-

Negative sentiment in the market caused the increase in outflows from BTC and ETH.

Projected distribution by a defunct exchanges puts the cryptos at risk of another decline

As a researcher with experience in the cryptocurrency market, I’m concerned about the recent trend of outflows from Bitcoin and Ethereum. The negative sentiment in the market caused investors to withdraw $1.2 billion from crypto investment products over the past two weeks. This is a worrying sign as it indicates that there is a lack of confidence in the market.

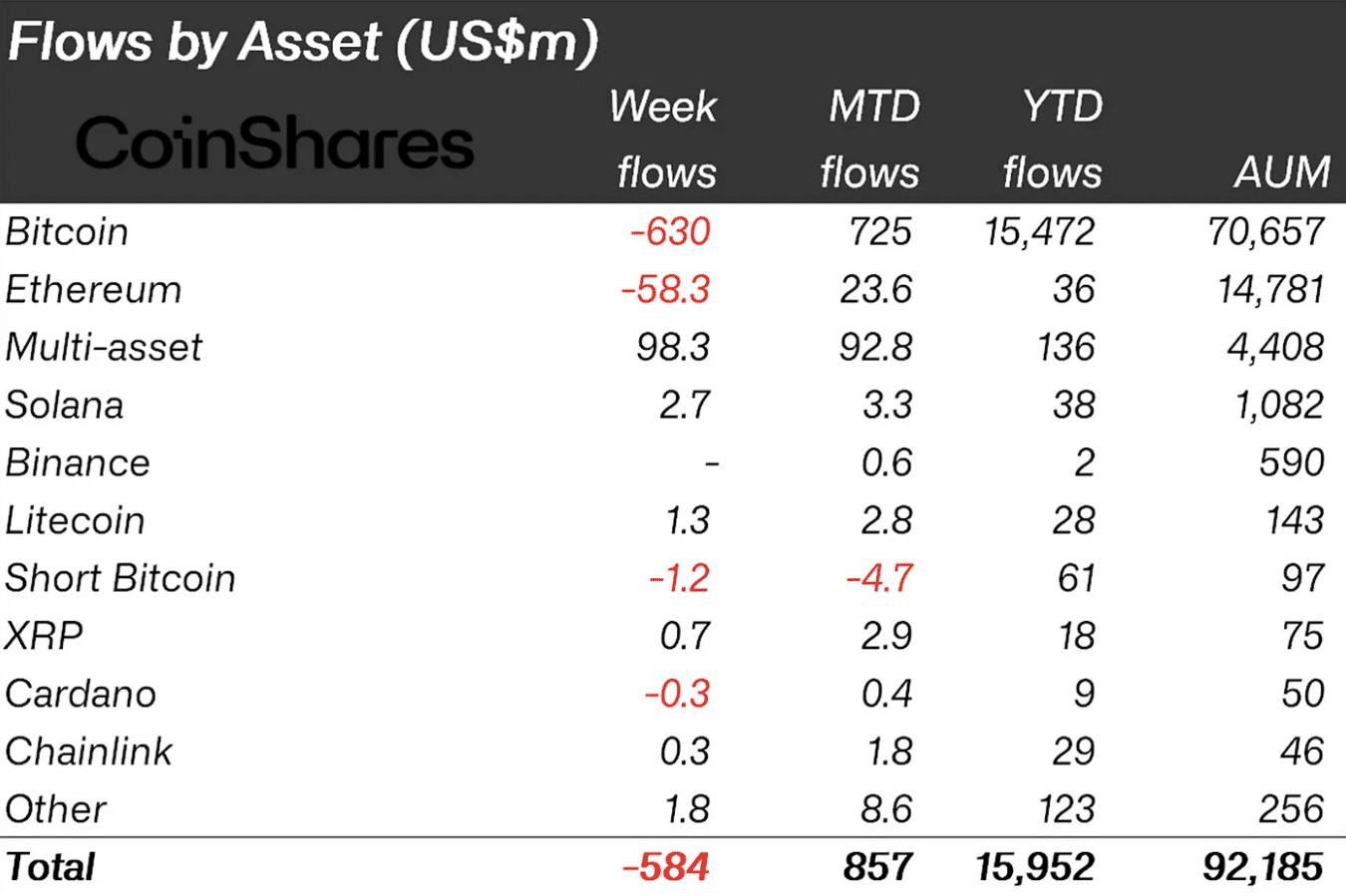

For the second week in a row, there was a significant increase in investments in crypto products as reported by CoinShares, totaling at a inflow of $584 million in the previous week. (Or) The latest report from digital asset management firm, CoinShares, indicated that crypto investment products experienced substantial inflows for the second consecutive week, amounting to a total of $584 million in outflows the previous week.

As a researcher studying the recent trends in cryptocurrency markets, I’ve observed that over the past two weeks, the total withdrawals amounted to an impressive $1.2 billion. Unsurprisingly, Bitcoin [BTC] led the pack with significant outflows of approximately $630 million. The report sheds light on the reasons behind this mass exodus: the dismal investor sentiment and the anticipated interest rate reduction.

It explained that,

As a crypto investor, I’ve noticed some market movements that lead me to believe these price changes might be due to investor sentiment regarding the Federal Reserve (FED) and potential interest rate cuts. Some investors seem pessimistic about the prospect of rate reductions this year, and this attitude could be influencing the crypto market negatively.

BTC, ETH play second fiddle to other altcoins

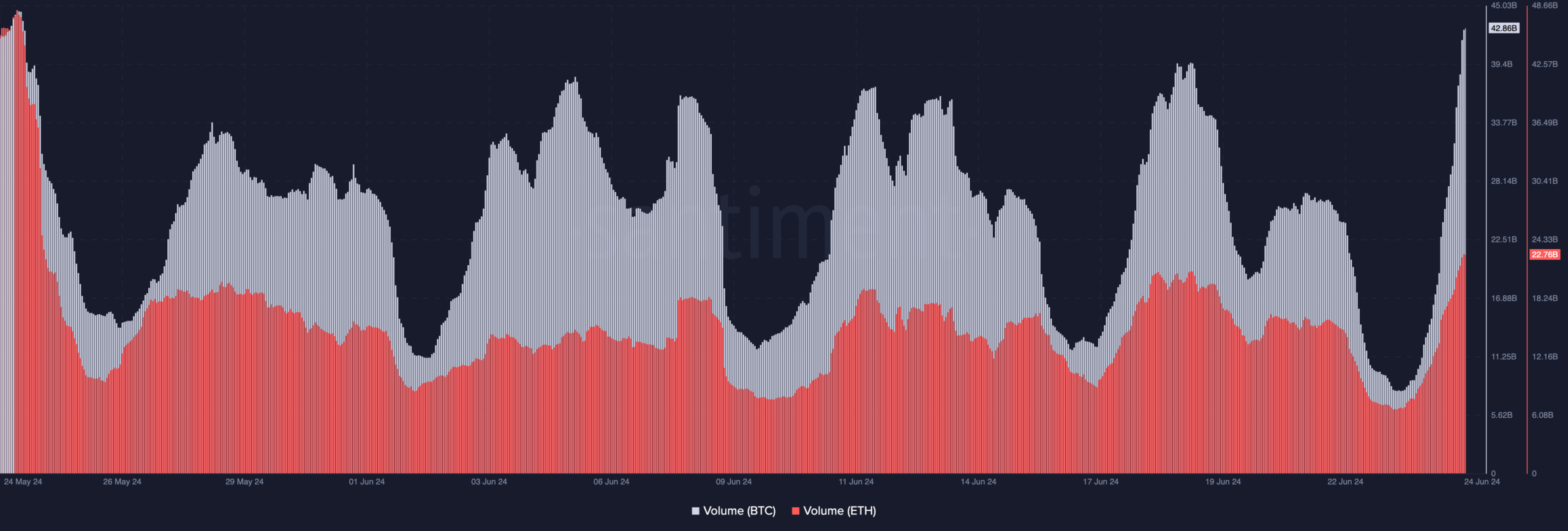

Besides the withdrawals, the trading activity for Exchange-Traded Products (ETPs) amounted to only $6.9 billion during this period. This represents Bitcoin’s smallest daily trading volume since January 10th, following the ETF’s approval.

It was a shock that Ethereum [ETH], ranking second, experienced an outflow of approximately $58.30 million, given the widespread anticipation that Ethereum-backed spot Exchange Traded Funds (ETFs) would debut in the market during July.

Normally, this was expected to foster optimism. Yet, contrary to anticipation, the report revealed that,

Ethereum wasn’t exempt from the pessimistic mood as it experienced a net withdrawal of $58 million. In contrast, several altcoins attracted investments following their recent price slumps. Notably, Solana, Litecoin, and Polygon recorded inflows worth approximately $2.7 million, $1.3 million, and $1 million respectively.

As a crypto investor, I’d say that currently, Bitcoin is being traded at around $60,028 following a brief dip under $59,000. On the flip side, Ethereum is being bought and sold at approximately $3,349.

It’s the season to apply caution

The revelation that Mt.Gox planned to repay creditors with approximately 9 billion dollars’ worth of Bitcoin starting in July could have contributed to the early decrease in prices.

As a crypto investor, I recall the unfortunate history of Mt.Gox, the defunct Bitcoin exchange where my digital assets were once held. In 2011, this platform was hacked, resulting in a significant loss for its users. Fast forward to 2014, and Mt.Gox filed for bankruptcy following another security breach. This unfortunate series of events led to a broader market collapse. If the distribution of recovered coins is scheduled to begin in July, I anticipate that many recipients may choose to sell off some or all of their allocated coins due to the uncertainty surrounding this event and the potential impact on market prices.

If BTC follows this trend, it might drop down to $54,000 according to certain forecasts. In contrast, ETH may be shielded from further correction due to the upcoming live trading of its ETFs.

Should this event transpire, the Ethereum price may hold firm against further declines, potentially signaling the long-awaited return of the altcoin market rally.

During the current period, Bitcoin’s trading activity approached its monthly peak with a reported volume of around $42.86 billion. This figure represents the total amount of coins bought or sold, signifying significant investor engagement within the Bitcoin market.

As an analyst, I’ve observed that the decrease in Bitcoin’s value indicates a higher volume of sellers compared to buyers in the market. On the other hand, Ethereum experienced an increase in trading activity as well, but it didn’t reach the same magnitude as Bitcoin.

Realistic or not, here’s ETH’s market cap in BTC terms

At present, the on-chain volume for Ethereum amounts to $22.76 billion. Meanwhile, Bitcoin appears to be holding its ground against a potential drop lower. Should buyers manage to keep the price afloat, there’s a possibility of a rally back up to $63,000.

As a crypto investor in Ethereum, I believe that the value of this digital asset could potentially reach $3,500 once again. Nevertheless, if there is an increase in sellers, we might witness new lows for Ethereum within the current quarter.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-25 12:07