-

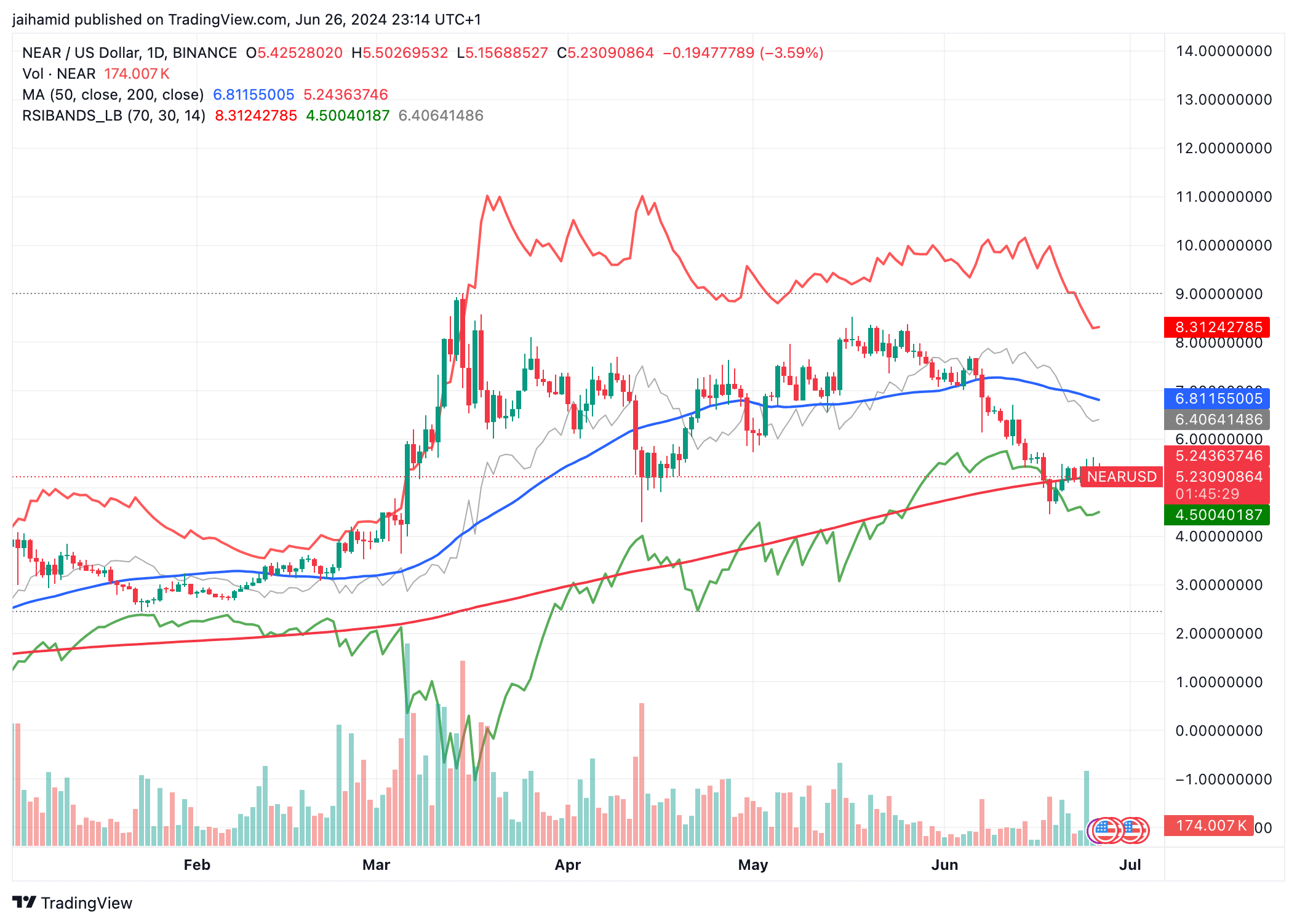

NEAR Protocol broke below the 50-day moving average, shifting to a bearish trend after a bullish week.

A massive drop in RSI towards the oversold territory and the formation of a lower low highlighted strong selling pressure.

Based on my analysis, NEAR Protocol’s bearish trend is evident as it has broken below the 50-day moving average and formed lower lows with significant selling pressure. The RSI’s move towards the oversold territory further emphasizes this trend. The MACD buy and sell signals also indicate more selling pressure. Although there have been double bottoms, the bearish momentum is quite strong, and a bullish reversal seems unlikely in the short term due to the price being below major resistance levels like the Ichimoku Cloud and key moving averages. Traders are closing positions as indicated by decreased trading volume and open interest. This analysis is based on technical indicators and market trends, but it’s essential to consider fundamental factors as well before making investment decisions.

As a researcher studying the cryptocurrency market, I’ve noticed that NEAR Protocol (NEAR) underwent a significant shift in trend lately. The previous week showed robustly bullish signs, leading to optimism and potential gains for investors. However, this positive momentum was suddenly reversed, causing concern about a possible pullback.

In simpler terms, the blue line representing the 50-day moving average previously functioned as both a floor and ceiling for the price. However, the value dipped beneath this line, signaling a downward trend.

At the given moment in time, the red line representing the 200-day moving average sat above the current market price, underscoring a potential resistance zone and potentially impeding further price increases.

Based on the Relative Strength Index (RSI), the price appears to have left the overbought territory and is approaching or could even enter the oversold territory.

This suggested that the selling pressure has been significant, leading to the price drop.

Bearish signals dominate

The downward trend of the market is more pronounced due to the recent low point ( LL), which is significantly lower than past lows, suggesting a greater influx of sellers in the near future.

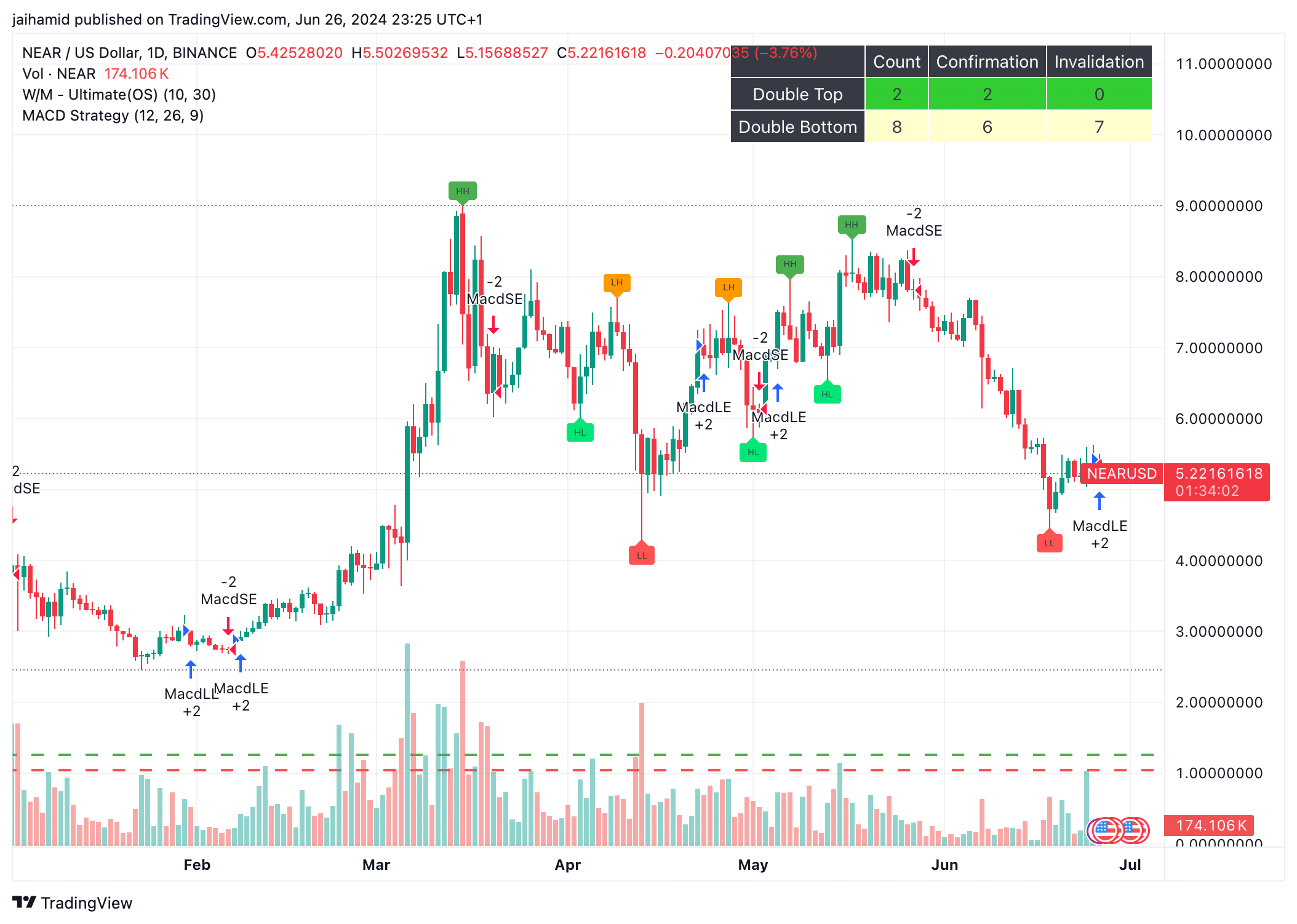

As a macroeconomic analyst, I’ve been closely monitoring the MACD indicators (specifically, the MACD buy and sell signals denoted as MACdSE and MACdLE). Lately, these signals have exhibited a high degree of volatility in terms of momentum shifts. The most recent data suggests that selling pressure is prevailing, as evidenced by the MACdSE signal’s consistent trend. This implies that the bearish momentum holds significant strength in the market at present.

As a crypto investor, I’ve noticed an intriguing pattern in the market – there seem to be more instances of double bottoms than double tops. A double bottom occurs when the price hits a support level twice before continuing its upward trend. Conversely, a double top is formed when the price hits a resistance level twice before starting a downward trend.

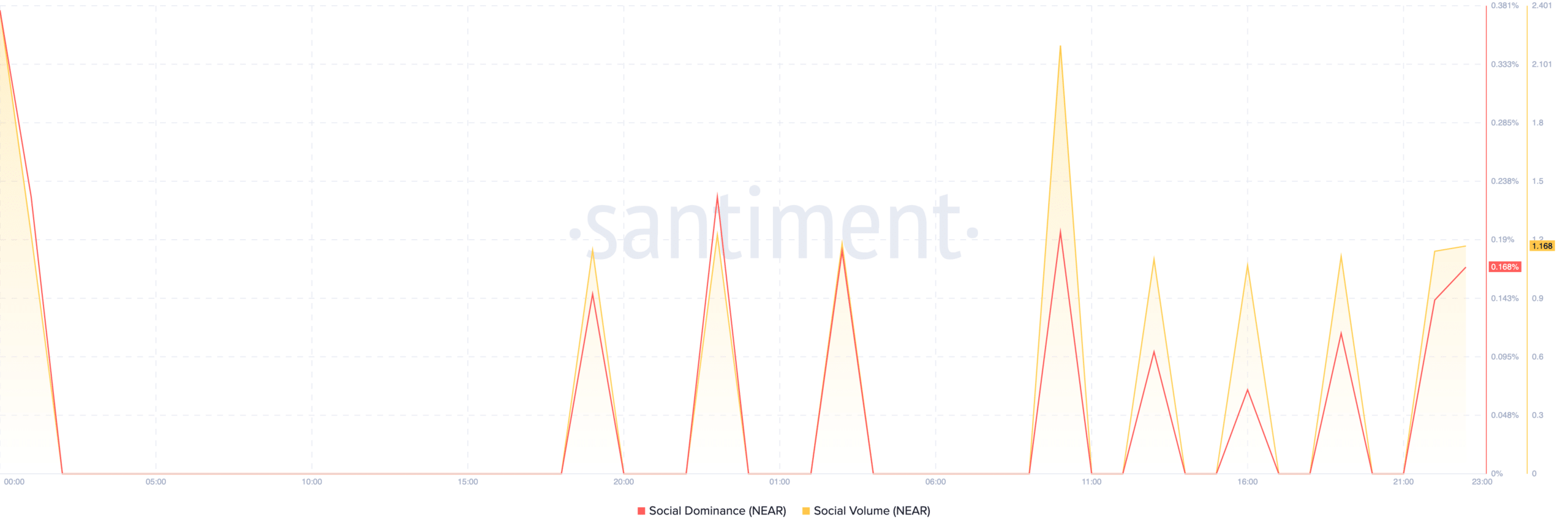

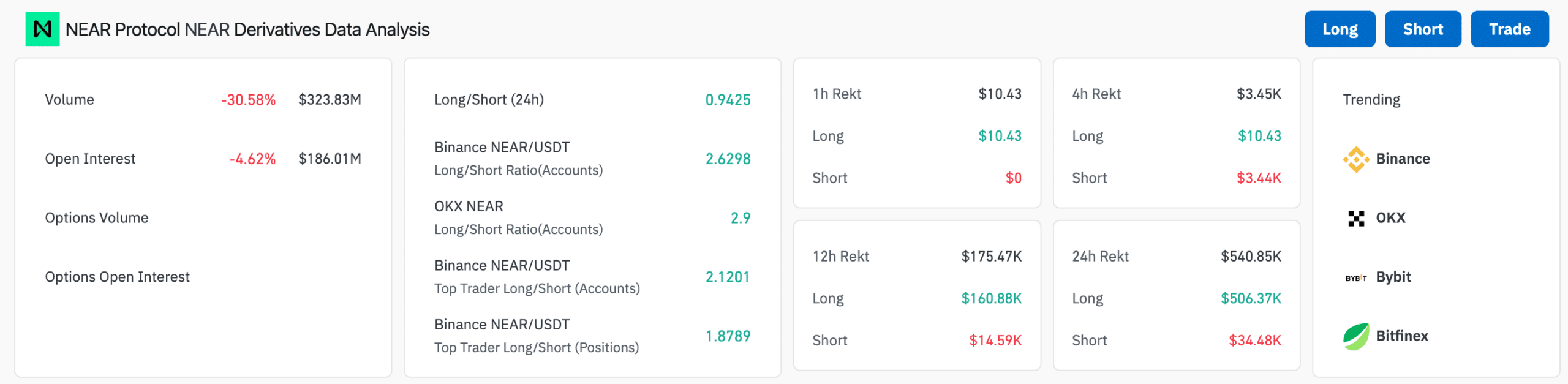

The alignment of NEAR‘s social media activity peaks with regard to volume and influence suggests a unified response or significant action from traders within the NEAR community. Unfortunately, the derivatives market associated with NEAR does not provide any relief in this regard.

In the last 24 hours, trading activity has dropped by more than 30%. Additionally, open interest has dipped by 4%, implying that some traders are wrapping up their positions in response to the gloomy market cues.

Realistic or not, here’s NEAR’s market cap in BTC’s terms

As a researcher studying the cryptocurrency market, I’ve noticed a general downturn in trading activity across major exchanges. However, some intriguing trends have emerged on specific platforms like Binance and OKX. These pockets of bullishness or speculative attempts to capitalize on potential market rebounds are worth further investigation.

As a researcher analyzing market trends, I’ve noticed that the current price falls beneath both the Ichimoku Cloud and key moving averages. Furthermore, the prevalence of short trades during recent market swings suggests a bearish trend. Consequently, it seems unlikely for a bullish reversal to transpire in the immediate future.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-27 11:05