-

KAS surged by 19.54% in seven days and 10.31% in 24 hrs.

Marathon, the largest mining company, has joined the Kaspa mining race.

As a researcher with experience in the crypto market, I find the recent surge of Kaspa (KAS) to be quite intriguing. While other altcoins are experiencing downward trends, KAS has managed to defy market trends and sustain its bullish trend.

In the past month, the cryptocurrency market as a whole has seen a decline. In contrast, Kaspa (KAS) has bucked this trend and maintained its upward trajectory.

At the moment of publication, the price of KAS stood at $0.1757, representing a significant increase of 10.31% within the past 24 hours. Moreover, over the last week, its value has jumped by an impressive 19.54%.

According to CoinMarketCap, KAS has a $4.2B market cap, which is a 10.35% surge in 24 hrs.

As an analyst, I’ve noticed that while many altcoins have been underperforming and experiencing downward trends, KAS has managed to sustain its growth. This observation has piqued my interest and that of the wider crypto community, leading us to explore the underlying factors contributing to this surge in KAS’s performance.

One significant factor contributing to KAS‘s recent growth can be attributed to the declaration made by the leading cryptocurrency mining company, Marathon.

On the official X page, which was previously known as Twitter, they announced their recent investment in Kaspa. They mentioned this development publicly.

Today, we’re pleased to share that we’ve been actively engaging in the process of extracting rewards from the Kaspa network. Our strategy of expanding into various areas of energy solutions and technological advancements has been essential for our investments, and it continues to be vital in managing our digital asset computing activities.

Marathon’s declaration that they will now mine Ethereum (PoW) in addition to Bitcoin is significant because the company has exclusively focused on Bitcoin mining since its inception in 2010. Consequently, this announcement makes Marathon the sole Proof of Work cryptocurrency that they mine apart from Bitcoin.

After the latest update from Marathon, I, an avid crypto investor, have decided to purchase some KAS following Michael Saylor’s lead. He made this announcement via his social media platform, X (previously known as Twitter).

“Take a bite.”

Saylor’s announcement has left KAS enthusiasts optimistic, with Cr7ptopreneur sharing that,

“It’s an exciting development that @MarathonDH is mining cryptocurrency $KAS. But if @saylor publicly announced his purchase of KASPA tokens, that would be even more bullish. Hmm, it seems @saylor may have already done so?”

What Kaspa fundamentals indicate

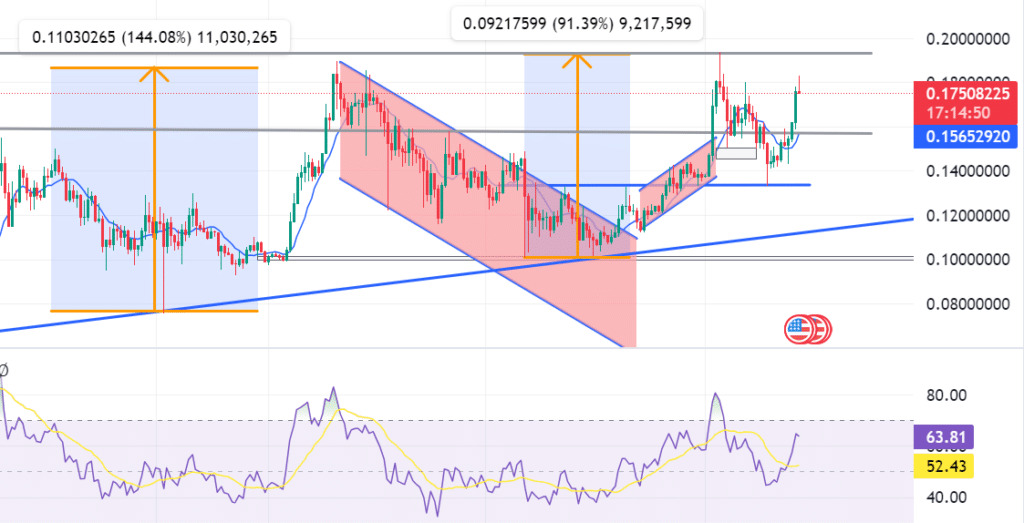

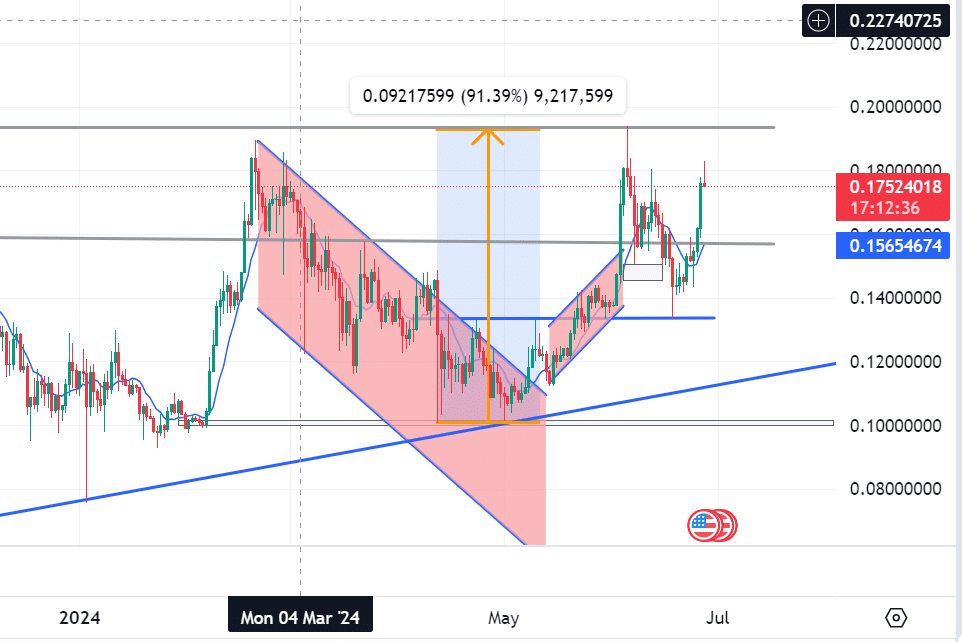

Based on the analysis by AMBCrypto, KAS appears primed for a prolonged price increase. Currently, its Relative Strength Index (RSI) stands at 65 and is exhibiting a consistent uptrend.

As a researcher observing market trends, I’ve noticed that prices have been on the rise. It’s plausible that this upward trend will persist since we’re not yet at the point where the market becomes overbought.

Similarly, Small-cap Market Average (SMA) exhibited a surge in bullish energy following its drop below the June 21st pricing. Consequently, over the past five trading days, Kas has encountered a buoyant investor attitude and rising share prices.

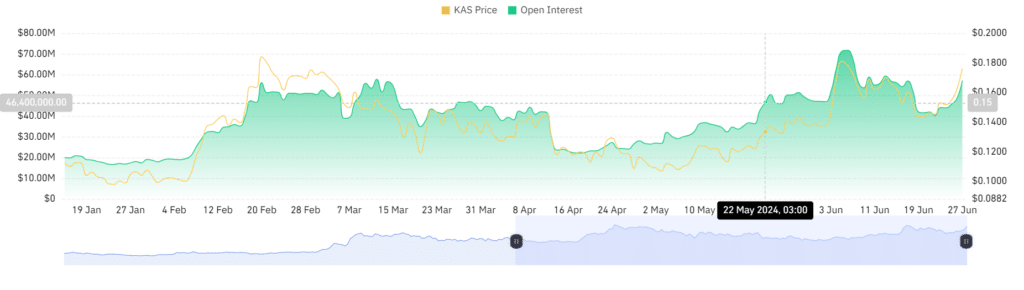

After taking a closer look at Coinglass data, we discovered that Kaspa has experienced a significant surge in open interest over the past 7 days. Specifically, open interest has grown from $40.4 million to $57.15 million within the last week. This increase suggests that traders have been establishing new positions without closing their previous ones.

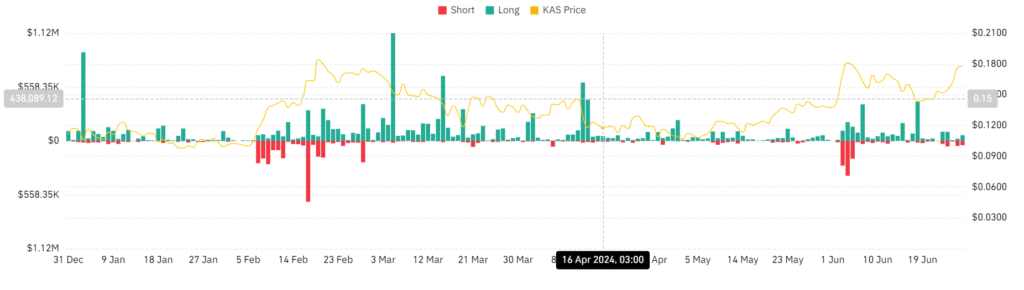

I’ve analyzed the market data and noticed that Kaspa has seen a decrease in liquidation for both its long and short positions over the past week. Specifically, in the last 24 hours, there was a liquidation of approximately $58,000 for long positions and around $44,000 for short positions.

Read Kaspa [KAS] Price Prediction 2024-25

Investors’ faith in these assets is reflected in the minimal sell-offs, indicating that they are keeping their stakes as fresh positions arise, contributing to the ongoing trend’s consistency.

Maintaining a favorable market outlook could push KAS prices up to $0.192 – the upcoming resistance point. However, should KAS encounter a market setback, its price may drop down to $0.158 – the imminent support level.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-27 14:16