-

The German government transferred BTC worth millions of dollars.

However, buying sentiment remained dominant in the market.

As an analyst with a background in cryptocurrency and experience observing market trends, I find it intriguing to see the German government’s recent transfer of millions of dollars worth of Bitcoin while the market sentiment remains uncertain.

During the final month of the second quarter this year, Bitcoin (BTC) investors have benefited significantly. This was due to Bitcoin undergoing several price adjustments.

In the meantime, the German administration took an action potentially leading to a decrease in Bitcoin’s value.

Are investors selling Bitcoin?

According to CoinMarketCap’s latest data, Bitcoin experienced a significant price drop of over 11% in the past thirty days. In just the previous seven days, the value of Bitcoin dipped by more than 6%.

When I penned down this text, Bitcoin was being transacted at the price of $61,043.62, and its market value exceeded one trillion dollars. However, according to IntoTheBlock’s statistics, approximately 12% of Bitcoin investors had depleted their funds due to the recent price decrease.

As that event unfolded, a recent tweet from Lookonchain disclosed that the German authorities moved significant amounts of Bitcoin.

The German government moved a total of 750 Bitcoin, equivalent to around $46.35 million, from its digital wallet. Of this amount, approximately $15.41 million in Bitcoin (250 coins) was sent to both Bitstamp and Kraken.

I, as a researcher at AMBCrypto, intended to examine the data to determine if selling pressure for Bitcoin was significant.

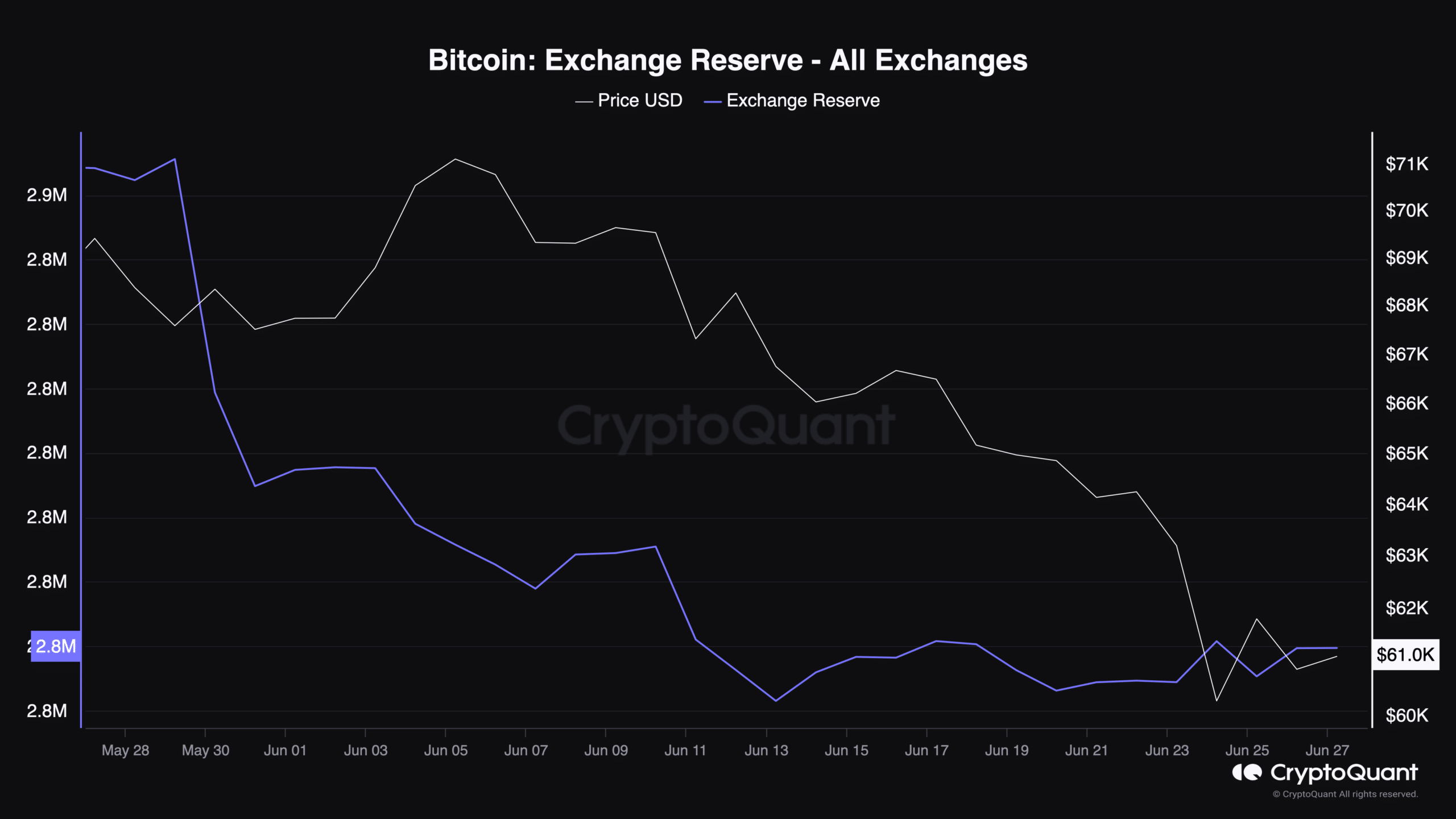

Based on our examination of CryptoQuant’s statistics, we discovered that the amount of Bitcoin being transferred into exchanges was greater than usual over the past week, suggesting strong demand for purchasing Bitcoin.

Last month, the cryptocurrency exchange holding of the leading digital coin, Bitcoin, significantly decreased. This reduction in reserves underscores the trend of investors purchasing Bitcoin despite its falling price.

Despite a prevailing bearish attitude among American investors, the Coinbase buying fee showed a negative figure at the current moment.

What to expect from BTC

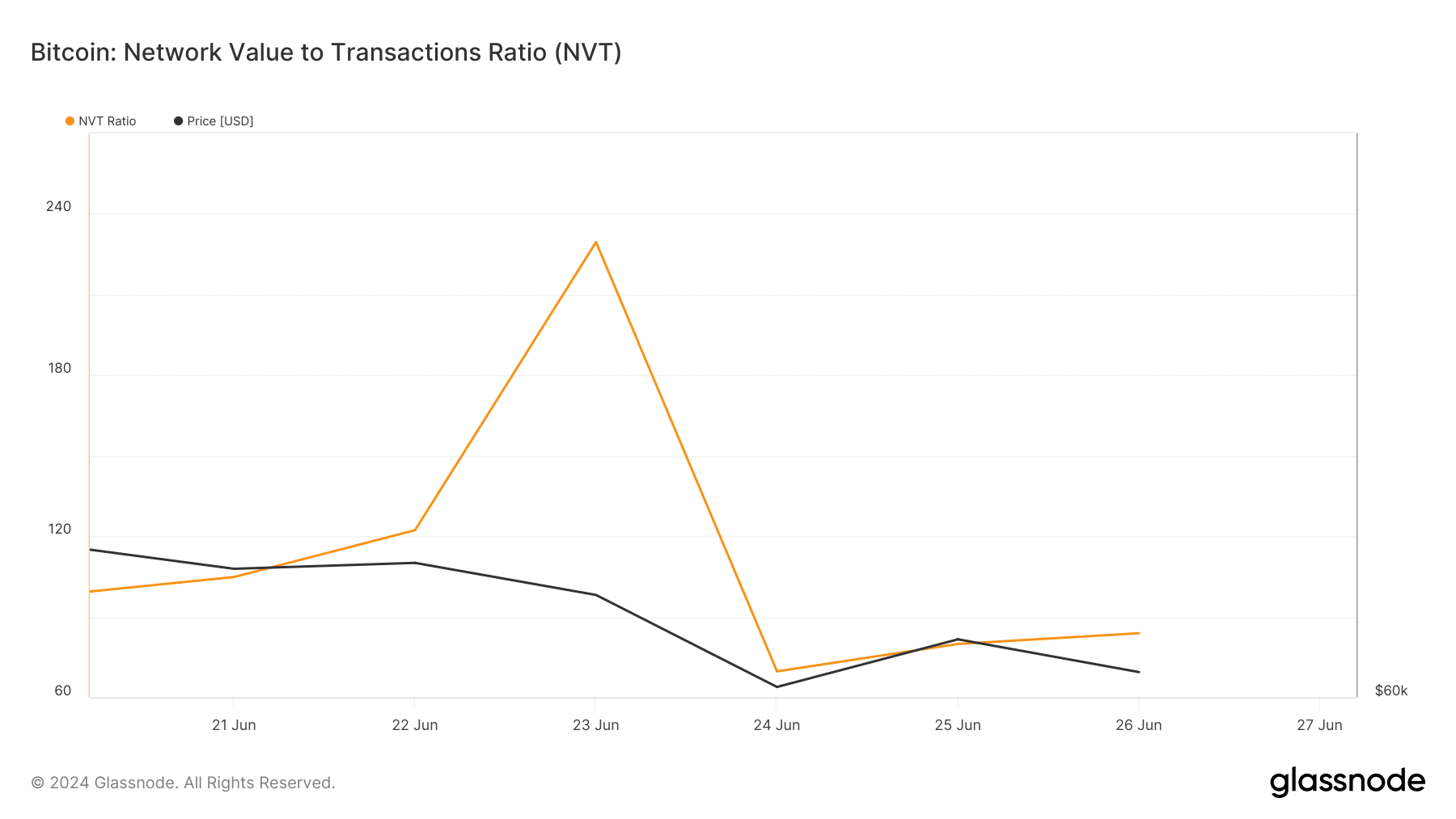

Intense demand for purchasing can lead to price escalations. Consequently, AMBCrypto examined Glassnode’s statistics and identified a bullish indicator.

Based on our recent assessment, Bitcoin’s NVT (Network Value to Transactions) ratio has noticeably decreased over the past few days. Historically, a drop in this metric suggests that an asset may be underpriced, potentially setting the stage for price growth in the near term. As a crypto investor, I would keep a close eye on this trend and consider increasing my positions accordingly.

Read Bitcoin’s [BTC] Price Prediction 2024-25

After making our plans, we intended to examine Bitcoin’s (BTC) day-to-day price chart in order to gain a clearer perspective on whether a price increase was imminent. According to our assessment, Bitcoin’s Relative Strength Index (RSI) indicator was hovering around the oversold region.

The Chaikin Money Flow (CMF) and buying pressure could potentially cause the coin’s price to increase. While the MACD still indicates bearish trends.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-06-27 12:07