-

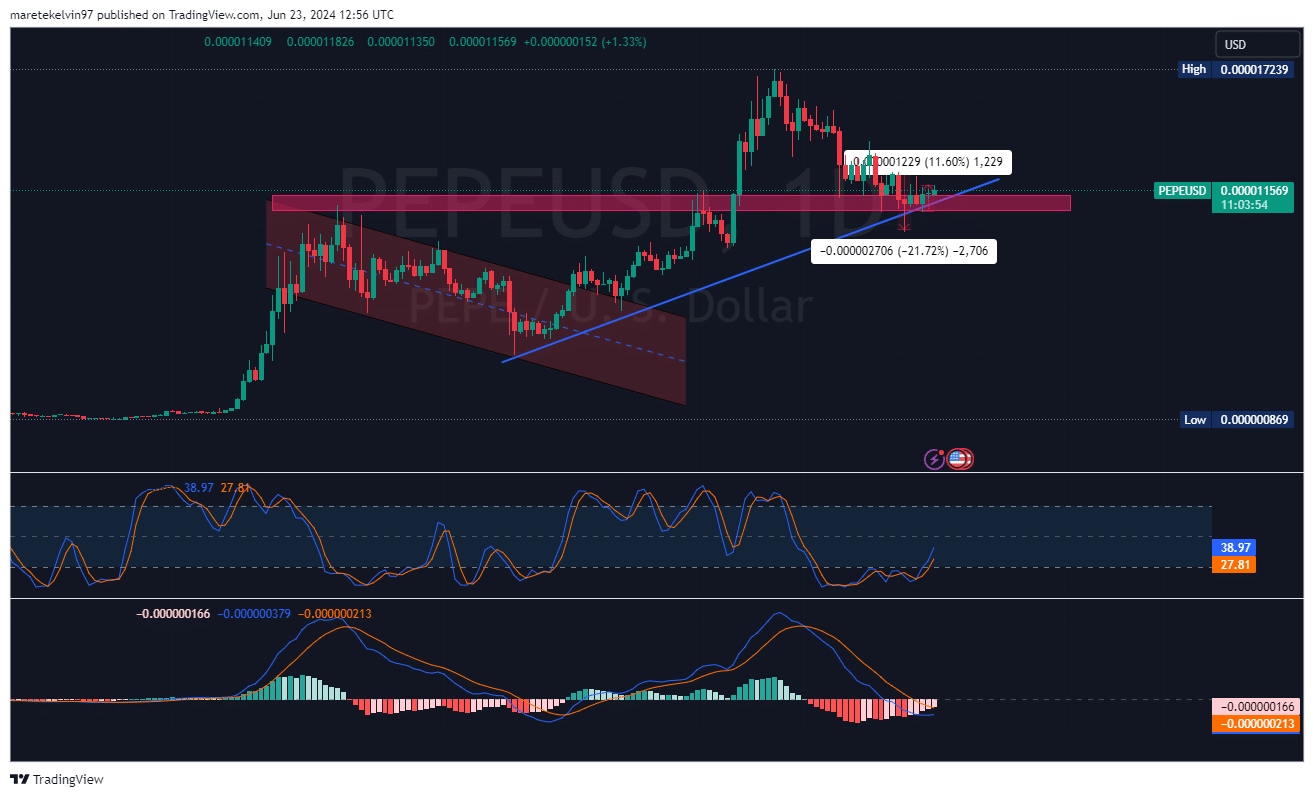

PEPE surged by 11.60% in 72 hours.

Bullish momentum accumulated despite short-term bearish bias.

As an experienced analyst, I have closely monitored PEPE‘s recent surge of 11.60% in just 72 hours. This rapid price increase was a clear indication of strong bullish momentum, despite the short-term bearish bias that persisted in the market.

As a crypto investor, I’ve noticed an exhilarating development with PEPE. In just the past three days, this cryptocurrency has experienced a remarkable surge of over 11%! This sudden gain is a clear sign of robust bullish sentiment, even amidst some short-term bearish signals in the market.

Let’s dig deep into the key market trends and on-chain data driving this performance.

I’ve analyzed the data from CoinMarketCap, and I can confirm that PEPE‘s price was at $0.0000116, representing a 2.56% rise over the previous 24 hours. Notably, PEPE has been on an uptrend, surmounting resistance levels and generating a bullish trendline.

The RSI and MACD indicators suggest that the market may experience a brief downturn in the near term despite its overall bullish outlook.

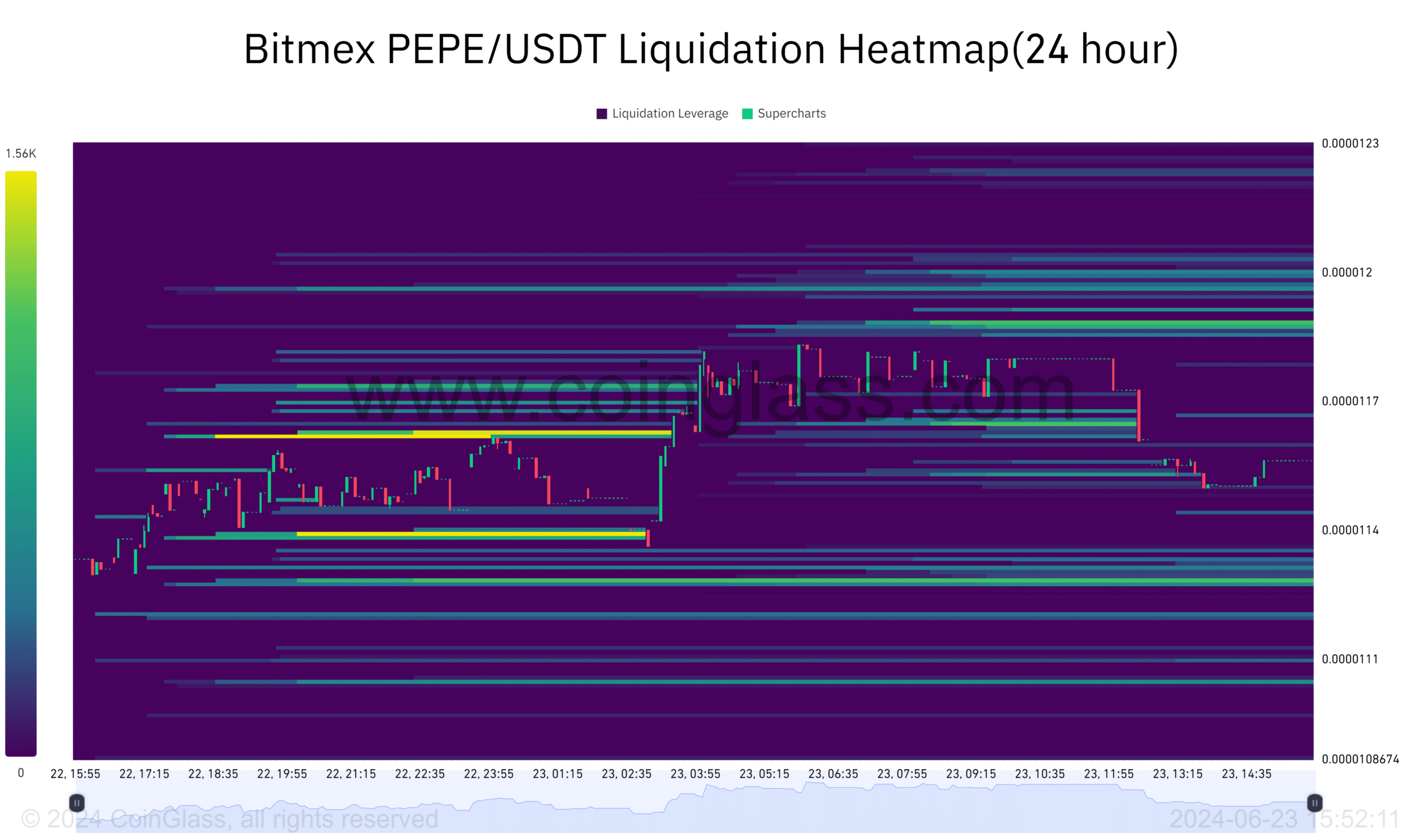

What the liquidity has in store

As a crypto investor, I’ve noticed that the price movements on Bitmex have closely followed the liquidation levels. This relationship was evident when I checked out the Coinglass liquidation heatmap, which clearly displayed the magnitude and frequency of liquidations at various price points.

Having high liquidation thresholds can result in heightened market volatility, providing potential for significant price swings. According to the heatmap, there was noticeable liquidation action occurring near the $0.000012 mark.

This suggested that traders should keep an eye on these levels for potential support or resistance.

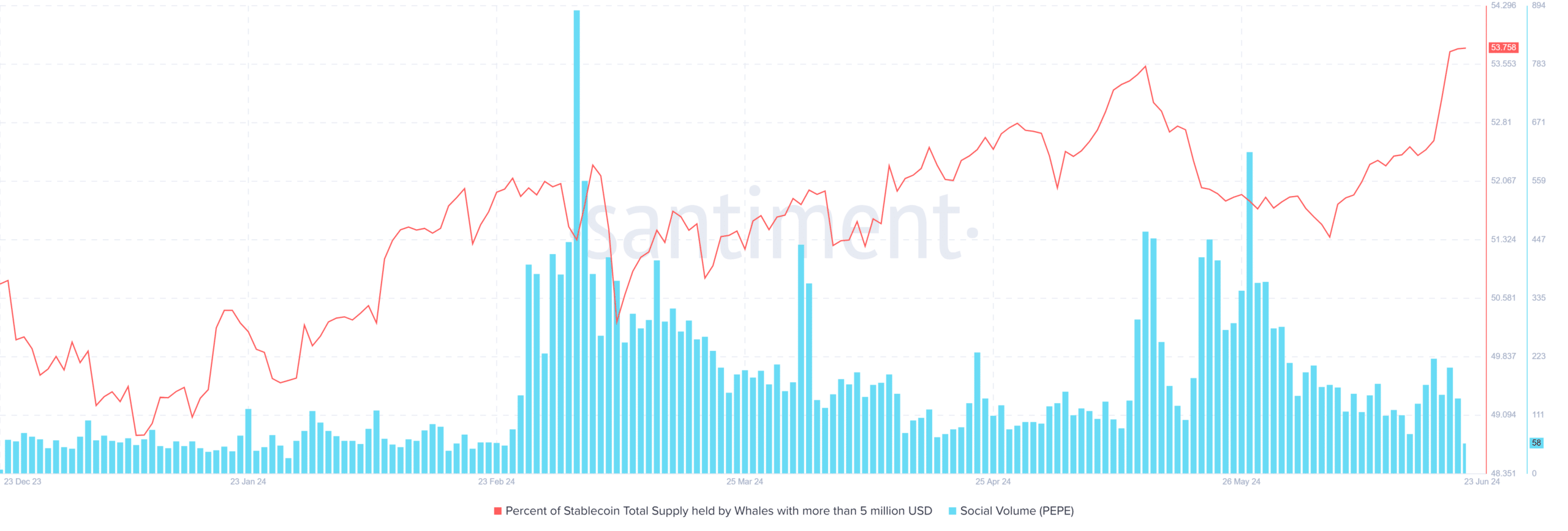

AMBCrypto further analyzed Santiment’s whale activity and social volume data for more insights.

Based on historical trends, if the proportion of stablecoin supply managed by large holders (over $5 million USD) reaches about 50%, and social media activity levels surpass 49.25, the price of PEPE tends to increase significantly.

As from the Santiment’s data, PEPE met these conditions, showing a potential strong bullish signal.

What is on the horizon for PEPE?

With more people engaging on social media platforms and large investors amassing stablecoins, there were signs of heightened market curiosity and possible price growth.

Read Pepe’s [PEPE] Price Prediction 2024-25

Based on current trends, PEPE may experience a prolonged bull run if the following on-chain conditions remain constant.

Despite the signals from the Stochastic RSI and MACD indicators indicating potential short-term downturns, it is important to acknowledge that price corrections are still a possibility.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-24 11:03