-

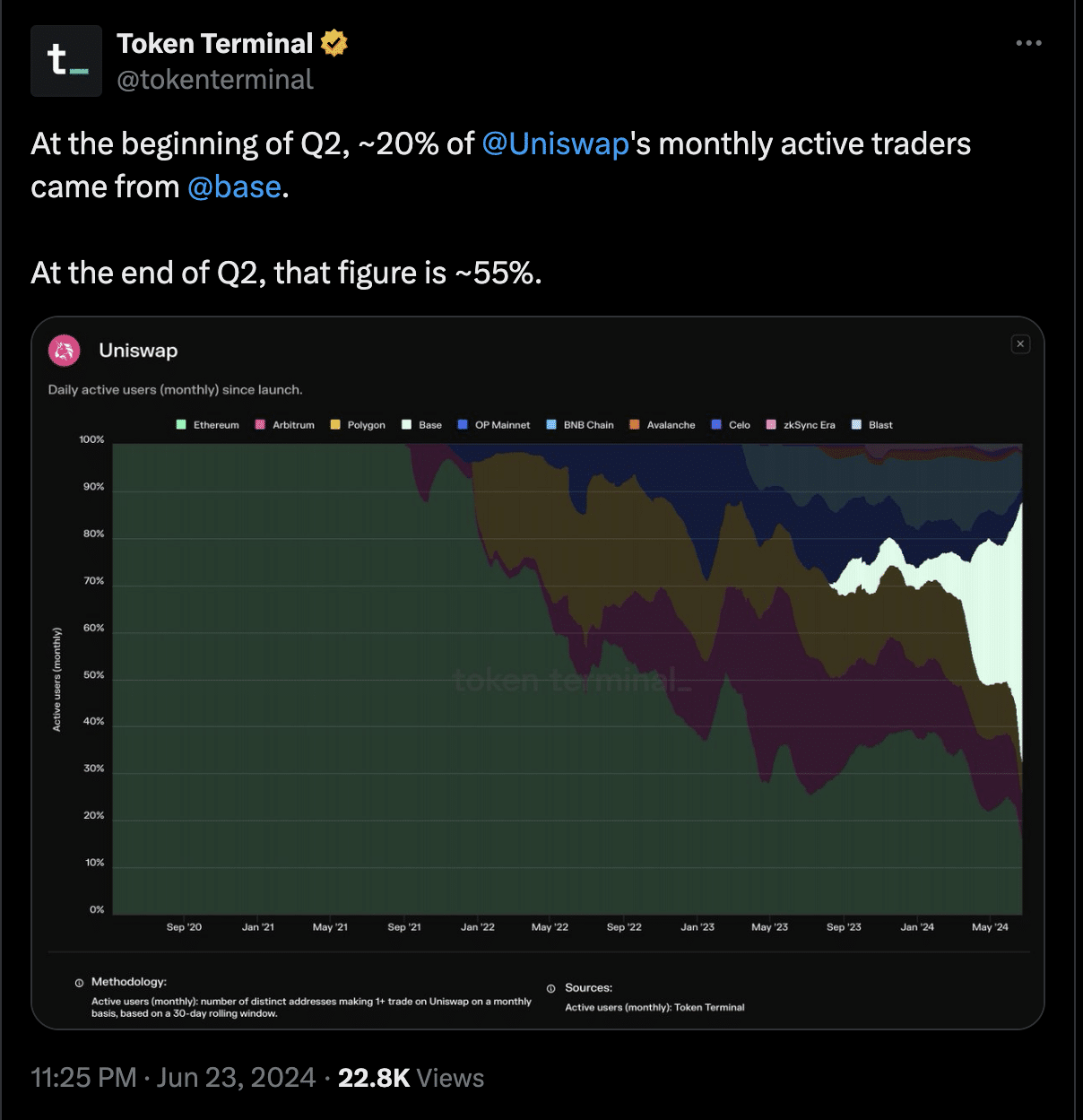

Active traders on Uniswap grew in notable numbers because of Base’s influence.

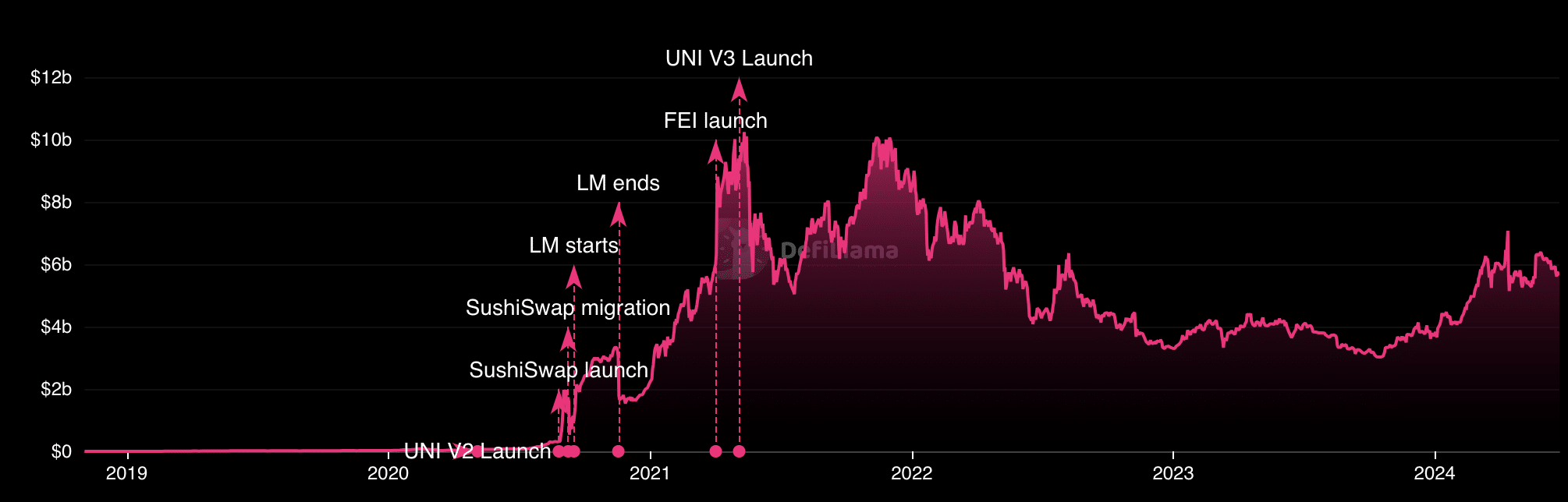

Both TVL decreased, with indicator suggesting a decline in UNI’s price.

As a researcher with experience in the DeFi space, I have closely observed the developments surrounding Uniswap and Base. Based on the available data, it seems that Base has had a significant impact on Uniswap’s growth in terms of active traders. However, there are some concerning signs that could potentially hinder its progress.

The base layer-2 blockchain, specifically Base, has contributed significantly to Uniswap (UNI) reaching another user milestone twice in a row, as indicated by Token Terminal’s data.

During the commencement of the second quarter (Q2) of the year, Uniswap experienced a 20% surge in monthly active traders. This significant growth was largely driven by Base at the time. As Q2 approached its conclusion, this metric expanded further, reaching a noteworthy 55%, once again attributable to the chain’s influence.

Base tokens have an influence, but all is not well

In August 2023, Uniswap was launched on the network, facilitating seamless trading interactions for users with tokens constructed on Layer 2 (L2).

Lately, the memecoin BRETT on the Base platform reached a new peak price with substantial trading activity observed on decentralized exchange platforms.

Because Uniswap holds the leading position among decentralized exchanges (DEXs) on Ethereum, it can be inferred that trading activity involving BRETT and certain “Based” tokens contributed significantly to the price increase.

Despite the uncertainty, Uniswap may not keep expanding due to the harsh market environment surrounding it.

As a researcher studying decentralized finance, I’ve observed a noteworthy decrease of 11.68% in Uniswap’s Total Value Locked (TVL) since my last analysis. TVL represents the aggregate value of assets securely deposited within this protocol.

When the total value locked (TVL) in a cryptocurrency platform is large, it indicates that market participants have a high level of trust in the platform. On the other hand, a decrease in TVL suggests that some participants have withdrawn their deposits, indicating a loss of confidence or the need for liquidity.

At the moment of publication, DeFiLlama reported a total value locked (TVL) of $5.58 billion in Uniswap. This figure signified a decrease of 11.38% over the past 30 days. The reduction suggests that investors and traders have expressed doubts about the potential returns offered by the protocol.

UNI’s price to drop below $9?

The TVL in Base amounted to $1.55 billion, marking a 9.81% decline compared to the previous month. If the level of activity and liquidity persists in decreasing for Base, it could pose a challenge for Uniswap’s growth maintenance.

As an analyst, I would interpret this as follows: If the total value locked (TVL) in Base experiences a significant increase during the third quarter, it could indicate heightened usage and engagement within the protocol.

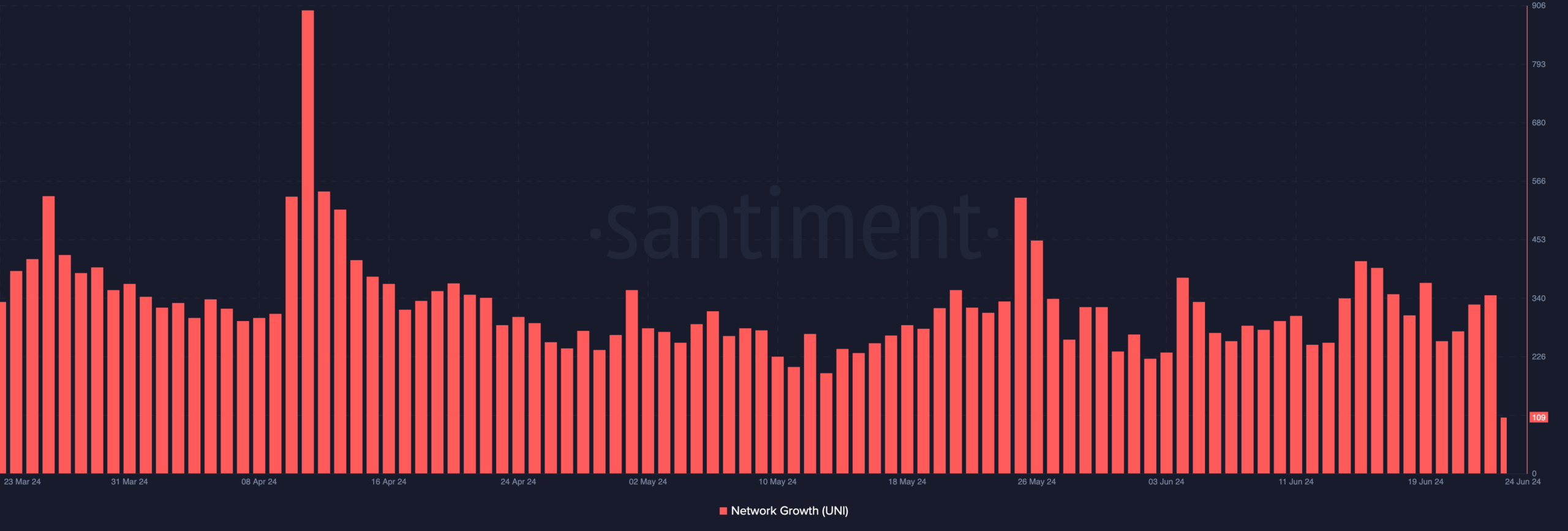

UNI closed at $9.12 today, representing a 9.07% decrease in value over the past 24 hours. Nonetheless, it may be difficult for UNI to recover from these losses based on recent on-chain indicators.

As a network analyst, I would describe Network Growth as follows: I focus on this key performance indicator (KPI) that measures the addition of novel transaction participants in a given network. In simpler terms, it reflects the number of unique addresses engaging in their initial transactions on the network.

From an analytical perspective, when a cryptocurrency experiences growth, it signifies expanding adoption. Conversely, a decrease indicates a waning interest or lack of traction in the marketplace, leading to diminished demand.

Realistic or not, here’s UNI’s market cap in ETH terms

As of now, Uniswap’s network growth has decreased to 109. A persistent decline in this statistic could potentially lead to a drop in UNI‘s value.

As a crypto investor, I can tell you that if the usage of Base picks up significantly, then Uniswap and its governance token could experience considerable price increases.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-24 17:12