-

SOL is set to get its first ETF in North America courtesy of Canada-based 3iQ digital asset management.

However, the update hasn’t stirred SOL’s market amidst extended broader retracement.

As a crypto investor with some experience in the market, I’m excited about the news of Solana (SOL) getting its first ETF in North America. This is a significant step forward for SOL and the cryptocurrency industry as a whole. However, I’m not overly optimistic about the immediate impact on SOL’s price action based on the current market conditions.

According to a recent announcement from 3iQ, a Canadian digital asset management firm, Solana [SOL] is poised to launch its first exchange-traded fund (ETF) in Canada.

As a crypto investor, I’m thrilled to share that 3iQ Corp. has taken an important step forward in the process of making The Solana Fund (QSOL) available to investors in Canada. We have formally submitted a preliminary prospectus for this innovative investment vehicle as part of its initial public offering.

Furthermore, the Solana Fund would deposit its SOL for staking to generate rewards, which would subsequently be distributed among investors.

It’s intriguing that Coinbase Institutional, which manages approximately 80% of US-listed Bitcoin exchange-traded funds (ETFs) in terms of custody, will collaborate with 3iQ and Tetra to oversee their assets.

If granted approval, might this initiative draw in additional asset managers and locations, with the United States being a likely contender? According to Eric Balchunas, an ETF analyst at Bloomberg, such an outcome is plausible, particularly if Donald Trump secures another term as U.S. President.

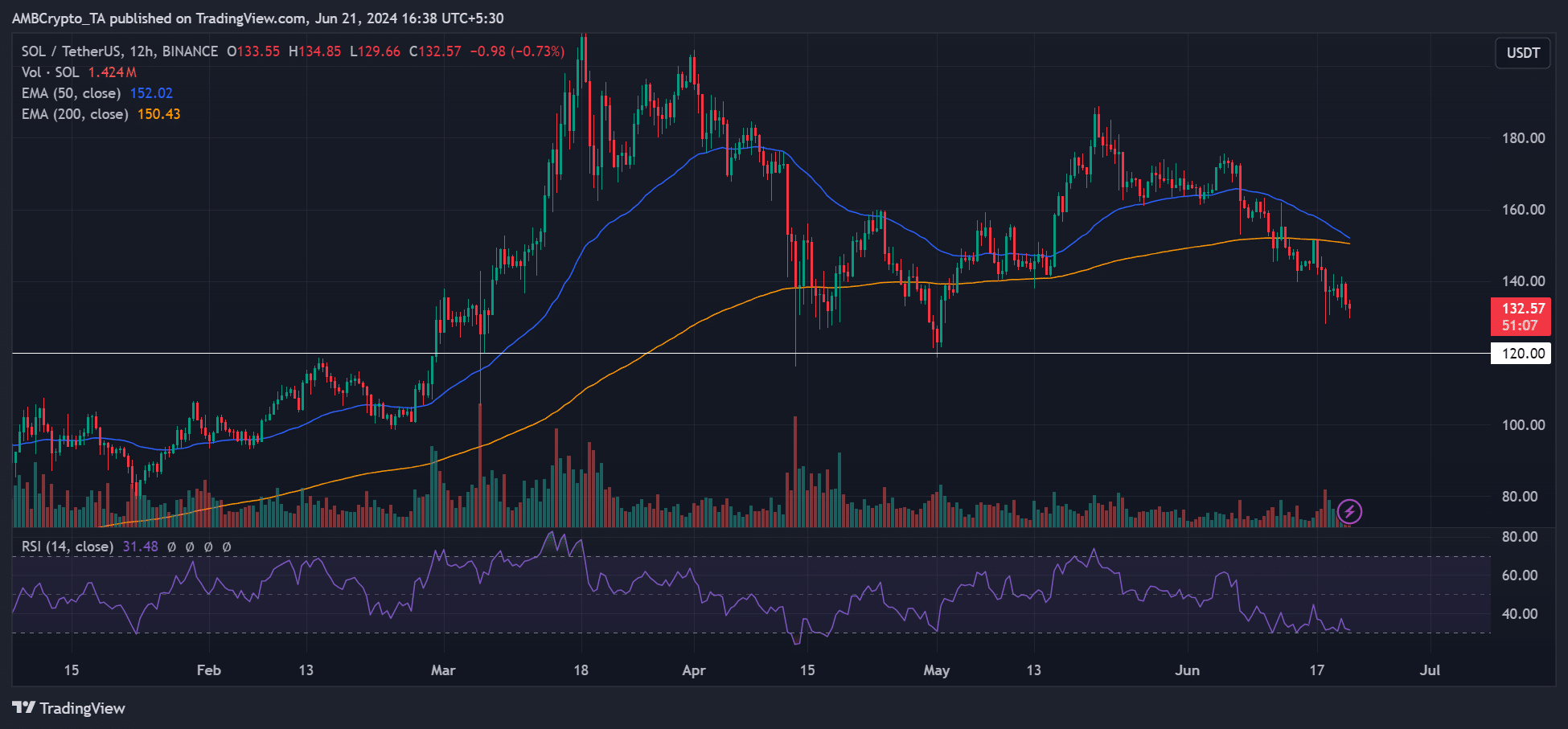

SOL’s status on charts

To date, the proposed approach for identifying eligible spot Exchange-Traded Funds (ETFs) featuring Bitcoin (BTC) and Ethereum (ETH) in the US has followed a different sequence. Instead of starting with spot products as some might expect, this method initiates with evaluating existing futures offerings for these digital assets. The SEC considered and approved futures prior to their potential spot product counterparts.

As a crypto investor, I’ve noticed that even though Solana (SOL) received a favorable announcement, its bullish price movement was overshadowed by the bearish trend in Bitcoin (BTC).

At the moment of publication, the value of SOL stood at $132, placing it beneath both its 50-day and 200-day moving averages (EMAs). This indicated that the price movement of SOL was going against the short-term and long-term trends, further strengthening a bearish outlook.

In the year 2024, the price of $120 has played a significant role as a support level. A potential revisit to this level may occur if purchasing power continues to be weak, as suggested by the relatively low RSI value below the normal range.

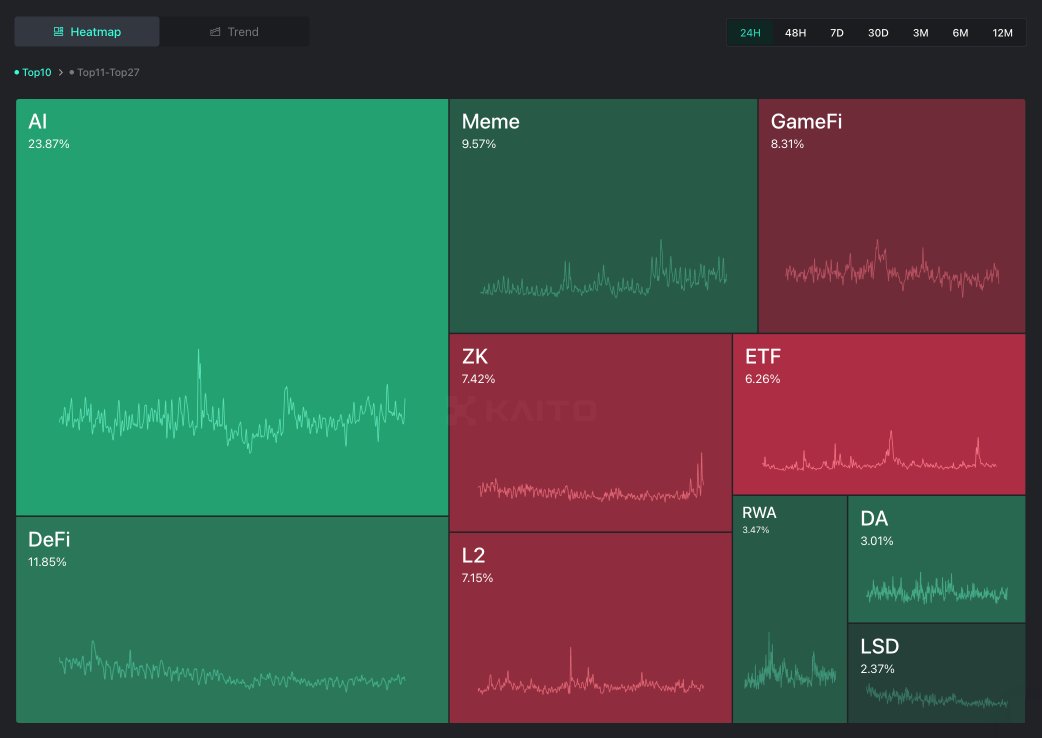

One challenge in SOL‘s path to recovery was the reported transition of altcoin market influence from meme coins towards Decentralized Finance (DeFi) as per the insights from the Web 3 market intelligence platform, Kaito AI.

‘DeFi has flipped Memecoins for mindshare. A very rare sighting this cycle.’

The DeFi narrative was growing stronger in contrast to memecoins, which form the foundation of the Solana platform.

Last week, I observed a decline in the dominance of memecoins in the altcoin market according to CryptoQuant founder Ki Young Ju’s statement.

As a researcher studying the memecoin market, I’ve observed a decrease in user activity which could potentially pose challenges for the entire memecoin ecosystem and Solana (SOL) in particular. Nevertheless, if Bitcoin (BTC) manages to reverse its recent downturn, there is a possibility that this trend may ease up for the altcoin.

Read More

2024-06-21 20:11