-

Bitcoin ETFs faced outflows, but BlackRock’s IBTC remained stable and increased holdings

Analyst Thomas believes Bitcoin’s current dip is a precursor to a significant bull run.

As a researcher with experience in the crypto market, I find it intriguing to observe the recent trends in Bitcoin Exchange-Traded Funds (ETFs). Despite the broader crypto community’s anticipation of Ethereum ETFs, Bitcoin ETFs have seen outflows for six consecutive days from June 13 to June 21.

In preparation for the debut of Ethereum [ETH] ETFs in the cryptocurrency market, there seems to be a decline in the level of excitement surrounding spot Bitcoin [BTC] ETFs.

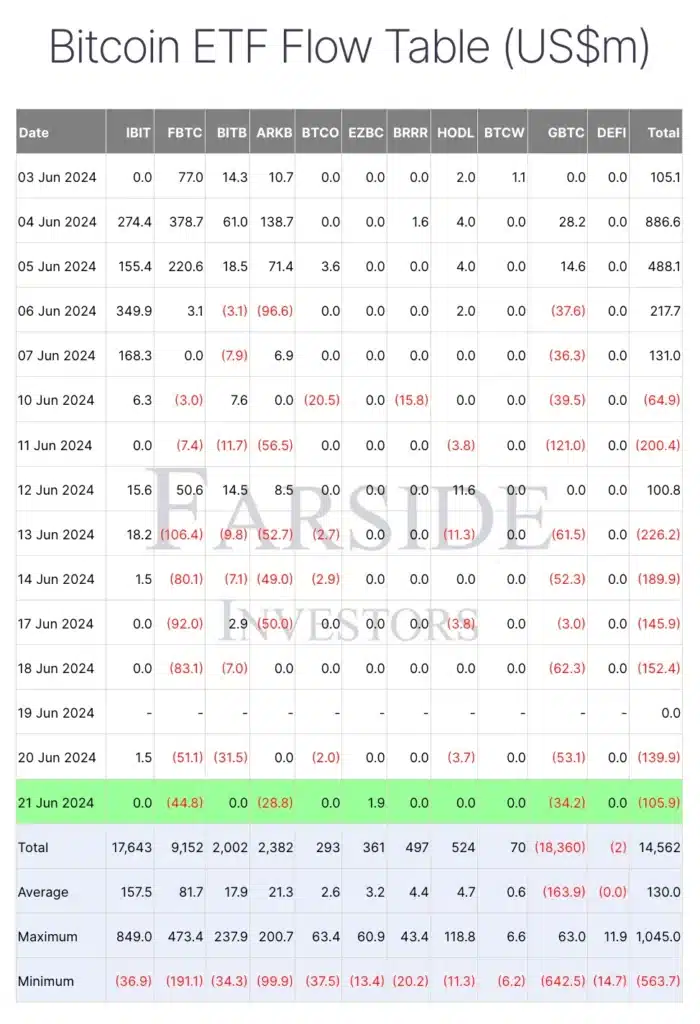

Bitcoin ETF flow analysis

From the latest data disclosed by Farside Investors, it was observed that Bitcoin Exchange-Traded Funds experienced six successive days of redemptions between the 13th and 21st of June, with the exception of the 19th.

On June 21st, Fidelity Wise Origin Bitcoin Fund experienced the largest withdrawals, amounting to $44.8 million, while Grayscale Bitcoin Trust recorded significant outflows to the tune of $34.2 million within a day.

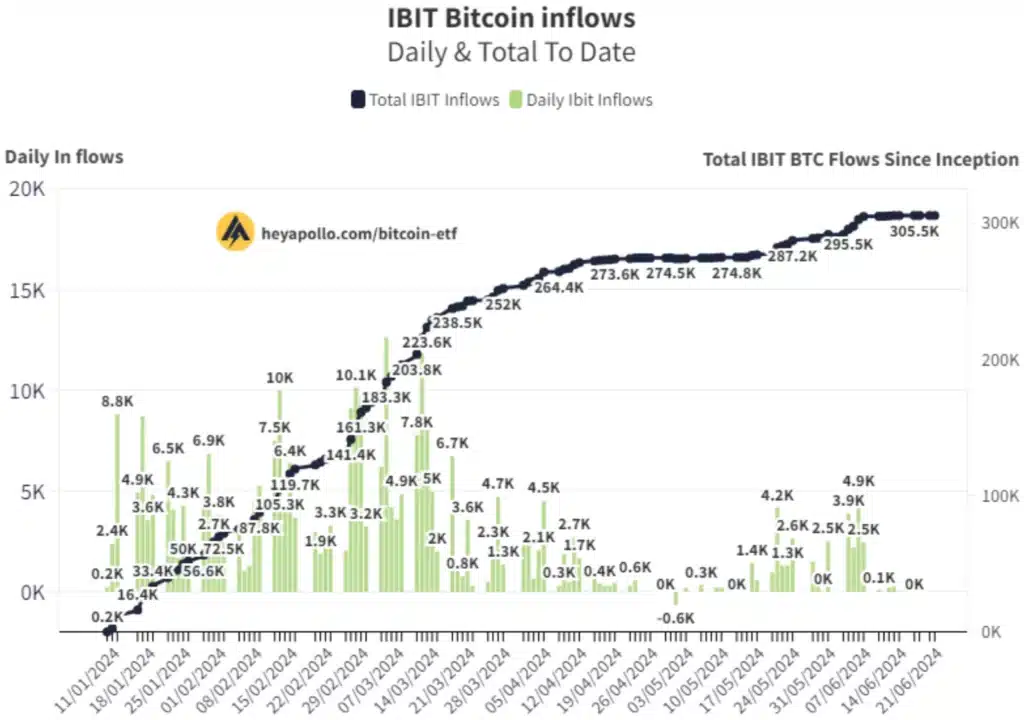

During this timeframe, not every Bitcoin Exchange-Traded Fund (ETF) experienced substantial redemptions. In fact, BlackRock’s iShares BitCoin Trust (IBTC) remained steady, recording no days of outflows throughout this period and before it.

Remarking on the same, Thomas, co-founder of ApolloSats took to X (formerly Twitter) and noted,

“Blackrock remains unfazed, reporting no withdrawals today. In contrast to other significant Bitcoin ETFs experiencing heavy losses, Blackrock added 23 more Bitcoins to its holdings this week. Impressive move by Larry once again.”

The differing levels of investor attention highlight the evolving trends in the cryptocurrency sector.

BlackRock stands strong

Some Bitcoin ETFs experienced substantial withdrawals of funds, but the unwavering popularity of BlackRock’s iShares BitCoin Trust (IBTC) indicates cautious optimism from investors.

As a financial analyst, I would interpret BlackRock’s increased investment in Bitcoin as a reflection of their confidence in the digital currency’s ability to serve as a hedge against inflation and function as an investment asset for institutions.

I made a significant purchase of Bitcoin on June 5th, adding 3,894 coins to my portfolio, which was equivalent to around $276.19 million at the time. With this acquisition, my total holdings expanded to approximately 295,457 Bitcoins, giving me a value of about $20.95 billion in this digital currency.

This action is interpreted as a optimistic gesture to the financial community, potentially inspiring other investors and boosting interest in Bitcoin, leading to increased requests for the cryptocurrency.

Executives hold the perspective that BlackRock’s amassing of Bitcoin could lead to a decrease in supply availability, thereby fueling price increases for the cryptocurrency as economic and regulatory landscapes continue to shift.

Impact on Bitcoin’s price

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin (BTC) has exhibited stability but hasn’t consistently risen on the price charts. At present, its value hovers below the $70,000 threshold.

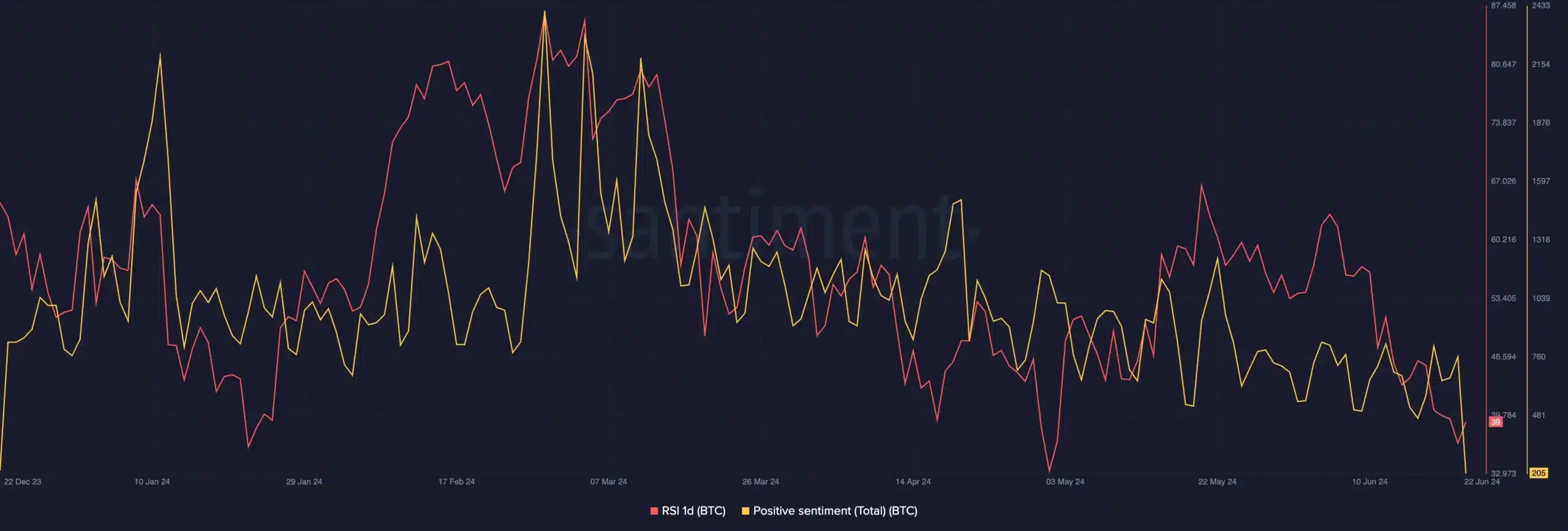

Thomas has identified similarities between the present Bitcoin market conditions and past halving cycles in his independent assessment. He believes that the recent market slump shares resemblances with historical trends, and furthermore, he expects an upcoming bull rally.

Despite the significant decrease in positive sentiment toward cryptocurrencies as indicated by AMBCrypto’s analysis of Santiment data, there are hints of a potential recovery based on the one-day Relative Strength Index (RSI) trending upwards from its recent lows.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-06-23 09:11