- Bitcoin miners opted to mine Kaspa to offset their losses.

- Overall interest in ETFs remained high despite declining prices.

As an experienced financial analyst, I’ve witnessed the volatility and uncertainty in the cryptocurrency market firsthand. The recent decline in Bitcoin’s price has put many miners in a precarious position, with some even opting to mine alternative coins like Kaspa to offset their losses.

The drop in Bitcoin’s [BTC] value lately has left miners feeling anxious and uncertain about the future.

Miners find new avenues

Because of this situation, numerous Bitcoin miners have chosen to explore new income sources and lessen the impact of a potential decrease in Bitcoin generation.

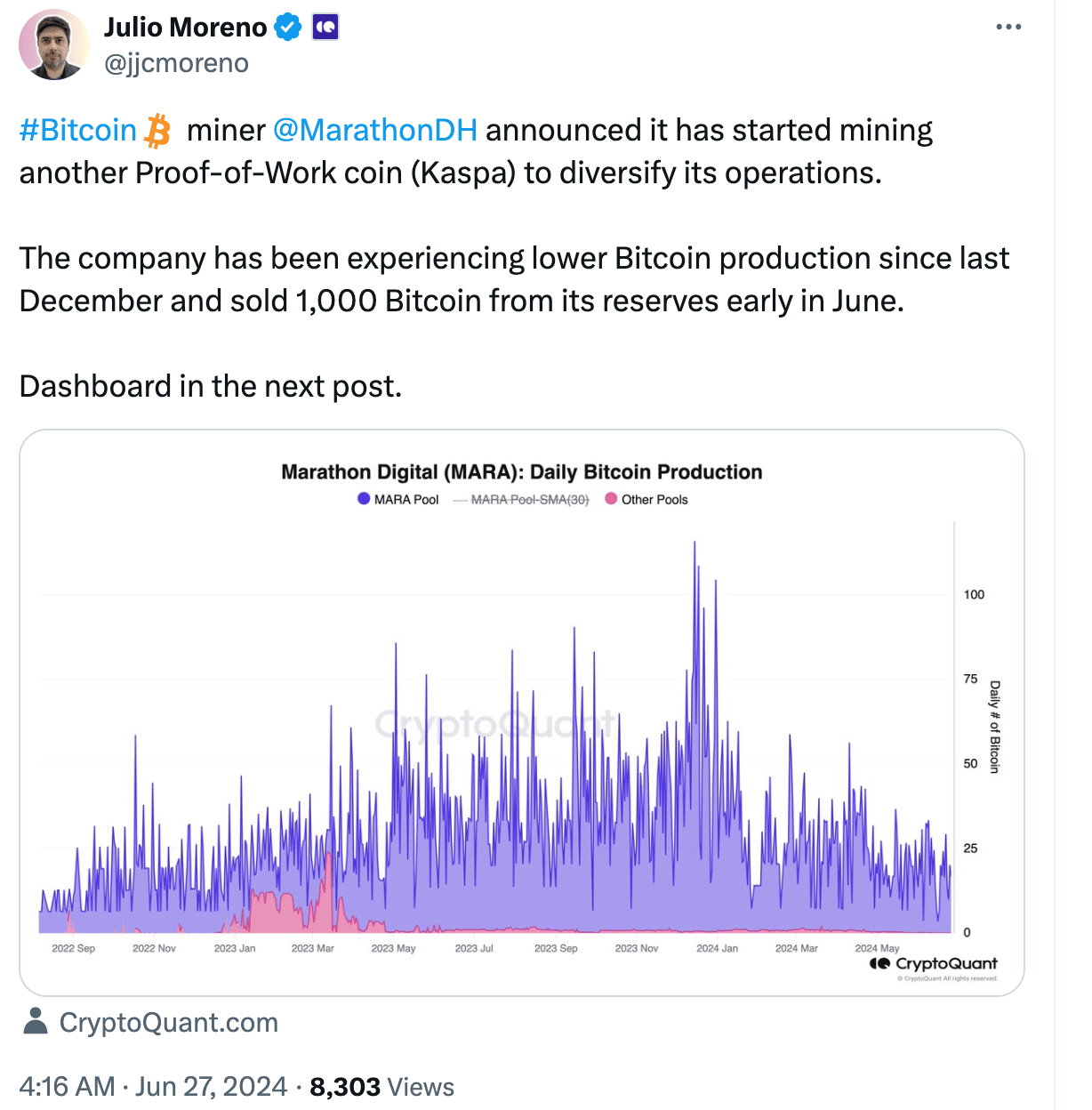

As a researcher studying the latest developments in the cryptocurrency industry, I’m excited to share that Marathon Digital Holdings, a significant player in Bitcoin mining, has recently expanded its operations. Instead of just focusing on Bitcoin (BTC), they have commenced mining Kaspa (KASP), another Proof-of-Work digital currency. This strategic move indicates MarathonDH’s forward-thinking approach and adaptability to the evolving crypto market.

Since late December 2023, Marathon Digital Has struggled with decreased Bitcoin output. This issue reached a point where the corporation had to sell approximately 1,000 Bitcoins from its stockpile in early June.

MarathonDH found Kaspa’s quicker block times and possible greater reward per block appealing, making it an alluring choice to boost profits.

Should large-scale Bitcoin miners decide to shift some of their resources towards mining Kaspa as a hedge, there’s a possibility that more Bitcoin could flood the market for sale. Consequently, this increased supply might put downward pressure on Bitcoin’s price temporarily.

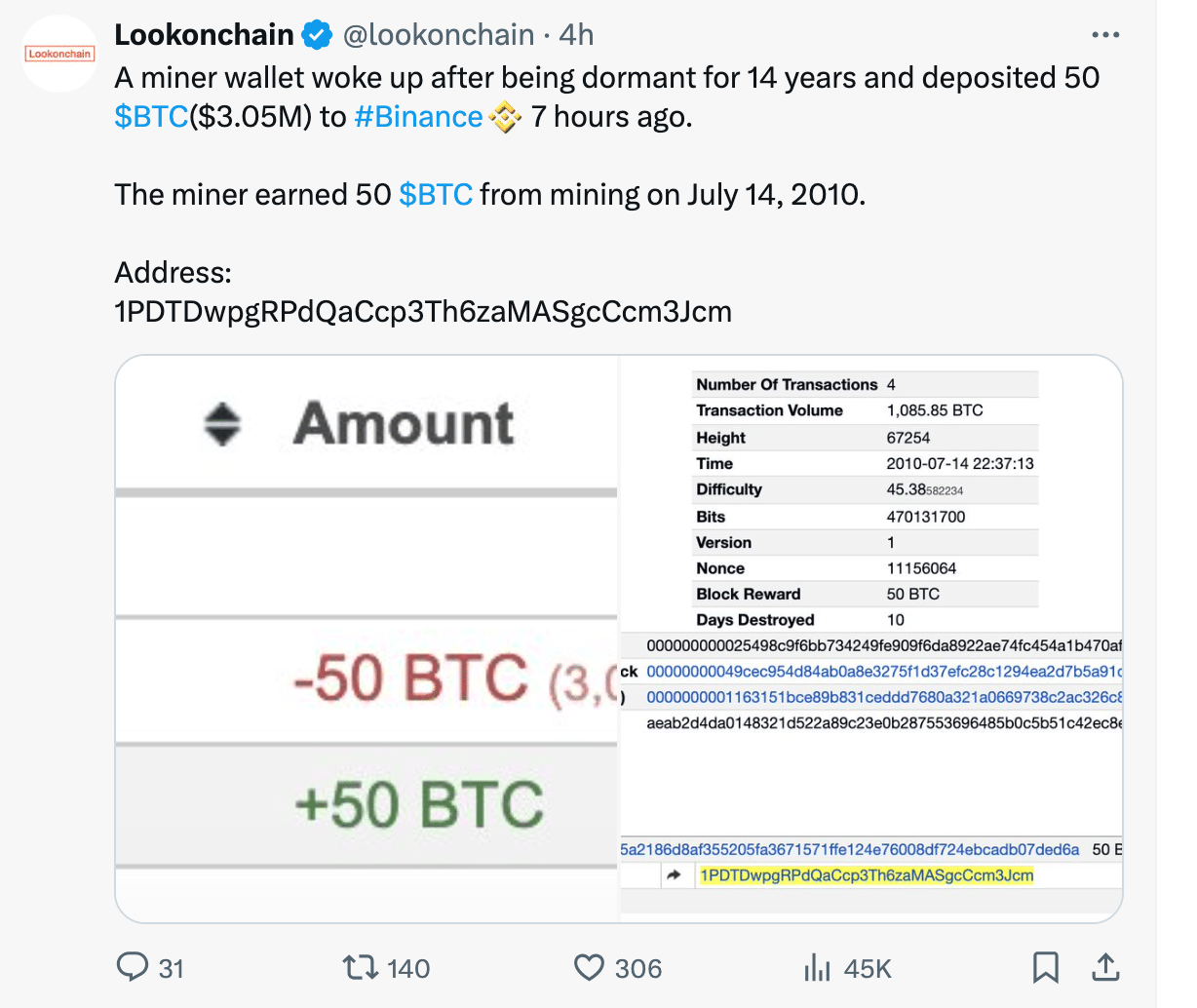

As a long-term crypto investor, I came across an unexpected event while monitoring my wallet: a dormant miner address, which had been inactive for an astounding fourteen years, suddenly showed signs of life. To my surprise, it transferred 50 Bitcoins (BTC) to a Binance deposit address.

On July 14, 2010, this miner successfully mined 50 Bitcoins. At that time, the value of each Bitcoin was a paltry $0.05.

As an analyst, I’d interpret the revival of activity in this cryptocurrency wallet and its connection to Binance as a possible sign of impending Bitcoin sell-offs. This development could potentially add more downward pressure on the market price.

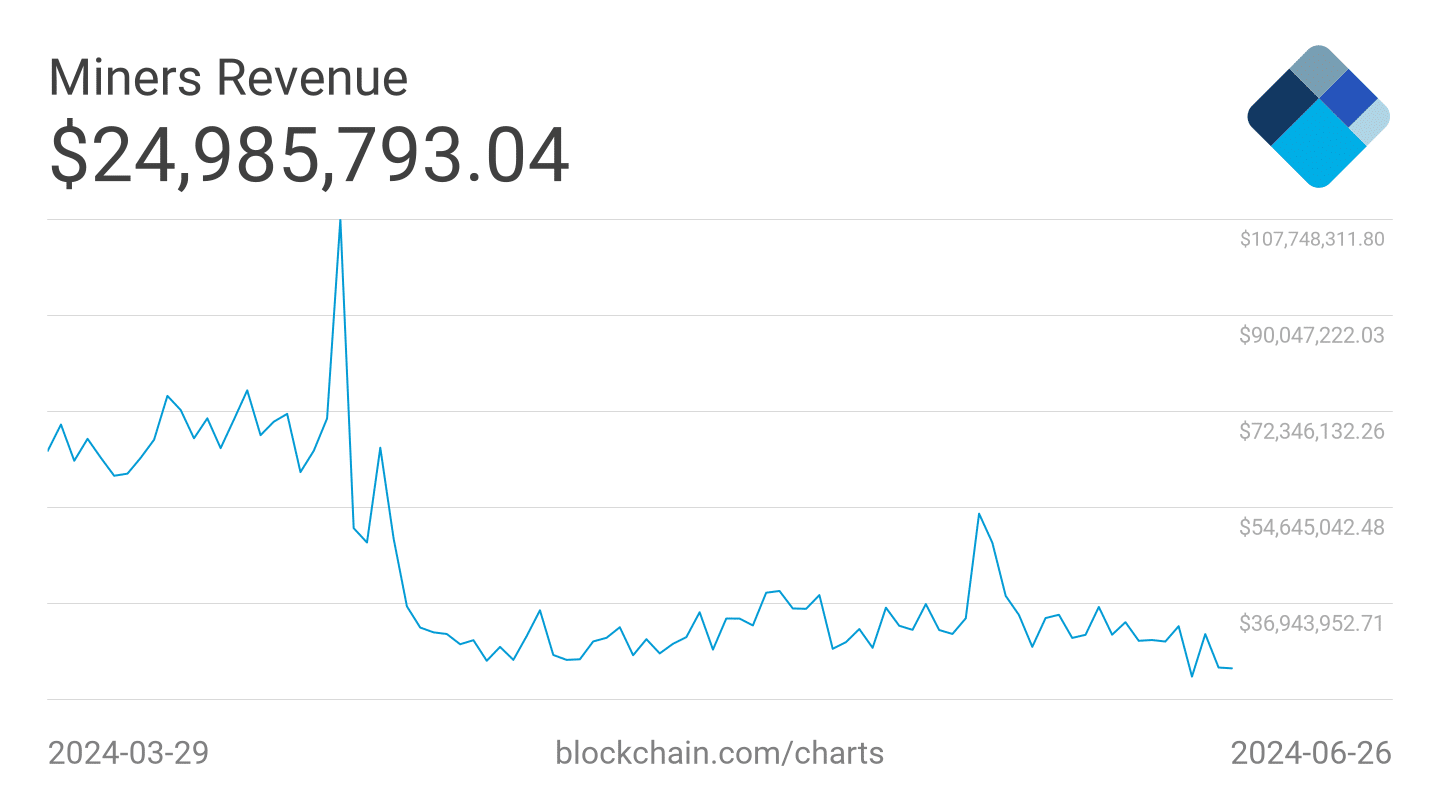

Over the past few days, the income earned daily by miners has noticeably dwindled. Specifically, there was a decrease from generating $54 million on June 7th, to only bringing in $24 million.

Miners who experience a lack of revenue growth may be compelled to dispose of their Bitcoin holdings to maintain profitability. This selling pressure could potentially lead to a decline in Bitcoin’s market price.

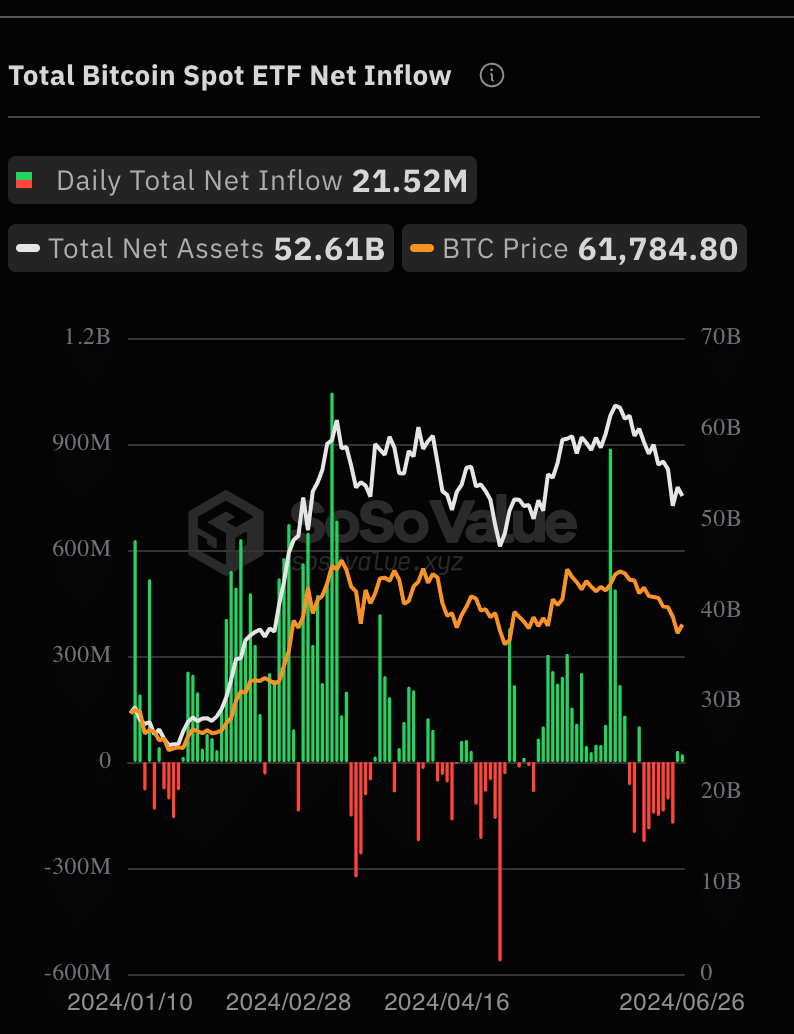

Interest in ETFs grew

As a market analyst, I recognize that the current situation for Bitcoin miners is far from ideal. However, I believe there’s a silver lining: The growing interest in Bitcoin Exchange-Traded Funds (ETFs) could potentially provide a cushion for Bitcoin’s price against heavy selling pressure.

As a researcher examining SoSo Value’s data, I discovered that on June 26th, investors showed significant interest in Bitcoin spot ETFs, resulting in a net inflow of roughly $21.4 million. This development follows a stretch of outflows preceding this event.

As a researcher studying the investments in Bitcoin trusts and exchange-traded funds, I can share that Grayscale Bitcoin Trust (GBTC) and Fidelity Bitcoin ETF (FBTC) were the main recipients of significant inflows.

Read Bitcoin’s [BTC] Price Prediction 2023-24

In one day, GBTC earned approximately $4.33 million, whereas FBTC drew in a larger amount of around $18.61 million.

As an analyst, I’ve observed a significant development in the Bitcoin ETF market. Specifically, the total net inflow into the FBTC fund has surpassed $9.185 billion, making it a prominent force in this space.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-27 16:40