- Litecoin has been accumulating bullish momentum in the short term.

- Metrics indicated mixed signals.

As a seasoned crypto investor with a few years of experience under my belt, I’ve learned to read between the lines when it comes to analyzing cryptocurrencies like Litecoin. Based on the data presented in this analysis, I see Litecoin as being at a crossroads right now.

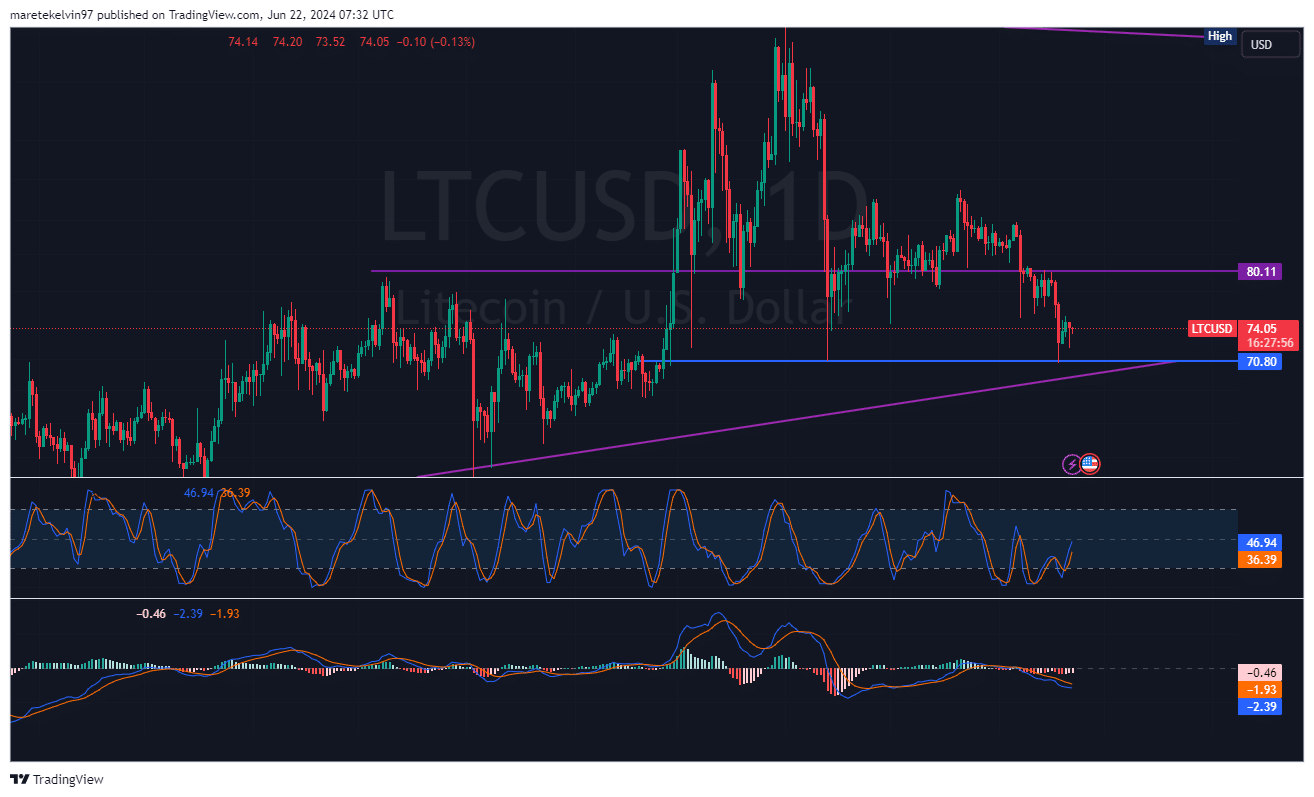

As a market analyst, I’ve noticed that Litecoin [LTC] has been trading between two key support levels since the 6th of June. After touching one of these supports, the price experienced a significant drop of approximately 11%, reaching the $71 mark. At this point, Litecoin tested and subsequently reversed course.

LTC has been accumulating bullish momentum since the 18th of June.

At present, Litecoin is priced at $74.05 according to CoinMarketCap’s latest update. In the previous day, there was a 1.81% rise in Litecoin’s value. However, over the past week, its price has decreased by 5.86%.

The company’s market value was $5.55 billion, but there was a 23.20% decrease in trading activity, amounting to $272.5 million, over the past 24 hours.

Based on current market signals, Long-Term Capital (LTC) may hold a bearish outlook in the long run. However, there are emerging pressures suggesting a potential bullish trend in the near term.

The RSI value of 46.94 based on random sampling had moved out of the oversold territory into the neutral range. This might be indicative of an impending price rise following a reversal, although the buying pressure may gradually weaken.

As a crypto investor, I’ve noticed an intriguing pattern while analyzing my charts using the Moving Average Divergence Convergence (MACD) indicator. Instead of the usual bullish histograms I’m accustomed to seeing, there have been several bearish ones appearing lately. Unlike other indicators I follow, such as the Stochastic RSI, this particular signal from the MACD is undeniably bearish for me.

A tale of two trends

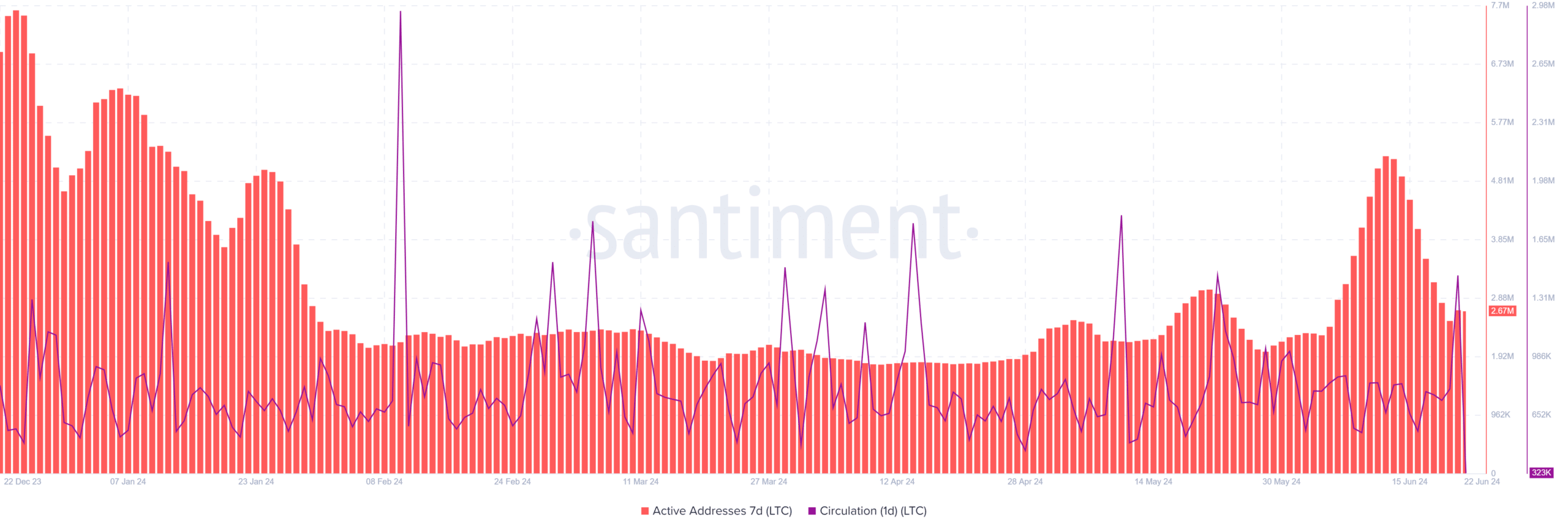

As a crypto investor, I found the analysis by AMBCrypto of Santiment’s data intriguing. According to their findings, there was an interesting dynamic between the number of active addresses and the circulating supply. The active addresses experienced several peaks, while the circulation displayed periodic surges.

The difference suggested a intricate market situation in which more user engagement does not automatically lead to greater trading amounts.

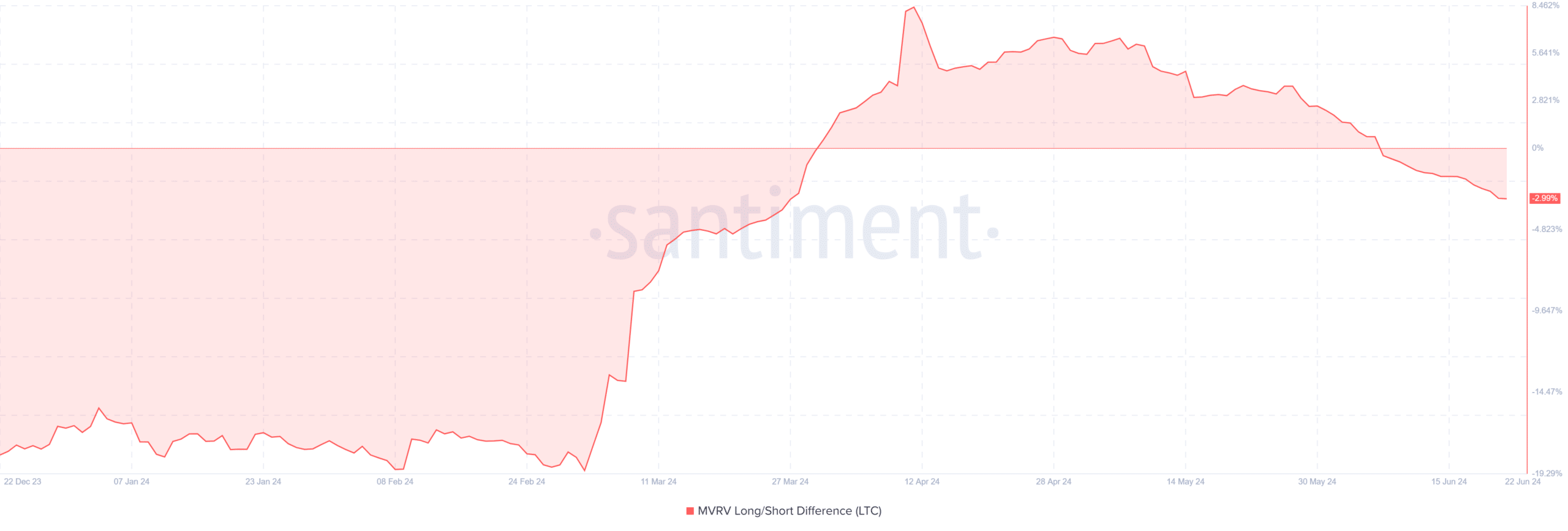

As a researcher studying market trends, I’ve noticed that the Market Value to Realized Value (MVRV) Long/Short Difference has shown an uptrend since March. Following a significant surge in March, this indicator has been gradually decreasing.

The decrease in Long-Term Holders’ Mean Reverting Volume (MRVT) indicates a possible weakening of bullish sentiments among this group. This bearish sign might result in additional downward pressure on Litecoin’s price.

Realistic or not, here’s LTC’s market cap in BTC terms

What’s ahead for Litecoin?

The changing trends in active addresses, MVRV ratio, and technical indicators indicated uncertainty for Litecoin investors. Their signals were inconclusive, implying a pivotal moment as investors pondered over whether to enter long or short trades.

During this period, the LTC price may hover near its current levels as the market deliberates between the bearish and bullish forces. The length of this “watch and observe” stage hinges on which group ultimately gains the upper hand.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-23 13:11