- Spot Ether ETFs may reduce Ethereum’s price to as low as $2,400.

- Institutional interest in Ethereum is less compared to Bitcoin, affecting ETF conversion rates.

As a seasoned crypto investor with a keen interest in Ethereum [ETH], I’ve witnessed firsthand how this digital asset has evolved over the years. The recent speculation surrounding the potential impact of ETH ETFs on its price is a topic that piques my curiosity.

Over the last 24 hours, Ethereum (ETH) has experienced a 5.1% price drop, resulting in a present value of $3,315 as it underperforms Bitcoin.

The current price decline is aligned with larger market patterns and shifting investor attitudes. However, analysts predict that this trend could continue due to the introduction of new financial instruments into the market.

According to Andrew Kang from Mechanism Capital, the arrival of spot Ethereum ETFs might cause Ethereum’s price to drop as low as $2,400.

ETH ETFs to drive down Ethereum’s price?

As a crypto investor, I’ve noticed an intriguing difference between the institutional adoption of Bitcoin and Ethereum. While Bitcoin has seen significant investment from institutions, Ethereum has yet to attract the same level of interest. Kang’s prediction is based on this observation.

The founder of Mechanism Capital revealed that the lack of compelling reasons to transform Ethereum’s spot market into ETFs, combined with underwhelming network earnings, paints a difficult picture for Ethereum’s near-term prospects in the ETF sector.

As a researcher studying the Ethereum market, I’ve identified several potential factors that could be impacting its ability to hold steady in the face of shifting market dynamics and investor sentiments. These elements might include:

As an analyst, I would rephrase it as follows: Based on Bitcoin’s ETF inflows experience, it is anticipated that Ethereum ETFs could attract around 15% of the investment flows when they become available. In simpler terms, if Bitcoin ETFs saw a significant amount of investment, Ethereum ETFs are expected to draw a similar proportion.

As an analyst, I’ve observed that spot Bitcoin Exchange-Traded Funds (ETFs) have drawn approximately $5 billion in fresh investments during the first half a year following their debut.

Based on the projections, Ethereum ETFs are anticipated to experience around $840 million in actual investments over a comparable period.

As a cryptocurrency investor, I’ve noticed Kang raising doubts about the compatibility between the crypto community’s aspirations and the priorities of traditional financial (tradfi) investors regarding the upcoming ETF launch. He suggests that the market might have already incorporated the anticipated impacts of this event into current prices.

Challenges in market perception

As a researcher studying the blockchain landscape, I’ve discovered Ethereum’s proposition as a decentralized monetary infrastructure for financial transactions and a foundation for next-generation Web3 applications holds great promise. Nevertheless, based on current data, according to Kang’s findings, it might prove to be an uphill battle convincing skeptics or gaining widespread adoption.

As a researcher studying the blockchain ecosystem, I’ve noticed an intriguing shift in the financial landscape. Specifically, the decline in transaction fees on the Ethereum network due to decreased activity in decentralized finance and non-fungible tokens has led some analysts to draw comparisons between ETH and overvalued tech stocks based on their financial metrics.

An unexpected development as per Kang is that regulatory bodies have recently approved Ethereum ETFs, leaving issuers with a narrow window to devise and promote successful marketing campaigns.

As a researcher studying the effects of ETF proposals on investor behavior, I found that eliminating staking options could potentially deter some investors from transitioning their assets to these funds. This decision might reduce the expected surge of capital inflow into the ETFs.

Concluding the insight, Kang noted:

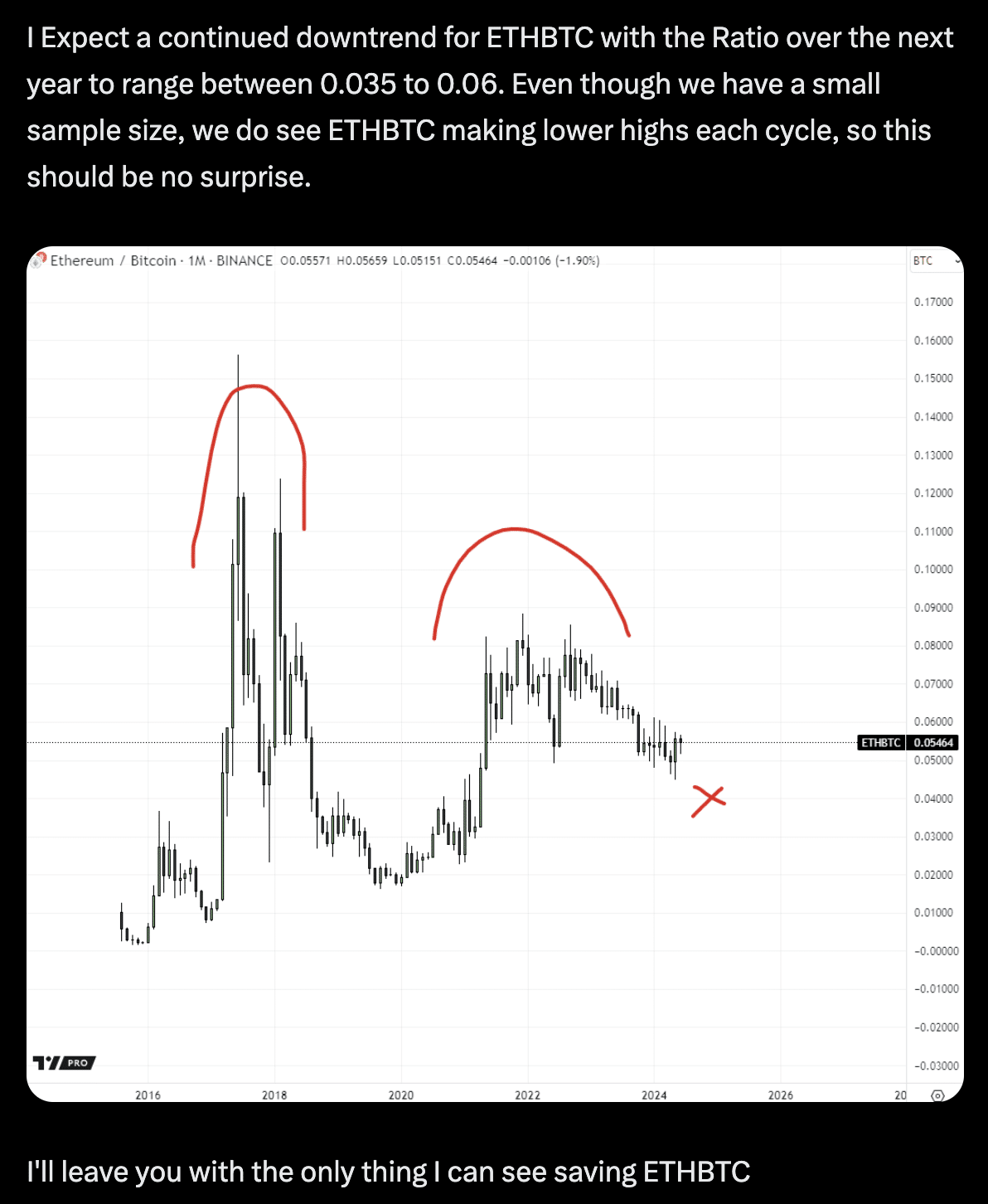

“Will ETH eventually reach a value of zero? No, that’s unlikely. At some point, ETH will be seen as offering good value, and when Bitcoin rises in the future, Ethereum is expected to follow suit to some degree. Prior to the launch of the ETH exchange-traded fund (ETF), it’s anticipated that ETH will trade between $3,000 and $3,800. Post-ETF launch, the expectation is for a price range of $2,400 to $3,000. Should Bitcoin surge to $100,000 by late Q4 or Q1 of 2025, Ethereum could reach new all-time highs, but with a lower Ethereum-to-Bitcoin ratio.”

Are there bearish signs from ETH?

As a researcher looking into Andrew Kang’s pessimistic perspective on Ethereum, it is crucial to delve deeper into the underlying fundamentals of the Ethereum network to assess the validity of his concerns.

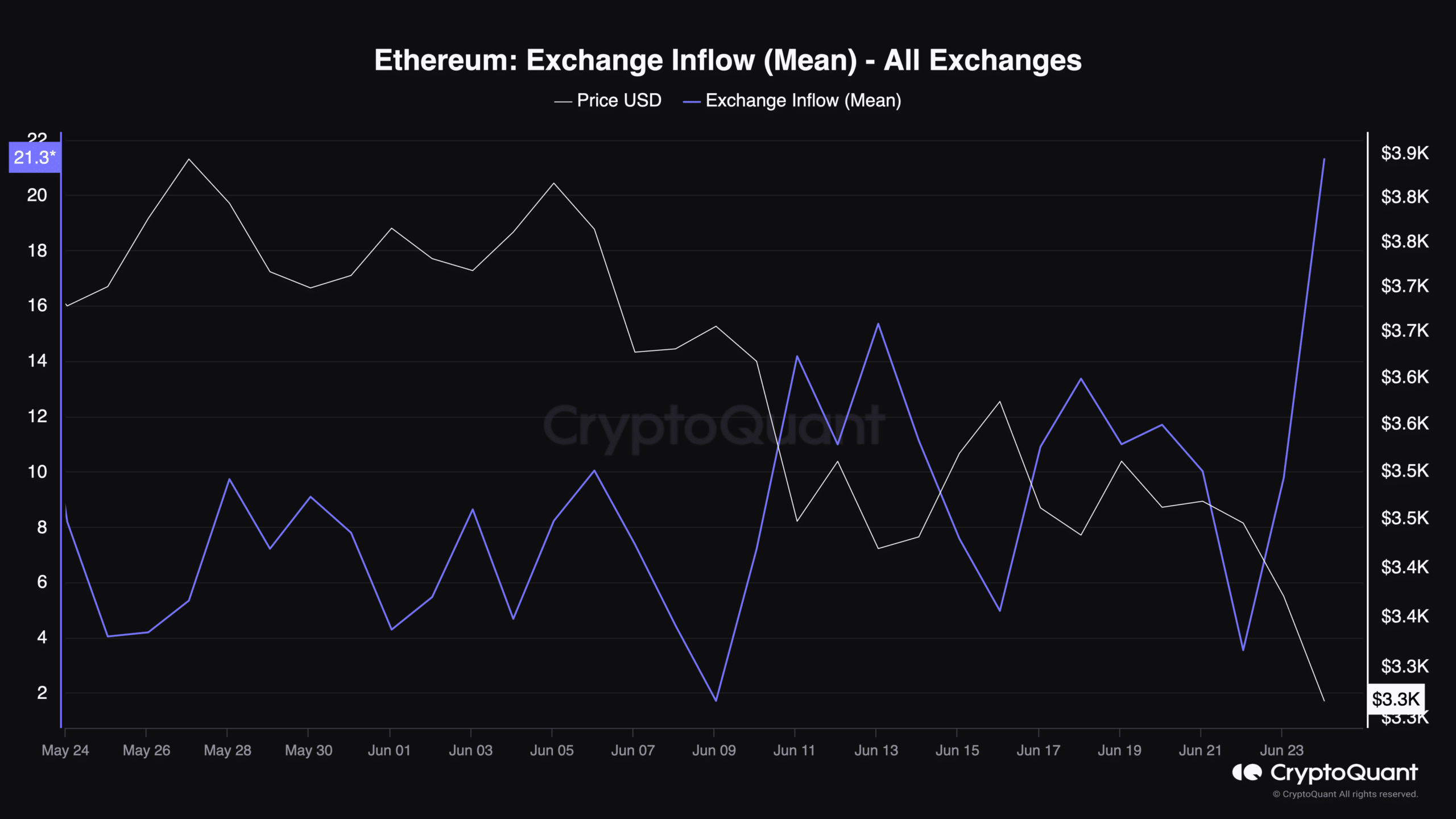

Based on the information from CryptoQuant, there is a concerning development regarding one of Ethereum’s essential indicators: The number of Ethereum deposits into exchanges has risen significantly, implying a possible surge in selling activity.

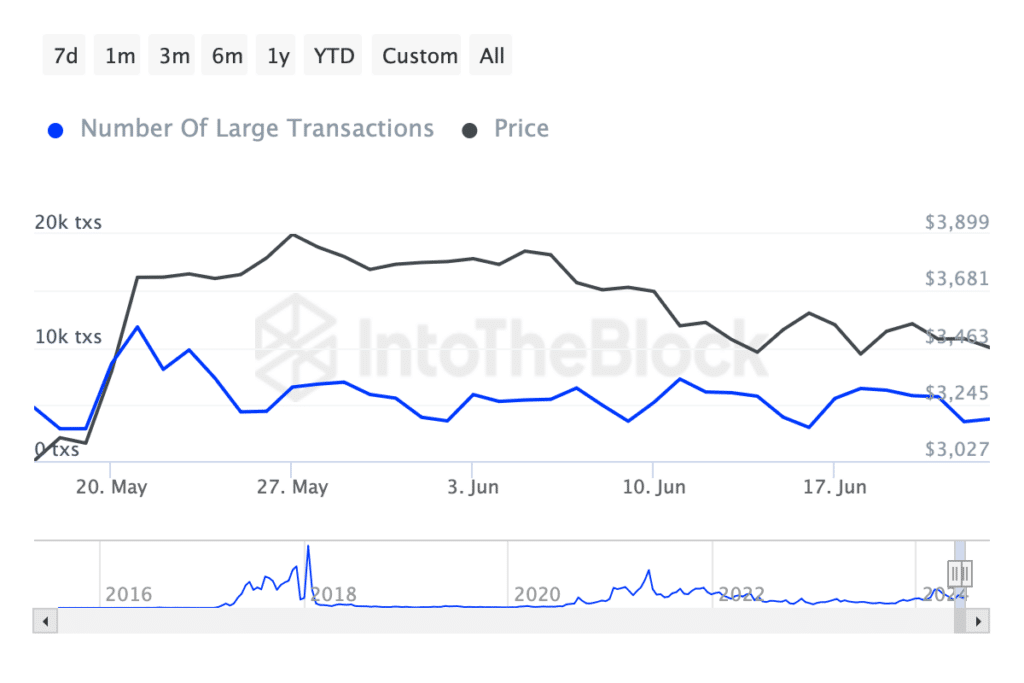

According to IntoTheBlock’s data, there has been a notable decrease in Ethereum transactions valued over $100,000, aligning with this indicator.

Read Ethereum’s [ETH] Price Prediction 2024-2025

These transactions have decreased from over 10,000 late last month to under 4,000 as of today.

As an analyst, I’ve noticed a surprising development in the Ethereum market despite the bearish indicators. A recent report from AMBCrypto reveals an increase in Ethereum’s daily active addresses. This finding adds complexity to the market dynamics and could potentially influence the price trend.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-06-24 18:48