- Toncoin Price tested critical trendline support despite a 5% decline in the last 24 hours.

- Metrics indicate mixed reactions

As a seasoned crypto investor with a few years of experience under my belt, I’ve seen my fair share of market fluctuations and trend reversals. The recent 5% decline in Toncoin’s price and its testing of critical trendline support is a situation that warrants close attention.

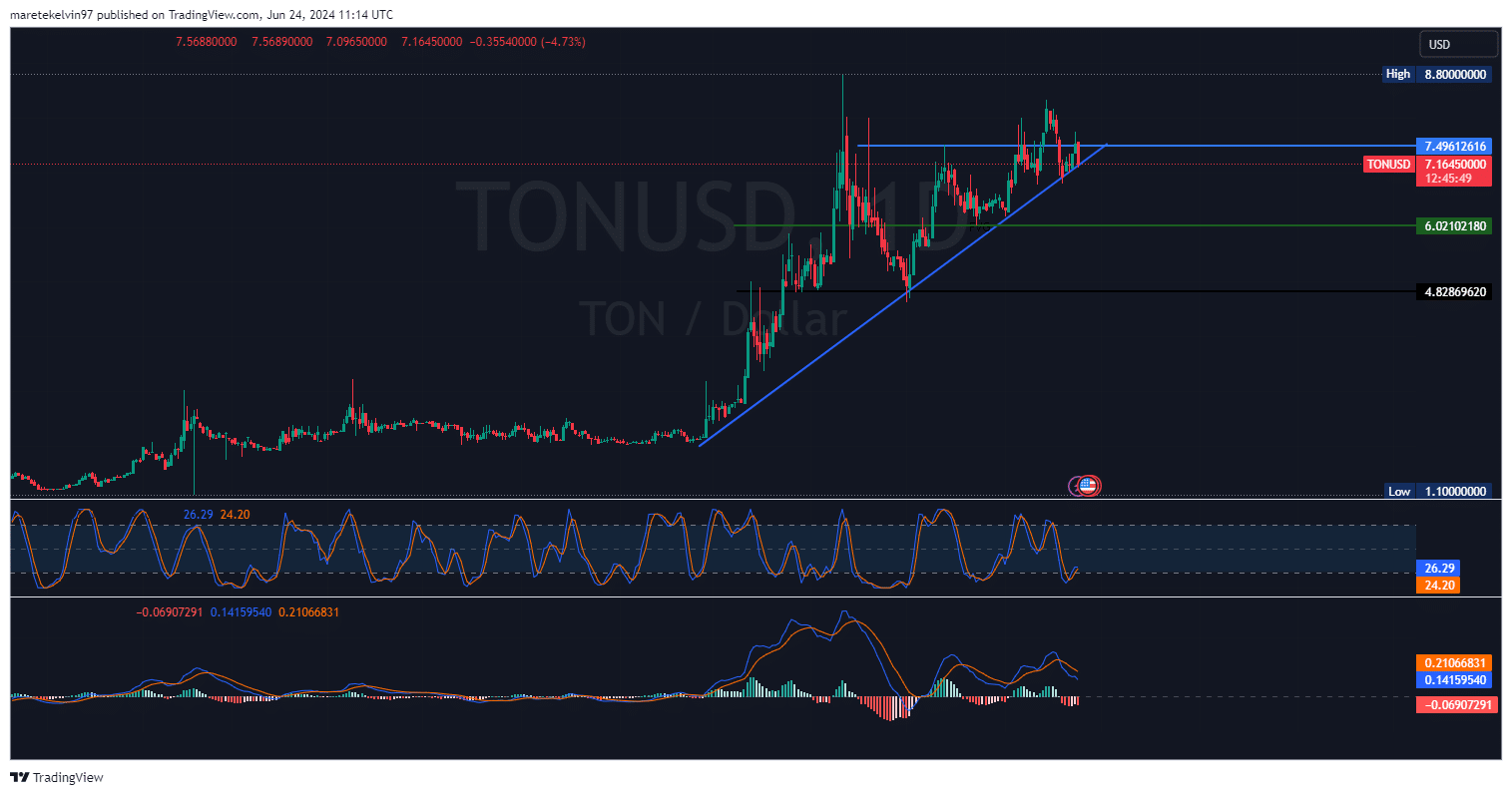

TON’s price took a 5% dip over the past day, approaching a significant support line it had previously encountered multiple times since late February.

Maintaining Toncoin’s bullish outlook in the short term relies significantly on this critical level. So far, Toncoin has followed an upward trend, consistently adhering to its supporting line.

If the cost falls beneath the designated support, a deeper decrease might ensue. On the other hand, if the bulls successfully hold up this support, it could mark the beginning of a fresh advance.

At present, the value of Toncoin on CoinMarketCap is reported as $7.24. The market capitalization of Ton has decreased by 4.82%, amounting to 17.8 billion dollars. In contrast, its trading volume has significantly increased by nearly double, reaching 298.88 million dollars within the past 24 hours.

As a researcher studying financial markets, I have observed that the Stochastic RSI, with a value of 24.20, is currently indicating an oversold condition. This finding implies that the asset’s price may experience a potential reversal soon. Furthermore, my analysis of Moving Average Convergence Divergence (MACD) histograms reveals that they are currently fading. This observation suggests that the selling pressure in the market is dwindling, potentially leading to a shift in market trends.

Active addresses and circulation paint a mixed picture

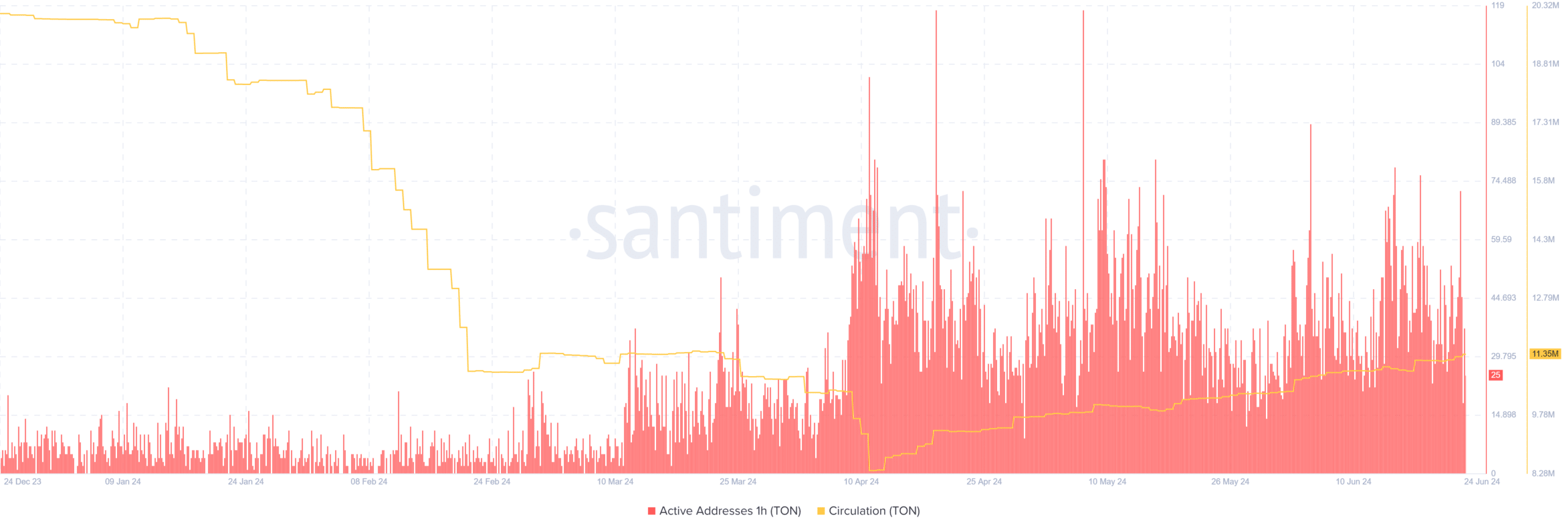

According to AMBCrypto’s interpretation of Santiment’s statistics, there has been an increase in the number of active addresses and circulating supply within the network, suggesting heightened engagement and activity.

As a researcher observing the cryptocurrency market, I’ve noticed an intriguing trend with Toncoin’s active addresses. The count has been steadily increasing since March. If optimistic sentiment continues to dominate, this growth could potentially indicate a price reversal for Toncoin.

Bulls vs bears at crossroads

We delved deeper into the Coingeasiness liquidation data. The findings revealed recurring peaks in both prolonged and instantaneous liquidations during the previous quarters.

These events correlate with sharp price movements, suggesting the volatile nature of the market.

Toncoin’s market direction was assessed through an analysis of its long/short ratio data from Coinglass, provided by AMBCrypto. This ratio shows that long and short positions on Toncoin have seesawed but largely remained equal in number.

As a researcher studying the investor sentiment, I’ve observed a noticeable split in opinions between those who are optimistic about market growth (bulls) and those who are cautious or pessimistic (bears). At present, neither camp appears to have a definitive advantage.

Is your portfolio green? Check the Toncoin [TON] Profit Calculator

What lies ahead for Toncoin?

If Toncoin reaches a significant support line it has previously failed to break, holding above this point might indicate a bullish turnaround and an uptrend.

As an analyst, I would interpret a price breakdown differently: A price breakdown could be a warning sign that further declines lie ahead, potentially reaching the lower support levels in the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-25 01:11