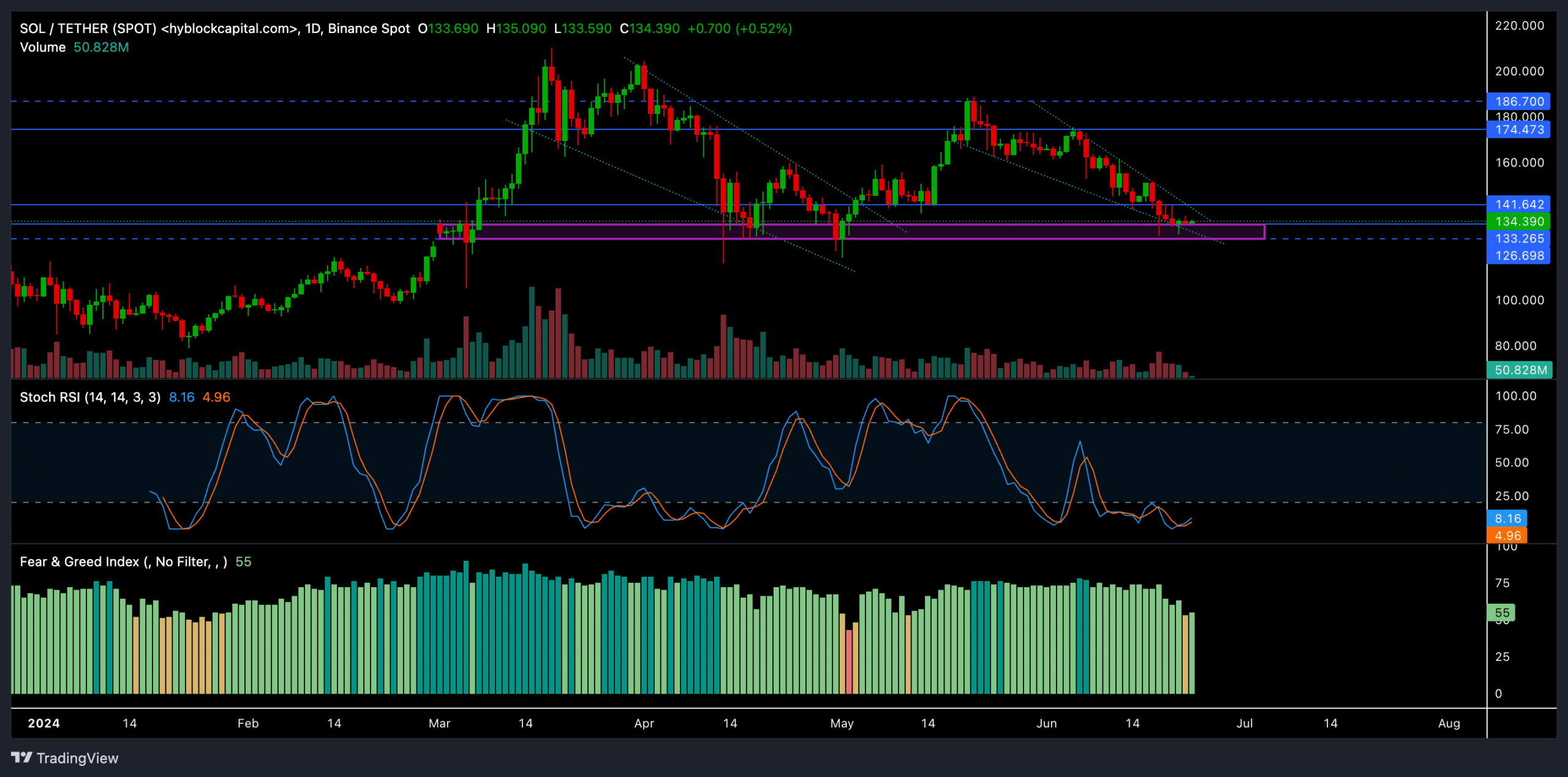

- Solana continued its downtrend to reach its four-month-long support range.

- The altcoin’s Open Interest showed signs of a likely reversal.

As a seasoned crypto investor, I’ve seen my fair share of market ups and downs. Solana (SOL) was a promising investment earlier this year, but its recent downtrend has left me feeling cautiously optimistic.

In the first quarter of this year, Solana (SOL) delivered an encouraging performance. However, its progression has been slow and slackening over the recent months.

Over the past month, SOL experienced a significant loss, with approximately 30% of its value disappearing. This decline came following a reversal at the $186 resistance mark. At the current moment, technical indicators suggested that the market was highly oversold and hinted at an imminent trend reversal.

Over the past month, the Open Interest for the coin has risen, forming a contrasting pattern with its price movement that suggests a bullish outlook. Currently, Solana (SOL) is priced at around $134.3, representing a nearly 7% decrease from its previous week’s value.

Can Solana bulls trigger an uptrend?

As a researcher studying the price movements of Solana (SOL), I observed that the coin’s failure to hold above the $186 resistance in the previous month added fuel to the bearish sentiment. Consequently, SOL continued its descent and approached the critical support level at around $133, which was a key price point at the time of my analysis.

It’s important to mention that for approximately four months, the price of SOL bounced between the $126 and $133 levels. Given this history, it may be reasonable to anticipate another potential reversal from this price range.

As a crypto investor observing the market, I’ve noticed an intriguing development with this particular coin. Its recent price action has formed a classic falling wedge pattern on the daily chart. This technical configuration often signals a potential reversal or continuation of an uptrend once the wedge’s resistance line is breached. Keeping a close eye on this coin’s price action and market sentiment will be crucial in determining the next move.

As an analyst, I would advise that if the bulls aim to put an end to the series of red candlesticks, they must keep the price within the supportive range of $126 to $133. Failing to do so could lead to a significant price decline.

As a researcher studying the behavior of SOL (Solana) bulls, I believe that if they manage to hold their ground within the current support range, they may accumulate sufficient strength to challenge the $174 resistance once again in the near future.

As a crypto investor, I’ve noticed that SOL underwent a significant price surge following a similar pattern of a falling wedge breakout, which occurred last month. This bullish move propelled SOL to reach a 30% gain and challenge the resistance at $186. If SOL manages to close above the current resistance at $141, it could be an indication of a potential rally ahead.

At the time of composing this text, the random RSI indicator indicated a significantly oversold condition, supporting a bearish outlook. Yet, it also signaled the potential for a turnaround based on a bullish crossover that occurred at the current moment.

The Crypto Fear and Greed Index remained in the “greed” territory, implying that the crypto market’s upward trend might continue.

Buyers need to monitor trading activity closely since the coin is attempting to escape from its existing trend. Insufficient volume behind the coin’s price increase may lead to a brief and unstable breakout.

Open Interest remains stable despite price drop

During a sharp price drop for Binance‘s [BNB], Open Interest (OI) levels showed resilience. This stability suggests that while prices were decreasing, there remained a strong appetite among traders to keep their positions open. They might be betting on a future price reversal.

While a steady OI level doesn’t necessarily indicate a bullish trend on its own, it can serve as a confirmation of a potential price reversal when combined with technical indicators and taken into account with broader market sentiment.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-23 20:08