- News of repayments in Bitcoin and Bitcoin Cash is likely to put additional downward pressure on the two assets.

- The metrics and futures data showed that the next week is likely to see more losses.

As an experienced analyst, I believe that the news of Bitcoin and Bitcoin Cash repayments from the now-defunct Mt. Gox exchange is likely to put additional downward pressure on these assets. The delayed deadlines for these repayments have kept markets in uncertainty for years, but with a concrete announcement finally made, it’s reasonable to expect that sizeable amounts of Bitcoin and Bitcoin Cash could enter the market, adding to the selling pressure.

Bitcoin’s price faced significant challenges as relentless selling pressure caused it to plummet from its previous high of $71,900 on June 6th to a current value of $61,400. The level of resistance at $60,500 was tested only hours prior and came in response to reports originating from the Bitcoin exchange, Mt. Gox.

In 2014, there was a large-scale cyberattack on the defunct cryptocurrency exchange, leading to the theft of around 740,000 Bitcoins. At present market values, this equates to a significant loss of approximately $15 billion.

Previously recognized as the leading exchange globally, its situation has significantly shifted over time. The restitution process for the pilfered clients’ assets was plagued with repeated postponements, but ultimately, word broke out on June 24, 2023 (Monday), that this restitution would begin in July 2024.

Nobuaki Kobayashi, as the Rehabilitation Trustee, announced that the Rehabilitation Plan would involve making repayments using Bitcoin (BTC) and Bitcoin Cash [BCH]. This revelation could potentially lead to increased supply in the market for these cryptocurrencies, which might put downward pressure on their prices.

Exploring the impact of this news

Around the last week of May, as mentioned in an AMBCrypto article, the exchange transferred approximately 140,000 Bitcoins, equivalent to around $9.4 billion at that time. This transaction did not initially influence Bitcoin’s price, but a week later, the cryptocurrency reached a local peak, just shy of the $72k mark.

As a researcher studying the recent trends in the Bitcoin market, I hypothesize that the persistent selling pressure observed over the past few weeks might have been driven by investors anticipating certain developments. If a significant portion of this selling pressure materializes in the form of actual transactions, it could potentially exacerbate Bitcoin’s downward trend and intensify the selling pressure further.

Between May 8 and May 14, 2024, Bitcoin bulls put up a strong defense at the $60,000 support level and ultimately pushed prices upward to reach a high of $71,900 on May 21.

Therefore, another retest of the $60.2k-$61.5k region is likely to see a positive reaction.

Metrics indicate that the correction could be coming to an end

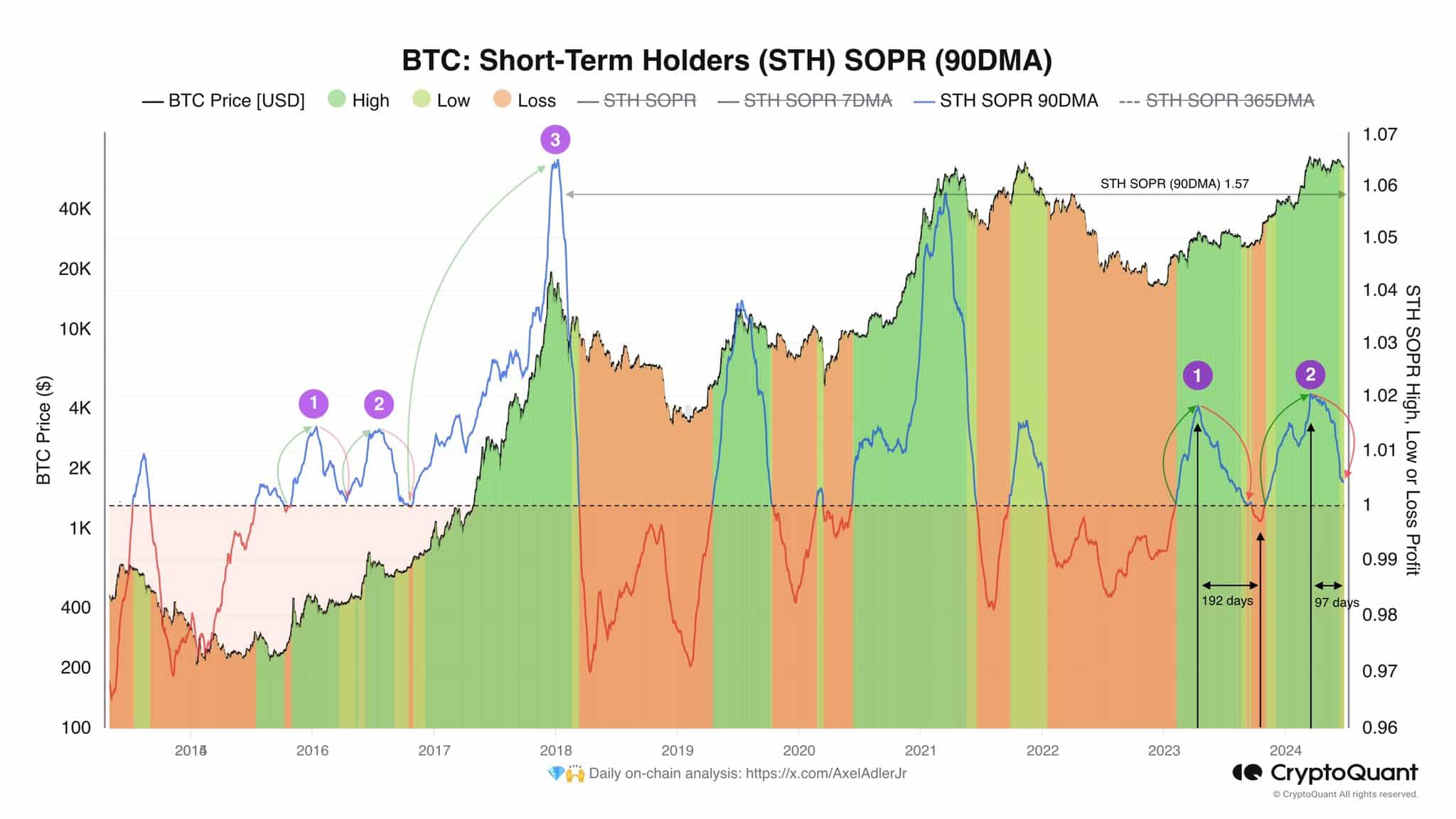

Expert: Crypto analyst Axel Adler recently highlighted on platform X, formerly known as Twitter, the significance of the short-term holders’ spent output profit ratio (SOPR) indicator.

As a researcher studying Bitcoin’s market trends, I’ve noticed that the 90-day moving average (90DMA) currently hovers around 1. In comparison to the 2016 price action, it’s plausible that Bitcoin could continue its correction until this metric drops below the 1 mark.

After that observation, the likelihood of Bitcoin’s price trending upward for the bulls could increase. However, this shift may not happen immediately and traders and investors might experience further losses or a period of price stability beforehand.

As a researcher studying Bitcoin price trends, I’ve observed an intriguing pattern. Analyst Ali Martinez noted that the daily Relative Strength Index (RSI) had dipped into oversold territory, falling below the 30 threshold. Historically, when this occurred three times before, Bitcoin prices saw significant recoveries: 60% price increase on the first occasion, a 63% surge in the second instance, and an impressive 198% price rise in the third occurrence.

Although this statement may provide a sense of comfort, it doesn’t necessarily mean the downward trend has ended or that an upward trend will immediately follow.

The price may take a sharp downward turn towards the $60,000 mark in the upcoming weeks, driven by selling pressure and the pursuit of greater liquidity, with signs of stabilization or rebound yet to emerge.

BTC futures market data shows bulls were going through much pain

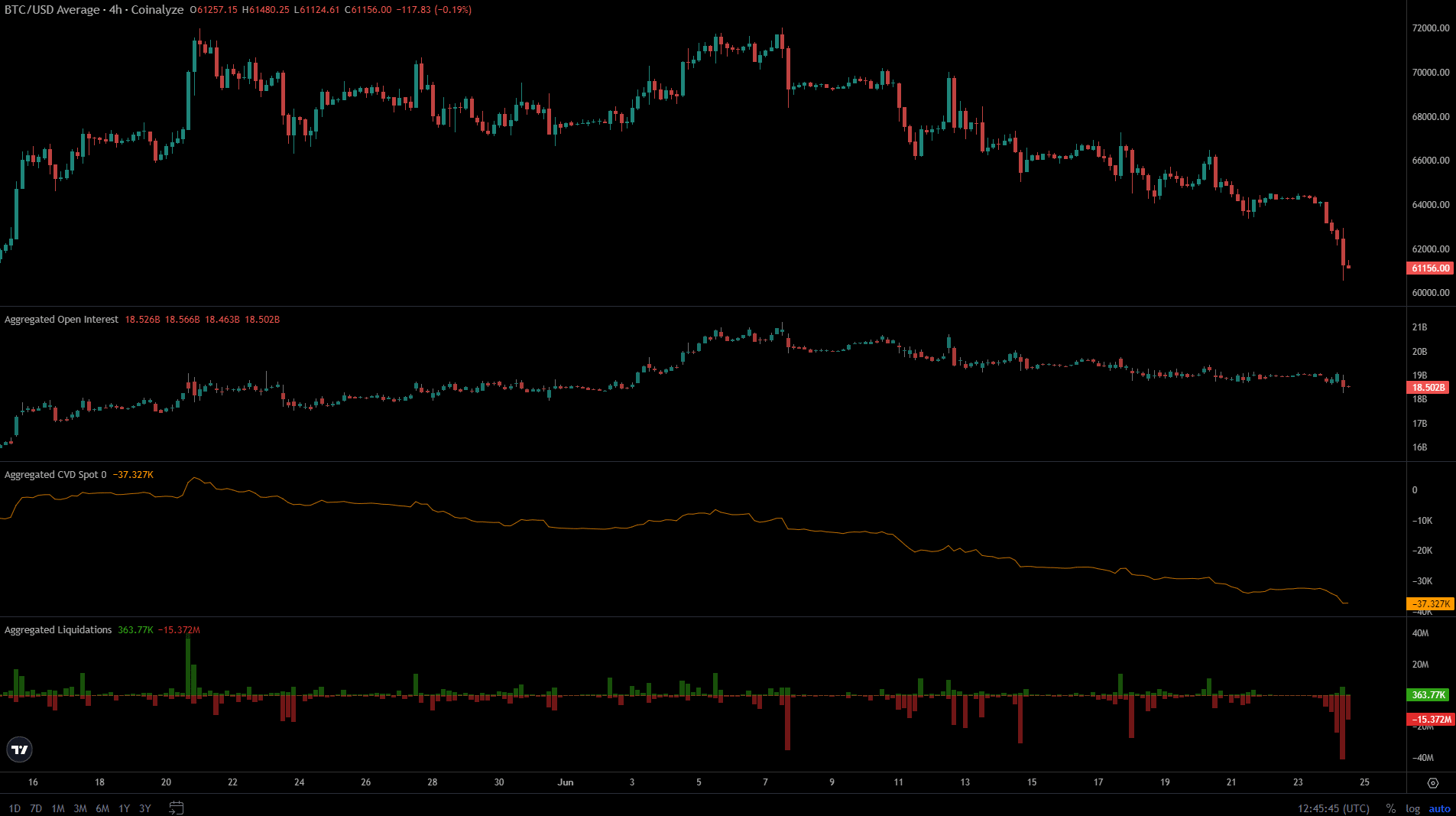

According to Coinalyze’s data, the volume at the CVD (Cross-Depth Value) spot has been decreasing consistently over the last month. This downtrend indicates increased selling activity in the Bitcoin spot market, highlighting Bitcoin’s vulnerability.

The Open Interest bounced higher in early June but after the first week, began to decline as well.

Over the past three weeks, the market showed signs of pessimism towards Bitcoin (BTC), as indicated by the collective behavior of futures and spot traders. Rather than taking a bullish stance by buying futures contracts or going long in the spot market, these traders chose to remain cautious and sell off their assets instead.

As an analyst, I would express it this way: I noticed that unexpectedly large sell orders caused significant price drops, exacerbating the pressure on buyers in the market.

As a crypto investor, I’ve noticed some significant long liquidations over the past 24 hours. In just a 12-hour span on the 24th of June, there were nearly $75 million worth of these liquidations based on Coinalyze data.

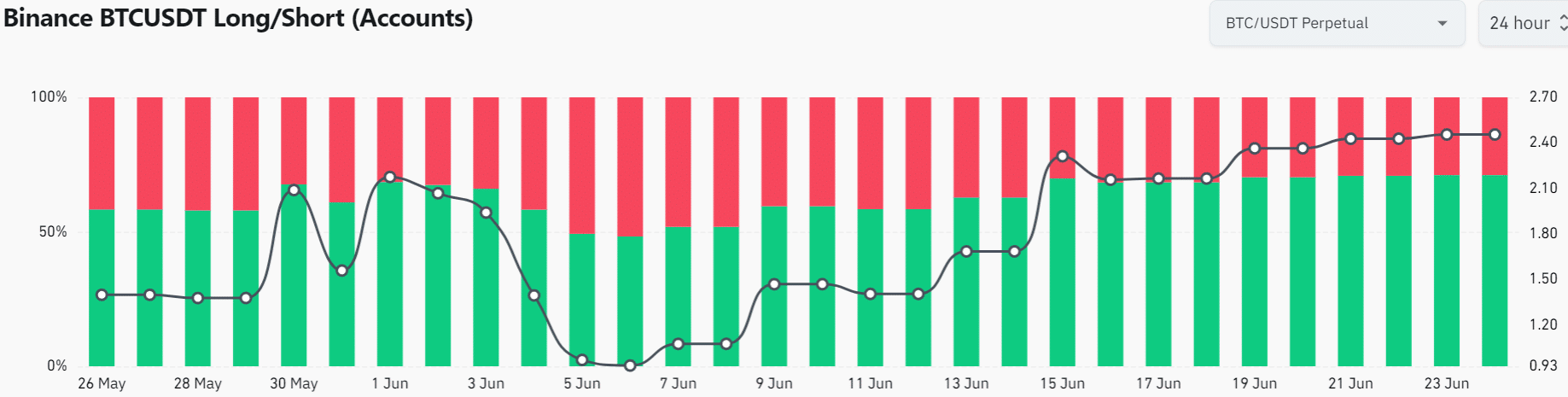

As a crypto investor, I’d interpret this as follows: At the current moment, for every short position taken, there are approximately 2.46 long positions in the market. In other words, there are more than twice as many investors holding long positions compared to those with short positions.

Smaller investors placed wagers on Bitcoin recovering, while larger players maintained their positions for a price drop.

Is your portfolio green? Check the Bitcoin Profit Calculator

Based on the available information, it seemed extremely probable that Bitcoin sellers would maintain control over the market for the next 2-4 weeks, leading bullish investors to follow suit.

A sudden drop in prices is also possible given the daily RSI’s dive into the oversold territory.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-06-25 04:08