- LISTA’s value has fallen by 30% in the last 24 hours

- Key technical indicators hinted at the possibility of a further decline in its value

As a crypto investor with some experience in the market, I’ve seen my fair share of sudden price drops in the value of tokens I hold. The recent decline of LISTA by almost 30% in just 24 hours has left me feeling a mix of disappointment and caution.

The value of LISTA, the native cryptocurrency for Lista Decentralized Autonomous Organization (DAO) and its open-source, decentralized stablecoin lending system, has dropped by nearly 30% over the past 24 hours.

The day prior saw a new peak for the altcoin at $0.84, reached on June 21. This spike occurred following Binance‘s announcement that LISTA would be integrated into several of their trading platforms such as Binance Simple Earn, Buy Crypto, Convert, Margin, and Futures.

As a crypto investor, I’ve witnessed a significant surge in the value of LISTA token after some positive news was announced, resulting in a 13% price increase. However, the token’s price has taken a downturn since then and is currently trading at $0.57 on CoinMarketCap, representing a 32% decrease from its previous value.

LISTA is under significant selling pressure

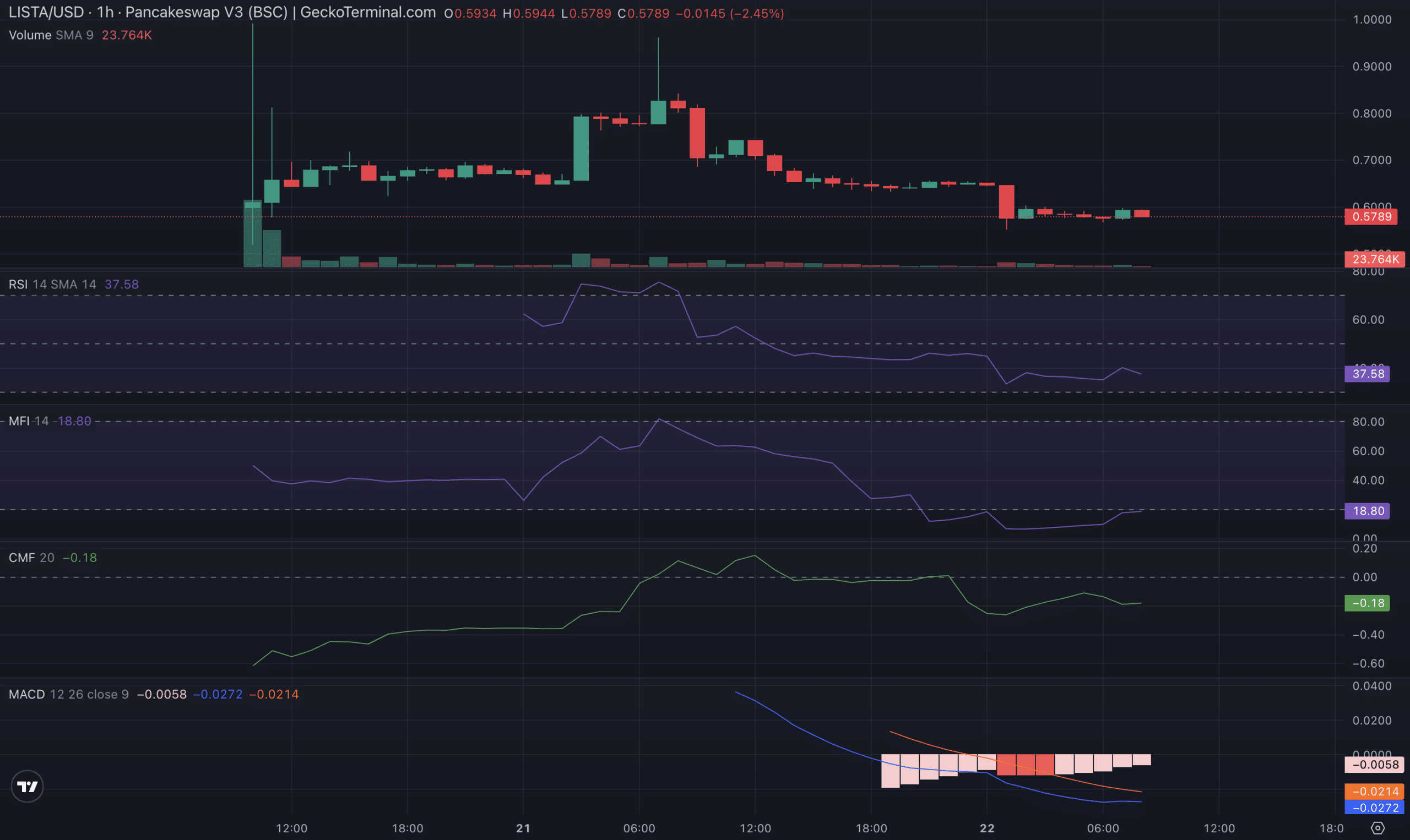

On an hourly basis, LISTA’s price showed a noticeable drop in demand as indicated by its price performance. At present, the crucial momentum indicators for this altcoin have moved beneath their median values.

The RSI value of the token stood at 35.24, contrasting with a MFI reading of 9.94.

Indicators calculate the level of buying and selling pressure in an asset based on its current price. Values exceeding 70 signify overbought conditions, suggesting potential correction. On the other hand, values falling below 30 indicate oversold conditions, possibly implying a forthcoming rebound.

As an analyst, I’ve examined LISTA’s Relative Strength Index (RSI) and Money Flow Index (MFI) at their current values. These indicators hinted towards a prevailing trend in token distribution. Specifically, they indicated that selling forces were more prominent than buying actions.

Additionally, the CMF value for the token stood at a level of -0.22 as of now. The Chaikin Money Flow (CMF) is a technical analysis tool that gauges the buying and selling pressure in an asset by evaluating both price and volume data.

A CMF value less than zero indicates market instability and is considered a bearish sign. This means that investors are likely selling off assets, leading to a further decrease in prices when an asset’s price drops and its CMF value turns negative.

At present, the MACD indicator from LISTA’s analysis indicates a bearish trend based on the reading. Specifically, the MACD line is situated beneath both the signal line and the zero line.

This marker serves as a clue for determining possible buying and selling opportunities. Configured in such a manner, it is perceived as a warning sign of impending bearish trend, suggesting that it could be advantageous to dispose of holdings at this juncture.

Read More

2024-06-22 22:15