- The range formation of April and May gained notability once again.

- The bulls might falter and cede the $60k level to the bears in the coming days.

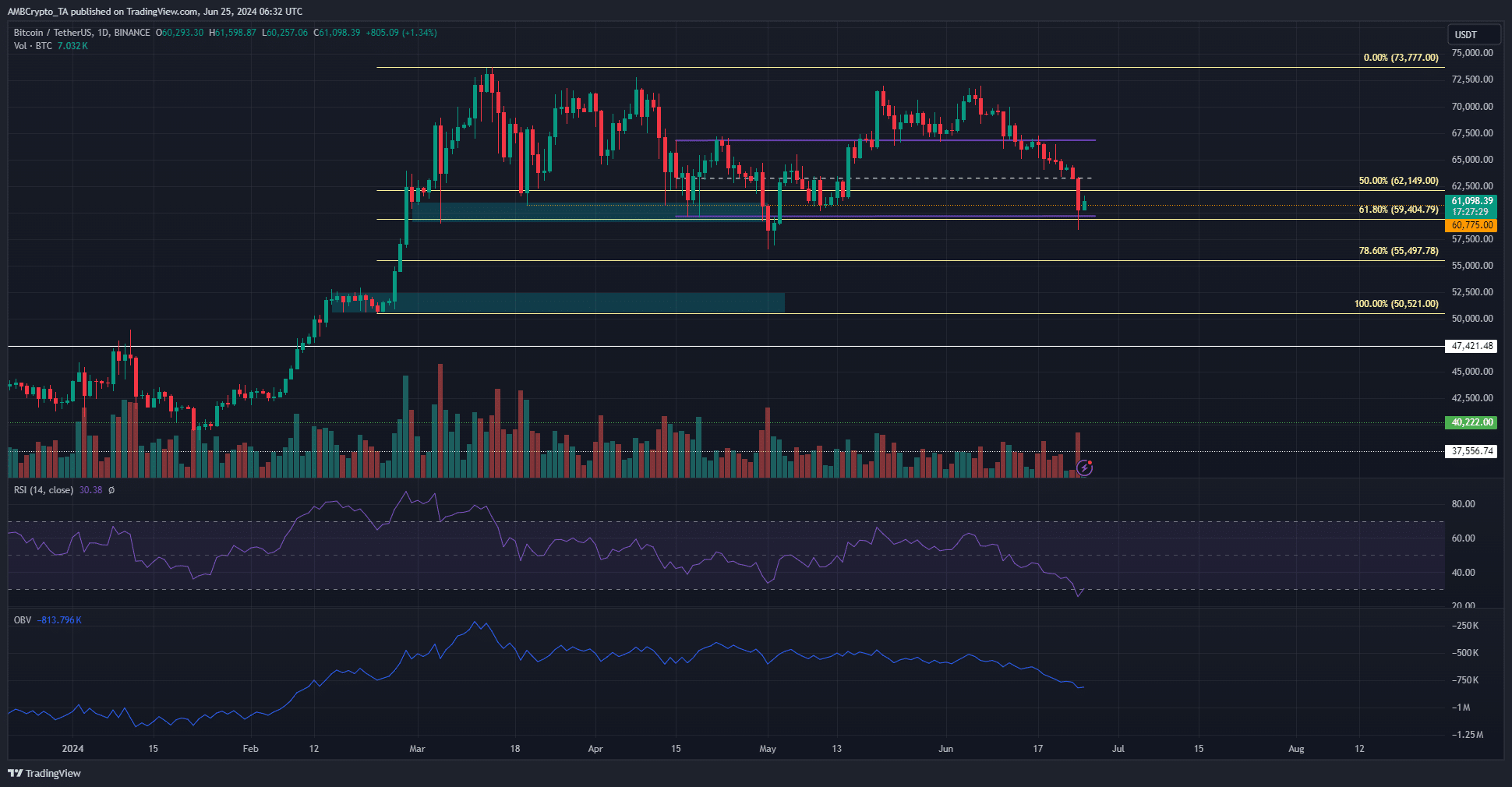

As an experienced analyst, I’ve seen my fair share of market volatility in the cryptocurrency space. The range formation of April and May gained significant attention once again as Bitcoin plunged 7.84% on June 24th, reaching a low of $58.4k before bouncing back slightly to trade at $61.1k.

As a crypto investor, I observed a decline of 7.84% in Bitcoin‘s value on Monday, the 24th of June. Previously, an AMBCrypto report had pointed out that potential news regarding Mt. Gox repayments could contribute to further selling pressure in the Bitcoin market.

The report indicated that a dramatic decrease in Bitcoin’s price might occur soon. Approximately hours after this observation, the cryptocurrency dipped to $58,400 and later rebounded slightly to $61,100 as of the current news update.

Will the support zone be defended this time too?

The range formation could be the key

On Sunday, the 16th of June, Bitcoin experienced a brief rebound from $66,000 to $66,900, touching upon previous resistance levels. Following this, its price trended downward and approached the support zones around $59,700. Analysts anticipate that the Bitcoin price may recover within the range of $59,000 to $60,000.

The RSI’s reading each day provided evidence for this proposition. It dipped as low as 25.6 on Monday, but had rebounded to 30.38 by press time. This uptick in the RSI increases the likelihood of a market recovery.

Despite the OBV showing a significant downward trend over the last fortnight, with heavy selling activity evident, it is crucial to halt this slide and initiate an uptrend to restore bullish sentiment.

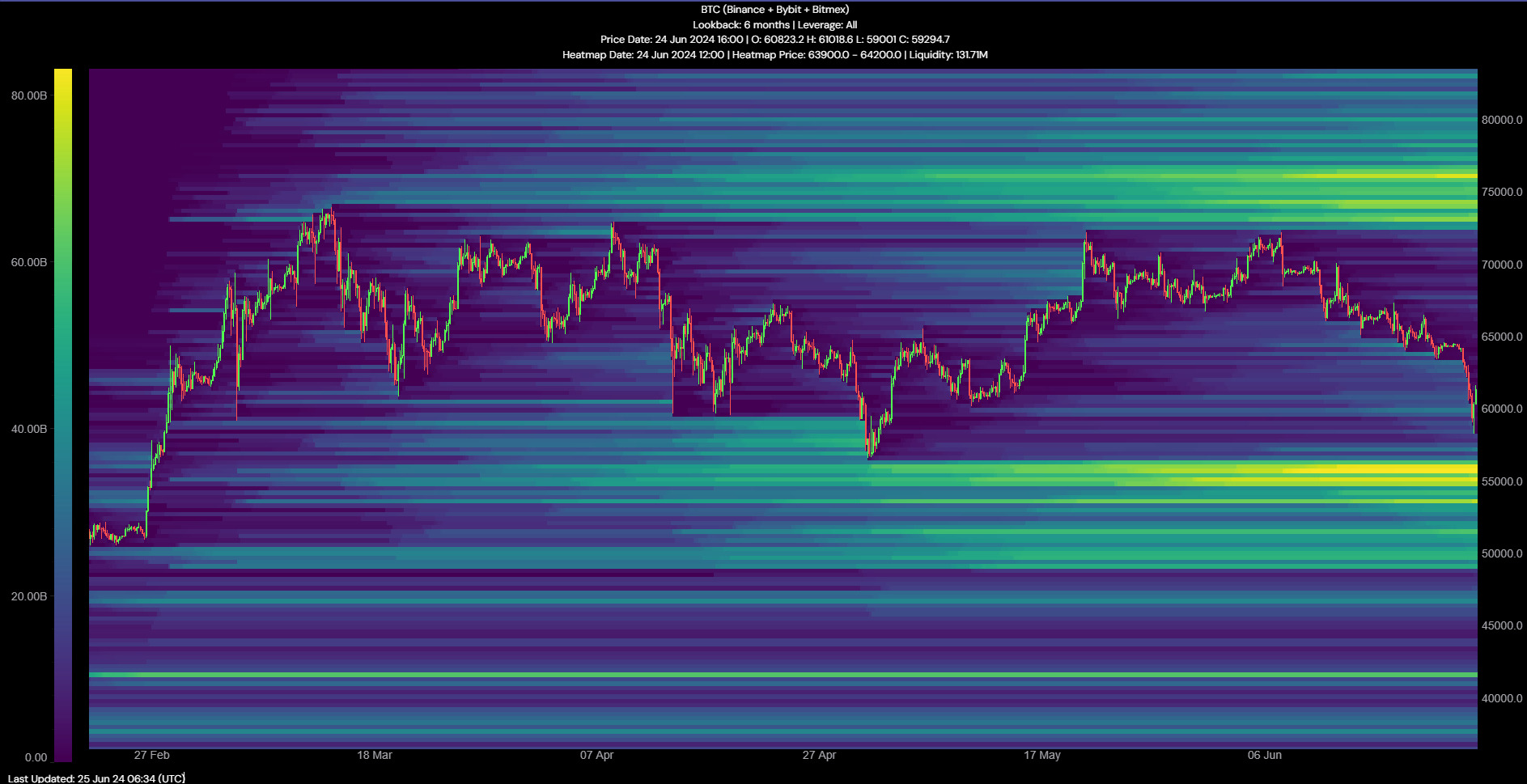

The liquidation heatmap showed traders could experience more pain

Despite the significant demand in the $59,000 range, it may not be sufficient to counteract the downward trend in Bitcoin’s price. According to AMBCrypto’s examination of Hyblock’s liquidation data, a probable 10% decrease in BTC value is imminent.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Based on the data from the past six months, there is a significant cluster of prolonged liquidation levels near the $55,000 price point. This area may exert a strong pull on prices, potentially causing them to be drawn back before the broader uptrend continues.

For traders and investors, there’s no need to rush selling; instead, a dip down to the $55,000 area might offer a good purchasing chance rather than triggering alarm.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-25 16:07