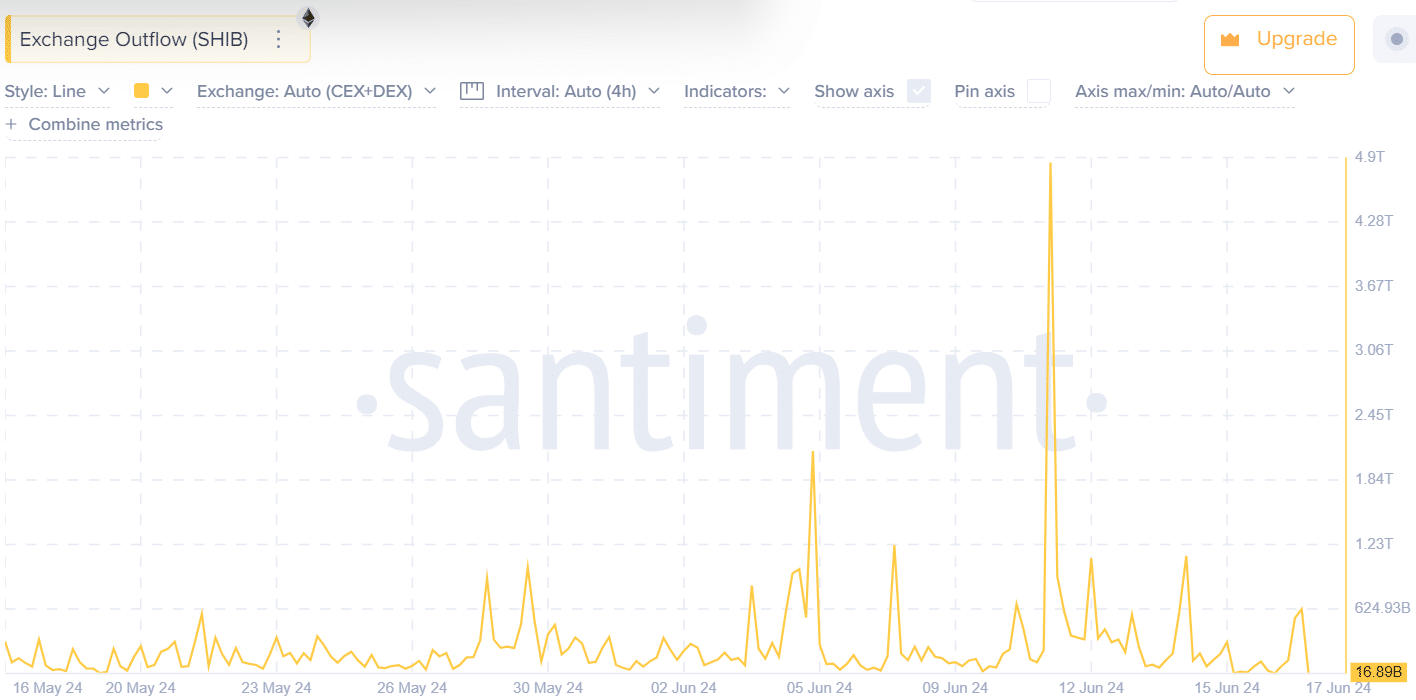

Similarly, according to Santiment’s data, there is a decrease in the amount of data indicating exchanges receiving funds. This reduction in exchange inflows suggests investors may be planning to offload their assets, increasing selling pressure and potentially causing asset prices to drop.

Implications of the recent burn

The surge in burn rates arises amidst increased selling pressure and lower prices.

The demand to buy cryptocurrency tokens like SHIB is increasing due to the large supply available for trading in the market. Despite this, the price of SHIB was continuing to drop at the current moment, meaning that the higher burn rates aimed at reducing token circulation didn’t succeed in their objective, leaving large investors with profits.

Read More

2024-06-21 19:03