-

UNI’s recent bullish trend showed potential support as many addresses were in profit.

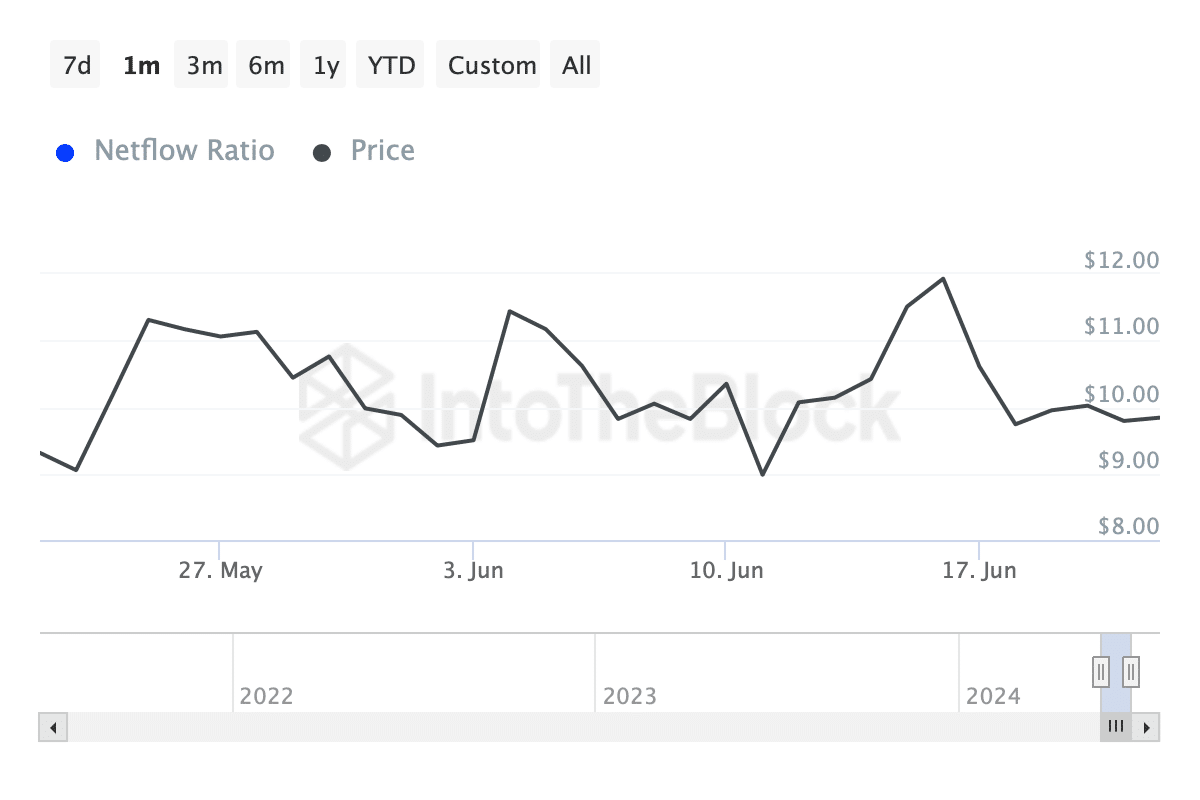

Whale activities and the prevalence of netflow spikes suggested the potential for bull traps.

As an experienced analyst, I’ve seen my fair share of bullish and bearish trends in the crypto market. UNiswap’s [UNI] recent price action has piqued my interest due to its potential for both profits and pitfalls.

The price behavior of Uniswap’s UNI token has shifted to a bullish pattern lately, leading to debates on how long this uptrend will last. This optimistic outlook comes despite the fact that bull market false alarms, or “bull traps,” have occurred frequently since the beginning of the year.

Let’s look into this one.

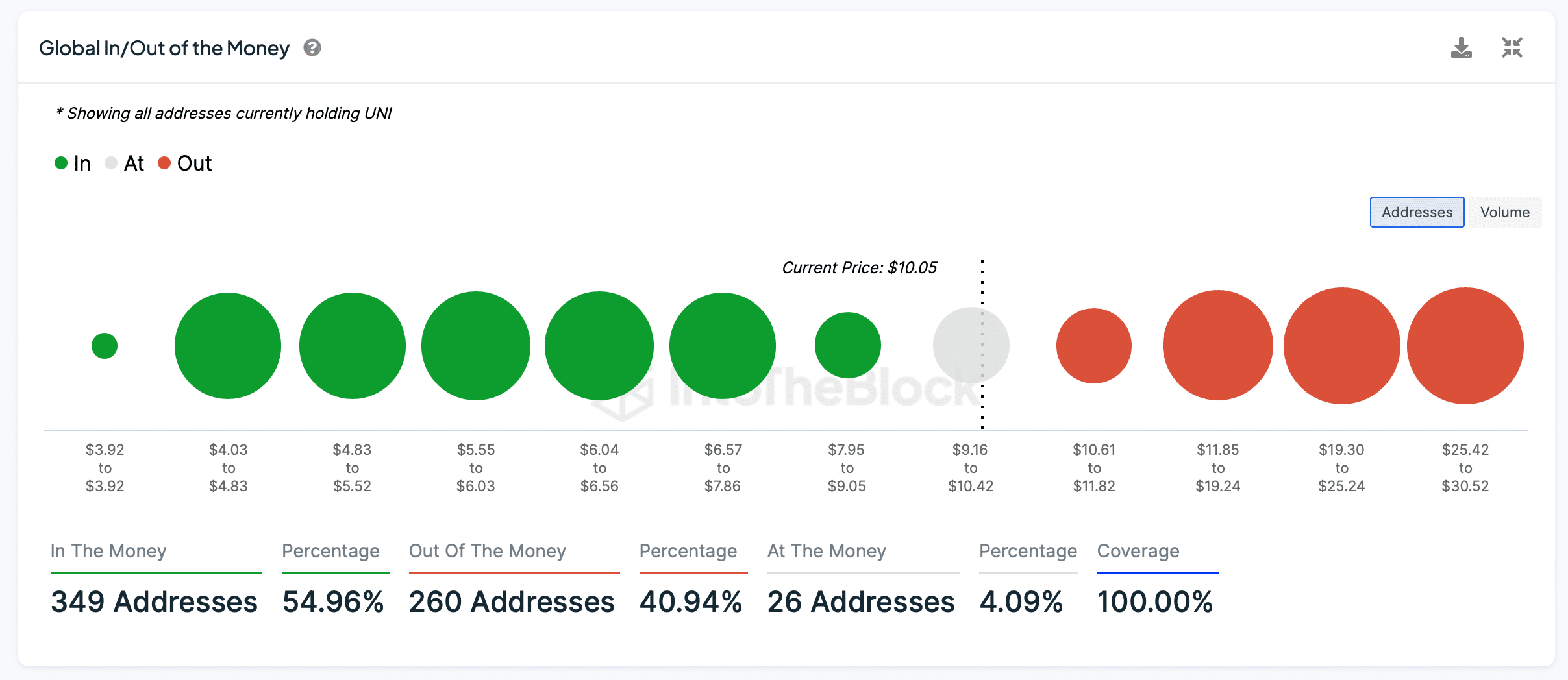

With UNI‘s price showing an uptrend lately, the present chart setup indicates a possible support zone where numerous investors currently enjoy profits.

Yet, a sizable number of investors holding just below the current market price may act as barriers to further advancement. These individuals might choose to sell once they’ve recouped their initial investment, having learned from past experiences with false market rallies.

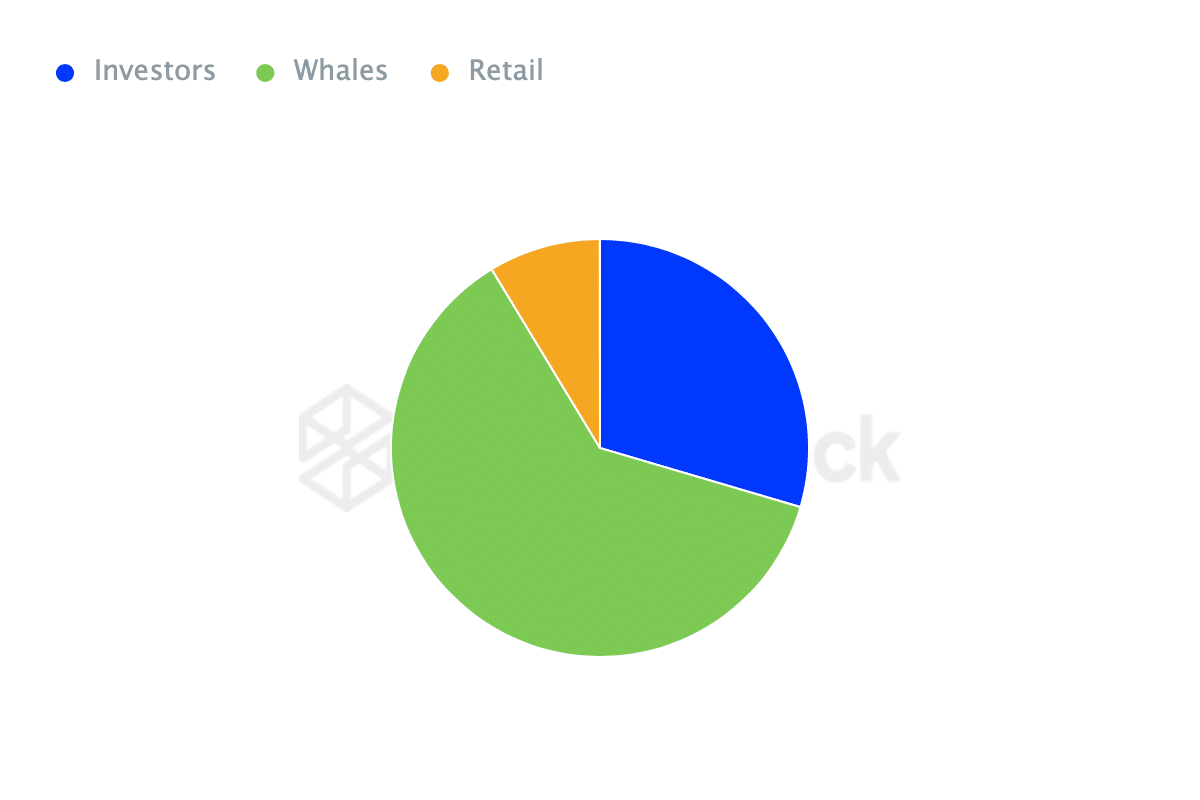

If large investors, or “whales,” choose to sell their holdings during the ongoing bull market, there’s a risk of sharp price decreases due to profit-taking actions.

At the current moment, the significant impact of whales on the market indicates a potential for price fluctuations due to the influence of a few key players.

As a seasoned crypto investor, I’ve learned that sudden netflow spikes could potentially be red flags for upcoming bear traps. These spikes might entice retail investors with alluring price increases, but beware! Whales in the market could be strategically selling off their holdings once these unsuspecting buyers jump in. The result? A devastating price crash that could leave you with substantial losses. Always exercise caution and consider multiple factors before making any investment decisions.

Uniswap’s trading patterns

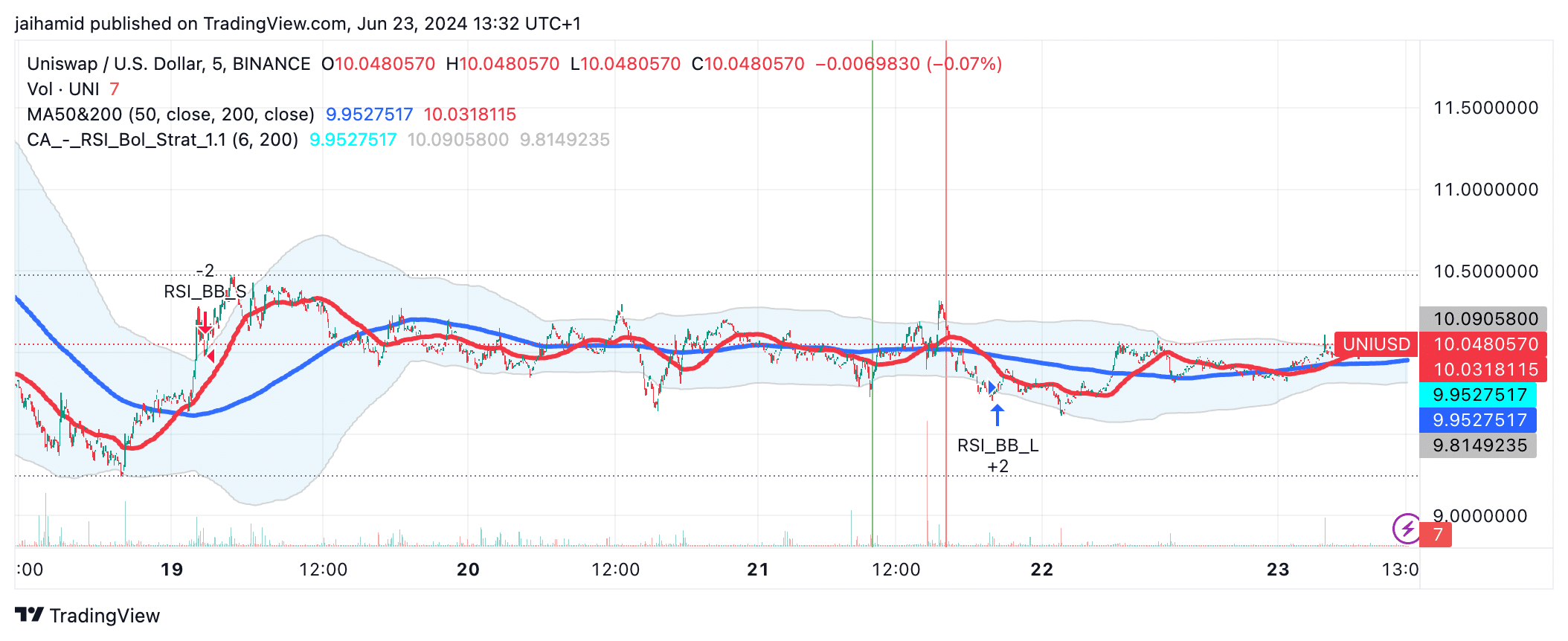

In simpler terms, the moving average of the last 200 periods functioned as a flexible barrier for UNI‘s price. UNI encountered this mark multiple times and pulled back each time, implying that surpassing it to secure lasting profits could be challenging in the upcoming period.

The Bollinger Bands, which had been expanding around the chart’s midpoint, signaled heightened market volatility. Yet, their subsequent contraction suggested that market conditions were becoming more stable.

As a researcher observing the UNI chart, I noticed a significant price development – a double top formation around the $10.15 mark. This is an intriguing bearish reversal pattern, which could potentially signal a forthcoming downturn in UNI’s price trend.

As an analyst, I’ve noticed a noteworthy bullish reversal pattern emerging in the market data. This pattern, specifically a double bottom, has signaled robust support levels that have been tested twice without causing the price to descend further. The price has stabilized around the $9.85 mark, suggesting significant potential for this pattern to hold strong and potentially lead to an upward trend.

As a researcher studying market trends, I’ve observed that the inconsistent shifts between upward (HH), leftward (HL), downward (LH), and level (LL) trends on price charts, in conjunction with the proximity of double top and double bottom formations, signifies significant intraday volatility.

This is typical of markets influenced by news or significant trader activity.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-06-24 12:07