- Polygon noted a bearish market structure and was poised for more losses

- The uptick in dormant circulation warned of a wave of selling pressure

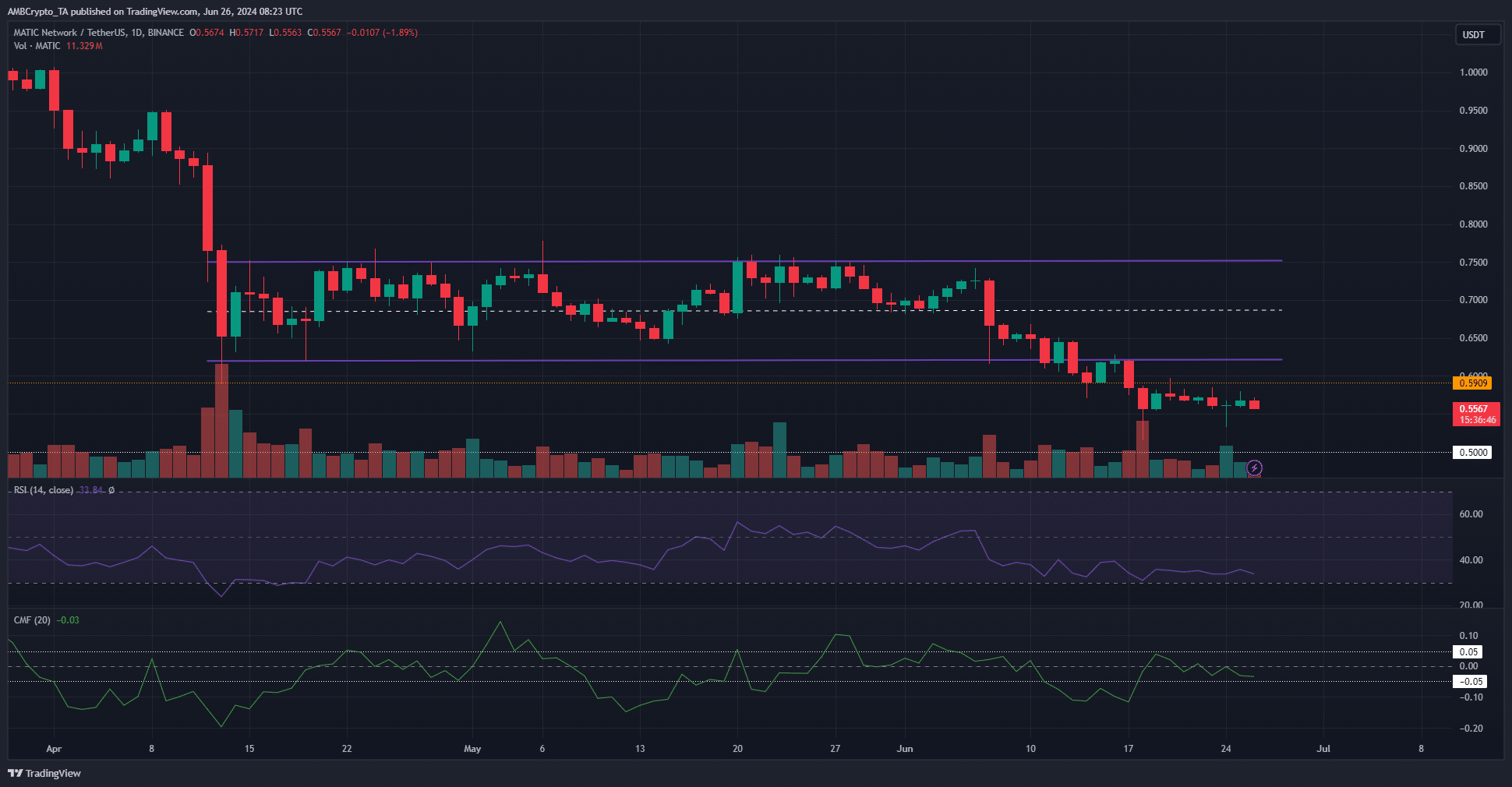

As an experienced analyst, I’ve closely observed Polygon [MATIC] crypto’s price action and market structure. The bearish trend intensified in June, with the price slipping below the 2-month range on the 11th and testing previous lows at $0.621 as resistance on the 16th. This solidified the bears’ holdings and paved the way for further losses.

In June, the cryptocurrency represented by the Polygon [MATIC] symbol experienced a notable price decline. The trend took a turn for the worse on the 11th of the month when the price dipped below the 2-month price range. On the 16th of June, the previous lows at $0.621 were revisited and attempted to act as resistance.

As a researcher studying the bear market, I can say that their positions were strengthened with this recent development, opening up an opportunity for them to advance further southward. At present, the resistance level hovering at $0.59 is significant. For bulls considering their next move in the market, they might want to assess if more losses are imminent and consider remaining on the sidelines.

The next HTF support level was also a psychologically important one

When the price of Polygon crypto has shifted, making the previous resistance level of $0.59 less significant, the next potential support for the asset is at $0.5. This level holds psychological and technical significance due to its relevance during September and October 2023. It played a crucial role in driving the substantial rally that propelled Polygon crypto to reach its peak of $1.29 in May 2024.

Given the heavily bearish market structure visible on the daily chart, it’s anticipated that investors will look towards this support level in pursuit of liquidity.

The $0.5 mark may not necessarily reverse the trend right away, but it could potentially pause it momentarily.

As an analyst, I would interpret the Current Ratio of Money Flow (CMF) being at -0.03 as suggesting that there has been a slight net outflow of capital from the markets recently. To confirm this trend, traders might consider waiting for the CMF to fall below the threshold of -0.05, which historically has indicated more substantial capital outflows.

If the indicators keep declining, it may weaken the argument for a bullish case defending the $0.5 support level.

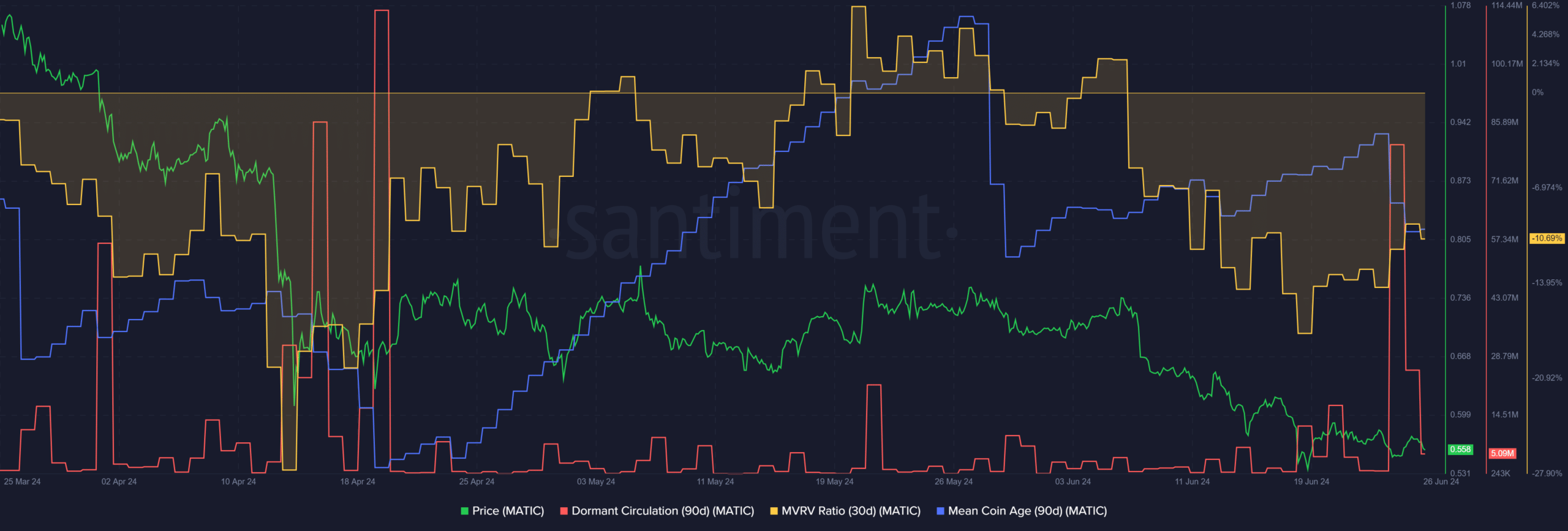

A spike in the dormant circulation hints at the next price move

On the 24th of June, there was a significant increase in the dormant circulation’s activity level, reminiscent of the surge witnessed around mid-April. During that period, the prices encountered resistance at the $0.6 support on numerous occasions.

Read Polygon’s [MATIC] Price Prediction 2024-25

It signaled Polygon crypto buyer capitulation and a similar scenario was playing out again.

As a researcher studying market trends, I can express this finding in a more personal and clear way: I’ve noticed that prices may continue to drop given the deeply negative MVRM (Maximal Pain and Realized Value) ratio. This indicator signals that short-term buyers have incurred losses. Any potential rebounds could lead these traders to sell, hindering any attempts at recovery.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-06-27 02:33